what is charitable activity in GST ?

Charitable activity in GST :

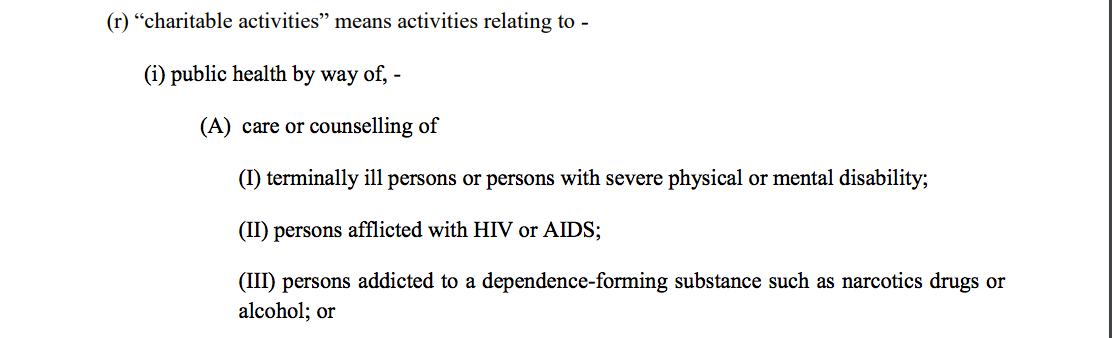

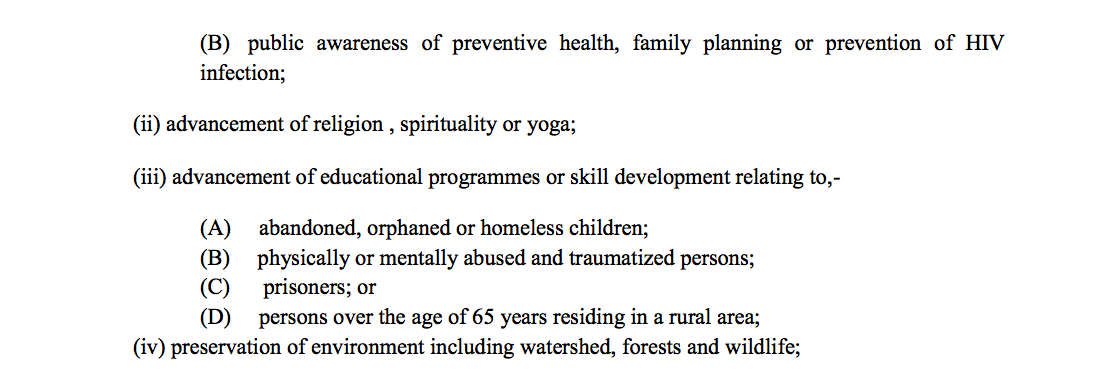

There is an exemption for charitable activity in GST. Entry no. 1 of notification no. 12/2017 covers the exemption for charitable activity.

Exemption for taxpayers engaged in charitable activity in GST:

This term is very important. Following two conditions shall be fulfilled:

- A person shall be registered under section 12AA of the Income-tax Act.

- He shall be engaged in charitable activities.

If both of these conditions are fulfilled. The entity is exempted from GST. But the exemption is restricted only to charitable activities. Many educational institutions in India are out of exemption from GST. Even the trusts engaged in research activities are out of the scope of the exemption.

This is also an important question, whether all activities of a charitable entity are exempted? Some of the activities like parking facility, the mess in a school, selling the books and dresses may be out of the preview of exemption. These activities may be taxable because the exemption is limited to charitable activity and not to all activities of the entity. It means that activity is exempted not the entity.

Now how to decide? First of all, check the nature of the business. Then check whether they are falling in some other entry like school, hospital etc. Then we can finally decide for the exemption of an entity. In some cases, they may be exempted even if they are not registered in section 12AA of Income Tax Act

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.