Circular 122/41/2019: Clarification on 20% ITC

CBIC issues circular no. 122/41/2019 for clarification on 20% ITC rule:

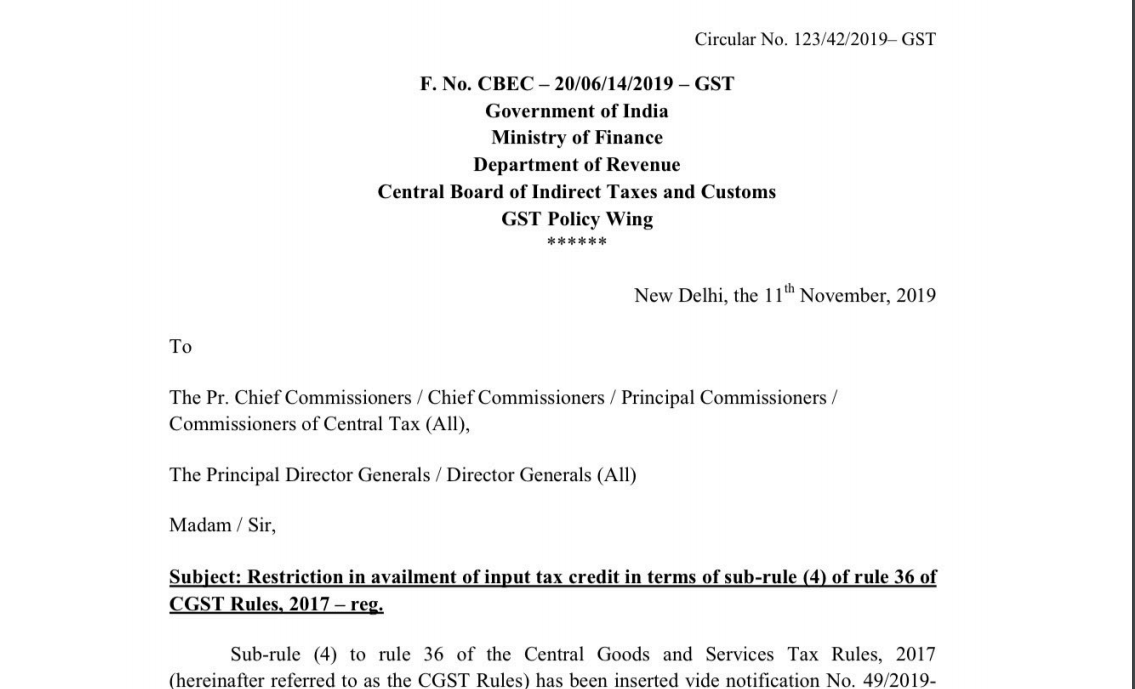

CBIC has clarified the issues on the implementation of rule 36(4) of CGST Rules. A circular is issues by CBIC. The copy of the circular is also attached here on the image. The following issues are clarified by CBIC.

- The restriction is only in relation to invoices required to be uploaded by the supplier. In case the invoice is not required to be uploaded the provision will not apply.

- Thus the invoices of import, Self-generated invoices under RCM and ISD invoice will not be covered by the restriction.

- The restriction is not supplier wise. It is consolidated. It is applicable to eligible ITC amounts reflected in 2A.

- The total amount reflected in 2A is not eligible but the restriction of section 17 will also be considered. Only then the amount can be calculated.

- Some examples are also given in the circular. ITC of reflected invoices + 20% can be taken on a provisional basis.

Many important issues are still unanswered. Like in case of quarterly filing of GSTR 1 how the ITC will be calculated. This is an important issue to address. Otherwise, small businesses will suffer. The industry will avoid any purchases from them. In spite of fact that they have made the payment in monthly GSTR3b the ITC will get stuck for 3 months. This issue needs an instant resolution. The due date for filing of GSTR 3b is approaching near.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.