Clarification on Reporting 4-digit/6-digit HSNs: CBIC

GST helpdesk is in receipt of some tickets at helpdesk wherein it was reported that certain 6-digit HSN codes are not available in HSN Master/ not accepted on e-invoice/e-Waybill portals.

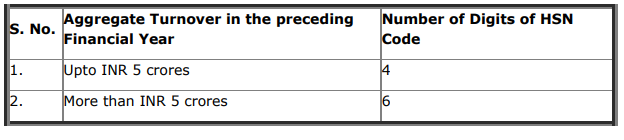

Background: Notification No. 12/2017-Central Tax dated June 28, 2017, as amended vide Notification No. 78/2020 – Central Tax, dated October 15, 2020, mandates taxpayers to declare specified digits, as follows, of Harmonised System of Nomenclature (HSN) / Service Accounting Code (SAC) Code on raising of tax invoices, w.e.f. April 1, 2021.

It may be noted that specific 6-digit HSNs, as available in the HSN/Customs Tariff (with the corresponding description of goods) are allowed in the system. It also follows that the declaration of HSN at 4/6 Digits has to be out of valid HSN codes only.

However, there are instances that some taxpayers are trying to report truncated first 6- digits out of an otherwise valid 8-digit HSN; which are actually not available in Tariff at 6- digit level and with no corresponding description of goods; these are invalid and hence not being allowed in the System.

Taxpayers may therefore note that based on the harmonious interpretation of the Notifications, as referred above, read with Customs Tariff Act, 1975, as made applicable to GST; the number of digits of HSN, as specified vide Notifications No. 12/2017 & 78/2020 (Central Tax), are the minimum number of digits of HSN to be mentioned on the invoice.

Example: Where HSN 6 digits are specified to be reported in the invoice, valid HSN codes as available in tariff, at both 6-digits and 8-digits can be mentioned. Similarly, where HSN at 4- digits are specified, valid HSN codes as available in tariff, at 4-digit, 6-digit and 8-digit can be mentioned. However, the 4/6 Digit HSN Codes, which are not available in the tariff; along with a specific description, Unit, and GST Rate; are not allowed to be mentioned.

Further, if the HSN of any Goods/Service is otherwise valid but not accepted on GST Portal/ e-invoice Portal / e-way Bill portal, please raise a ticket on GST Self-Service Portal: > Report Issue > Type ‘HSN’ in ‘Type of Issue/Concern’ search box > Select relevant sub-category, e.g. ‘e-Invoice – IRP – HSN Code related’

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.