Clarifications on Vivad se vishas scheme

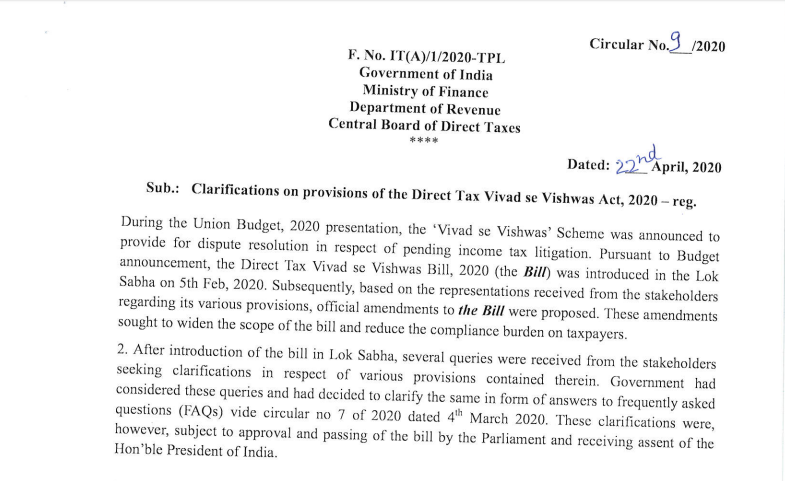

Circular No. 9/2020

Sub: Clarifications on provisions of the Direct Tax Vivad se Vishwas Act,2020-reg.

During the Union Budget, 2020 presentation, the ‘Vivad se Vishwas’ Scheme was announced to provide for dispute resolution in respect of pending income tax litigation. Pursuant to Budget announcement, the Direct Tax Vivad se Vishwas Bill, 2020 (the Bill) was introduced in the Lok Sabha on 5th Feb 2020. Subsequently, based on the representations received from the stakeholders regarding its various provisions, official amendments to the Bill were proposed. These amendments sought to widen the scope of the bill and reduce the compliance burden on taxpayers.

2. After the introduction of the bill in Lok Sabha, several queries were received from the stakeholders seeking clarifications in respect of various provisions contained therein. The government had considered these queries and had decided to clarify the same in the form of answers to frequently asked questions (FAQs) vide circular no 7 of 2020 dated 4th March 2020. These clarifications were, however, subject to approval and passing of the bail by the parliament and receiving the assent of the Hon’ble President of India.

3. The bill has since been passed by the parliament and has also received the assent of the Hon’ble President of India and has now been enacted as the Direct Tax Vivad se Vishwas Act, 2020 (Vivad se Vishwas). The objective of Vivad se Vishwas is to inter alia reduce pending income tax litigation, generate timely revenue for the Government and benefit taxpayers by providing them peace of mind, certainly and savings on account of time and resources that would otherwise be spent on the long-drawn and vexatious litigation process.

4. 55 questions contained in circular no 7 of 2020 are reissued under this circular with following modifications

(i) Vivad se Vishwas referred to Direct Tax Vivad se Vishwas Bill, 2020 in circular no. 7. However, in this circular, it refers to The Direct Tax Vivad se Vishwas Act, 2020.

(ii) Since clauses of the Bill have now become sections in the Vivad se Vishwas, the reference to ”clause” in circular no 7 has been with “section”.

Download the copy:

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.