cliantha research limited advance ruling

original copy of cliantha research limited advance ruling

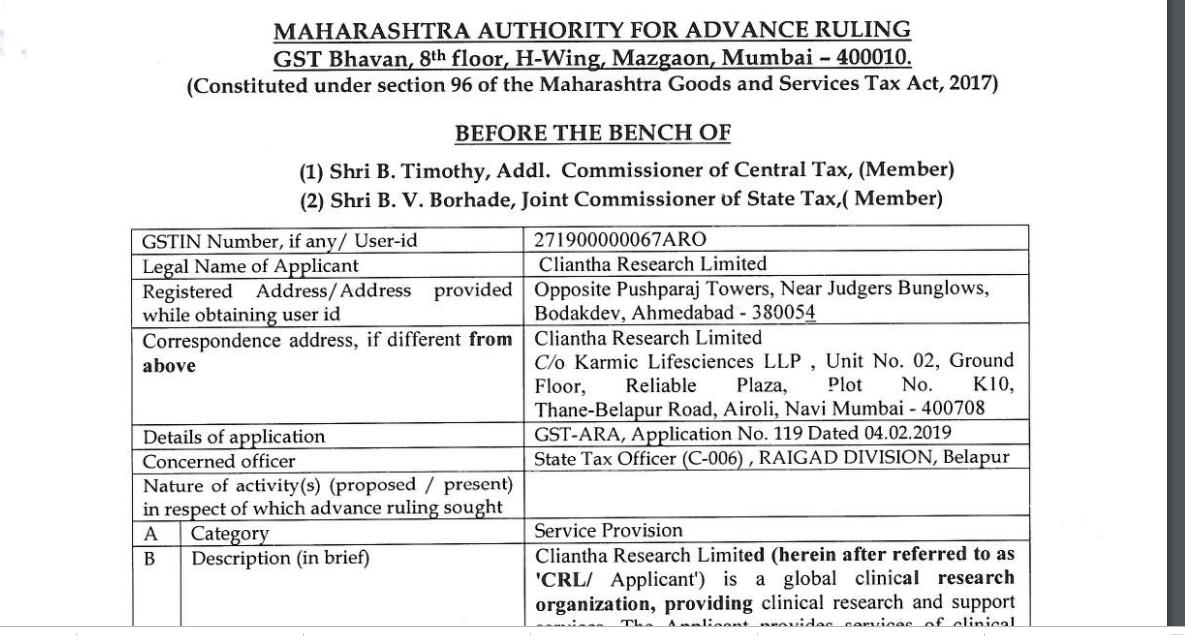

MAHARASHTRA AUTHORITY FOR ADVANCE RULING GST Bhavan, 8h floor, H-Wing, Mazgaon, Mumbai ~ 400010.

(Constituted under section 96 of the Maharashtra Goods and Services Tax Act, 2017) BEFORE THE BENCH OF

- Shri B. Timothy, Addl. Commissioner of Central Tax, (Member)

- Shri B. V. Borhade, Joint Commissioner of State Tax,( Member)

GSTIN Number, if any/ User-id 271900000067ARO

Legal Name of Applicant Cliantha Research Limited

Registered Address/Address provided | Opposite Pushparaj Towers, Near Judgers Bunglows, while obtaining user id Bodakdev, Ahmedabad – 380054

Correspondence address, if different from | Cliantha Research Limited

above C/o Karmic Lifesciences LLP , Unit No. 02, Ground

Floor, Reliable Plaza, Plot No. K10, Thane-Belapur Road, Airoli, Navi Mumbai – 400708 Details of application GST-ARA, Application No. 119 Dated 04.02.2019 Concerned officer State Tax Officer (C-006) , RAIGAD DIVISION, Belapur Nature of activity(s) (proposed / present) in respect of which advance ruling sought A | Category Service Provision

B_ | Description (in brief) Cliantha Research Limited (herein after referred to as | ‘CRL/ Applicant’) is a global clinical research organization, providing clinical research and support services. The Applicant provides services of clinical research and analysis to entities located within India and outside India. The Applicant is proposing to provide the above mentioned services from the State of Maharashtra. The present application pertains to determination of tax liability of the Clinical Research services provided by the Applicant.

Issue/s on which advance ruling required | (v) determination of the liability to pay tax on any goods or services or both

Question(s) on which advance ruling is | As reproduced in para 01 of the Proceedings below. required

PROCEEDINGS

(Under section 98 of the Central Goods and Services Tax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017)

The present application has been filed under section 97 of the Central Goods and ‘ax Act, 2017 and the Maharashtra Goods and Services Tax Act, 2017 [hereinafter »d!to as “the CGST Act and MGST Act”] by Cliantha Research Limited, the applicant, seeking and advance ruling in respect of the following question.

The Applicant would like to seek a ruling on whether the “Clinical Research” services proposed to be provided by them to entities located outside India is liable to Central Goods and Services Tax and State Goods and Services Tax or Integrated Goods and Services Tax or is it eligible to be treated as an export of service under Section 2(6) of the Integrated Goods and Services Tax Act, 2017?

At the outset, we would like to make it clear that the provisions of both the CGST Act and the MGST Act are the same except for certain provisions. Therefore, unless a mention is specifically made to any dissimilar provisions, a reference to the CGST Act would also mean a reference to the same provision under the MGST Act. Further to the earlier, henceforth for the purposes of this Advance Ruling, the expression ‘GST Act’ would mean CGST Act and MGST Act.

2 FACTS AND CONTENTION – AS PER THE APPLICANT

The submissions, as reproduced verbatim, could be seen thus-

Statement of relevant facts having a bearing on the question raise

Background of the operations undertaken by CRL

(i) The Applicant CRL (formerly known as B.A. Research India Limited), a global Clinical Research Organization, providing comprehensive range of clinical research and support services by performing technical testing and analysis on the Drug/ Investigational Product provided by sponsors located outside India and submits final the report to such foreign sponsors.

(ii) In India, the Applicant is registered as a public limited company under the Companies Act,1956. The Applicant provides Clinical Research services to the sponsors located outside India.

(iii)The Clinical Research services provided by Applicant involves conducting Bio equivalence and Bio-availability clinical studies which includes fasting and fed conditions, single and multiple dose in healthy subjects, drug to drug interaction, drug food interaction, special/patient population studies. The study is undertaken using formulations in the form of tablets, capsules, gels sprinkles, syrups, sprays, inhalers etc., sent by the foreign entities (sponsors). Applicant performs clinical trials (based on preset criteria) using that Investigational Product/drug on humans, records the results of the trial, makes a detailed study (analyze the result) and submits a report (in digital form) to the sponsors located outside India. The goods/ Investigational Product given by the sponsor will get consumed during the process of the study and is never returned back to the sponsor . In the case the Applicant fails to submits a report or submits an erroneous report, the Applicant would be liable to undertake the above study again at its own cost or refund the contract price to the sponsor. The transaction flow of this services can be summarized as below: Providing Investigational Product/drugs along with protocol: Applicant will be provided IP/drug along with detailed protocol specifying the Study design, objectives, inclusion exclusion criteria, procedure for reporting adverse drugs experience and other relevant issues.

> Testing and Analysis by Applicant: Investigational Product/Drug is given to identified volunteer subjects in India for conducting a study of the effect of these Investigational Product/drug, in accordance with the protocol provided by the Sponsor.

> Submission of final report: At the time of completion of study, Applicant will supply the Sponsor with a copy of an acceptable summary report containing the analysis of the study conducted by the Applicant and the report detailing the observation.

> Sample copy of an agreement entered into by the Applicant for performing a similar service is enclosed to this application as Annexure A and Sample protocol for the agreement is enclosed as Annexure B

(iv) For the services provided above, Applicant will raise invoice to sponsor in foreign currency and receive the consideration in foreign currency.

Statement containing Applicant’s interpretation of law in respect of the aforesaid question

The Applicant would like to make the submissions before this Hon’ble Authority for Advance Ruling on the following grounds, amongst others, each of which is requested to be taken as the alternative and without prejudice to each other: A. The clinical Research services provided by the Applicant would amount to export of

(i) The Applicant would like to submit that the clinical research services provided by them to the foreign sponsors would amount to export of service for the reasons detailed below.

(ii) The term export of service has been defined under Section 2(6) of the Integrated Goods and Services Tax Act, 2017 (IGST Act) to mean: “export of services” means the supply of any service when,–

(i) the supplier of service is located in India;

(ii) the recipient of service is located outside India;

(iii) the place of supply of service is outside India;

(iv) the payment for such service has been received by the supplier of service in convertible foreign exchange 1[or in Indian rupees wherever permitted by the Reserve Bank of India); and

(v) the supplier of service and the recipient of service are not merely establishments of a distinct person in accordance with Explanation 1 in section 8;”

(iii)A perusal of the above provisions makes it clear that all the conditions must be cumulatively fulfilled Rug gs fulfilled for a transaction to qualify as export. In the present facts, it is clear that the conditions mentioned in (i), (ii), (iv) and (v) above are satisfied. That is, Applicant is located in India, the recipient of the service (sponsor) is located outside India, the payment for the said service is receivable in convertible foreign currency and the Applicant and the sponsors are not merely establishments of distinct persons.

(iv) The only condition therefore that requires evaluation is whether the place of supply of service is outside India.

(v) The rules to determine place of supply of services where location of supplier or location of recipient is outside India is contained in Section 13 of the IGST Act. As per Section 13 of the IGST Act:

(2) The place of supply of services except the services specified in sub-sections (3) to (13) shall be the location of the recipient of services: Provided that where the location of the recipient of services is not available in the ordinary course of business, the place of supply shall be the location of the supplier of services.”

(vi) From the above, it is clear if the place of provision of service is not determinable in accordance with sub-section 3 to 13 of Section 13 of the IGST Act, then the place of supply of service will be the location of service recipient as per Section 13(2) of the IGST Act.

(vii) In this regard, the Applicant submits that sub sections 3 (b) to 13 of Section 13 is not applicable to the facts of the present case. The only sub-section that requires evaluation is 3(a) of Section 13 which provides as under:

(3) The place of supply of the following services shall be the location where the services are actually performed, namely:

a) services supplied in respect of goods which are required to be made physically available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services:

(viii) As per Section 13 (3)(a) of the IGST Act, any services performed in respect of goods that are physically required to be made available by the recipient will be the location where the services are performed.

(ix) In this regard, the Applicant would like to submit that Section 13(3)(a) of the IGST Act will be applicable only in those cases where a service in the nature of repair, testing etc.) is performed on the goods sent by the recipient to the supplier of service and not to those cases where the service is provided using the goods provided by the recipient or in cases where the goods sent by the recipient are altered (consumed) while providing the service.

(x) The Applicant would like to rely on the decision of Hon’ble Mumbai Tribunal in the case of Principal Commissioner of C.Ex. Pune – I v Advinus Therapeutics Ltd. 2017 (51) S.T.R. 298 (Tri. – Mumbai) which has been decided specifically in the context of research and drug development using information provided by the recipient. Hon’ble Tribunal while detailing the applicability of Rule 4 of the Place of Provision of Service Rules, 2012. Has held:

‘It has been noted by the first appellate authority that the applicant for refund is in the business of rendering ‘scientific or technical consultancy services’ and has earned convertible foreign currency by rendering these services during the relevant periods. Contention of Revenue 4 is that place of provision of service is in India because Rule 4 of Place of Provision of Services, 2012 stipulates that when –

– the service is provided in respect of goods that are required to be made physically available by the recipient of the service to the provider of service’

– the place of provision of service is the location of the performance of service. It is also contended that this must be read in consonance with Rule 6A of Service Tax Rules, 1994 which, with effect from 1st July, 2012, has been made applicable to Rule 5 of Cenv]hu at Credit Rules, 2004. Reliance is also placed on Guidance Note 5 of the Education Guide dated 20th June, 2012 published by the Central Board of Excise & Customs which pertaining to Rule 4 of Place of Provision of Service, 2012 is –

The essential characteristic of a service to be covered under this rule is that the goods temporarily come into the physical possession or control of the service provider, and without this happening the service cannot be rendered. Thus the service involves movable objects or things that can be touched, felt or possessed….Examples of such services are…. Technical testing/inspection analysis of goods etc…. Learned Authorized Representative took us through the various grounds of appeal and urged us to accept the contention of Revenue that the services rendered by the respondent do not qualify as exports.

The proposition put forth by appellant-Commissioner would, if accepted, circumscribe and limit Rule 5 of Cenvat Credit Rules, 2004 and jeopardize the privilege of exporters. Morever, that proposition would also lead to taxing the activities of the respondent for, if the place of provision of the service is India, it would place the consideration received thereof, notwithstanding its receipt from an overseas entity in convertible foreign currency, within the ambit of taxation under Section 66B of Finance Act, 1994. It is moot if such an interpretation of Place of Provision of Services Rules, 2012 can create a jurisdiction to tax and should be allowed to prevail over the principle that taxes are not be exported with goods or services.

That the following ingredients which crystallize an activity as ‘export of service’ for the purposes of Rule 6A of Service Tax Rules, 1994, viz., that provider of service is in taxable territory, that recipient is outside India, that the service is not in the ‘negative list’, that payment is received in convertible foreign exchange and that the provider and recipient are not covered by the fiction in Explanation 2(b) of Section 65B(44) of Finance Act, 1994, are applicable to the service rendered by the respondent is common ground. The cavil is that the activity does conform to the provisions of Rule 4 of Place of Provision of Services, Rules, 2012 because the service is allegedly.

4 …..provided in respect to goods that are required to be made physically available by the recipient of service to the provider of service, or to a person acting on behalf of the provider of service, in order to provide the service..’

rendering the location of performance of services, i.e. India, to be pertinent to the activity of respondent.

It is an admitted fact that the respondent had been rendering services that were, in the erstwhile pre-negative list regime, taxable but for the provider being an Export Oriented Unit under the entry in Section 65(105)(za) of Finance Act, 1994. In the scheme of Export of Service Rules, 2005, the various taxable services had been categorized as object-based, performance-based and recipient-based for the purpose of exemption under Section 93 of Finance Act, 1994. Though those Rules are no longer valid for the purposes of Rule 5 of Cenvat Credit Rules, 1994, their guidance value cannot be discountenanced. The ‘negative list regime was not intended to be either detrimental or beneficial to existing assesses except where such intent was specifically sanctioned by legislation. The respondent, prior to Ist July, 2012, was eligible for all benefits as the service rendered by them were treated as export with the recipient of the service being outside the country. The corresponding provision in Place of Provision of Services Rules, 2012 is Rule 3 which brings the service within the ambit of export of service in Rule 6A of Service Tax Rules, 1994, Revenue has not made any submission of legislative intent to deprive a provider of ‘scientific or technical consultancy service’ in the erstwhile regime of its status as exporter of service owing to change in the regime.

In the context of a catena of judgments and decisions that exports are not taxable and, with the most palpable manifestation of export of invisibles being the receipt of convertible foreign exchange from a recipient of service located outside the country, that services are taxable at the destination, the scope of Rule 4 must necessarily be scrutinized to ascertain if there was, indeed, legislative intent to deny acknowledgement as exporter to a certain category of service providers that were so privileged tell them. There is no dispute that the recipient of service is located outside India and that the consideration is received in foreign convertible currency. Yet, Revenue insists that performance of service is in India. A service is not necessarily a single, discrete, identifiable activity; on the contrary, it is a series of invisibles that cater to the needs of a recipient; it is upon the consumption of the service by the recipient that service is deemed to have become taxable.

It would appear from the exposition in the judgment that the tax was intended as a levy on activities that would otherwise be performed by the recipient for itself. The new industry of hiving out or outsourcing of what was, conceivably, being done within the enterprise was intended to be subject to the new levy. In the matter of service rendered by respondent, this activity could, but for commercial viability, will be executed by the recipient within its own organization or the territory in which it exists. The satisfaction of the customer occurs upon an outcome which is possessed by the recipient. Hence, even if some of the activities are carried out in India, by no stretch can it be asserted that the fulfilment of the activity is in India.

In this context, the legislative intent of incorporating a special and specific provision in Rule 4 may yield further insights. The special provision, which may be seen as an exception to the general Rule 3, deals with services in respect of goods as well as those provided to individuals. Not unnaturally, the services that require the physical presence of the person is taxed where the consumer receives the service and not at his location which as per Rule 2(i)(iv) would be his usual place of residence. In what can be considered as a most telling example of the scope of this portion of Rule 4, we could do a lot worse than refer to a decision of the Hon’ble High Court of Delhi that, in the course of dealing with other, more weighty matters in Orient Crafts Ltd. v. Union of India (2006-TIOL-271-HC-DEL ST = 2006 (4) S.T.R. 81 (Del.)], took note of, and answered, one of the submissions thus –

- The contention of the learned Counsel for the petitioner, based on the interpretation of Section 66A of the Act, is that any service that is obtained by a person who has a fixed place of business in India is liable to tax for services availed by him in a foreign country. By way of an example, learned Counsel for the petitioner has cited that if such a person in India goes abroad, and has a haircut, he would be liable to pay service tax in India on the basis of Section 66A of the Act. 5. We are not at all convinced by this argument of learned Counsel for the petitioner. The rules that have been Jramed by the Central Government make it absolutely clear that taxable service provided from outside India is liable to service-tax. In the example given by the learned Counsel for the petitioner, there is no question on the service of haircut having been received in India.’

The intent in Rule 4 to remedy out some specific situations that would, otherwise, have enabled escapement from tax or leviability to tax where Rule 3 of Place of Provision of Services Rules, 2012 may not serve to confer jurisdiction becomes increasingly obvious.

15. Accordingly, we can infer that the location of performance of service in respect of goods is not an abstract, absolute expression for fastening tax liability on services that involve goods in some way; for that, Rule 3 would have sufficed. A contingency that is not amenable to Rule 3 has been foreseen and remedied by Rule 4 and in the process, the sovereign jurisdiction to tax is asseted. It is, therefore, not by the specific word or phrase in Rule 4(1) of Place of Provision of Services Rules, 2012 that the taxability is to be determined but from the mischief effect intended to be plugged. It is obviously not intended to tax any activity rendered on goods as to alter its form because that would be covered by excise on manufacture or be afforded privileges available to merchandise trade. The provision itself excludes goods imported temporarily for repairs but that does not, ipso facto, exempt goods imported temporarily for repairs from taxability which would, by default, be predicated by the intent in Rule 3. Consequently, a recipient in India would be liable to tax on such temporary imports for repairs while service to a recipient located abroad would not be taxable. This is in consonance with the privilege of exemption afforded to export of services. The special and distinct role of Rule 4 becomes learer.

Not intended to tax the activity of alerting goods supplied by the recipient of service or for repairs on goods, Rule 4(1) of Place of Provision of Services Rules, 2012 would appear, by ‘elimination of possibilities, to relate to goods that require some activity to be performed without altering its form. The exemplification in the Education Guide referred supra renders it pellucid. Certification is an important facet of trade and such certification, if undertaken in India, will not be able to escape tax by reference to location of the entity which entrusted the activity to the service provider in India. This is merely one situation but it should suffice for us to enunciate that Rule 4(1) is intended to resorted when services are rendered on goods without altering its form that in which it was made available to the service provider. This is the harmonious construct that can be placed on the applicability of Rule 4 in the context of tax on services and the general principle that taxes are not exported with services or goods.

The goods supplied to the respondent, minor though the proportion may be, are subject to alteration in the course of research. It is not asserted anywhere that these goods, in its altered or unaltered form, are sent back to the service recipient, if it were, the provisions of Customs Act, 1962 would be invoked to eliminate tax burden. If the goods cease to exist in the form in which it has been supplied, it cannot be said that services have been provided in respect of goods even if it cannot be denied that services have been rendered on the goods. Consequently, the provisions of Rule 4 (1) are not attracted and, in terms of Rule 6A of Service Tax Rules, 1994, the definition of export of services is applicable thus entitling the appellant to eligibility under Rule 5 of Cenvat Credit Rules, 2004.”

[Emphasis Supplied]

Further, the Applicant would also like to rely on the decision of Commissioner of Central Excise Pune — I Vs. Sai Life Sciences 2016 (42) STR 882 (Tri-Mum), wherein Hon’ble Mumbai Tribunal has upheld the order of the Appellate authority and held:

“While acknowledging that some of the chemicals required for research an development are provided by the clients of the appellant and hence the condition that goods be made available by the service recipient has been complied with, the impugned order, holding that services are not rendered in relation to these materials, notes as below :

“The deliverables’ by the Appellants are neither supplied nor owned by the service receiver nor the Appellants are providing any service in respect of the deliverables. Synthesis of a new compound using various chemicals, solvents reagents, compounds cannot be called as service in respect of the said chemicals, solvents, compounds. Further, the Appellants are formulating the process of the manufacture of the new compounds and the process is being sent to their clients/service receiver. It is seen from the detail service agreement that the Appellants are engaged into converting compound 120 into compound 129.”

- In view of those principles emphasized time and again and reiterated as above, the appeal is devoid of merits and is accordingly rejected. The stay petitions are also disposed of.”

The Applicant would like to submit that the provisions contained in Section 13(3)(a) of the IGST Acct is in pari materia with the provision contained in Rule 4 of the Place of Provision of Services Rules. Therefore the principles enunciated in the above judgements can be relied for understanding the scope of Section 13(3)(a) of the IGST Act. Relevant portion of Rule 4 of the “Place of provision of performance based services.

4. The place of provision of following services shall be the location where the services . are actually performed, namely:

(a)services provided in respect of goods that are required to be made physically available by the recipient of service to the provider of service, or to a person acting on behalf of the provider of service, in order to provide the service:

(xiii) Applying the above judicial precedents to the facts of the present case, as detailed in Exhibit I] above, the Applicant is providing service of clinical research which requires the Applicant to record the effects of the drug (provided by the recipient) when administered to human or animal volunteers based on pre-set criteria (protocols), analyze the results and to deliver a report detailing the observations and analysis of the Applicant.

(xiv) In the whole chain of activities, administration of the drug to the volunteers is merely the first step in providing the service (providing a detailed test report) and the service is not completed or consumed at this stage. The Applicant thereafter is required to record the test results and analyze the results (which requires an expert knowledge) and submit a report detailing the same. Applicant would like to submit that it is for the report that the sponsors engage the Applicant and not for merely administering the drug and recording the results alone.

(xv)The Applicant therefore submits that the service provided is not in respect of the goods given by the recipient. This is also further fortified by the fact that the Applicant is not required to give the goods back to the service recipient and the goods cease to exist after the study. Therefore, the Applicant submits that the service provided by them is not covered within the ambit of Section 13(3)(a) of the IGST Act. Consequently, as per Section 13(2) of the IGST Acct, the place of supply of service is outside India and therefore, the service provided by the Applicant qualifies to be treated as export of service as per Section 2(6) of the IGST Act.

B. GST is a destination based consumption tax

(i) Alternatively, the Applicant would also like to submit that GST is a destination based consumption tax and therefore as long as the consumption of service is outside India, no tax can be levied on the Applicant. Applicant in this regard, would like to make reference to the Frequently Asked Questions on GST issued by the Central Board of Excise & Customs, New Delhi dated 31 March 2017 (2nd Edition) which highlights the conceptual understanding of GST as under:

Q1. What is Goods and Services Tax (GST)?

Ans It is a destination based tax on consumption of goods and services. It is proposed to be “levied at all stages right from manufacture up to final consumption with credit of taxes paid at evious stages available as setoff. In a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer.

Q.2 What exactly is the concept of destination based tax on consumption?

Ans: The tax would accrue to the taxing authority which has jurisdiction over the place of consumption which is also termed as place of supply.”

[Emphasis Supplied]

(ii) It is a settled principle of law that when the service is consumed outside India, tax is not leviable in India. Reliance in this regard can be placed on the following cases wherein it has been specifically held that even though the test has been conducted in India and the test reports were prepared in India, the service will be treated as export of service as the service is consumed outside India:

a. Commissioner v B.A Research India Ltd 2010 (18) S.T.R. 439

b. KSH International Pvt. Ltd. v. Commissioner 2010 (18) S.T.R. 404

c. Sai Life (supra) – Post introduction of Place of Provision of Service Rules 2012

d. Advinus Therapeutics (supra) – Post introduction of Place of Provision of Services Rules 2012

(iii) Further, we would like to submit our own case of Commissioner Of service Tax, Ahmedabad Versus B.A. Research India Ltd (supra). this case, decision was given in favor of the Applicant. It was held that the performance of testing and analysis has no value unless and until it is delivered to its client. Thus, delivery of report to its client is an essential part of the service report, which was delivered and used outside India. Therefore, it should be construed as export of service.

(iv) In the present case, as stated above, the service is consumed by the recipient only when the reports (detailing the analysis and observations) is sent by the Applicant to the foreign sponsor. The consumption of service therefore clearly is only outside India.

(v) In light of the above stated judicial precedents and in line with the concept of GST, since the consumption of service is outside India, the Applicant submits that the service provided by them is liable to be treated as export of service and is subject to be taxed accordingly.

C. Conclusion

In view of the factual and legal position set out hereinabove, the Applicant submits that the services provided by them qualifies to be an export of service.

Further to above submissions, we most respectfully pray Hon’ble Authority:

- To allow us to reiterate all the submissions without prejudice to one another;

- Grant a personal hearing to put forth our contentions and explain our submissions before passing any order in this regard;

- Allow us to amend, alter and add to the present reply;

- Allow us to produce additional documents and other material during the time of Personal Hearing: and

- In that behalf pass such other orders and directions as may be deemed proper and necessary.

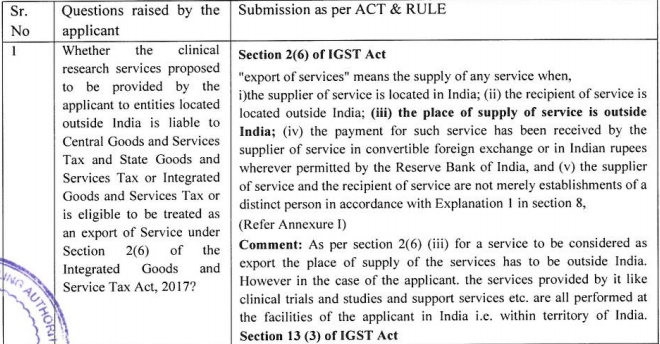

03. CONTENTION – AS PER THE CONCERNED OFFICER

The submission, as reproduced verbatim, could be seen thus-

“With reference to the above mentioned subject, Cliantha Research Ltd. (URD) filed application seeking Advance Ruling with reference to prospective tax liability on the Clinical Research Services proposed to be provided by it.

Cliantha Research Ltd. (herein after referred to as the applicant) is a public limited company under the Companies Act, 1956 with its registered office at Ahmedabad Gujarat. It is clinical research organization and is involved in providing clinical research and support services to its clients located within India and outside India,.

The clinical research services provided by the applicant involves conducting bio-equivalence studies, bioavailability studies, drug reactions, drug interactions etc. for newly developed drug formulations or for the existing ones. The applicant enters into agreement with the foreign clients and is needed to submit the product investigation report as per the terms and conditions of the agreement.

The clinical trials and investigation studies are performed by the applicant on the individuals in India at their facilities. The products under investigation i.e. drug in capsule, tablet etc. forms are supplied by the foreign based clients as per the terms of agreement.

The output of this business activity is a product investigation report that is sent to the clients based outside India in digital format. For these services the applicant raises invoices to their foreign clients in foreign currency and receives the consideration in foreign currency.

The applicant has raised following query:

04, HEARING

Preliminary Hearing in the matter was held on 27.02.2019. Sh. Shivrajan C.A, of Price Waterhouse Coopers Pvt Ltd appeared and requested for admission of application. During hearing, Jurisdictional Officer Sh. Manish Palia, State Tax Officer (C-006), Raigad Division, Navi Mumbai appeared and also made written submissions

The application was admitted and called for final hearing on 10.04.2019. Sh. Shivrajan C.A, PWC Pvt Ltd appeared, made oral & written submissions. Jurisdictional Officer Shri Manish Palia, State Tax Officer (C-006), Raigad Division, Navi Mumbai appeared.

05. OBSERVATIONS

We have gone through the facts of the case, documents on record and submissions made by both, the applicant as well as the jurisdictional office. The query raised by the applicant is in respect of a future transaction which will be undertaken by them.

We first of all reproduce the salient features of the draft agreement (submitted as Annexure A), which the applicant would be entering into which is as under:-

- The agreement does not mention the name of the Sponsor.

- The date of the agreement is 31.10.2017 and the proposed period for the same is effective from 21.11.2018 which is much before the date of filing the subject application.

- The Protocol Title is “Single dose oral bioequivalence pilot study of Oxycarbazepine Oral . Suspension 300 mg/5 ml and ‘TRILEPTAL®, (Oxycarbazepine) Oral Suspension 300 mg/5 ml in : healthy adult male subjects under fed conditions”.

4. In clause VII PUBLICATIONS it is mentioned that “It is understood that the Contractor shall not receive any royalty payment as a consequence of the sale of the marketing of the test product”

5. Clause X SUPPLIES: “ The Sponsor shall provide, without charge, all drugs to be studies under i sr ae this agreement……The Contractor agrees to keep all Study drugs in a locked, secured area..

6. Clause XVII. ADVERTISING : “ Under no circumstances will the name of the Sponsor be associated with the name of the drug being investigated on any advertisement placed to enroll subjects that will be used for the study”.

Further in Annexure B submitted by the applicant, the ‘Protocol Summary’ is mentioned, salient features of which are mentioned as under:-

- Objectives: “to compare and evaluate the oral bioavailability of Metformin HCI Extended Release Tablets 1000 mg with that of ‘FORTAMET® (Metformin HCI) Extended Release Tablets 1000 mg in healthy, adult, human subjects under fed conditions”.

We find that the Applicant will be providing Clinical Research (as mentioned in their application), in the form of comprehensive range of clinical research and support services to their clients (sponsors), by performing technical testing and analysis on the Drug/Investigational Product, 12 provided by sponsors located outside India and submits final analyses report to such foreign sponsors. The Research (study) will be conducted on human subjects. Thus we find that the Research is for conducting a study of the effect of such Investigational Product/drug. It has also been submitted that the goods/ Investigational Product given by the sponsor will get consumed during the process of the study and is not returned back to the sponsor. After the completion of study, the applicant will supply the Sponsor with a copy of a detailed report containing the analysis of the study conducted by them.

We agree with the applicants submission that their transaction satisfies the conditions mentioned in clauses (i), (ii), (iv) and (v) of Section 2(6) of the Integrated Goods and Services Tax Act, 2017 (IGST Act). However to be considered as Export of Services as per the GST Laws clause number (iii) with respect to Place of Supply of Services should be outside India. Hence we take up the issue of place of supply in the subject case.

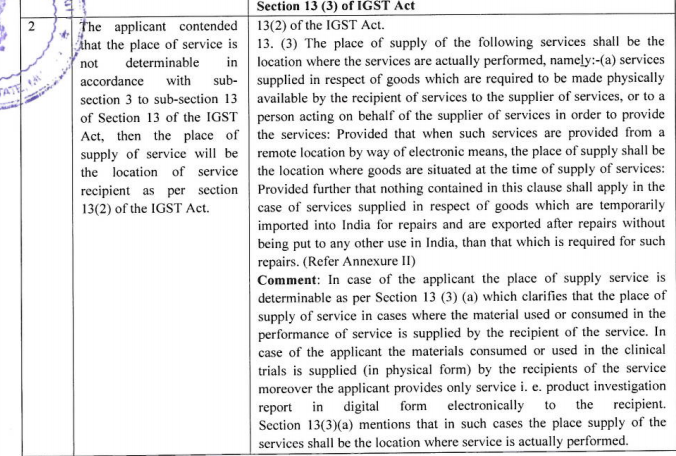

We therefore refer to the provisions of Section 13 of the IGST Act, 2017 which will be applicable to determine the place of supply since, in this case, the applicant supplying the services is in India and the client/sponsor to whom the services are supplied is situated outside India. Sec 13(2) of IGST Act, 2017 is reproduced below –

“13(2)The place of supply of services expect the services specified in sub sub-sections (3)to (13) “shall be the location of the recipient of services: Provided that where the location of the recipient of services is not available in the ordinary course of business, the place of supply shall be the location of the supplier of services.”

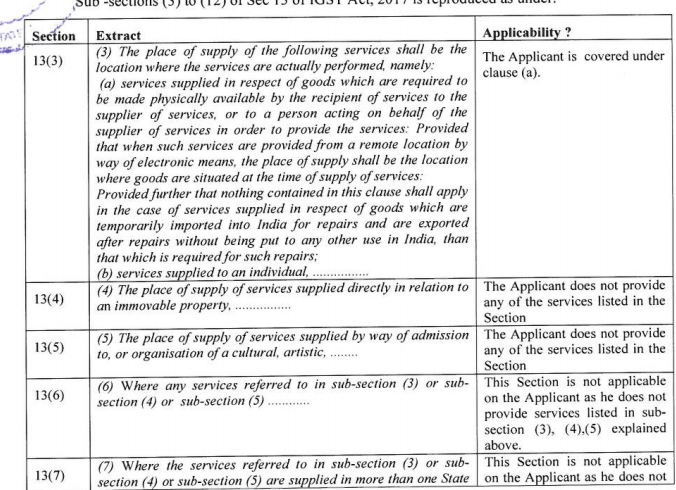

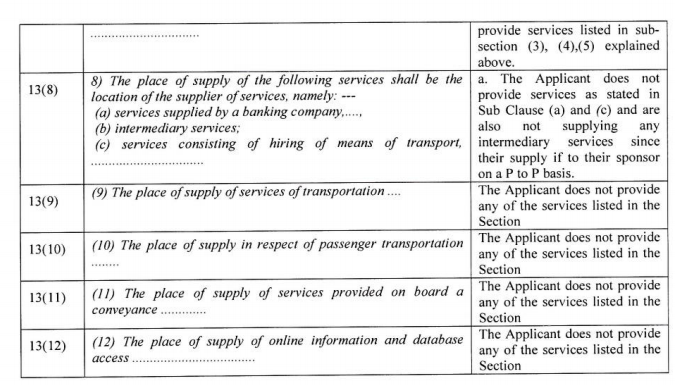

Sub -sections (3) to (12) of Sec 13 of IGST Act, 2017 is reproduced as under.

We shall now discuss whether Section 13(2) is applicable in the instant case. The Applicant’s case is not covered by the Section 13(2) as their case is covered under Section 13(3) of the IGST Act,2017. Section 13(3) states that,-

“ (3) The place of supply of the following services shall be the location where the services are actually performed, namely

(a) services supplied in respect of goods which are required to be made physically Available by the recipient of services to the supplier of services, or to a person acting on behalf of the supplier of services in order to provide the services: Provided that when such services are provided from a remote location by way of electronic means, the place of supply shall be the location where goods are situated at the time of supply of services:

(b) services supplied to an individual, …………….

We find from the submissions made by the applicant that the supply of services, in this case, is a pilot study/research to test the effect/efficacy of their subject product in healthy adult male subjects under fed conditions”. Thus the prime importance in this case is their product itself, which is supplied to them in India by their sponsors. Without this product to be tested the Research study cannot take off and therefore we find that the said supply of research services is in respect of subject products/goods and the same are required to be made physically available by the recipient of services to the supplier of services i.e. the applicant. We do not agree with the applicant’s contention that Section 13(3)(a) of the IGST Act will be applicable only in those cases where a service in the nature of repair, testing etc. is performed on the goods sent by the recipient to the supplier of service. The said section does not give any exemption to goods that are consumed in the process of research. The applicant have themselves submitted that the services of research are rendered by them in respect of the subject Drug/product, which are made available to them in India. Only when these drugs are received then they administer the same to their subject under certain conditions and observed the effect of the drugs on such subject and finally make research reports which are then sent to their sponsors. The Applicant has submitted that they are engaged by the sponsors only for the report and not for merely administering the drug and recording the results alone. This contention is flawed inasmuch as it is natural that in such cases the sponsors would like to know the efficacy of their drugs on subject and for which the testing of the drugs themselves are important. The entire administration of the drugs has to take place under controlled conditions and results have to be meticulously taken down. The report is only a culmination of the entire process.

Further the applicant has submitted that the case of Commissioner Of service Tax, Ahmedabad Versus B.A. Research India Ltd (supra) in their own case where it was held that the performance of testing and analysis has no value unless and until it is delivered to its client. Thus, delivery of report to its client is an essential part of the service report, which was delivered and used outside India and therefore, it should be construed as export of service. Whilst the applicant is citing the subject decision, they have ignored the same as can be seen from the documents submitted before this authority. The applicant has submitted 3 invoices issued by their Ahmedabad office, Invoice Nos. DEC 18/E/67, JAN 19/E/21 and NOV 18/3/29 dated 26.10.2018, 16.01.2019 and 22.11.2019 wherein they have been charging 18% IGST. Secondly the case of Commissioner Of service Tax, Ahmedabad Versus B.A. Research India Ltd pertains to pre-GST regime where Section 13 of the IGST Act,2017 was not there “and hence cannot be relied upon.

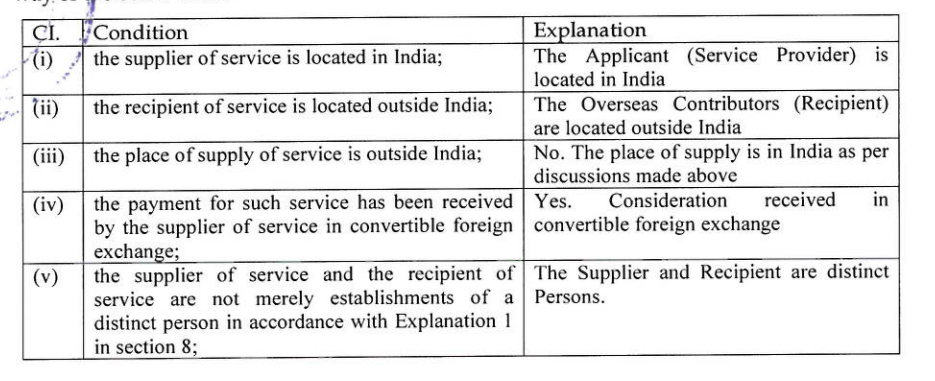

In light of the above, it is essential to see whether the ‘Export of Services’ definition contained in Sec 2(6) of the IGST Act, 2017 is satisfied for the subject transaction. The same is examined by way of the below table

In view of the above, as the applicant receives goods in India and the testing process is also carried out in India. The said goods are physically made available to them by their sponsors and therefore the place of supply of services is in India as per Section 13(3)(a) of the IGST Act. Since the place of supply is in taxable territory it is clear that the provisions of Section 2(6) of the IGST Act are not fulfilled in this case and therefore their supply cannot be considered as Export of Services as per the GST Law.

05. In view of the extensive deliberations as held hereinabove, we pass an order as follows :

ORDER

For reasons as discussed in the body of the order, the questions are answered thus –

Question 1:- The Applicant would like to seek a ruling on whether the “Clinical Research” services proposed to be provided by them to entities located outside India is liable to Central Goods and Services Tax and State Goods and Services Tax or Integrated Goods and Services Tax or is it eligible to be treated as an export of service under Section 2(6) of the Integrated Goods and Services Tax Act, 2017?

Answer :- The Clinical Research services proposed to be provided by them to entities located outside India is not eligible to be treated as an export of service under Section 2(6) of the IGST Act, 2017. The services are liable to CGST and SGST as the location of ‘supplier of service’ and the ‘place of supply’ is in the same State, in terms of Section 13(3)(a) of IGST Act, 2017.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.