Key Developments in Companies Act 2013

Table of Contents

Amendment To Schedule-III

Applicability:

Applicable on All Companies for the Financial Year on or after 01st April 2021 i.e, for the Financial Statements ending as on 31St March 2020 (F/Y 2021-22)

Purpose:

- To provide more transparency;

- To align the Companies Financial Statements in accordance with the Auditor’s Reporting Requirements.

Related Topic:

Important audit checks: Balance sheet

Key Highlights of Amendments:

I. General Instructions for Preparation of Balance Sheet:

Rounding Off:

Earlier Rounding off was not mandatory and it was applicable on Turnover of the Company.

As per New Amendment, The Rounding off shall be mandatory and instead of Turnover the rounding off will be applicable on Total Income.

| Total Income | Rounding Off |

| (a) less than one hundred crore rupees | To the nearest hundreds, thousands, lakhs, or millions, or decimals thereof. |

| (b) one hundred crore rupees or more | To the nearest lakhs, millions or crores, or decimals thereof. |

II. Additional Disclosure in Notes to Balance Sheet

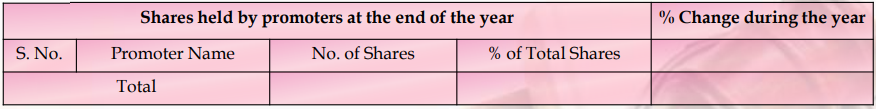

1. Shareholding of Promoters:

Note on Share Capital in Financial Statements shall disclose the Shareholding of promoters in the format prescribed:

2. Trade Payables (Aging Schedule):

Schedule for Payments which are due, to be disclosed in the notes of Trade Payables in the prescribed format.

Similar information shall be given where no due date of payment is specified in that case disclosure shall be from the date of the transaction.

Related Topic:

Changes made to Schedule III for AS & Ind AS

3. Reclassification:

a. Current Maturities of Long-Term Borrowings: Reclassified under the Head Short-Term Borrowings instead of Other Current Liabilities.

b. Security Deposits: Reclassified under the Head Other Non-Current Assets instead of Long Term Loans and Advances.

4. Property, Plant, and Equipment:

a. Heading of Property Plant and Equipment to include “and Intangible Assets”;

b. Instead of Tangible Assets the words “Property, Plant and Equipment” to be substituted;

c. A reconciliation of the gross and net carrying amounts of each class of assets at the beginning and end of the reporting period showing additions, disposals, acquisitions through business combinations, amount of change due to revaluation (if the change is 10% or more in the aggregate of the net carrying value of each class of Property, Plant and Equipment, and Intangible assets) and other adjustments and the related depreciation and impairment losses/reversals shall be disclosed separately.

Related Topic:

Companies Act, 2013 – Rotation of auditors for Private Companies

5. Disclosure on Utilization of Borrowings:

Where the Company has not used the borrowings from banks and financial institutions for the purpose for which it was taken at the Balance Sheet date, the Company shall disclose the details of where they have been used.

Related Topic:

MCA Relaxes the Additional Fee on Filing of Certain Forms under Co. Act, 2013/LLP Act, 2008

Read & Download the Full copy in pdf: