M/s Adani Gas Limited : NCLAT Delhi

Citations: Shri Balaganesan Metals Vs. M N Shanmugham Chetty & Ors Excel Crop Care Ltd. Vs. Competition Commission of India & Anr Aero Traders (P) Ltd. Vs. Ravinder Kumar Suri NATIONAL COMPANY LAW APPELLATE TRIBUNAL, NEW DELHI TA (AT) (Competition) No. 33 of 2017 (Old Appeal No. 50 of 2014) [Arising out of Order dated 3rd July, 2014 passed by the Competition Commission of India in Case No. 71 of 2012] IN THE MATTER OF: M/s Adani Gas Limited SSR Corporate Park, Sector – 27B, 13/6, NH-2, Delhi-Mathura Road, Faridabad – 121003. Haryana. …Appellant Vs 1. Competition Commission of India. Through its Secretary, Hindustan Times House 18-20 Kasturba Gandhi Marg, New Delhi – 110001. 2. Faridabad Industries Association FIA House, BATA Chowk, Faridabad - 121001. Haryana ….Respondents Present: For Appellant: Mr. Parcival Billimoria, Ms. Avaantika Kakkar, Ms. Neelambera Sandeepan, Mr. Satvik Mohnaty, Mr. Shubhankar Jain, Mr. Aamir Khan, Ms. Marcellina Kalikotey, Mr. Dhruv Rajan and Mr. Shaurya Vardhan, Advocates. For Respondents: Mr. Pallav Sishodiya, Senior Advocate with Mr. Vikram Sobti and Mr. Mehul Parti, Advocates for Respondent No. 1. Mr. Sharad Gupta and Mr. Vinayak Gupta, Advocates for Respondent No. 2. With TA (AT) (Competition) No. 34 of 2017 (Old Appeal No. 57 of 2014) [Arising out of Order dated 3rd July, 2014 passed by the Competition Commission of India in Case No. 71 of 2012] IN THE MATTER OF: Faridabad Industries Association FIA House, BATA Chowk, Faridabad - 121001. Haryana …Appellant Vs 1. Competition Commission of India. Through its Secretary, Hindustan Times House 18-20 Kasturba Gandhi Marg, New Delhi – 110001. 2. M/s Adani Gas Limited SSR Corporate Park, Sector – 27B, 13/6, NH-2, Delhi-Mathura Road, Faridabad – 121003. Haryana. ….Respondents Present: For Appellant: Mr. Sharad Gupta and Mr. Vinayak Gupta, Advocates for Respondent No. 2. For Respondents: Mr. Pallav Sishodiya, Senior Advocate with Mr. Vikram Sobti and Mr. Mehul Parti, Advocates for Respondent No. 1. Mr. Parcival Billimoria, Ms. Avaantika Kakkar, Ms. Neelambera Sandeepan, Mr. Satvik Mohnaty, Mr. Shubhankar Jain, Mr. Aamir Khan, Ms. Marcellina Kalikotey, Mr. Dhruv Rajan and Mr. Shaurya Vardhan, Advocates. J U D G M E N T BANSI LAL BHAT, J. ‘Adani Gas Limited’ (AGL) has preferred the instant appeal being appeal No. TA (AT) (Competition) No. 33 of 2017, Old Appeal No. 50 of 2014 against order dated 3rd July, 2014 passed by the Competition Commission of India (Commission) in Case No. 71 of 2012 (Faridabad Industries Association Vs. Adani Gas Limited) under Section 27 of ‘the Competition Act, 2002’ (Act) holding that the Appellant has contravened the provisions of Section 4(2)(a)(i) of the Act by imposing unfair conditions upon the buyers under ‘Gas Supply Agreement’ (GSA). The Commission, apart from directing the Appellant to cease and desist from indulging in conduct found to be in contravention of the provisions of the Act in terms of the impugned order, directed the Appellant to modify the GSA’s in the light of observations and findings recorded in the impugned order and imposed a penalty @ 4% of average turnover of the last three years quantified at Rs.2567.2764 Lakh. 2. The Informant - ‘Faridabad Industries Association’ (FIA) also has filed cross appeal being TA (AT) (Competition) No. 34 of 2017, Old Appeal No. 57/2014. 3. For better appreciation of the issues raised in these appeals reference to the allegations in the information filed by FIA against AGL and the action taken by the Commission culminating in passing of impugned order is inevitable. Briefly adverting to the factual matrix, it comes to fore that FIA is an Association of Industries registered under the Societies Registration Act, 1860, situated in Faridabad, comprising of about 500 Members operating industries in auto components, medical devices, steel, alloys, textile, chemical, etc. AGL is a Company incorporated and registered engaged interalia in the business of setting up distribution network in various cities to supply natural gas to industrial, commercial, domestic and CNG customers. It was averred in the information that about 90 Members of FIA were consuming natural gas supplied by AGL to meet their fuel requirements. The Informant alleged that AGL, by grossly abusing its dominant position in the relevant market of supply and distribution of natural gas in Faridabad, has put unconscionable terms and conditions in GSA which are unilateral and lopsided besides being heavily tilted in favour of AGL. Thus, AGL was alleged to have imposed its diktat upon the buyers of natural gas (Members of FIA) under the garb of executing GSA. It was further alleged that the terms of GSA have been drafted unilaterally by AGL leaving no scope for Members of FIA, who are solely dependent for supplies upon AGL. Referring to various clauses of GSA, the Informant alleged that the said clauses and conduct of AGL clearly demonstrated abuse of dominant position by AGL in imposing unfair and discriminatory conditions in GSA’s executed by it with the Members of FIA. While we propose to refer to allegedly offending clauses at the appropriate stage as we proceed further, be it noticed that on the strength of aforesaid allegations Informant complained of contravention of provisions of Section 4 of the Act seeking various reliefs including direction to AGL to discontinue such abuse of dominant position, direct modification of offending clauses in GSA by providing fair and non-discriminatory terms and imposition of exemplary penalty within the ambit of Section 27(b) of the Act. 4. It emerges from impugned order that the Commission, upon consideration of the material available on record, directed the Director General (DG) to cause an investigation to be made in the matter and submit report within 60 days of its order dated 27th December, 2012. DG filed the investigation report on 7th February, 2014 5. As per Investigation Report of DG, the relevant market is the market of supply and distribution of natural gas to industrial consumers in Faridabad District and AGL is in a dominant position in the said relevant market. DG concluded that Sub–clause 9.4 of Clause 9 (Quality), Subclauses 10.2, 10.5 and 10.6 of Clause 10 (Measurement and Calibration), Sub-clause 11.2.4 of Clause 11 (Shutdown and Stoppage of Gas), Subclause 12.6 of Clause 12 (Contract Price), Sub-clauses 13.4, 13.6 and 13.7 (partially) of Clause 13 (Billing and Payment) and Sub-clause 14.1 of Clause 14 (Payment Security) of GSA of AGL with its industrial consumers did not reflect abusive conduct attributable to dominant position of AGL. However, Sub-clause 13.5 of Clause 13 (Billing and Payment) of GSA to the extent of stipulating any such rates as may be decided by the seller in future and Sub-clause 13.7 of Clause 13 (Billing and Payment) to the extent of absolving AGL from paying interest on excess amount in dispute paid by the consumers amounted to imposition of unfair conditions by AGL upon consumers. It also concluded that sub-clause 16.3 under Clause 16 of GSA to the extent of reservation of right at its sole discretion by AGL to accept or reject request of customers for force majeure and Sub-clause 11.2.1 under Clause 11 of GSA to the extent of buyer being obliged to meet its Minimum Guaranteed Off-take (MGO) payment obligation even in the event of emergency shutdown calling for complete or partial off-take of gas amounted to imposition of unfair conditions. DG further concluded that Sub-clause 17.4 of Clause 17 (Expiry and Termination) of GSA which empowered AGL to terminate the Agreement in the event of consumer’s failure to take 50% or more of the Cumulative Daily Contracted Quantity (DCQ) during a period of 45 consecutive days amounted to imposition of unfair condition by AGL upon consumers. However, DG did not find AGL having indulged in abuse of its dominant position qua the allegations of irrational and arbitrary increase in gas prices. The allegations in regard to non-adherence to the PNGRB Regulations by AGL were found factually incorrect. 6. Upon consideration of the Investigation Report submitted by the DG, the Commission decided to proceed with the enquiry and provided opportunity to the parties to file their replies/ objections to the Investigation Report and provided them oral hearing. On analysis of the Information, the Investigation Report and the Replies/Objections of the parties, the Commission formulated following issues for determination:- (i) What is the relevant market in the present case? (ii) Whether the Opposite Party is dominant in the said relevant market? (iii) If finding on the issue no. (ii) is in affirmative, whether AGL has abused its dominant position in the relevant market? Relevant Market 7. The Commission agreed with classification of consumers made by the DG who identified various categories of consumers viz. industrial consumers, domestic consumers, commercial consumers and transportation consumers further observing that since interchangeability or substitutability of a product in terms has to be seen from the perspective of consumers while determining the relevant market, industrial consumers formed a category different and distinct from domestic, commercial and transportation consumers. The Commission noted that the intended use and price of natural gas for each of these categories of consumers was different. The price charged for supply of natural gas to these different consumer segments being different and technical considerations involved in supply and distribution of gas to the different segments being different necessitated a distinction to be made between consumers under such categories. The Commission found itself in agreement with DG as regards natural gas being distinct and distinguishable from other sources of energy as it was a flammable gaseous mixture composed mainly of Methane made available to consumers through a network of pipelines. Unlike other Liquid Hydrocarbons, it did not require any storage facilities at the end of consumers. It also noted that the natural gas was a clean, smoke free and soot free fuel as compared to Liquid Hydrocarbons and its supply was uninterrupted as it did not require storage by consumers at their premises. Based on such considerations, the Commission was of the view that the Relevant Product Market in the present case would be the market of supply and distribution of natural gas to industrial consumers. 8. Adverting to the aspect of ‘Relevant Geographic Market’, the Commission found that the DG had rightly noticed that the Government of Haryana having authorized only AGL to build and operate a CGD network in district Faridabad and there being no other authorized entity in Faridabad to lay such network makes district Faridabad the Relevant Geographic Market in the instant case. The Commission also agreed with the Investigation Report of DG to the effect that AGL faced no competition from any other entity in the said geographical area. Whether AGL is dominant in the said Relevant Market? 9. The Commission noticed that AGL held 100% market share in the Relevant Market being the only entity authorized by Government of Haryana to setup and operate CGD Network in Faridabad. The Commission noticed that the regulations framed under the Petroleum and Natural Gas Regulatory Board Act, 2006 (PNGRB Act) contain provisions to grant 25 years infrastructure exclusivity to lay, expand or operate CGD Network with further provision for three years marketing exclusivity to an existing CGD Network and five years exclusivity to a new CGD Network from the purview of common or contract carrier after which it provides for open access allowing competition and choice to the consumer. Based on the relevant factors including absence of any countervailing buying power, market structure, size thereof and the entry barriers, the Commission found that the AGL was holding a dominant position in the defined relevant field. Whether AGL has abused its dominant position in the relevant market? 10. Dwelling upon various clauses of Gas Sales Agreement (GSA) executed inter-se the members of FIA and AGL, the Commission was of the view that with reference to Clauses 9 and 10 of GSA, the allegations of FIA as regards unilateral self-declaration of the quality/ measurement of gas by the seller were misconceived. It noticed that AGL was not producer but only supplier of gas sourced by it from GAIL and certified by GAIL as regards its quality/ measurement which was supplied by AGL through a closed pipe network. The Commission noticed that FIA itself had relied on the certificate of gas quality/ measurement issued by GAIL. It also noticed that for resolution of any dispute arising out of the interpretation/ implementation or breach of any of the provisions of GSA there was a Dispute Resolution Mechanism provided with further provision that in the event of such dispute not being resolved, Clause 20 providing for Arbitration shall be invoked. Thus, the Commission found, the buyer could take recourse to the remedies provided under such mechanism. 11. As regards Clause 11 of GSA declining any compensation to the buyer on account of disruption of gas supply due to any reason whatsoever, the Commission was of the view that the said clause being reflective of the upstream agreement of AGL with GAIL did not reflect abuse of dominant position by AGL. 12. As regards Clause 12 of GSA providing for unrestricted right to seller to change/ modify/ revise the contract price and excess gas price, the Commission agreed with conclusions of the DG that by virtue of peculiarities of Gas Industry coupled with the fact that the gas prices are market driven and the nature of relationship between AGL and its consumers makes price negotiation an impracticable proposition, it was impractical to have a fixed formula based pricing mechanism for fixation of gas prices. It noticed the fact that the revision in prices of gas depended upon revision in prices by GAIL to AGL in terms of the agreement, consequently, affecting the consumer as the end user. 13. As regards Clause 13 providing for billing and payment, the Commission agreed with the DG that this Clause imposed unfair conditions upon consumers in as-much-as under Clause 13.7, if any amount becomes payable or reimbursable by AGL to consumers on account of erroneous billing/ invoicing on the part of AGL, there was no obligation on the part of AGL to pay interest on the said amount. It also found that the Clause specified rate of interest to be levied for delayed payment by the buyer with further stipulation that any such rates may be communicated by the seller in future which clearly amounted to imposing of unfair conditions. However, the Commission agreed with the conclusion drawn by DG on interpretation of Clause 13.7 providing for the buyer to pay the invoice amount alongwith interest and penalty before invoking the arbitration clause as being not abusive on the ground that AGL too in terms of its Agreement with GAIL was bound by similar stipulation. 14. As regards Clause 14 (Payment Security), the DG did not find this clause to be abusive. The Commission, while agreeing with such conclusion observed that such arrangements are necessitated by the extremely interdependent and interlinked nature of the business. Default in payment by AGL to GAIL and by GAIL to its suppliers would disrupt the entire supply chain. Thus, the Clause was not abusive. 15. As regards Clause 17 (Expiry and Termination), dealing with failure on the part of seller to deliver and buyer to take delivery of gas, the DG found Clauses 17.2 and 17.4 to be abusive. The Commission, having conspectus of the relevant Clauses, observed that while the AGL enjoyed longer period from GAIL for meeting the DCQ obligation, it provided only 45 days to do so for its industrial consumers. The wide disparity between the two periods was not warranted. However, it did not find any merit in the allegation of discriminatory conduct of AGL as such condition had uniformly been stipulated in GSAs executed with all industrial customers by AGL. 16. As regards Clause 16 (Force Majeure) and Clause 17 (Shutdown etc.), the Commission while agreeing with the analysis of the DG observed that Sub-clause 16.3 of GSA to the extent AGL has reserved the right at its sole discretion to accept or reject request of customers for Force Majeure which amounts to imposition of unfair conditions upon consumers. The Commission held that Clause 11.2.1 of GSA to the extent of rendering the buyer liable to meet its MGO Payment obligation even in the event of emergency shutdown amounted to unfair conditions and abuse of dominant position. 17. As regards the allegation of FIA qua revision of gas prices by AGL from time to time arbitrarily and irrationally, the Commission observed that the conduct of AGL in revising gas prices could not be construed to be reflection of abuse of its dominant position as found by DG. In arriving at its finding the Commission was influenced by the observation of DG that the cost of gas was prone to frequent fluctuations due to the peculiarities of the gas industry and a fixed formula based pricing mechanism for gas sector being impractical. It also noted that the gas prices for consumers were not solely linked to crude oil prices. Thus, the Commission brushed aside the allegations emanating from FIA on this score. 18. The Commission was of the opinion that AGL had contravened provisions of Section 4(2)(a)(i) of the Act by imposing unfair conditions upon buyers under GSA. It accordingly proceeded to pass the impugned order directing AGL to cease and desist from indulging in the conduct found to be violative of law, modify GSAs in light of its findings and imposed penalty @ 4% of average turnover of the last three years on AGL quantified at Rs.2567.2764 Lakhs. Aggrieved thereof AGL has filed TA (AT) (Competition) No. 33 of 2017, Old Appeal No. 50/2014 assailing the findings recorded by the Commission and the penalty imposed on it. Cross Appeal being TA (AT) (Competition) No. 34 of 2017, Old Appeal No. 57/2014 has been filed by FIA in regard to some findings by the Commission dismissing its allegations in regard to abuse of dominant position 19. Learned counsel for the Appellant – AGL submits that the finding of dominance was erroneous as the definition of ‘relevant market’ by the Commission was fallacious. Denying abuse of alleged dominance on the part of AGL, learned counsel further submitted that though the principles of natural justice were violated, AGL, in order to cut short the controversy filed affidavit dated 16th May, 2018 in response to the suggestion of this Appellate Tribunal for effecting changes in the Clauses held anticompetitive by the Commission. It is further submitted that it is not important that the products are similar or not but whether one product competes with the other. The definition of relevant market given in Section 2 (t) makes it clear that products may be interchangeable or substitutable by the consumer. It is submitted that Piped Natural Gas (PNG) supplied by AGL competes with several other products and FIA has admitted that out of its 500 Members only 90 consume Natural Gas supplied by the AGL to meet their fuel requirements. It is pointed out that there are around 5000 industrial units located at Faridabad while AGL had only about 120 customers. Learned counsel further submits that several customers have been using other sources of fuel prior to AGL’s entry in the market and some customers of AGL too opted out and switched back to such other sources. Reference in this regard is made to some correspondence in response to objections of FIA to the DG Report to demonstrate that customers had expressed their intent to switch to other industrial fuels on account of increase in the price of Natural Gas supplied by AGL. It is submitted that SSNIP Test, so essential for determination of relevant market was not commissioned and the Report submitted by an expert was not considered. Learned counsel for AGL further submits that Liquid Petroleum Gas (LPG) is a superior product as compared to PNG. Heat transfer efficiency of LPG is 85% compared to 65% for PNG. Use of other sources of energy like Furnace Oil, HSD, Propane, LPG, Power and Coal is not prohibited or prevented by law. It is submitted that the only relevant question for determining the ‘relevant market’ is whether at some particular point a consumer may switch from one product to another and whether a product is superior or not is not relevant. The relevant factors are the characteristics, prices and intended use in relation to interchangeability and not characteristics which may be considered to be superior. It is submitted that PNG is interchangeable with other fuels and the said facts have been sufficiently established during investigation before DG and during enquiry before the Commission. 20. It is further submitted that the pipeline infrastructure setup by the Appellant – AGL can be used by any other competitor to distribute CNG as provided by the regulations/ license. Therefore, a distributor like Indraprastha Gas can use the Appellant’s infrastructure in the same way as telecom structure can be shared. Thus, there is no monopoly or dominance. It is further submitted that the Respondent’s (FIA’s) case as setup in the cross appeal is misconstrued, as a distributor enters into a back-to-back agreement for supply of gas from GAIL. The issue is contractual in nature and does not involve infraction of Competition Law. In this regard reference is made to paragraph 71, 99 – 102 and 85 – 87 of the impugned order and the Appellant’s response to Report of DG. Reference is also made to paragraph 15, 16 & 17 of the affidavit of Appellant filed on 16th May, 2018. 21. Per contra it is contended on behalf of FIA that the industrial purposes for which natural gas was being used as fuel by the industries in Faridabad till November, 2012 were such that no other fuel could be used as its substitute by reason of the unique characteristics of natural gas, intended use and price. It is further contended that natural gas is Methane (CH4). On burning any hydrocarbon molecule, the heat comes mostly from the combustion of hydrogen and very little from the combustion of carbon, the ratio of carbon to hydrogen being 1:4. However, LPG comprising of Propane (C3H8) or Butane (C4H10) has ratio of carbon to hydrogen at less than 1:3. In liquid hydrocarbon fuels like furnace oil, the ratio is hardly 1:2. Thus, in the event of equal weights of all hydrocarbon fuels being burned the maximum heat would be yielded by the natural gas. Moreover, the liquid hydrocarbons contain numerous impurities including Sulfur restricting their use as fuel due to its corrosive effect. Therefore, it is contended, natural gas having superior qualities is unique and stands apart from all other hydrocarbon fuels. It is contended that the natural gas cannot be replaced with any other hydrocarbon fuel. It is contended that the ‘relevant product market’ has to be decided taking into account the intended use of the fuel and not the number of industrial customers. It is further submitted that natural gas is the preferred fuel for certain applications such as manufacturing of certain high purity alloys involving direct heating. It is submitted that there are members of FIA who manufacture high precision alloys which mandate use of natural gas only. Responding to AGL’s contention that some of the industrial units shifted away from natural gas, it is submitted that such shift may be due to unfair conditions imposed by AGL in supplying natural gas. Moreover, same is not relevant for ascertaining AGL’s dominant position or the ‘relevant product market’. Moreover, data referred to in this regard is for the period post November, 2012 and irrelevant for disposing of this appeal. It is submitted that the only supplier of natural gas in Faridabad during 2009 to 2012 being AGL, the industrial consumers were constrained to procure natural gas for their requirements only from AGL. 22. On behalf of Commission, a detailed note has been submitted which is in sync with the findings recorded in the impugned order. It is submitted on behalf of Commission that on account of different intended use and price of natural gas for the different categories duly classified and identified as consumers by AGL, the industrial consumers form a different class as concluded by DG and found by the Commission. The Commission found that while for domestic, commercial and transport categories of consumers LPG is considered as a substitute for natural gas, same is not a substitute for industrial consumers as also admitted by the Appellant. The Commission did not dispute the Appellant’s contention that at the relevant time for industrial consumers there was no available gaseous substitute for natural gas. It is submitted that the Appellant has admitted that it does not have any competitor in relation to supply of natural gas in the relevant geographic market of Faridabad, which implies that AGL was the only supplier of natural gas while other competitors in the field like IOCL, BPCL and HPCL competed with the supply of other alternative fuels. 23. Having heard learned counsel for the parties and after wading through the record, we find that this appeal alongwith the cross appeal was earlier heard by the Competition Appellate Tribunal (COMPAT) which had reserved the judgment but before pronouncement of judgment COMPAT came to be merged with this Appellate Tribunal, thereby rendering it imperative to rehear the parties. Fathoming through the minutes of proceedings recorded in appeal proceedings, it emerges that this Appellate Tribunal initially directed the parties to address it on limited issues whether the Appellate Tribunal on the basis of certain suggestions made by learned counsel for the Appellant can give quietus to the dispute or remit the case or decide the case on merit. This comes to fore from order recorded on 11.09.2017. However, subsequently on 09.10.2017 parties were directed to address their respective case on merits. It was during the course of hearing that on 07.02.2018, Appellant - AGL was permitted to seek suitable amendment of the Terms of the Agreement and asked to produce same in sealed cover. On 28.02.2018, learned counsel for AGL handed over a copy of proposal for amendment proposed to be made in the Terms of Agreement. Copies thereof were provided to the Commission and to the FIA. AGL was allowed to file an additional affidavit giving the background of proposed amendment together with the proposed amendment. Same was complied as reflected in order dated 26.03.2018. AGL was further permitted to file a fresh affidavit. As the hearing progressed, AGL brought to the notice of this Appellate Tribunal certain evidence as regards existence of other players in the gas supply field in the relevant area. AGL was accordingly permitted to file additional affidavit with right of rebuttal given to Respondents. This is reflected in order dated 20.09.2019. Same having been complied, hearing was concluded. 24. Having noticed the factual matrix of the respective cases of the parties, report of Director General, findings recorded by the Commission and the developments that have taken place during the hearing manifesting in proposed revised agreement suggested by AGL to allay the apprehensions of FIA with regard to conditions in GSA found unfair by the Commission and having conspectus of the respective contentions of the parties, it is apt to notice the relevant provisions of law bearing on the case so as to narrow down the controversy to definite issues and focus thereon to determine whether there was abuse of dominant position on the part of AGL qua supply of gas to its consumers viz. members of FIA and if so, whether the proposed revised agreement takes care of such alleged unfair conditions in GSA and whether the step taken would suffice to redress the grievance of FIA without insisting upon imposition of penalty on AGL for the alleged contravention of provisions of Section 4 of the Act with reference to allegations of abuse of dominant position. The relevant provisions are reproduced herein below:- “4. Abuse of dominant position.— [(1) No enterprise or group shall abuse its dominant position.] (2) There shall be an abuse of dominant position 1[under sub-section (1), if an enterprise or a group].— (a) directly or indirectly, imposes unfair or discriminatory— (i) condition in purchase or sale of goods or service; or (ii) price in purchase or sale (including predatory price) of goods or service. Explanation.— For the purposes of this clause, the unfair or discriminatory condition in purchase or sale of goods or service referred to in sub-clause (i) and unfair or discriminatory price in purchase or sale of goods (including predatory price) or service referred to in sub-clause (ii) shall not include such discriminatory condition or price which may be adopted to meet the competition; or (b) limits or restricts— (i) production of goods or provision of services or market therefor; or (ii) technical or scientific development relating to goods or services to the prejudice of consumers; or (c) indulges in practice or practices resulting in denial of market access [in any manner]; or (d) makes conclusion of contracts subject to acceptance by other parties of supplementary obligations which, by their nature or according to commercial usage, have no connection with the subject of such contracts; or (e) uses its dominant position in (e) uses its dominant position in one relevant market to enter into, or protect, other relevant market. Explanation.—For the purposes of this section, the expression— (a) “dominant position” means a position of strength, enjoyed by an enterprise, in the relevant market, in India, which enables it to— (i) operate independently of competitive forces prevailing in the relevant market; or (ii) affect its competitors or consumers or the relevant market in its favour. (b) “predatory price” means the sale of goods or provision of services, at a price which is below the cost, as may be determined by regulations, of production of the goods or provision of services, with a view to reduce competition or eliminate the competitors [(c) “group” shall have the same meaning as assigned to it in clause (b) of the Explanation to section 5.]” Section 2(r) defines ‘relevant market’ as under:- ““relevant market” means the market which may be determined by the commission with reference to the relevant product market or the relevant geographic market or with reference to both the markets;” Section 2 (s) defines ‘relevant geographic market’ as under:- ““relevant geographic market” means a market comprising the area in which the conditions of competition for supply of goods or provision of services or demand of goods or services are distinctly homogenous and can be distinguished from the conditions prevailing in the neighbouring areas;” Section 2(t) defines ‘relevant product market’ as under:- ““relevant product market” means a market comprising all those products or services which are regarded as interchangeable or substitutable by the consumer, by reason of characteristics of the products or services, their prices and intended use;” 25. The core issue for determination in these appeals is:- (a) Whether AGL did enjoy a dominant position? (b) Whether AGL’s dominant position prevailed in the relevant market? (c) Whether AGL abused its dominant position? Thus, in the first place it is to be determined whether the Appellant – AGL did enjoy a dominant position in the relevant market enabling it to operate independently of competitive forces prevailing in the relevant market or affect its competitors or consumers or the relevant market in its favour and if so, whether AGL imposed any unfair or discriminatory conditions in purchase or sale of goods or services or in price or imposed unfair or discriminatory price in purchase or sale of goods or services or limited or restricted production of goods or provision of services or indulged in practices resulting in denial of market access. 26. In order to understand the controversy involved at the bottom of instant cause, it is necessary to grasp the nature of industries functioning in the ‘relevant geographic market’ of Faridabad and the energy requirements of the industrial consumers. Details of the list of association members of FIA not using Natural Gas forms pages 1144 to 1153 of the appeal paper book, while list of members using Natural Gas forms pages 1154 to 1157 of the appeal paper book. Perusal thereof reveals that the members of FIA are operating industries of dyes, ceramics, automotive components, forging and casting etc., who previously depended upon other sources of energy like diesel, electricity and furnace oil out of whom the industries incorporated in list running through page nos. 1154 to 1157 subsequently switched over to natural gas through CGD Network for their energy requirements. This factual position remains uncontroverted. The Commission has delineated the different types of industries in para 2 of the impugned order at page 173 of the appeal paper book which reveals that FIA has about 500 members and the industries comprise auto component, medical devices, steel, alloys, textile, chemical etc. Annexure-1 to DG Report and page no. 540-541 of the appeal paper book classifies natural gas in three categories viz. Liquefied Natural Gas (LNG), Compressed Natural Gas (CNG) and Piped Natural Gas (PNG). Such classification is not disputed by AGL. According to Appellant – AGL, the end consumers are to be classified in four different categories viz. Domestic Consumers, who use gas for cooking purposes; Commercial Consumers like Restaurants, Malls, Hospitals, etc. who use gas for cooking, power generation, cooling or heating; Transport Sector Consumers, who use who use gas as means to generate electricity and heating etc. From the submission of AGL as reflected at page 563 of the appeal paper book, it is gatherable that the Appellant – AGL does not dispute the factum of each of the aforesaid categories of consumers being different and distinct on the basis of intended use and price of natural gas being different to each category. The fact that AGL has been treating each category of consumers at a different footing is writ large as emerging from the GSA being executed only with Industrial Consumers while it enters into business relationship with Domestic and Commercial Consumers for supply of gas merely through an application form but no such agreement or application form is entered with the category of Transport Sector Consumers. A glance at the Investigation Report of Director General, paragraphs 4.5 and 4.6 (at page 484-485 of the appeal paper book) lays it bare that based on the aforesaid admission of AGL and the relevant considerations including different intended use and price of natural gas for each category, the DG arrived at conclusion that differentiation amongst consumers was based on aforesaid considerations inspite of all of them consuming the same product i.e. natural gas as source of energy. The Commission has based its finding on the Investigation Report of the DG coupled with the classification made by AGL and the intended use and price of natural gas for each category being different, thus, treating the Industrial Consumers as a different category. 27. A vital question for consideration which cannot be glossed over and is of primary importance in regard to status of Industrial Consumers as a distinct category is whether there is any gaseous substitute for natural gas for the Industrial Consumers. It emerges from the record that two types of agreements were offered by AGL to Industrial Consumers viz. (a) MGO Contract, whereby the off taker agrees to purchase a minimum amount of natural gas ensuring a minimum level of supply to the buyer and stable revenue to the supplier and (b) Non-MGO Contracts, where the buyer is not under any obligation to purchase a minimum level of gas and has the liberty to purchase gas based on its requirement. It further emerges from record that the natural gas competes with most of the fuels available in the market like furnace oil, electricity, diesel, coal and naptha. The customers have the ability to switch over to the alternate fuels without incurring substantial costs. The Industrial Customers can switch over to solid fuel (coal and lignite), liquid fuels (mainly furnace oil), grid electricity. This factual position is not disputed by AGL in its reply to the DG. Reference in this regard can be made to page 568 and 771 of the appeal paper book (submissions of AGL qua the DG Report). It is not in controversy that the natural gas supplied to members of FIA is primarily re-gasified LNG (i.e. PNG), which is sourced from GAIL and the Appellant – AGL has admitted this factual position in its response to the DG Report comprising page 566 of the appeal paper book. There is no escape from the conclusion that LPG is not a substitute for Industrial Consumers though the same constitutes a substitute for natural gas qua Domestic, Commercial and Transport Sector categories. Appellant has not disputed this proposition of fact. Even FIA in its reply to the DG (page 1154 to 1157) clarified that its members used other sources of energy like furnace oil, diesel, high speed diesel and electricity as sources of energy prior to their switch over to natural gas. AGL and FIA do not appear to be on a course of collision as regards the factum of Industrial Consumers being faced with the prospect of having no available gaseous substitute for natural gas. The Investigation Report of DG further reveal that natural gas was different from liquid hydrocarbons and electricity and with no gaseous substitute available for natural gas, the Industrial Consumers of Faridabad i.e. FIA members were solely dependent upon supplies of natural gas by AGL, the Appellant – AGL being the only supplier of natural gas while IOCL, BPCL and HPCL competed with the supply of other alternative fuels. Thus, the only conclusion deducible on the basis of material available on record is that during the relevant period there was no gaseous substitute of natural gas available to Industrial Units in Faridabad. It is emphatically clear that PNG was not interchangeable with other fuels as contended on behalf of AGL. Furthermore, it cannot be ignored that during the relevant period LPG was not available to Industrial Units as an alternate fuel as revealed from the submissions made before the DG. It is therefore futile on the part of AGL to contend that it had successfully demonstrated that PNG was interchangeable with other fuels at the relevant time. Having regard to all relevant considerations and the material available on record, we find no hesitation in supporting the finding recorded by the Commission on the aspect of ‘relevant market’ and ‘AGL’s dominant position in the relevant market’. The fact that the pipeline infrastructure setup by AGL subsequently can be used now by any other competitor to distribute CNG does not create any dent in the aforesaid finding. As a sequel thereto, we affirm the finding that the Appellant – AGL occupied a position of strength making it the dominant player and enjoying dominant position in the relevant market. 28. The case setup by FIA in cross appeal qua some alleged contraventions does not raise competition concern in as-much-as AGL as a distributor enters into a back-to-back agreement for supply of gas from GAIL. The concern raised being purely contractual in nature does not fall within the embrace of Competition Law 29. Now coming to the issue of alleged abuse of dominant position be it seen that the Commission in its impugned order held against AGL contravention only as regards clauses 11.2.1, 13.5, 13.7, 16.3 and 17.4 of the GSA. The agreement pertains to period 2009 to 2012. The agreement appears to have been revised w.e.f. 1st April, 2013. Offending Clause 17.4 stands deleted and has not been incorporated in the revised agreement. Admittedly, the benefit of such deletion would enure to all consumers. AGL has furnished the tabulation set out in the Annexure to its affidavit filed vide diary no. 4965 dated 17.05.2018 in compliance to order of this Appellate Tribunal dated 28th February, 2018. Same is reproduced hereinbelow:- Tabulation of Changes to the Agreement and the Revised Agreement

Having found that AGL, being the only supplier of natural gas and there being no gaseous substitute for the same, we find that AGL abused it dominant position qua the Industrial Customers by imposing unfair conditions upon the Buyers under GSA as it existed in original form. As regards Clause 13 (Billing and Payment), the terms and conditions under this Clause providing that an excess payment by the Buyer to the Seller due to erroneous billing/ invoicing on the part of Seller would give rise to no liability whatsoever on the part of the Seller including interest whereas a delayed payment by the Buyer renders him liable to pay interest and there being no corresponding obligation on the part of AGL to pay interest in terms of Clause 13.7, such clause imposes unfair conditions upon the Buyers. Sub-clause 13.5 also imposes unfair condition upon the Buyers in as-much-as the interest rate was left to be determined by the Seller and communicated in future. We also find that Clause 17.2 and 17.4, imposes conditions providing for short duration of only 45 days for the Industrial Consumers as against longer duration available to AGL from GAIL for meeting the cumulative DCQ Obligation on account of failure to take off with termination clause which amounts to imposition of unfair conditions. Clause 16.3 of GSA, dealing with force majeure, vesting discretion in AGL to accept or reject request of customers for force majeure, on the face of it, amounts to imposition of unfair conditions. Sub-clause 11.2.1 of GSA imposes unfair conditions to the extent the consumer is obliged to meet its MGO payment obligation even in the event of emergency shutdown calling for complete or partial off take of gas. Such conditions stare in the face of AGL eloquently speaking of same being unfair, lopsided, unilateral, harsh and detrimental to the interests of the consumers and even a bare look at such clauses does not warrant a contrary opinion. Even AGL must have been conscious of such conditions being unfair to consumers and abusive of its dominant position which is clearly inferable from its conduct in substituting the original GSA with revised one modifying the contravening terms and conditions. We have therefore no hesitation in arriving at the finding that the AGL abused its dominant position in the relevant market. 30. During the course of hearing, Respondents did not dispute the fact that the proposed modification in terms of the offending clauses in the GSA by AGL brings it out of the ambit of contravening conduct. Admittedly, such modification is prospective in operation and complies with the mandate of Section 27 (d) of the Act. It is however imperative to ascertain whether under Section 27 of the Act the Commission can pass orders singularly (such as to discontinue and not re-enter) or with any other directions as stipulated therein (such as imposition of penalty and/or modification of the impugned agreement) or pass all orders under Section 27 of the Act. This Appellate Tribunal vide order dated 2nd September, 2019 had directed the parties to file short written submissions on the question of law. Before we advert to the stand taken by the parties in this regard, it is apt to reproduce the relevant provision of law engrafted in Section 27 of the Act, which reads as under:- “27. Orders by Commission after inquiry into agreements or abuse of dominant position.— Where after inquiry the Commission finds that any agreement referred to in section 3 or action of an enterprise in a dominant position, is in contravention of section 3 or section 4, as the case may be, it may pass all or any of the following orders, namely:— (a) direct any enterprise or association of enterprises or person or association of persons, as the case may be, involved in such agreement, or abuse of dominant position, to discontinue and not to reenter such agreement or discontinue such abuse of dominant position, as the case may be; (b) impose such penalty, as it may deem fit which shall be not more than ten percent of the average of the turnover for the last three preceding financial years, upon each of such person or enterprises which are parties to such agreements or abuse: [Provided that in case any agreement referred to in section 3 has been entered into by a cartel, the Commission may impose upon each producer, seller, distributor, trader or service provider included in that cartel, a penalty of up to three times of its profit for each year of the continuance of such agreement or ten percent. of its turnover for each year of the continuance of such agreement, whichever is higher.] (c) [Omitted by Competition (Amendment) Act, 2007] (d) direct that the agreements shall stand modified to the extent and in the manner as may be specified in the order by the Commission; (e) direct the enterprises concerned to abide by such other orders as the Commission may pass and comply with the directions, including payment of costs, if any; (f) [Omitted by Competition (Amendment) Act, 2007] (g) pass such other [order or issue such directions] as it may deem fit. [Provided that while passing orders under this section, if the Commission comes to a finding, that an enterprise in contravention to section 3 or section 4 of the Act is a member of a group as defined in clause (b) of the Explanation to section 5 of the Act, and other members of such a group are also responsible for, or have contributed to, such a contravention, then it may pass orders, under this section, against such members of the group.] 31. On a plain reading of the provision engrafted in Section 27 of the Act, it emerges that contravention of Section 3 or Section 4 of the Act being established, the Commission is empowered to pass all or any of the orders envisaged under Clauses (a) to (g). The language of this provision leaves no scope for doubt that the Commission may, befitting the circumstances of a case, pass any order falling under either one or more of the Clauses in combination or even encompassing all the Clauses. The term ‘any’ has to be accorded a purposive and a creative interpretation which can be explained on no hypothesis other than the one that it embraces one, more than one, some, many and all. In ‘Shri Balaganesan Metals Vs. M N Shanmugham Chetty & Ors.’, reported in (1987) 2 SCC 707, the Hon’ble Apex Court interpreted the term ‘any’ to mean ‘some’, ‘one of many’ and ‘an indiscriminate number’. Again in ‘Excel Crop Care Ltd. Vs. Competition Commission of India & Anr.’, reported in (2017) 8 SCC 47, the term ‘any’ was interpreted to mean ‘all’, ‘every’, ‘some’ or ‘one’ based on the context and subject matter of the statue. It is abundantly clear that the term ‘any’ is all-encompassing and empowers the Commission to pass orders either singularly (such as to desist, discontinue and not reenter) or coupled with any other discretion (such as imposition of penalty and/ or modification of the impugned agreement) or pass all orders under Section 27 of the Act. 32. In the instant case, the Commission passed orders under Clauses (a), (b) & (d) of Section 27. Under Section 27(a), Commission directed AGL to cease and desist from indulging in the contravening conduct; under Section 27(b), the Commission imposed a penalty of 4% of the average turnover of the last three years while under Section 27(d), the Commission directed AGL to modify the Gas Supply Agreements (GSAs) in light of observations in the impugned order. So far as direction under Section 27(a) is concerned, no exception can be taken to it. AGL has to be restrained perpetually from indulging in the contravening conduct. Now before coming to quantum of penalty under Section 27, it is apt to ascertain whether AGL has modified the Gas Supply Agreements (GSAs) to bring it out of the offending, violative and contravening conduct. 33. The Commission held AGL guilty of contravention of provisions of Section 4(2)(a)(i) of the Act by imposing unfair conditions upon the Buyers under GSA. As regards Clause 13 (Billing and Payment), the Commission was of the view that the terms and conditions under this Clause providing that an excess payment by the Buyer to the Seller due to erroneous billing/ invoicing on the part of Seller gives rise to no liability whatsoever on the part of the Seller including interest whereas a delayed payment by the Buyer renders him liable to pay interest. The Commission was of the opinion that there being no obligation on the part of AGL to pay interest in terms of Clause 13.7, such clause imposed unfair conditions upon the Buyers. Further, Sub-clause 13.5 also imposed unfair condition upon the Buyers in as much as the interest rate was left to be determined by the Seller and communicated in future. As regards Clause 17.2 and 17.4, the Commission was of the view that the conditions providing for short duration of only 45 days for the Industrial Consumers as against longer duration available to AGL from GAIL for meeting the cumulative DCQ Obligation on account of failure to take off with termination clause amounts to imposition of unfair conditions. As regards Clause 16.3 of GSA, dealing with force majeure, Commission found that the clause vesting discretion in AGL to accept or reject request of customers for force majeure amounts to imposition of unfair conditions. As regards Sub-clause 11.2.1 of GSA, the Commission found it imposing unfair conditions to the extent the consumer is obliged to meet its MGO payment obligation even in the event of emergency shutdown calling for complete or partial off take of gas. 34. To take care of this contravening conduct in the context of Clauses found to be offending, violative and abusive of the dominant position in the form of imposing unfair conditions upon Industrial Consumers and in the light of observations of this Appellate Tribunal adumbrated hereinabove, as also taking care of other reservations expressed by the FIA in their cross appeal, the AGL proposed the revision in the relevant clauses of GSA as noticed in para 29 above, which reasonably take care of all objections and reservations as regards the contravening clauses bringing it within the fold of acceptable conduct and safeguarding the concerns and legitimate interests of Industrial Consumers. 35. Finally, we are left to deal with application of Section 27 Clause (b) which provides for imposition of penalty upon the enterprise found guilty of abuse of dominant position viz. AGL in the instant case. Imposition of penalty for abuse of dominant position by an enterprise is left to the discretion of the Commission with the rider that such penalty shall not exceed 10% of the average of the turnover for the last three preceding financial years upon such person(s) or enterprises which are parties to the contravening agreements or abuse of dominant position. The phraseology employed in the provision clearly brings it to fore that while there is a ceiling on the maximum penalty sought to be imposed upon the enterprise found guilty of abuse of dominant position in the relevant market, no restriction as regards minimum has been prescribed. The discretion with the Commission in imposing penalty lies within the aforesaid delineated bounds. It is well settled by now that judicial discretion connotes exercise of judgment by a judicial or quasi-judicial authority based on what is fair under the circumstances and guided by the principles of law. There is no hard and fast rule and an actual exercise of judgment on consideration of the peculiar facts and circumstances of the case is required. It is also settled by now that the affected party is not entitled to claim exercise of discretion in its favour as a matter of right [refer ‘Aero Traders (P) Ltd. Vs. Ravinder Kumar Suri’, Reported in (2004) 8 SCC 307]. However, it is entitled to show that there are mitigating factors/ extenuating circumstances warranting imposition of lesser/ reduced penalty. 36. The Commission while imposing penalty noticed that only few clauses out of the GSA have been found to be in contravention of the provisions of the Act. It also noticed the changes effected by AGL during investigation and pendency of proceedings before the Commission in the agreements (GSAs). Having regard to the same, it decided to impose penalty @ 4% of average turnover of AGL for financial years 2009-10, 2010-11 and 2011-12 worked out at Rs.2567.2764 Lakhs. Some more development took place during the pendency of appeals before this Appellate Tribunal to which we have alluded to earlier. The Gas Supply Agreements (GSAs) that had been revised by AGL during course of investigation and enquiry before the Commission came up for further revision of the contravening clauses to make them more consumer friendly and to protect the interests of Industrial Consumers by removing the disparity as regards revision of gas prices, payment obligation in case of shutdown of supply and for complete or partial off take of gas, etc. which came about in compliance to thesuggestions put forth by this Appellate Tribunal. Such modifications which in effect eliminated discrimination qua Industrial Consumers and subsequent emergence of competitors of natural gas on the scene coupled with the fact that AGL not only came up with voluntary revision of GSAs even before conclusion of enquiry by the Commission and was amenable to the advice/ suggestions falling from this Appellate Tribunal resulting in incorporation of the consumer friendly clauses substituting the contravening provisions in the GSAs, in our considered opinion carve out mitigating factors/ extenuating circumstances in favour of AGL outweighing the only aggravating factor i.e. abuse of dominant position. Keeping that in view we are of the considered opinion that reducing the penalty imposed on AGL from 4% of the average annual turnover of the relevant three years to 1% would be commensurate with and proportionate to the level of proved abusive conduct of AGL. We are of the firm opinion that this reduction would meet the ends of justice and achieve the desired object of the statue in the peculiar facts and circumstances of the case. 37. Both the appeals are accordingly disposed of upholding the impugned order passed by the Commission holding AGL guilty of abuse of dominant position with the orders and directions passed by the Commission with modification in imposition of penalty on AGL as indicated hereinabove. Balance amount of the penalty as reduced be deposited by AGL within thirty days of pronouncement of this judgment. All other orders/directions given by the Commission shall remain intact. The revised agreement (GSA) as approved by us shall be made operational with immediate effect. There shall be no orders as to costs. Download the copy:

ConsultEase Administrator

ConsultEase Administrator

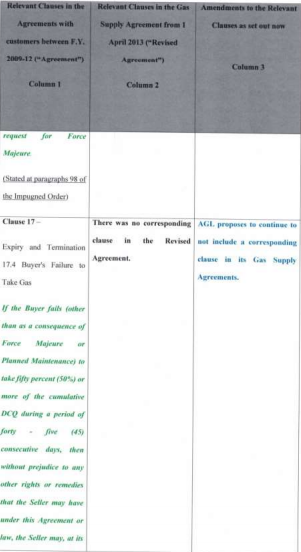

Consultant

Faridabad, India

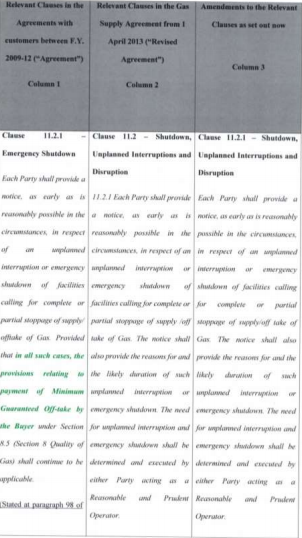

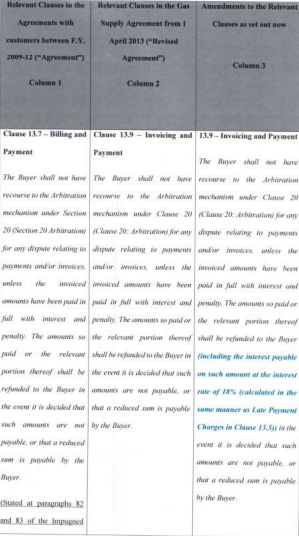

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.