Composition scheme in GST

Composition scheme in GST

Basic conditions to be fulfilled to get Composition scheme in GST:

Following are the basic condition which are required to be fulfilled to be eligible for Composition scheme in GST.

- The proper officer of CG/SG may allow a registered taxable person to pay tax under composition scheme.

- The aggregate turnover of the taxpayer shall not exceed more than Rs. 50 Lac in previous financial year. If the turnover exceed Rs. 50 lac in any financial year, he will be out of the composition scheme from the day when the turnover so exceeds.

- The person registered under composition scheme shall not be eligible to collect any amount of tax from recipients.

- If later on PO comes to believe that the person was not eligible for composition scheme. He will be liable to pay the amount of tax plus penalty under the provisions of section 67 or 66.

- He should not falling under any criteria which are ineligible for composition. There are five conditions mentioned in Law. If a taxable person

- is engaged in the supply of services

- makes any supply of goods which are not leviable to tax under this Act

- any inter-State outward supplies of goods

- makes any supply of goods through an electronic commerce operator who is required to collect tax at source under section 56

- is a manufacturer of such goods as may be notified on the recommendation of the Council.

- All taxable persons under one singal PAN have opted for the composition scheme.

Related Topic:

Composition Scheme (Section-10 of CGST Act, 2017)

Registration and returns for taxpayers under composition scheme in GST:

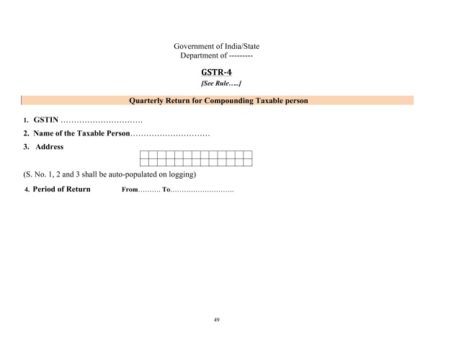

Registration form for composition dealer is same. Only thing is they need to tick on point 6a of form which is declaration that their turnover will not exceed R.s 50 lac. The composition dealer is not required to file the monthly returns. There is a separate form for them. They need to file a return within 18 days of end of quarter (section 34). So their return in quarterly. The form for filing return for a composition dealer is GSTR-4. Format is attached here

Apart from this composition taxpayer will be required to file annual return. But their format for annual return is simplified. They will have less compliances. Only setback is they will not be able to utilize the ITC.

Tax to be paid by taxpayers under composition scheme:

Under the composition the tax to be paid by the taxable person shall not be less than 1%. This will become 1% for CGST and 1% for SGST so their tax rate will be at least 2% for trader and 5% for manufacturers.It is important to notice that this is minimum rate. Actual rate may be more than that.

Provisions of ITC for taxpayer under composition scheme in GST:

A composition dealer is also a registered person in GST. But h is not allowed to collect tax or utilize input tax credit for making payment of output tax liability. Although rate of tax on a composition is also very less.Now there can be two instances for a composition dealer. First is that he enter from section 8 levy to section 9 i.s composition levy.Second is that he leaves the section 9 levy and enters back into section levy.In both of these cases his Input tax will have different treatment.Let us discuss those provisions under this heading.

When a person enters into the section 9 levy i.e composition levy in GST from section 8:

Section 18(7) covers the provisions for shifting from section 8 to section 9. The treatment of accumulated ITC on the date will be as follows.

- Taxpayer will an amount equivalent to the credit of input tax in respect of inputs held in stock and inputs

contained in semi-finished or finished goods. - And input tax on capital goods as reduced by prescribed percentage points.

- On the day immediately preceding the day when he ceases to be taxable in section 8.

- The balance of input tax credit, if any, lying in his electronic credit ledger shall lapse (after payment of such amount).

When a person enters into section 8 i.e normal levy from section 9 i.e. composition levy in GST:

Section 18(3) covers the provision when a composition dealer enters into the normal levy.Now he is eligible to utilize ITC. Following credits will be allowed to a composition dealer when he will enter into section 8.

- on input tax in respect of inputs held in stock, inputs contained in semi-finished or finished goods held in stock

- on capital goods reduced by such percentage points as may be prescribed in this behalf

immediately preceding the date from which he becomes liable to pay tax under section 8.

When it will be beneficial to take composition scheme in GST:

It totally depends on the business model of the taxpayer.We have tried to set some benchmarks to help the taxpayers to choose whether they should choose a composition scheme or not.

- If they are providing services, They cant opt for composition.

- If they are making b2b supplies where the recipient may be willing to take ITC, composition is not an option. Because in composition scheme the taxpayer cant pass on the ITC.

- Composition scheme may be beneficial only when they are selling to the end consumer.

- If the margin is low the normal levy may be beneficial. When margin is high composition may be better but subject to the ITC requirements of recipient.

Thus we have tried to compile all the provisions related to the composition scheme at one place.You can make any feedback or ask any query in comment.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.