Composition Scheme (Section-10 of CGST Act, 2017)

Table of Contents

Composition Scheme (Section-10 of CGST Act, 2017)

- Every tax system requires compliances with statutory provisions in a time-bound manner such as periodic tax payments, filing of returns, maintenance of prescribed records, etc. which many a time pose a challenge to small business. Provisions to protect the interest of such small businesses are often found in the taxing statutes. Under the GST law, this benefit for small businesses has been introduced in the form of the Composition Scheme.

- The objective of the composition scheme is to bring simplicity and to reduce the compliance cost for small taxpayers.

- Suppliers opting for composition levy need not worry about the classification of their goods or services, the rate of tax applicable on the same, etc. They are not required to raise any tax invoices, but simply need to issue a “Bill of Supply” wherein no tax will be charged from the recipient.

- At the end of the quarter, the composition dealer is required to pay a specified percentage of his turnover for the quarter as a tax without availing the benefit of an input tax credit.

Related Topic:

TAXABILITY OF TDR ON OR AFTER 01.04.2019

Introduction to Composition Scheme: –

Section 10 of the CGST Act prescribes a “Composition Scheme” for small dealers wherein they are freed for a large number of compliances and procedures which a regular taxpayer is otherwise expected to comply with.

Related Topic:

Composition Scheme for Real-estate

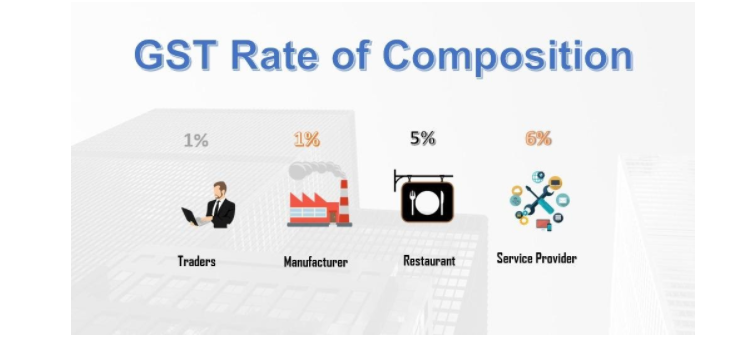

Composition Scheme is an alternative option allowed to small taxpayers whose turnover is within the limits prescribed u/s 10 of the CGST Act. A dealer opting for composition levy is required to pay the following amounts as composition tax: –

| Category of Registered Person | CGST | SGST | Total GST |

| Manufacturers Eligible for Composition Levy | 0.5% | 0.5% | 1% |

| Suppliers of Restaurant/ Catering Services | 2.5% | 2.5% | 5% |

| Any other Supplies Eligible for composition levy (i.e. Traders) | 0.5% | 0.5% | 1% |

| Service Provider | 3% | 3% | 6% |

A Simplified Scheme for Small Service providers: –

- A simplified scheme has been introduced with effect from 1st April 2019 for small service providers (and those who are suppliers of goods as well as services) whose aggregate turnover during the preceding financial year does not exceed Rs. 50 Lakhs. This scheme has been introduced vide Notification No 2/2019-CT (Rate) dated 7th March 2019

- The taxable person opting for this scheme is required to pay GST @ 6% on supplies made on or after 1st April 2019 (3% CGST+3% SGST).

- A person who has opted to pay under this scheme is required to issue a bill of supply for supplies made instead of a tax invoice. On the top of each bill of supply, the following words need to be added “Taxable person paying tax in term Notification No. 2/2019-CT (Rate) dated 7th March 2019 not eligible to collect tax on supplies”

- Various conditions are required to be fulfilled by a dealer who opts for a composition scheme as prescribed u/s 10 of CGST Act, 2017. Such conditions shall also apply where a dealer opts to pay tax under this scheme.

Related Topic:

Section 33 of CGST Act:Amount on tax documents

Person Eligible to opt for Composition Scheme: –

Eligibility Criteria: –

- A person can opt for a composition scheme if his turnover during the preceding financial year does not exceed Rs. 1.5 crore.

- However, in the case of eight states (i.e. Arunachal Pradesh, Manipur. Meghalaya, Mizoram, Sikkim, Nagaland, Tripura, and Uttarakhand) the limit of Rs. 75 lakh shall apply instead of Rs. 1.5 crore.

- Related Topic:

Rule 142 of the CGST Act – Notice and order for demand of amounts payable under the Act.

Calculation of Aggregate Turnover: –

Aggregate turnover of the preceding financial year is the determining factor for ascertaining whether a dealer is eligible for a composition scheme or not. Therefore, it becomes important to know the items which are to be included/excluded at the time of computation of aggregate turnover.

Turnover of all the entities which are registered under a common permanent account number (PAN) across India has to be aggregated to determine the eligibility of an assessee to opt for composition scheme.

For Example: – A dealer has two offices in Delhi. In order to determine whether he is eligible to avail of a composition scheme or not, the turnover of both the offices would be taken into account and if the same does not exceed Rs. 1.5 crore, only then the dealer can opt avail the composition levy (subject to fulfillment of other prescribed condition)

|

Aggregate Turnover |

|

| Inclusion | Exclusion |

Following outward supplies made by all entities registered under same Pan across India:

|

|

Person Not Eligible to OPT for Composition Scheme: –

The following person cannot opt for composition scheme and therefore, such a person is required to discharge their tax liability, if any, in the normal manner: –

- Supplier of any services other than the supplier of restaurant/catering services.

- Vide Order No. 01/2019-central tax dated February 1, 2019, CBEC has clarified that a supplier of exempt services by way of extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount shall be eligible to opt for composition scheme.

- A recent amendment allows suppliers of goods to supply taxable services up to 10% of the turnover of preceding financial year or Rs. 500000, whichever is higher and still shall be eligible to claim the benefit of composition scheme.

- Supplier of goods which are not taxable under the CGST/SGST/UTGST/IGST Act.

- Supplier of Interstate outward suppliers of goods

- The person supplying goods through an electronic commerce operator.

- Manufacturer of curtain notified goods: –

- Ice Cream

- Pan masala

- Aerated water

- Tobacco and other manufactured tobacco substitutes have been notified

- Casual Taxable person as well as Non-Resident taxable person.

For Example: –

- Mohan is engaged in providing legal services in Rajasthan and is registered in the same state. Determine whether the supplier in the following case is eligible for composition levy provided their turnover in a preceding year does not exceed Rs. 1 crore?

Supplier of any taxable services other than the supplier of restaurant/catering services is not eligible for composition levy. Since Mohan provides legal services, he is not eligible for composition levy.

- Sugam manufacturers have registered offices in Punjab & Haryana and supply goods neighboring states. Determine whether the supplier in the following case is eligible for composition levy provided their turnover in a preceding year does not exceed Rs. 1 crore?

Since the Supplier of inter-state outward supplies of goods is not eligible for composition levy, Sugam Manufacturers is not eligible for composition levy.

Restriction Imposed on a Composition Supplier: –

Multiple restrictions have been imposed on a person who opts composition levy which has been described below: –

- The goods held in stock by a composition dealer should have been purchased from a registered supplier. Where any goods have been purchased from an unregistered supplier, the composition supplier should have paid the applicable tax under Reverse charge u/s 9(4) of CGST Act,2017

- Where the composition dealer is required to pay tax under reverse charge u/s 9(3) and 9(4) of CGST Act on any inward supply of goods or services or both the composition dealer should have paid the same.

- A composition dealer shall mention the words “Composition Taxable person, not eligible to collect tax on supplies” at the top of every bill of supply issued by him.

- The composition scheme has to be adopted uniformly by all the registered persons having the same permanent account number (PAN). If one such registered person opts for the normal scheme, others become ineligible for composition scheme.

For Example:- A dealer X has two offices in Delhi and is eligible for composition levy. If X opts for composition scheme, both the offices would have to pay tax under composition scheme and abide by all the condition as may be prescribed for the composition scheme

- A composition dealer is required to issue a bill of supply instead of a tax invoice.

- A taxable person opting for composition scheme is not entitled to any credit of input tax.