Condonation in filing of appeal for genuine problem in checking GSTN dashboard (Pdf Attach)

Table of Contents

Cases Covered:

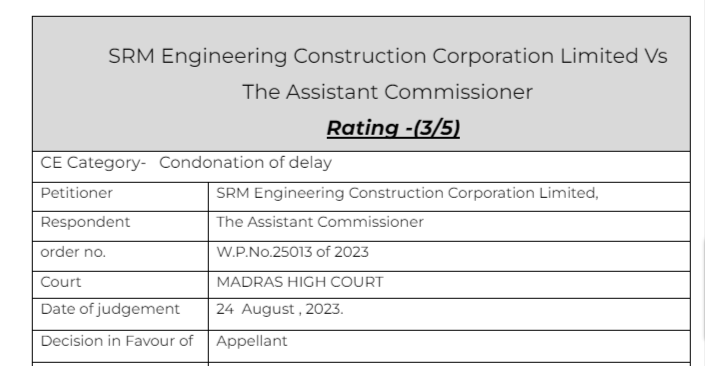

SRM Engineering Construction Corporation Limited vs. the Assistant Commissioner

Citations:

Facts of the cases:

A notice was issued to the applicant for the difference in GSTR 1 and GSTR 3b. The petitioner has challenged the impugned Assessment order dated 23.02.2023. The impugned order proceeds notice issued in GST DRC 01 on 19.12.2022. The petitioner however failed to respond to the same and therefore on account of the mismatch between GSTR1 and GSTR 3B and also the difference in ITC between GSTR 3B and GSTR 2A, the impugned order has been passed.

He couldn’t file the appeal as his business was running at a loss. Most of the employees left the company. Thus there was no one to check the portal.

Observation & Judgement of the Court:

The petitioner has challenged the impugned Assessment order dated 23.02.2023. The impugned order preceeds notice issued in GST DRC 01 on 19.12.2022. The petitioner however failed to respond to the same and therefore on account of the mismatch between GSTR1 and GSTR 3B and also a difference in ITC between GSTR 3B and GSTR 2A, the impugned order has been passed.

Comment:

Very important judgment for Condonation of delay. We have many judgments against the appellant but this one was in favour. The honorable court considered the genuine problem of the appellant in checking the GSTN Dashboard.

The author can be reached at shaifaly.ca@gmail.com

Read & Download the Full SRM Engineering Construction Corporation Limited vs. the Assistant Commissioner

[pdf_attachment file=”1″ name=”optional file name”]

.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.