ADVANCE RULING

CENTRAL GOODS AND SERVICES TAX ACT, 2017

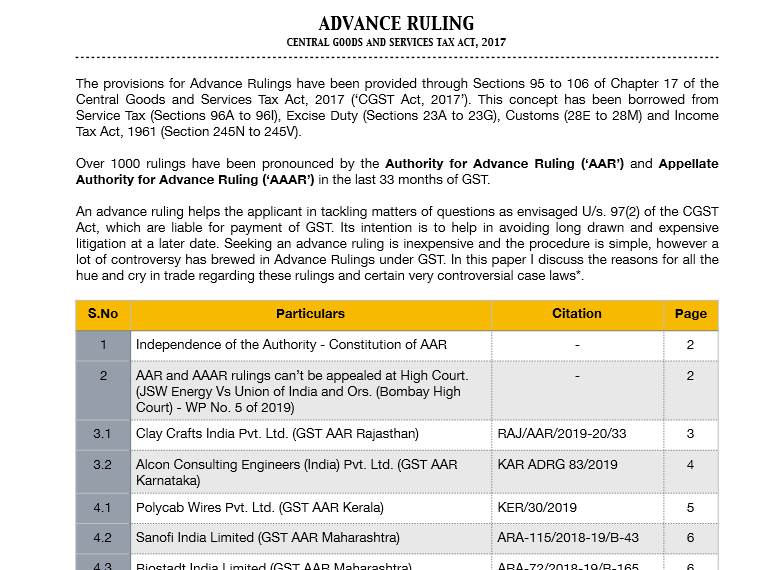

The provisions for Advance Rulings have been provided through Sections 95 to 106 of Chapter 17 of the Central Goods and Services Tax Act, 2017 (‘CGST A […]

RULE 36(4) AND CIRCULAR NO. 123/42/2019-GST, ULTRA VIRES, AND IMPOSSIBLE MATHEMATICS!

Abstract:

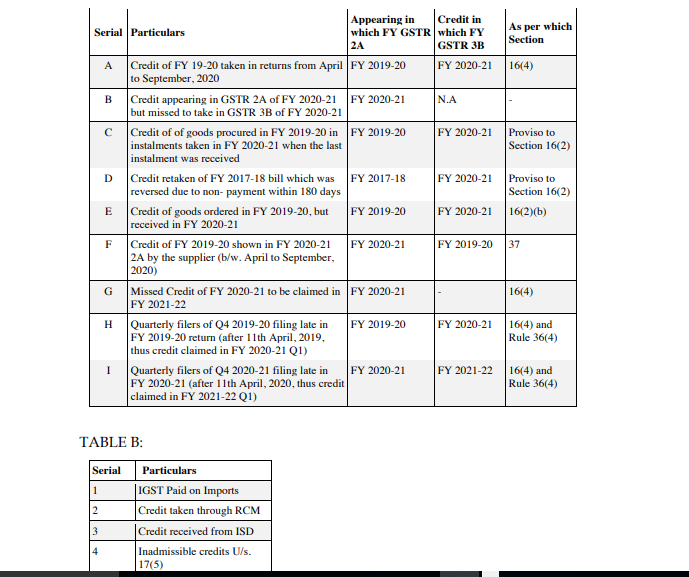

Rule 36(4) was introduced from October 2019 to restrict credit taken by any GST registered person to the amount […]

Abhishek Daga

@abhishek-daga

active 5 years, 8 months agoAbhishek Daga

OOPS!

No Packages Added by Abhishek Daga. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewAbhishek Daga wrote a new post, Most Controversial Rulings in Last 33 Months 5 years, 8 months ago

ADVANCE RULING

CENTRAL GOODS AND SERVICES TAX ACT, 2017

The provisions for Advance Rulings have been provided through Sections 95 to 106 of Chapter 17 of the Central Goods and Services Tax Act, 2017 (‘CGST A […]

Abhishek Daga wrote a new post, Rule 36(4) and Circular No. 123/42/2019-GST, Ultra Vires and Impossible Mathematics! 5 years, 8 months ago

RULE 36(4) AND CIRCULAR NO. 123/42/2019-GST, ULTRA VIRES, AND IMPOSSIBLE MATHEMATICS!

Abstract:

Rule 36(4) was introduced from October 2019 to restrict credit taken by any GST registered person to the amount […]