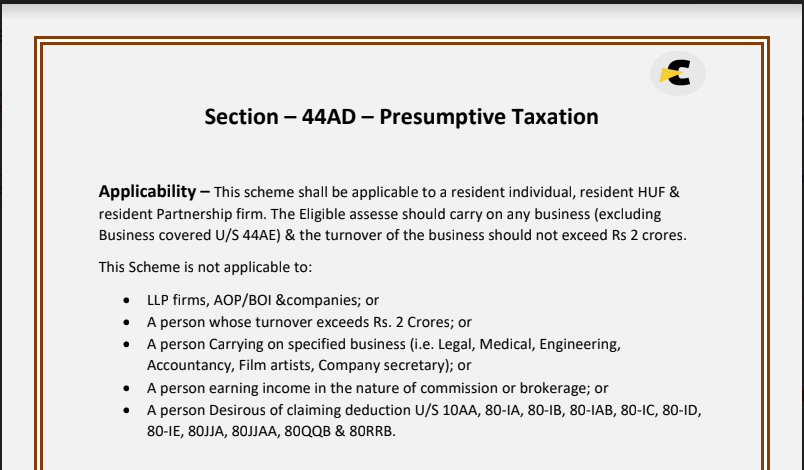

Section 44AD – Presumptive Taxation for small businesses

Section 44AD – Presumptive Taxation for small businesses.This is special scheme for small businesses. They can pay tax easily with simplified return. No […]

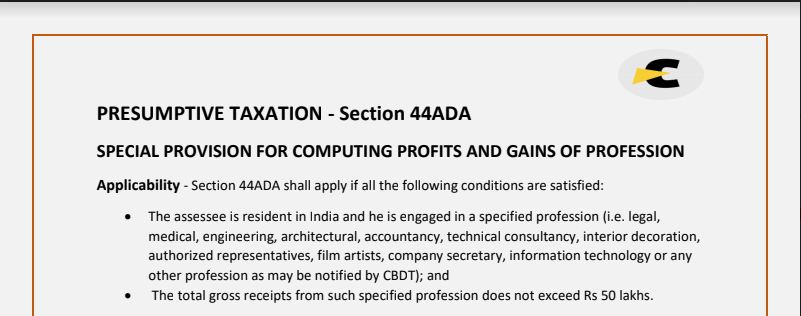

Presumptive Taxation for small professionals – Section 44ADA

SPECIAL PROVISION FOR COMPUTING PROFITS AND GAINS OF PROFESSION

Applicability

Section 44ADA shall apply if all the following conditions are […]

Every tax system requires compliances with statutory provisions in a time-bound manner such as periodic tax payments, filing of returns, maintenance of […]

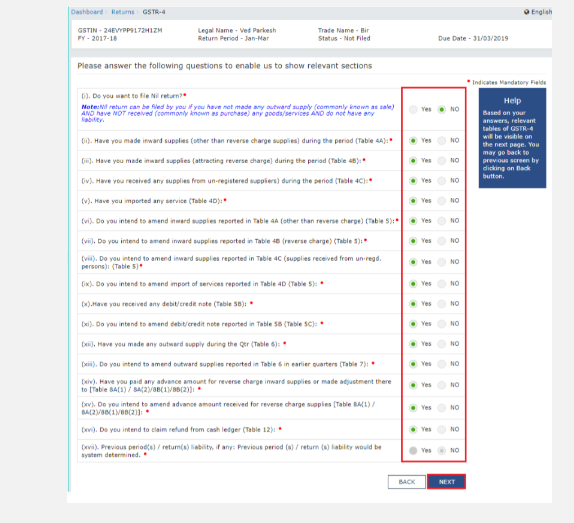

GSTR-4

Form GSTR-4 (Annual Return) is a yearly return to be filed by taxpayers opting for composition scheme on an annual basis. Unlike a normal taxpayer who needs to furnish three monthly returns, a dealer […]

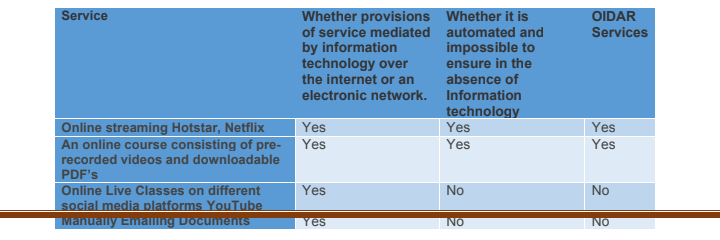

Online Information Database Access And Retrieval: OIDAR

OIDAR Services are a category of services whose Delivery is mediated through the internet & its supply is essentially automated involving minimum or zero […]

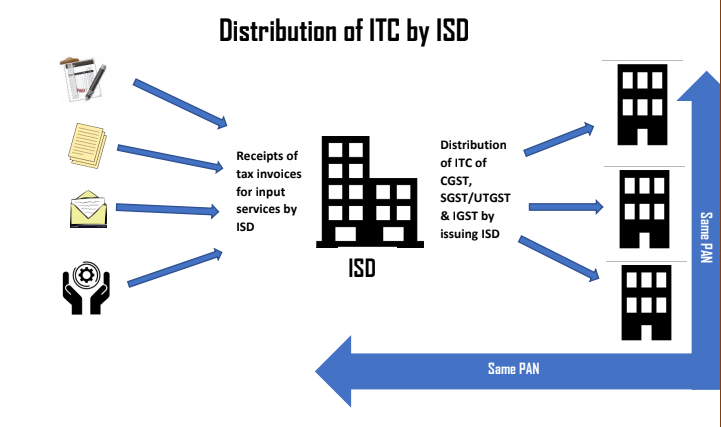

Input Service Distributor (ISD)

Definition –

As per Section 2(61) of CGST Act,2017, Input Service Distributor means an office of the supplier of goods or services or both which receives tax invoices issued […]

What is a Udyog Aadhar?

Udyog Adhar is the registration number under MSME. In the last couple of weeks, many benefits are offered for MSME. You need to register under Udyog Aadhar. Only then you will be eligible […]

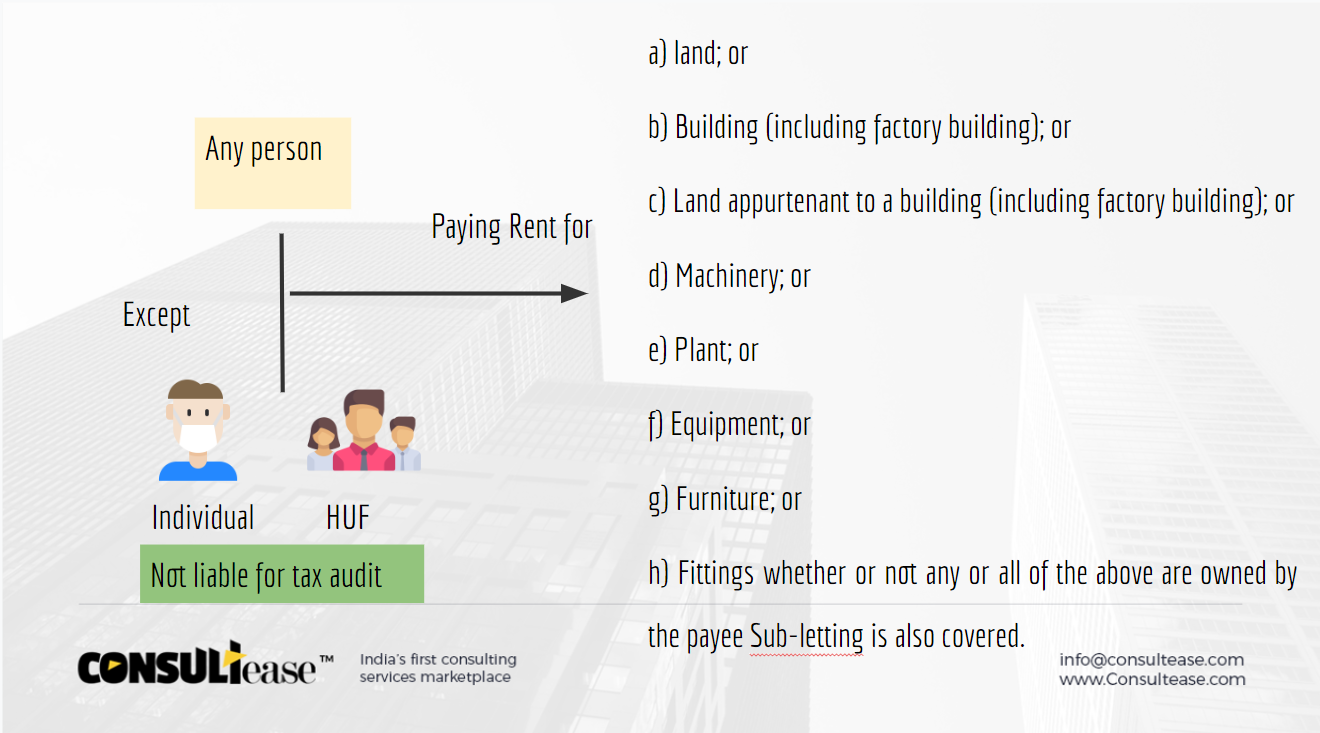

This section is applicable to any person who is responsible for the payment of rent. He is liable to deduct and deposit the TDS on Rent. However, an individual or a HUF who is […]

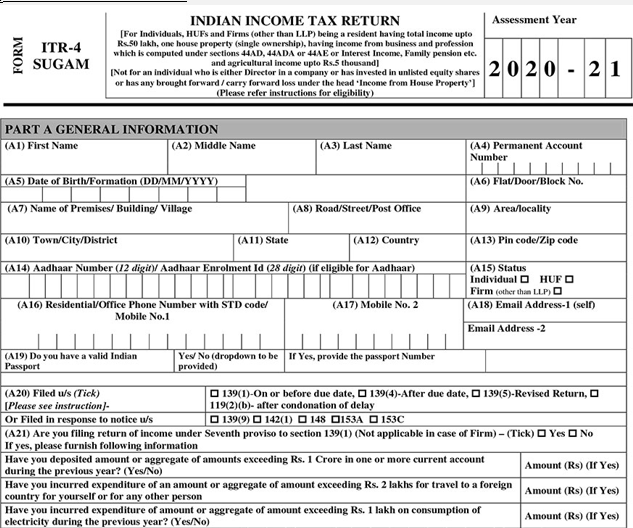

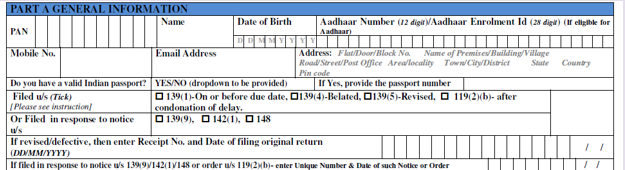

What is the ITR 4 Sugam Form?

ITR stands for Income Tax Return and ITR 4 Sugam Form is for the taxpayers who are filing return under the presumptive income scheme in Section 44AD, Section 44ADA and Section 44AE […]

All you need to know about ITR 1for FY 19-20 also called ITR Sahaj

It is time to file the ITR of the current AY. Forms are available on the income tax website. In this article, we have covered the ITR 1 for FY […]

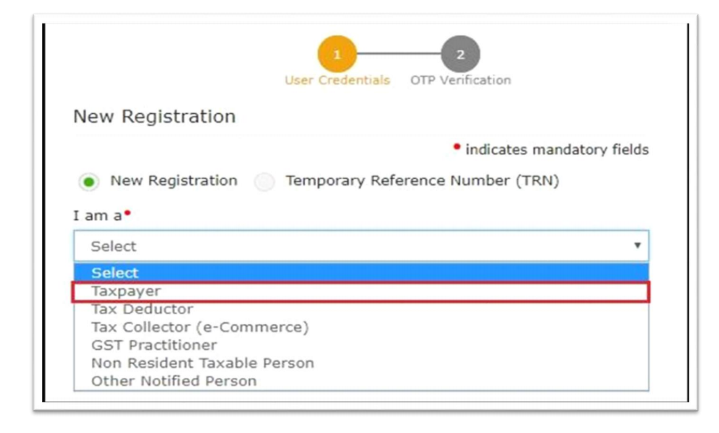

Question-Answer for New Return Of GST

1. Who are liable to file RET-01 monthly?

Large taxpayers (i.e. with turnover > Rs 5 crore in the preceding F.Y.) will have to file this return monthly.

2. Who are liable […]

Annu Singh

@annu-singh

active 2 years, 6 months agoAnnu Singh

OOPS!

No Packages Added by Annu Singh. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewAnnu Singh wrote a new post, [watch video] Section 44AD – Presumptive Taxation for small businesses 5 years, 3 months ago

Section 44AD – Presumptive Taxation for small businesses

Section 44AD – Presumptive Taxation for small businesses.This is special scheme for small businesses. They can pay tax easily with simplified return. No […]

Annu Singh wrote a new post, Section 44ADA – Presumptive Taxation for small professionals 5 years, 3 months ago

Presumptive Taxation for small professionals – Section 44ADA

SPECIAL PROVISION FOR COMPUTING PROFITS AND GAINS OF PROFESSION

Applicability

Section 44ADA shall apply if all the following conditions are […]

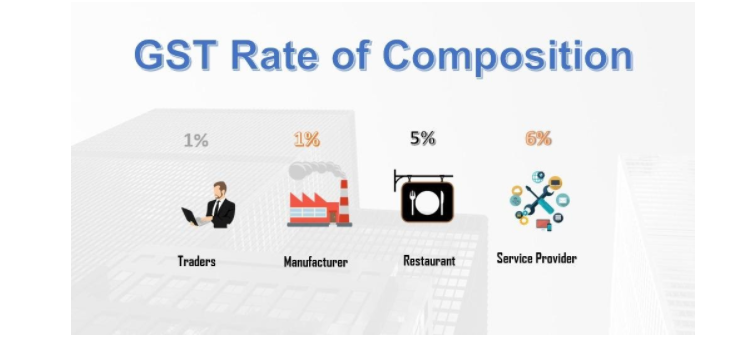

Annu Singh wrote a new post, Composition Scheme (Section-10 of CGST Act, 2017) 5 years, 5 months ago

Composition Scheme (Section-10 of CGST Act, 2017)

Every tax system requires compliances with statutory provisions in a time-bound manner such as periodic tax payments, filing of returns, maintenance of […]

Annu Singh wrote a new post, GSTR-4 5 years, 5 months ago

GSTR-4

Form GSTR-4 (Annual Return) is a yearly return to be filed by taxpayers opting for composition scheme on an annual basis. Unlike a normal taxpayer who needs to furnish three monthly returns, a dealer […]

Annu Singh wrote a new post, Online Information Database Access And Retrieval: OIDAR 5 years, 6 months ago

Online Information Database Access And Retrieval: OIDAR

OIDAR Services are a category of services whose Delivery is mediated through the internet & its supply is essentially automated involving minimum or zero […]

Annu Singh wrote a new post, Input Service Distributor (ISD) 5 years, 6 months ago

Input Service Distributor (ISD)

Definition –

As per Section 2(61) of CGST Act,2017, Input Service Distributor means an office of the supplier of goods or services or both which receives tax invoices issued […]

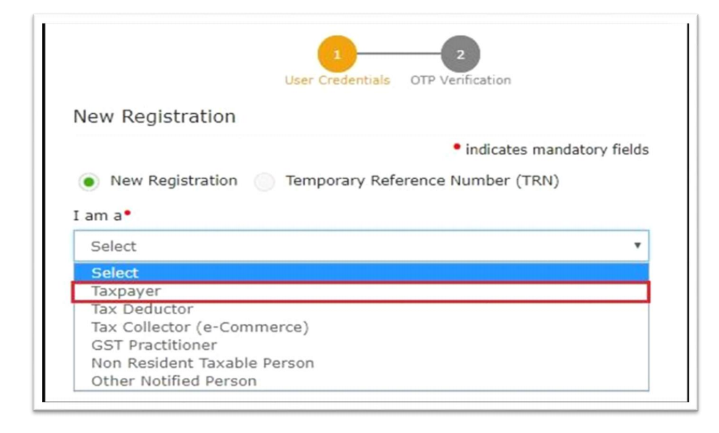

Annu Singh wrote a new post, Non-Resident Taxable Person (NRTP) (Section 2(77) Of CGST ACT) 5 years, 6 months ago

Non-Resident Taxable Person (NRTP) (Section 2(77) Of CGST ACT)

“Non-resident taxable person” means any person who

➢ Occasionally undertakes transactions

➢ Involving the supply of goods or services or both

➢ […]

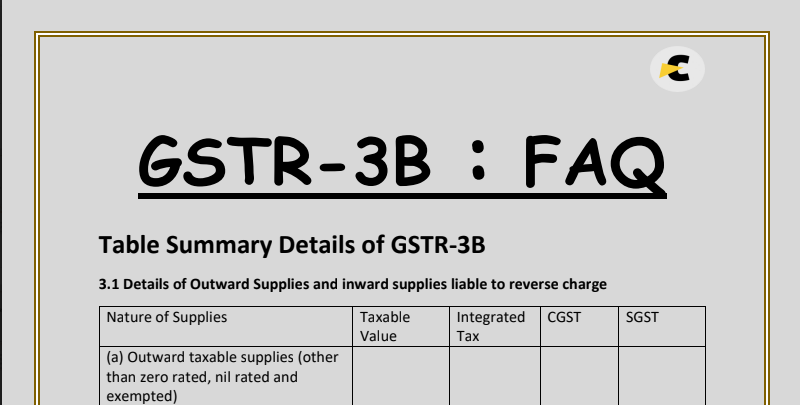

Annu Singh wrote a new post, GSTR-3B: FAQ 5 years, 6 months ago

GSTR-3B: FAQ

Table Summary Details of GSTR-3B

3.1 Details of Outward Supplies and inward supplies liable to reverse charge

Nature of Supplies

Taxable

Value

Integrated

Tax

CGST

CGST

(a) […]

Annu Singh wrote a new post, Casual Taxable Person (CTP) (Section 2(20) of CGST Act) 5 years, 6 months ago

Casual Taxable Person (CTP) (Section 2(20) of CGST Act)

Casual Taxable person means a person who

Occasionally undertakes transaction involving the supply of goods or services or both

In the course or f […]

Annu Singh wrote a new post, FAQ’s on Udyog Aadhar, MSME benefits and registration 5 years, 9 months ago

What is a Udyog Aadhar?

Udyog Adhar is the registration number under MSME. In the last couple of weeks, many benefits are offered for MSME. You need to register under Udyog Aadhar. Only then you will be eligible […]

Annu Singh wrote a new post, Section 194I – TDS on Rent under income Tax 5 years, 9 months ago

What is TDS on Rent u/s 194I?

This section is applicable to any person who is responsible for the payment of rent. He is liable to deduct and deposit the TDS on Rent. However, an individual or a HUF who is […]

Annu Singh wrote a new post, All you need to know about ITR 4 of FY 19-20 5 years, 10 months ago

What is the ITR 4 Sugam Form?

ITR stands for Income Tax Return and ITR 4 Sugam Form is for the taxpayers who are filing return under the presumptive income scheme in Section 44AD, Section 44ADA and Section 44AE […]

Annu Singh wrote a new post, Form of ITR 1 for FY 19-20 notified, read FAQs 5 years, 10 months ago

All you need to know about ITR 1for FY 19-20 also called ITR Sahaj

It is time to file the ITR of the current AY. Forms are available on the income tax website. In this article, we have covered the ITR 1 for FY […]

Annu Singh wrote a new post, FAQs for New Return of GST 5 years, 11 months ago

Question-Answer for New Return Of GST

1. Who are liable to file RET-01 monthly?

Large taxpayers (i.e. with turnover > Rs 5 crore in the preceding F.Y.) will have to file this return monthly.

2. Who are liable […]

Annu Singh wrote a new post, VIVAD SE VISHWAS SCHEME 5 years, 11 months ago

VIVAD SE VISHWAS SCHEME

The bill is aimed at resolving Direct Tax-related disputes in a speedy manner.

Question-1: – Who can avail of the benefit under this scheme?

Answer: -A taxpayer can avail the benefit […]