Order Now $14,550 (2)

-

4 Logo Drafts, Icon based, modern

312 Sold

-

30 Minutes Call with me

12 Sold

-

Monthly Fee

21 Sold

-

1 year shared hosting

ConsultEase.com Interviewed.

Read Interview-

CA Arpit Haldia wrote a new post, GST Case 5- Indian Institute of Management 6 years, 7 months ago

GST Case 5- Indian Institute of Management

Can you imagine a student at IIM Bengaluru paying fees for his Post Graduate Programme (PGP) along with 18% GST and his friend at IIM Kolkata paying his fees for the […] -

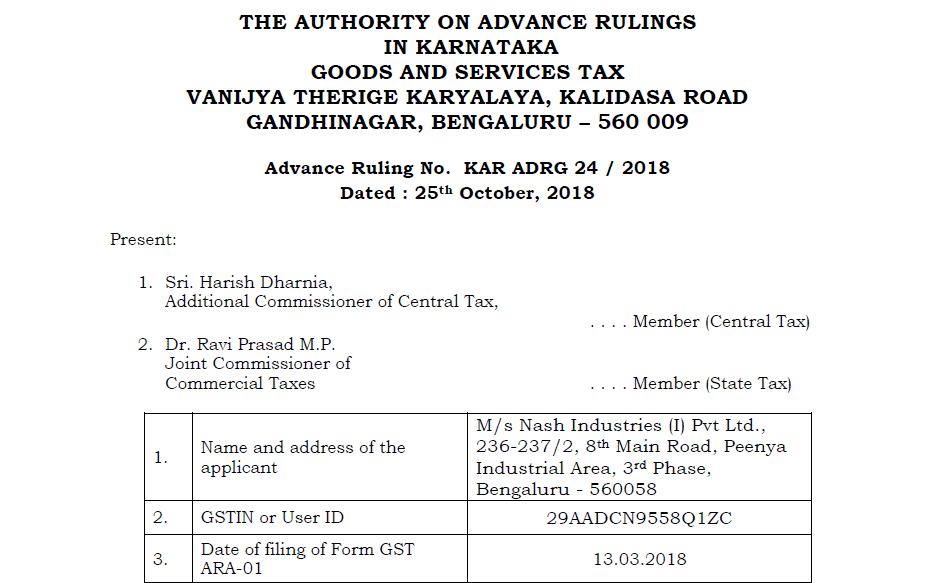

CA Arpit Haldia wrote a new post, GST AAR Case 4- Nash Industries (I) (P.) Ltd. 6 years, 7 months ago

GST AAR Case 4- Nash Industries (I) (P.) Ltd.

GST AAR Case 4- Nash Industries (I) (P.) Ltd. an initiative by CA Arpit Haldia.

Query:

Whether the amortized cost of the tool has to be added to arrive at the value […]

-

CA Arpit Haldia wrote a new post, GST Case 2- Indian Institute of Management 6 years, 7 months ago

GST Case 2- Indian Institute of Management

Following the GST case of Indian Institute of Management in which the tax liability of certain supply is questioned:

Query: After the introduction of the IIM Act […] -

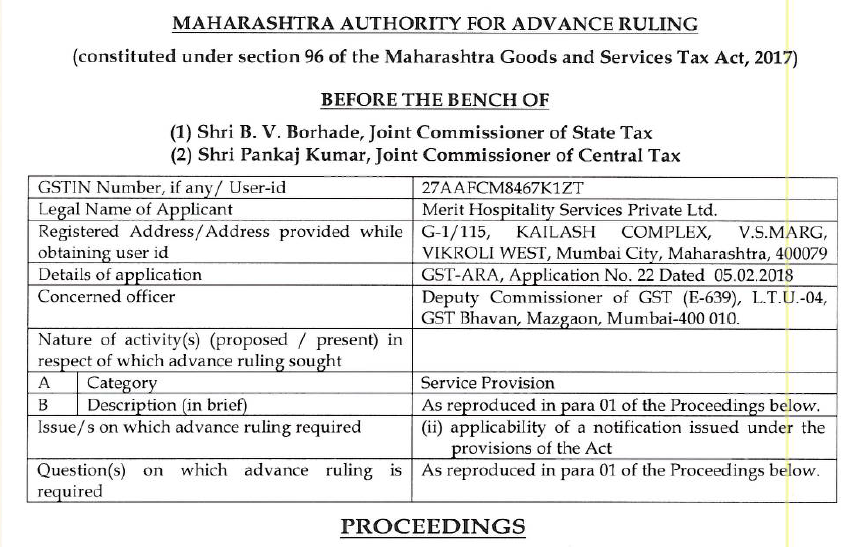

CA Arpit Haldia wrote a new post, GST Case 3- Merit Hospitality Services (P) Ltd. 6 years, 7 months ago

Case GST 3- Merit Hospitality Services (P) Ltd.

Following is the GST case in which the taxliability id questioned regarding the food distributed to the employees:

Facts: The applicant has entered into a contract […]

-

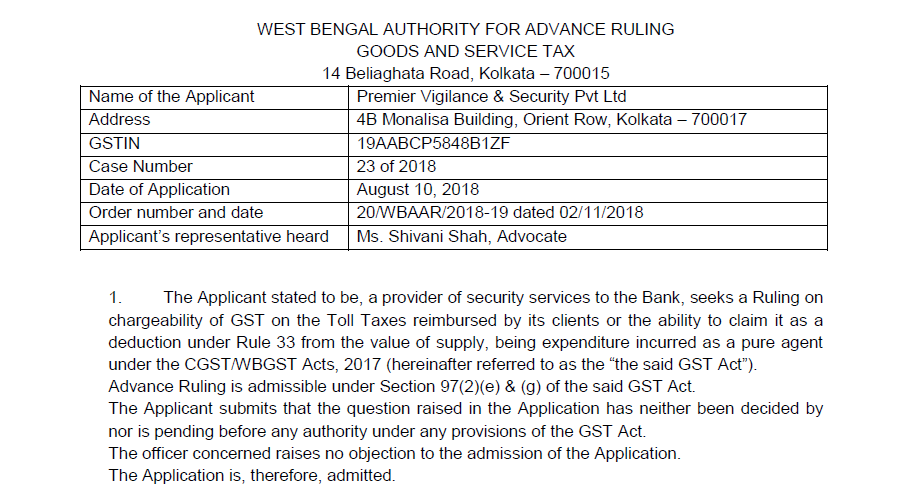

CA Arpit Haldia wrote a new post, GST Case 1-Premier Vigilance & Security (P.) Ltd. 6 years, 7 months ago

GST Case 1-Premier Vigilance & Security (P.) Ltd.

Query: Whether Toll Taxes reimbursed by the client can be claimed as a deduction under Rule 33 from the value of supply, being expenditure incurred as a pure […]

-

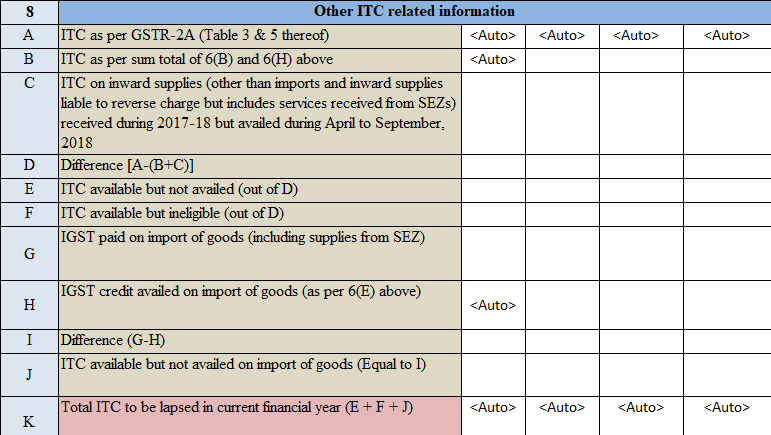

CA Arpit Haldia wrote a new post, IGST paid on import to lapse, if not availed before March 6 years, 9 months ago

IGST paid on import to lapse, if not availed before March

On an analysis of Table 8 of Annual Return. Various items are noticed and have the major effect on the taxpayers. One of the major problems which may […]

CA Arpit Haldia

@arpith

Not recently active