Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).

Commissioner of central taxes GST Delhi

Issue:

Whether bank account of a director of the company can be provisionally attached where proceeding u/s 67 of the act was […]

The Commissioner of Central GST and Central Excise

Issue:

Whether refund of CGST and IGST can be denied on the ground that his petitioner’s claim got consolidated u […]

State Tax Officer

Issue:

Whether the input tax credit availed by the purchaser can be questioned without taking any action against the seller?

Brief Facts […]

The Deputy Commercial Tax Officer

Issue:

Whether it is mandatory that when a truck is carrying goods of TWO e-Way Bills then it has to unload the goods of shorter distance […]

The Authority for Advance Ruling

Issue:

The date for the purpose of calculation of time barring shall be the date of the original order by AAR or the date of order of […]

State of Maharashtra and Others

Issue:

Whether the bank account can be attached by the departmental officer without having any pending proceeding under any of the […]

State of Gujarat

Issue:

The applicant was arrested on 09.12.2020, for the allegations of total evasion of GST and disposing of the manufactured goods without […]

Principal Commissioner of Central Tax

Issue:

Provisional attachment of the bank account of the petitioner continued even after the expiry of 1 year.

Brief […]

The Principal Commissioner of Customs

Issue:

IGST refund was withheld on the grounds that petitioner has availed Higher duty drawback instead of on lower duty […]

State of Bihar

Issue:

Authority has passed the order without giving an opportunity of personal hearing and also not considered the reply filed by the […]

Union Of India

Issue:

Goods and Service Tax Practitioners’ Association, has filed a writ petition seeking for extension of the due date for filing Annual […]

Can both SGST and then CGST proceed with proceedings for same offence and arrest?

We have filed a petition before the Hon’ble Gujarat High Court against such an act of CGST.

Brief Facts

Allegation of the d […]

I am happy to share that in the matter of M/s Jariwala Sales Pvt Ltd Vs Union of India SCA No 5781 of 2020 the petitioner has challenged Rule 86A of the CGST Rules 2017.

Hon’ble Gujarat High Court has issued n […]

Friends

Happy to share an update with regards to Section 16(4) of the CGST Act. This is being shared for the benefit of one and all.

The petitioner received Notice and was asked to pay the amount equivalent to […]

Nowadays we continuously are getting information that so and so person is arrested due to the fake invoice/fraudulent ITC etc.

QUESTION before the Hon’ble Court does they have the power to ARREST prior to a […]

UNION OF INDIA

Facts of the case:

A lot of notices are being sent by way of mail as well as in hard copy with regards to the reversal of input tax credit […]

Introduction: IGST refund inspite of duty drawback on higher rate

Happy to Share for the benefit of all, that today in the matter of Petitioner is M/s Precot Meridien Limited. , I argued before *Madurai Bench of […]

Dr. Avinash Poddar

@avinash-poddar

active 6 years, 4 months agoDr. Avinash Poddar

Avinash Poddar, currently practicing as a lawyer, as a Law Graduate, a fellow member of Institute of Chartered Accountants of India, Certified Financial Planner, Microsoft Certified Professional and DISA (Diploma in Information Systems Audit) from ICAI. He has also completed various certificate courses of ICAI such as Arbitration, Forensic Accounting and Fraud Detection, Valuation, IFRS, Indirect Taxes. He has also completed post-graduate diploma is Cyber Crime (PGCCL).

Registered Categories

Location

Ahemdabad, India

OOPS!

No Packages Added by Dr. Avinash Poddar. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewDr. Avinash Poddar wrote a new post, Telangana HC in the case of M/s Golden Mesh Industries Vs. Assistant Commissioner State Tax 4 years, 7 months ago

Case Covered:

M/s Golden Mesh Industries

Vs.

Assistant Commissioner State Tax

Issue:

Whether the best judgement order can be passed without stating by which method the principal amount arrived at the […]

Dr. Avinash Poddar wrote a new post, Delhi HC in the case of Roshni Sana Jaiswal Vs. Commissioner of central taxes GST Delhi 4 years, 7 months ago

Case Covered:

Roshni Sana Jaiswal

Vs.

Commissioner of central taxes GST Delhi

Issue:

Whether bank account of a director of the company can be provisionally attached where proceeding u/s 67 of the act was […]

Dr. Avinash Poddar wrote a new post, Madras High court in the case of Tvl. Mehar Tex 4 years, 7 months ago

Case Covered:

Tvl. Mehar Tex

Versus

The Commissioner of Central GST and Central Excise

Issue:

Whether refund of CGST and IGST can be denied on the ground that his petitioner’s claim got consolidated u […]

Dr. Avinash Poddar wrote a new post, Madras HC Order in the case of M/S DY Beathel Enterprises Vs. State Tax Officer 4 years, 8 months ago

Case Covered:

M/S DY Beathel Enterprises

Versus

State Tax Officer

Issue:

Whether the input tax credit availed by the purchaser can be questioned without taking any action against the seller?

Brief Facts […]

Dr. Avinash Poddar wrote a new post, Telangana HC in the case of Vijay Metal Vs. The Deputy Commercial Tax Officer 4 years, 8 months ago

Case Covered:

Vijay Metal

Versus

The Deputy Commercial Tax Officer

Issue:

Whether it is mandatory that when a truck is carrying goods of TWO e-Way Bills then it has to unload the goods of shorter distance […]

Dr. Avinash Poddar wrote a new post, Karnataka HC in the case of M/s NMDC Vs. The Authority for Advance Ruling 4 years, 9 months ago

Case Covered:

M/s NMDC

Vs.

The Authority for Advance Ruling

Issue:

The date for the purpose of calculation of time barring shall be the date of the original order by AAR or the date of order of […]

Dr. Avinash Poddar wrote a new post, Bombay HC in the case of Praful Nanji Satra Vs. State of Maharashtra 4 years, 9 months ago

Case Covered:

Praful Nanji Satra

Vs.

State of Maharashtra and Others

Issue:

Whether the bank account can be attached by the departmental officer without having any pending proceeding under any of the […]

Dr. Avinash Poddar wrote a new post, Gujarat HC in the case of Basant Pherumal Makhija Versus State of Gujarat 4 years, 10 months ago

Case Covered:

Basant Pherumal Makhija

Versus

State of Gujarat

Issue:

The applicant was arrested on 09.12.2020, for the allegations of total evasion of GST and disposing of the manufactured goods without […]

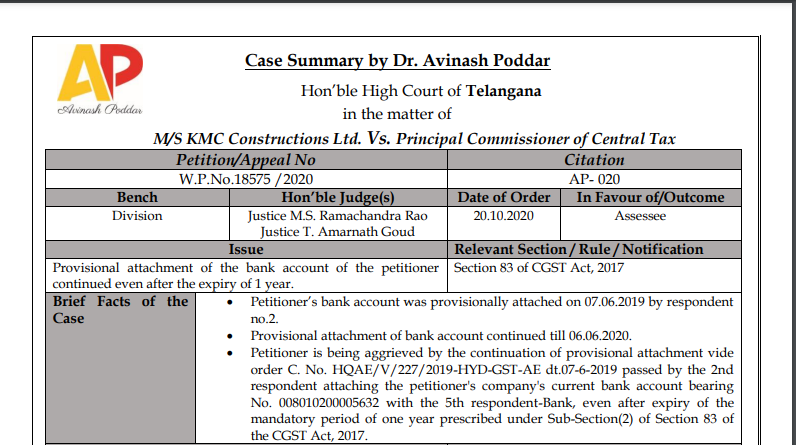

Dr. Avinash Poddar wrote a new post, Telangana HC in the case of M/s KMC Constructions Ltd. Versus Principal Commissioner of Central Tax 4 years, 10 months ago

Case Covered:

M/s KMC Constructions Ltd.

Versus

Principal Commissioner of Central Tax

Issue:

Provisional attachment of the bank account of the petitioner continued even after the expiry of 1 year.

Brief […]

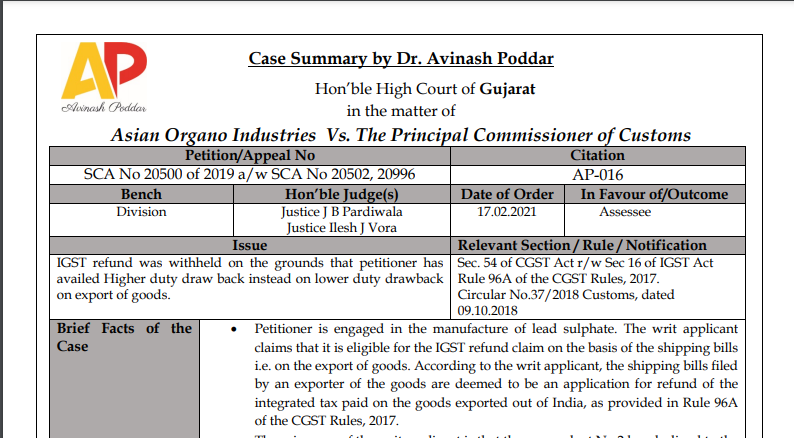

Dr. Avinash Poddar wrote a new post, Gujarat HC in the case of Asian Organo Industries Versus The Principal Commissioner of Customs 4 years, 10 months ago

Case Covered:

Asian Organo Industries

Versus

The Principal Commissioner of Customs

Issue:

IGST refund was withheld on the grounds that petitioner has availed Higher duty drawback instead of on lower duty […]

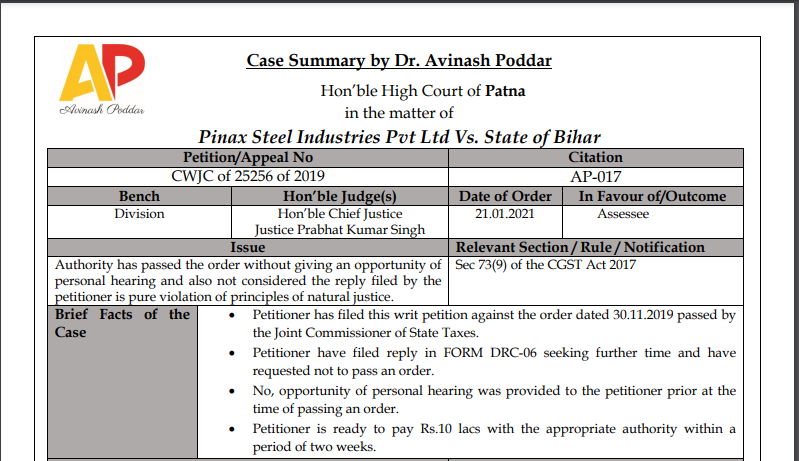

Dr. Avinash Poddar wrote a new post, Patna HC in the case of Pinax Steel Industries Pvt Ltd Versus State of Bihar 4 years, 10 months ago

Case Covered:

Pinax Steel Industries Pvt Ltd

Versus

State of Bihar

Issue:

Authority has passed the order without giving an opportunity of personal hearing and also not considered the reply filed by the […]

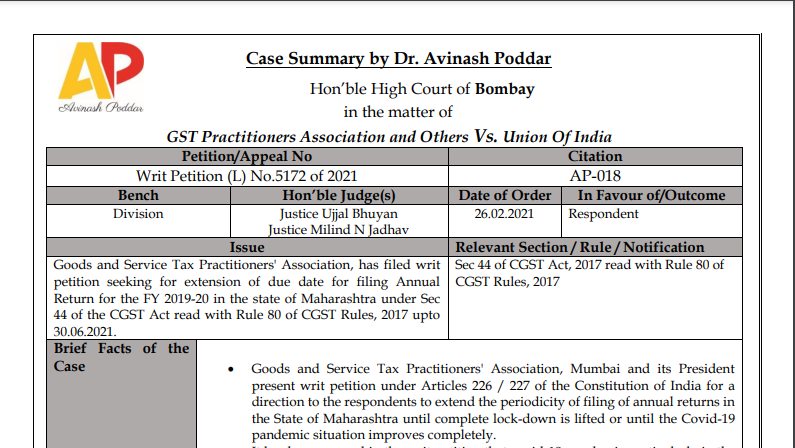

Dr. Avinash Poddar wrote a new post, Bombay HC in the case of GST Practitioners Association Versus Union Of India 4 years, 10 months ago

Case Covered:

GST Practitioners Association

Versus

Union Of India

Issue:

Goods and Service Tax Practitioners’ Association, has filed a writ petition seeking for extension of the due date for filing Annual […]

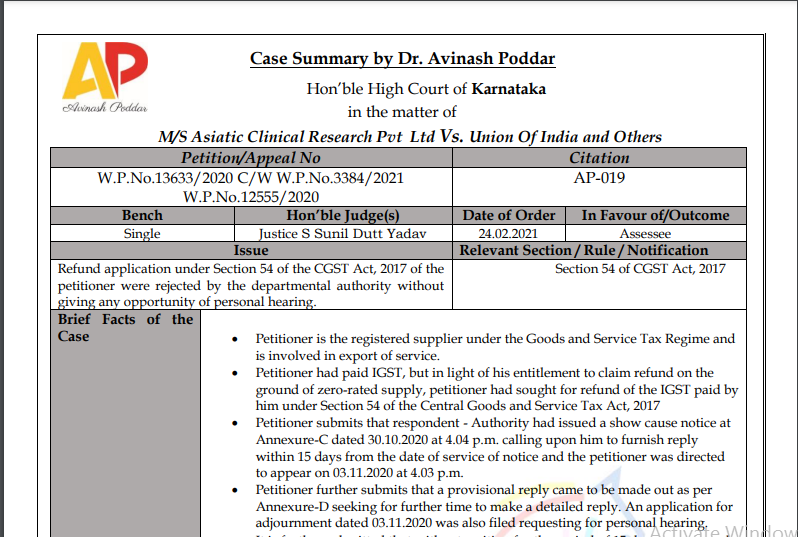

Dr. Avinash Poddar wrote a new post, Karnataka HC in the case of M/s Asiatic Clinical Research Pvt Ltd Versus Union Of India 4 years, 10 months ago

Case Covered:

M/s Asiatic Clinical Research Pvt Ltd

Versus

Union Of India

Issue:

Refund applications under Section 54 of the CGST Act, 2017 of the petitioner were rejected by the departmental authority […]

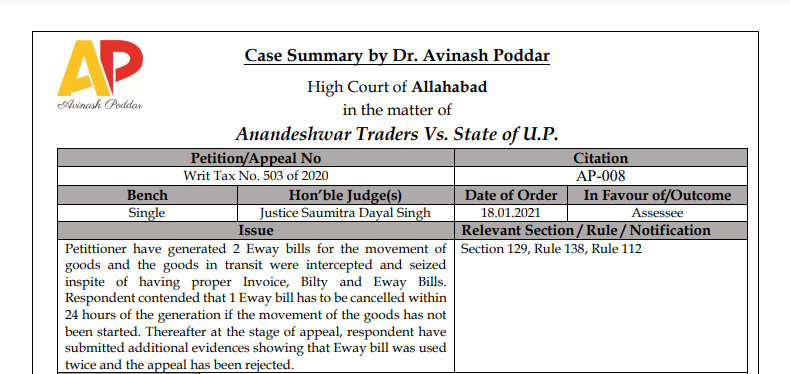

Dr. Avinash Poddar wrote a new post, Allahabad HC in the case of Anandeshwar Traders Versus State of U.P. 4 years, 10 months ago

Case Covered:

High Court of Allahabad

in the matter of

Anandeshwar Traders Vs. The state of U.P.

Issue:

Petitioners have generated 2 Eway bills for the movement of goods and the goods in transit were […]

Dr. Avinash Poddar wrote a new post, Can both SGST and then CGST proceed with proceedings for same offence and arrest? 5 years, 1 month ago

Can both SGST and then CGST proceed with proceedings for same offence and arrest?

We have filed a petition before the Hon’ble Gujarat High Court against such an act of CGST.

Brief Facts

Allegation of the d […]

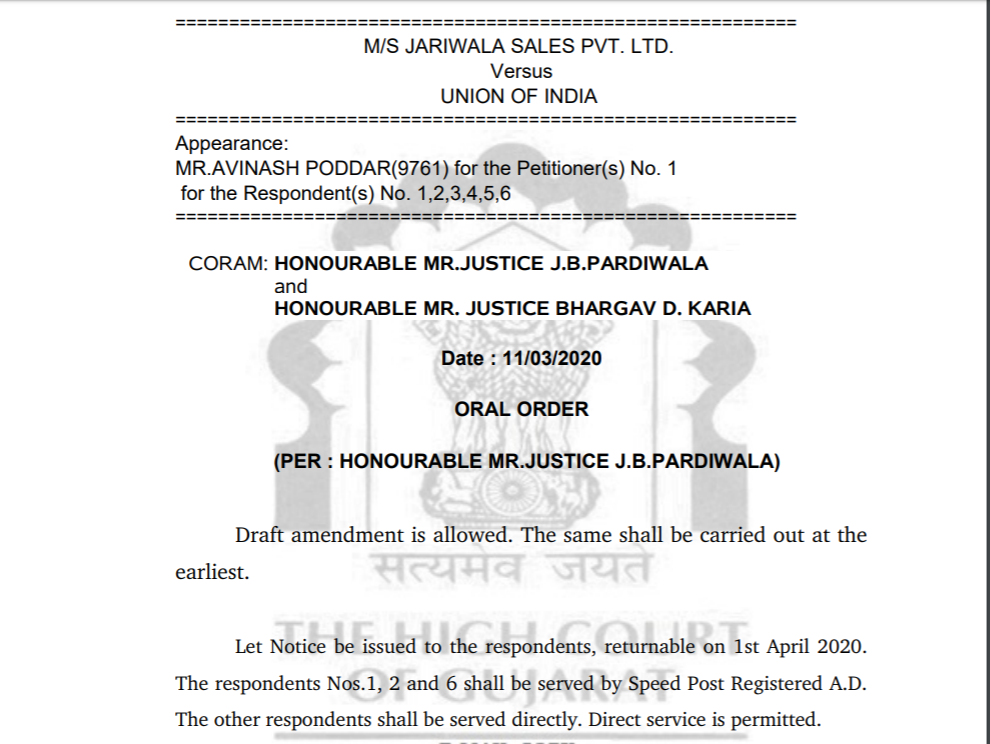

Dr. Avinash Poddar wrote a new post, Rule 86A challenged in Gujarat High court 5 years, 10 months ago

I am happy to share that in the matter of M/s Jariwala Sales Pvt Ltd Vs Union of India SCA No 5781 of 2020 the petitioner has challenged Rule 86A of the CGST Rules 2017.

Hon’ble Gujarat High Court has issued n […]

Dr. Avinash Poddar wrote a new post, Gujarat high court ordered not to take any coercive steps for recovery for 16(4) Notice 5 years, 10 months ago

Friends

Happy to share an update with regards to Section 16(4) of the CGST Act. This is being shared for the benefit of one and all.

The petitioner received Notice and was asked to pay the amount equivalent to […]

Dr. Avinash Poddar wrote a new post, Do the Authorities have the power to ARREST prior to adjudication. 5 years, 11 months ago

Nowadays we continuously are getting information that so and so person is arrested due to the fake invoice/fraudulent ITC etc.

QUESTION before the Hon’ble Court does they have the power to ARREST prior to a […]

Dr. Avinash Poddar wrote a new post, Notices for reversal of ITC under Section 16(4) challenged 5 years, 11 months ago

Case covered:

TIMES HEAVEN CLUB PVT. LTD.

Versus

UNION OF INDIA

Facts of the case:

A lot of notices are being sent by way of mail as well as in hard copy with regards to the reversal of input tax credit […]

Dr. Avinash Poddar wrote a new post, IGST refund inspite of duty drawback on higher rate 6 years ago

Introduction: IGST refund inspite of duty drawback on higher rate

Happy to Share for the benefit of all, that today in the matter of Petitioner is M/s Precot Meridien Limited. , I argued before *Madurai Bench of […]