Excess Input Tax Credit claimed in 3B of F.Y.2017-18 and 2018-19 (Both) but not reversed in 3B of F.Y.2018-19 and effect have given through DRC-03 in GSTR-9 of Financial Year 2018-19.

Herewith I giving with the […]

Excess Input Tax Credit claimed in 3B of F.Y. 2017-18 and not reversed in 3B of F.Y.2018-19 and effect have given through DRC-03 in GSTR-9 of Financial Year 2018-19.

Herewith I giving with the example for your […]

The short claim of Input Tax Credit in GSTR-3B of Financial Year 2017-18 and 2018-19 but both are not claimed in 3B of 2018-19-LAPSED.

Herewith I giving with the example for your better […]

The short claim of Input Tax Credit in GSTR-3B of Financial Year 2017-18 and not claimed in GSTR-3B of Financial 2018-19. LAPSED.

Herewith I giving with the example for your better […]

Excess Input Tax Credit claimed in GSTR-3B for the F.Y.2017-18 and reversed in GSTR-3B of F.Y 2018-19

Herewith I giving with the example for your better understanding.

Important things to be considered before GSTR-9, 9A Returns and Reconciliation Statement in GSTR-9C for the A.Y.2018-19 under GST Law

(1) Important Documents:

(i) Copy of the GST Registration Certificate: You […]

GST on Transfer of Development Rights or Long term Lease

GST on Transfer of development rights or long term lease by the landowner to promoter Dear colleagues, before going to the subject we have to refer an […]

Lease & rental Services With or Without Operators under GST Scenario:

Dear professional colleagues, Good morning to all of you. I have received suggestions from our friends on services relating to “Lease & Re […]

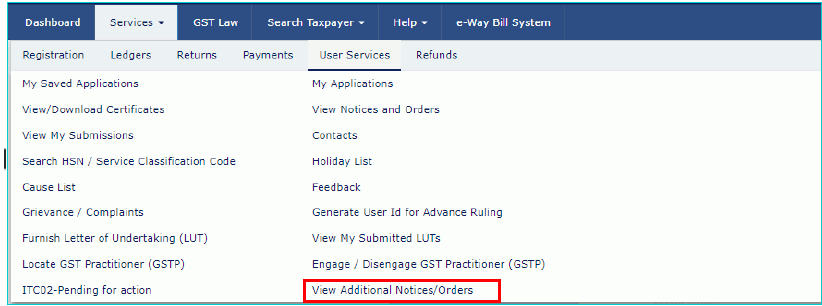

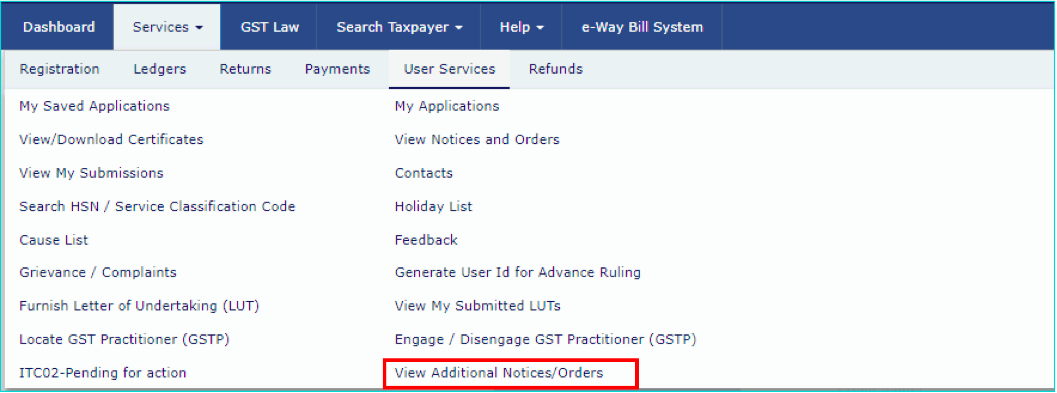

The Tax Official has issued Form GST DRC-22 to the concerned authorities for provisional attachment of my property, bank accounts, etc. How can I file reply to Form GST DRC-22 against proceedings initiated against […]

FAQ’s on filling reply to Form GST DRC-22

Dear Colleagues, I have received suggestion to prepare article on “Filling reply to Form GST DRC-22 against proceedings initiated for recovery of Taxes under GST Law […]

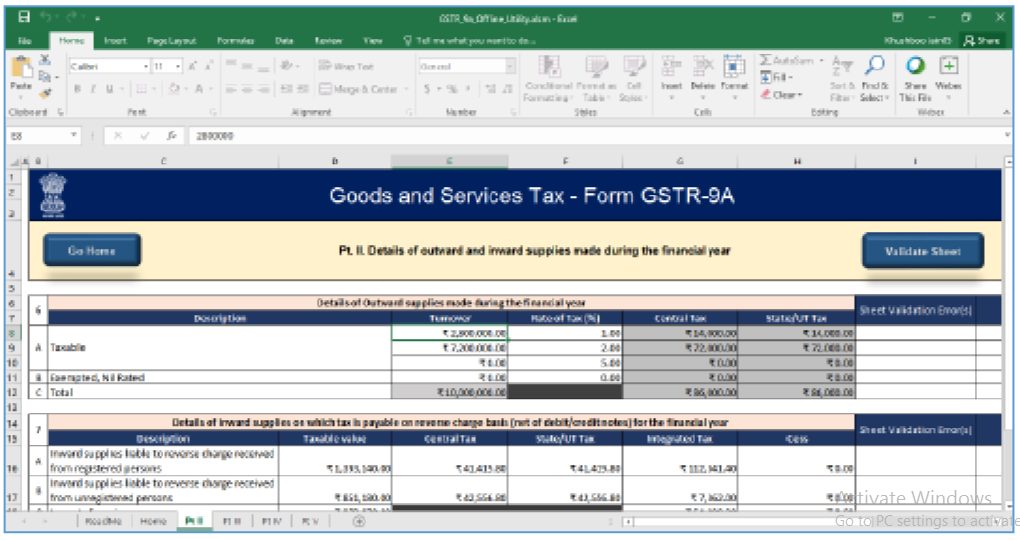

Now all the entries that were auto-filled in relevant fields of different tables of Form GSTR-9A, based on filed Form GSTR-4, would be auto-populated in the respective sheets in the Offline tool. Next, you need to […]

Dear Colleagues, good morning to all of you. I have received messages from our friends about to prepare notes on GSTR 9A, GSTR-9, and GSTR-9C after modified to the forms. So, I am preparing notes on the above […]

Dear Colleagues. The NACIN announced GST practitioner exam will be conducted on 14.6.2019. so, from today onward I am providing my model question papers to all of you on daily through What’s APP. Kindly refer a […]

Central Tax Rate Notification under the GST Act, 2017:

Notification No.2/2019-Central Tax (Rate) – Dated.29.03.2019: This notification states that the rules applicable to the composition scheme shall be a […]

B S Seethapathi Rao

@bsseethapatirao

Not recently activeB S Seethapathi Rao

Registered Categories

Location

East Godavari, India

OOPS!

No Packages Added by B S Seethapathi Rao. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewB S Seethapathi Rao wrote a new post, Excess Input Tax Credit claimed in 3B of F.Y.2017-18 and 2018-19 (Both) but not reversed in 3B of F.Y.2018-19 and effect have given through DRC-03 in GSTR-9 of Financial Year 2018-19. 5 years, 2 months ago

Excess Input Tax Credit claimed in 3B of F.Y.2017-18 and 2018-19 (Both) but not reversed in 3B of F.Y.2018-19 and effect have given through DRC-03 in GSTR-9 of Financial Year 2018-19.

Herewith I giving with the […]

B S Seethapathi Rao wrote a new post, Excess Input Tax Credit claimed in 3B of F.Y. 2017-18 and not reversed in 3B of F.Y.2018-19 and effect have given through DRC-03 in GSTR-9 of Financial Year 2018-19. 5 years, 2 months ago

Excess Input Tax Credit claimed in 3B of F.Y. 2017-18 and not reversed in 3B of F.Y.2018-19 and effect have given through DRC-03 in GSTR-9 of Financial Year 2018-19.

Herewith I giving with the example for your […]

B S Seethapathi Rao wrote a new post, Short claim of Input Tax Credit in GSTR-3B of Financial Year 2017-18 and 2018-19 but both are not claimed in 3B of 2018-19-LAPSED. 5 years, 2 months ago

The short claim of Input Tax Credit in GSTR-3B of Financial Year 2017-18 and 2018-19 but both are not claimed in 3B of 2018-19-LAPSED.

Herewith I giving with the example for your better […]

B S Seethapathi Rao wrote a new post, The short claim of Input Tax Credit in GSTR-3B of Financial Year 2017-18 and not claimed in GSTR-3B of Financial 2018-19. LAPSED. 5 years, 3 months ago

The short claim of Input Tax Credit in GSTR-3B of Financial Year 2017-18 and not claimed in GSTR-3B of Financial 2018-19. LAPSED.

Herewith I giving with the example for your better […]

B S Seethapathi Rao wrote a new post, Excess Input Tax Credit claimed in GSTR-3B for the F.Y.2017-18 and reversed in GSTR-3B of F.Y 2018-19 5 years, 3 months ago

Excess Input Tax Credit claimed in GSTR-3B for the F.Y.2017-18 and reversed in GSTR-3B of F.Y 2018-19

Herewith I giving with the example for your better understanding.

Illustration-3.

“A” Tax Payer pur […]

B S Seethapathi Rao wrote a new post, Important things to be considered before GSTR-9,9A Returns and Reconciliation Statement in GSTR-9C for the A.Y.2018-19 under GST Law 5 years, 5 months ago

Important things to be considered before GSTR-9, 9A Returns and Reconciliation Statement in GSTR-9C for the A.Y.2018-19 under GST Law

(1) Important Documents:

(i) Copy of the GST Registration Certificate: You […]

B S Seethapathi Rao wrote a new post, GST on Transfer of Development Rights or Long term Lease 5 years, 5 months ago

GST on Transfer of Development Rights or Long term Lease

GST on Transfer of development rights or long term lease by the landowner to promoter Dear colleagues, before going to the subject we have to refer an […]

B S Seethapathi Rao wrote a new post, Lease & rental Services With or Without Operators under GST Scenario 5 years, 10 months ago

Lease & rental Services With or Without Operators under GST Scenario:

Dear professional colleagues, Good morning to all of you. I have received suggestions from our friends on services relating to “Lease & Re […]

B S Seethapathi Rao wrote a new post, Article on Job Work relating to Printing Industry under GST 5 years, 10 months ago

Article on Job Work relating to Printing Industry under GST Scenario:

Dear professional colleagues, Good morning to all of you. I have received suggestions from our friends on services relating to “ Job W […]

B S Seethapathi Rao wrote a new post, Filing reply to Form GST DRC-22 6 years ago

The Tax Official has issued Form GST DRC-22 to the concerned authorities for provisional attachment of my property, bank accounts, etc. How can I file reply to Form GST DRC-22 against proceedings initiated against […]

B S Seethapathi Rao wrote a new post, FAQ’s on filling reply to Form GST DRC-22 6 years ago

FAQ’s on filling reply to Form GST DRC-22

Dear Colleagues, I have received suggestion to prepare article on “Filling reply to Form GST DRC-22 against proceedings initiated for recovery of Taxes under GST Law […]

B S Seethapathi Rao wrote a new post, How to file a reply in form GST ASMT-11? 6 years, 1 month ago

1.How can I file reply in Form GST ASMT-11 to the notice issued against Scrutiny of Returns?

Ans: To file reply in Form GST ASMT-11 to the notice issued against Scrutiny of Returns, perform following […]

B S Seethapathi Rao wrote a new post, Filing reply in FORM GST ASMT-11 6 years, 1 month ago

FAQ’s on filing reply in form GST ASMT-11:

1.When a Tax Official will conduct Scrutiny of Returns?

Ans: In case, any discrepancy is found in return furnished by registered person on the basis of risk […]

B S Seethapathi Rao wrote a new post, Notes on GSTR-9A is continue. dt.6.5.2019. 6 years, 7 months ago

Now all the entries that were auto-filled in relevant fields of different tables of Form GSTR-9A, based on filed Form GSTR-4, would be auto-populated in the respective sheets in the Offline tool. Next, you need to […]

B S Seethapathi Rao wrote a new post, Brief notes on GSTR 9A with practical 6 years, 7 months ago

Dear Colleagues, good morning to all of you. I have received messages from our friends about to prepare notes on GSTR 9A, GSTR-9, and GSTR-9C after modified to the forms. So, I am preparing notes on the above […]

B S Seethapathi Rao wrote a new post, Model question paper for GST practitioner exams #1 6 years, 7 months ago

Dear Colleagues. The NACIN announced GST practitioner exam will be conducted on 14.6.2019. so, from today onward I am providing my model question papers to all of you on daily through What’s APP. Kindly refer a […]

B S Seethapathi Rao‘s profile was updated 6 years, 7 months ago

B S Seethapathi Rao wrote a new post, Brief Notes on detailed Analysis on recent notifications issued under GST Law, 2017 continue… dated.18.4.2019 6 years, 7 months ago

Central Tax Rate Notification under the GST Act, 2017:

Notification No.2/2019-Central Tax (Rate) – Dated.29.03.2019: This notification states that the rules applicable to the composition scheme shall be a […]