CA Aanchal Kapoor qualified in first attempt as chartered accountant in 2009 and is a practising chartered accountant for past 10 years in the field of direct and indirect taxes. With special focus on GST she has done extensive study on the subject with many certified courses and GST is one of her core competency areas. Since inception of her academics, she has been placed in the merit list at various levels as a rank holder in CA and Gold medalist in graduation. In pursuing her professional career in GST she is practically into this field and has delivered various seminars on GST in Punjab, Delhi and Mumbai to profession as well as industry.

GST Latest Case laws-2020

Sec. 54 (Refund of Tax)

(3) Subject to the provisions of sub-section (10), a registered person may claim a refund of any unutilized input tax credit at the end of any tax […]

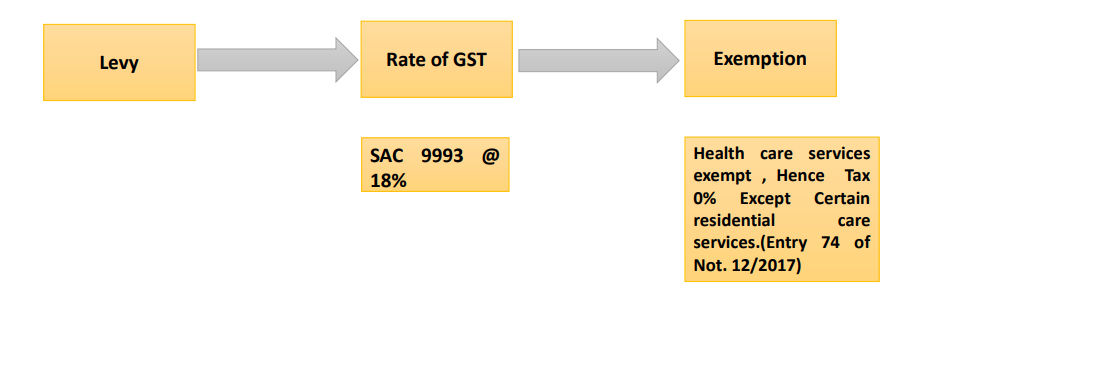

GST Implication on Healthcare Sector

Levy & Rate of tax

Section 9(CGST):- Levy & collection Section 5 (IGST Act)

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the central […]

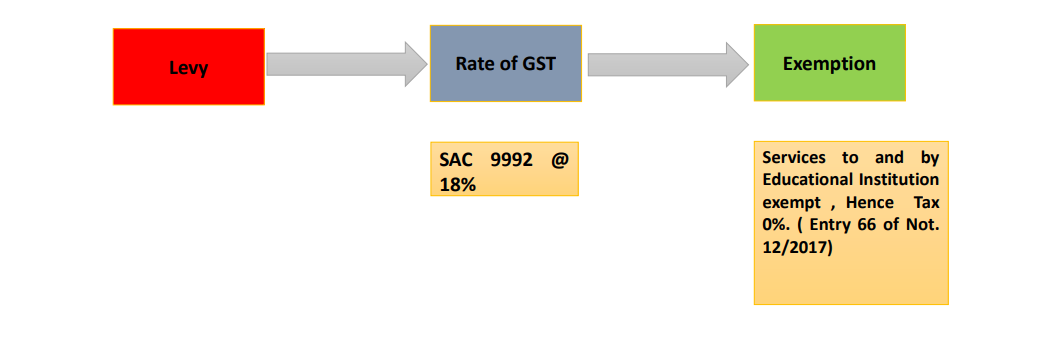

GST Implication on Education Sector

Section 9:- Levy and Rate of Tax

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the central goods and services tax on all intra-State […]

CA Aanchal Kapoor

@ca-aanchal-kapoor

active 3 years, 10 months agoCA Aanchal Kapoor

CA Aanchal Kapoor qualified in first attempt as chartered accountant in 2009 and is a practising chartered accountant for past 10 years in the field of direct and indirect taxes. With special focus on GST she has done extensive study on the subject with many certified courses and GST is one of her core competency areas. Since inception of her academics, she has been placed in the merit list at various levels as a rank holder in CA and Gold medalist in graduation. In pursuing her professional career in GST she is practically into this field and has delivered various seminars on GST in Punjab, Delhi and Mumbai to profession as well as industry.

Registered Categories

Location

Amritsar, India

OOPS!

No Packages Added by CA Aanchal Kapoor. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Aanchal Kapoor wrote a new post, Recent Amendments in GST covering E-Invoicing, Rule 86B and QRMP scheme 5 years ago

Recent Amendments in GST covering E-Invoicing, Rule 86B and QRMP scheme

E-invoicing under GST

Legal Provisions

N. N. 68/2019-CT Rule 48(4)

The invoice shall be prepared by such class of registered persons […]

CA Aanchal Kapoor wrote a new post, Decoding of Finance Bill 2021 5 years ago

Decoding of Finance Bill 2021

Amendment in section 7

1. Scope of Supply

w.e.f. 01.07.2017

7) (1) For the purposes of this Act, the expression “supply” includes––

(a) all forms of supply of goods or serv […]

CA Aanchal Kapoor wrote a new post, GST Latest Case laws-2020 5 years, 2 months ago

GST Latest Case laws-2020

Sec. 54 (Refund of Tax)

(3) Subject to the provisions of sub-section (10), a registered person may claim a refund of any unutilized input tax credit at the end of any tax […]

CA Aanchal Kapoor‘s profile was updated 5 years, 7 months ago

CA Aanchal Kapoor wrote a new post, GST Implication on Healthcare Sector 5 years, 7 months ago

GST Implication on Healthcare Sector

Levy & Rate of tax

Section 9(CGST):- Levy & collection Section 5 (IGST Act)

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the central […]

CA Aanchal Kapoor wrote a new post, GST Implication on Education Sector 5 years, 7 months ago

GST Implication on Education Sector

Section 9:- Levy and Rate of Tax

(1) Subject to the provisions of sub-section (2), there shall be levied a tax called the central goods and services tax on all intra-State […]

CA Aanchal Kapoor‘s profile was updated 5 years, 9 months ago