Growing Pains of Small Sole Proprietor and CA Firms

It is a bare truth that chartered Accountant profession needs the progressive dimension of running a successful Audit firm. Another truth is that in today’s n […]

Points to ponder upon about GST Annual Return

As per section 44 of CGST ACT,2017 “Every registered person, other than input service distributor, a person paying tax under section 51/52 and non-resident taxable p […]

Recovery of arrears of wrongly availed CENVAT credit under the existing law and inadmissible transitional credit

Various representations have been received seeking clarification on the process of recovery of […]

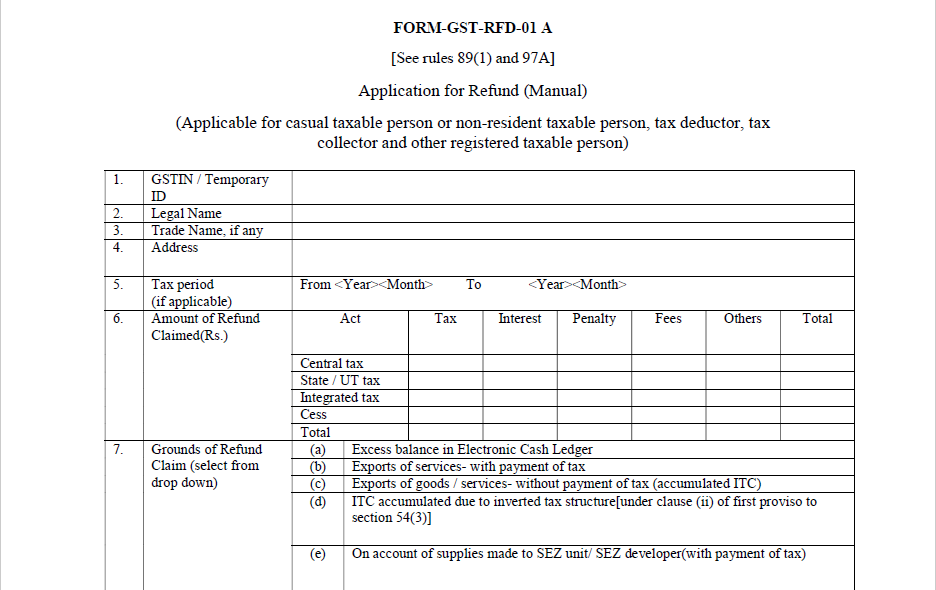

Refund Procedure for Goods/Services made to Zero-Rated Supplies

It has been shown that Government has made extra efforts to disburse various Refund requests. Following is the Refund Procedure for Goods/Services […]

My Departure Address – Common Seal

I am a COMMON Seal of the company who ruled the corporate world for a century. I come to you with a message of leave-taking and farewell, and to share a few final thoughts with […]

Advisory to taxpayers for filing refund application under GST-RFD-01A

Advisory to taxpayers for filing refund application under GST-RFD-01A:

1. Refund application can be filed using the application form […]

Decoding ITR 7 of A.Y 2018-19

Persons including companies that are required to furnish Income-tax return under section 139(4A) or 139(4B) or 139(4C) or 139(4D) or 139(4E) or 139(4F) shall furnish the return of […]

NOTE ON E-WAY Bill

To understand the structure and mechanism of the e-way bill, the following is NOTE on E-Way Bill:

Section 129(1) of CGST Act

Detention, seizure, and release of goods and conveyance in […]

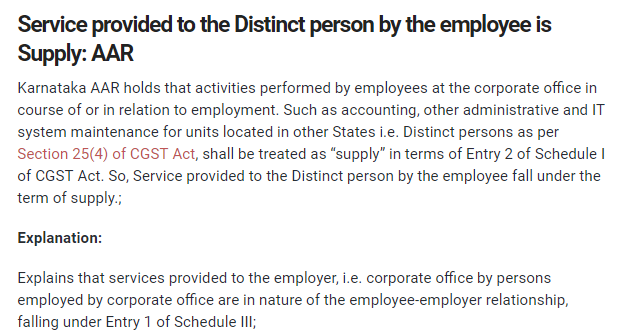

Service provided to the Distinct person by the employee is Supply: AAR

Karnataka AAR holds that activities performed by employees at the corporate office in course of or in relation to employment. Such as […]

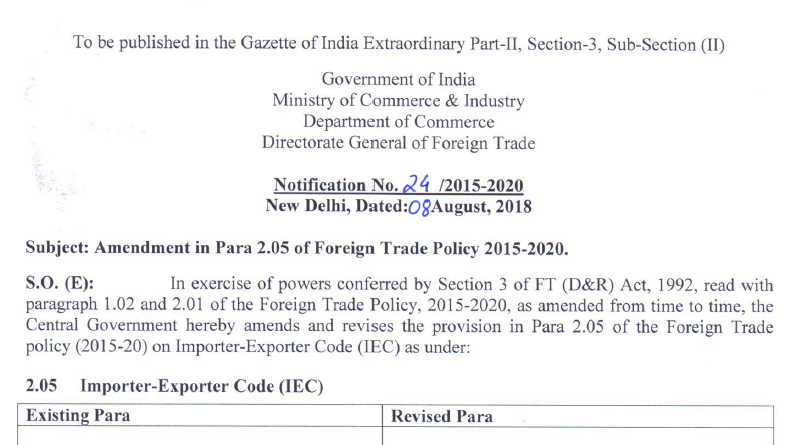

Application of IEC simplified and auto-generated

DGFT revises FTP para 2.05 and HBP para 2.08 with regards to IEC and modification of IEC vide notification no. 24 DT. 08.08.2018 and public notice no. 27 DT. […]

Multipurpose Empanelment Form 2018 Application

The uploading of form is not smooth. Many problems are being surfaced. The last date for filing the Multipurpose Empanelment Form 2018 is 21st August 2018.

This y […]

Important note for GST on Canteen Services

Whether reimbursement of food expenses from employees for the canteen provided by the company comes under the definition of outward supplies as taxable under the GST […]

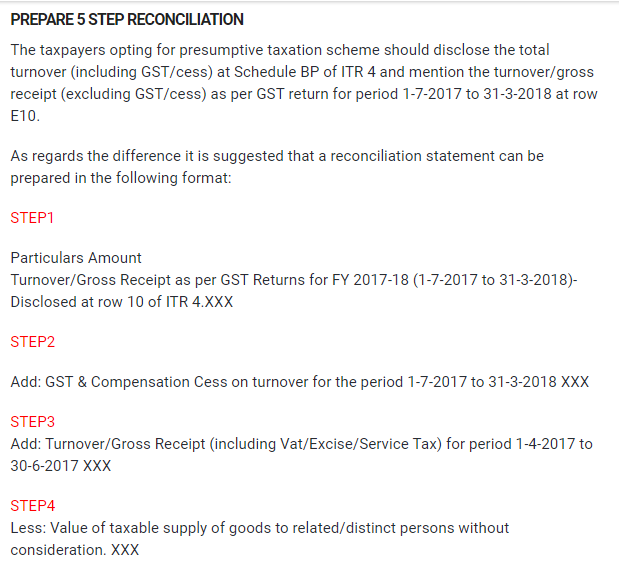

Matching GST returns and ITR

The first financial year after the regime of the GST has ended and now the time is for the filing of the Income-tax Return. But there are some confusion and problems arising in the m […]

Take note of following Precautions while filing ITR-7

Some of the claims made under sections 11 may are being disallowed during processing for reasons and in certain cases, the same may be rectifiable by suitable […]

In the case of project completion method, Income can only be taxable after sale deed execution

IT: Where the assessee, engaged in construction business, was following project completion method, its income could […]

GSTN to temporarily shut down on 1st July

The Goods and Services Tax Network (GSTN) will not be available on the first anniversary day of GST, i.e, 1st July, GSTN said. As the Goods and Services Tax Network ( […]

Suggestive Ways to Deal ROC Latest Notice STK-5

The Companies which have not filed their Financial Statement (AOC-4 / 23AC, ACA) or Annual Return (MGT-7) for a period of two immediately preceding financial year […]

Nine Steps for Revocation of Cancelled GST Registration

{ Application for revocation of cancelled GST registration can be accessed within 30 days, from issuance of the Cancellation Order on the GST Portal, after […]

Common enrolment for transporters for e-Way Bills; Seizure / Confiscation orders made available online

Central Govt. notifies CGST (Sixth Amendment) Rules 2018 from date of their publication in Official Gazette; […]

CA Amresh Vashisht

@ca-amresh-vashisht

Not recently activeCA Amresh Vashisht

Registered Categories

Location

Meerut, India

OOPS!

No Packages Added by CA Amresh Vashisht. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Amresh Vashisht wrote a new post, Growing Pains of Small Sole Proprietor and CA Firms 7 years, 5 months ago

Growing Pains of Small Sole Proprietor and CA Firms

It is a bare truth that chartered Accountant profession needs the progressive dimension of running a successful Audit firm. Another truth is that in today’s n […]

CA Amresh Vashisht wrote a new post, Points to ponder upon about GST Annual Return 7 years, 5 months ago

Points to ponder upon about GST Annual Return

As per section 44 of CGST ACT,2017 “Every registered person, other than input service distributor, a person paying tax under section 51/52 and non-resident taxable p […]

CA Amresh Vashisht wrote a new post, Recovery of arrears of wrongly availed CENVAT credit 7 years, 5 months ago

Recovery of arrears of wrongly availed CENVAT credit under the existing law and inadmissible transitional credit

Various representations have been received seeking clarification on the process of recovery of […]

CA Amresh Vashisht wrote a new post, Refund Procedure for Goods/Services made to Zero Rated-Supplies 7 years, 5 months ago

Refund Procedure for Goods/Services made to Zero-Rated Supplies

It has been shown that Government has made extra efforts to disburse various Refund requests. Following is the Refund Procedure for Goods/Services […]

CA Amresh Vashisht wrote a new post, My Departure Address – Common Seal 7 years, 5 months ago

My Departure Address – Common Seal

I am a COMMON Seal of the company who ruled the corporate world for a century. I come to you with a message of leave-taking and farewell, and to share a few final thoughts with […]

CA Amresh Vashisht wrote a new post, Advisory for filing refund application under GST-RFD-01A 7 years, 5 months ago

Advisory to taxpayers for filing refund application under GST-RFD-01A

Advisory to taxpayers for filing refund application under GST-RFD-01A:

1. Refund application can be filed using the application form […]

CA Amresh Vashisht wrote a new post, Decoding ITR 7 of A.Y 2018-19 7 years, 5 months ago

Decoding ITR 7 of A.Y 2018-19

Persons including companies that are required to furnish Income-tax return under section 139(4A) or 139(4B) or 139(4C) or 139(4D) or 139(4E) or 139(4F) shall furnish the return of […]

CA Amresh Vashisht wrote a new post, NOTE ON E-WAY Bill 7 years, 5 months ago

NOTE ON E-WAY Bill

To understand the structure and mechanism of the e-way bill, the following is NOTE on E-Way Bill:

Section 129(1) of CGST Act

Detention, seizure, and release of goods and conveyance in […]

CA Amresh Vashisht wrote a new post, Service provided to the Distinct person by the employee is Supply: AAR 7 years, 5 months ago

Service provided to the Distinct person by the employee is Supply: AAR

Karnataka AAR holds that activities performed by employees at the corporate office in course of or in relation to employment. Such as […]

CA Amresh Vashisht wrote a new post, Application of IEC simplified and auto-generated 7 years, 5 months ago

Application of IEC simplified and auto-generated

DGFT revises FTP para 2.05 and HBP para 2.08 with regards to IEC and modification of IEC vide notification no. 24 DT. 08.08.2018 and public notice no. 27 DT. […]

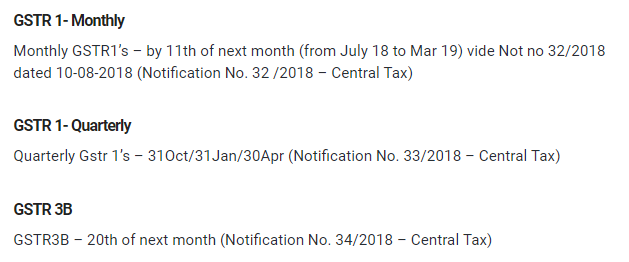

CA Amresh Vashisht wrote a new post, Updates on GST Returns 7 years, 5 months ago

Updates on GST Returns

GST Returns (GSTR1 and GSTR3B) continues till 31.03.2019 vide Notification no 33/2018 and 34/2018 dated 10-08-2018

Due dates

GSTR 1- Monthly

Monthly GSTR1’s – by 11th of next month […]

CA Amresh Vashisht wrote a new post, Multipurpose Empanelment Form 2018 7 years, 6 months ago

Multipurpose Empanelment Form 2018 Application

The uploading of form is not smooth. Many problems are being surfaced. The last date for filing the Multipurpose Empanelment Form 2018 is 21st August 2018.

This y […]

CA Amresh Vashisht wrote a new post, Important note for GST on Canteen Services 7 years, 6 months ago

Important note for GST on Canteen Services

Whether reimbursement of food expenses from employees for the canteen provided by the company comes under the definition of outward supplies as taxable under the GST […]

CA Amresh Vashisht wrote a new post, Matching GST returns and ITR 7 years, 6 months ago

Matching GST returns and ITR

The first financial year after the regime of the GST has ended and now the time is for the filing of the Income-tax Return. But there are some confusion and problems arising in the m […]

CA Amresh Vashisht wrote a new post, Take note of following Precautions while filing ITR-7. 7 years, 6 months ago

Take note of following Precautions while filing ITR-7

Some of the claims made under sections 11 may are being disallowed during processing for reasons and in certain cases, the same may be rectifiable by suitable […]

CA Amresh Vashisht wrote a new post, Income can only be taxable after sale deed execution 7 years, 7 months ago

In the case of project completion method, Income can only be taxable after sale deed execution

IT: Where the assessee, engaged in construction business, was following project completion method, its income could […]

CA Amresh Vashisht wrote a new post, GSTN to temporarily shut down on 1st July 7 years, 7 months ago

GSTN to temporarily shut down on 1st July

The Goods and Services Tax Network (GSTN) will not be available on the first anniversary day of GST, i.e, 1st July, GSTN said. As the Goods and Services Tax Network ( […]

CA Amresh Vashisht wrote a new post, Suggestive Ways to Deal ROC Latest Notice STK-5 7 years, 7 months ago

Suggestive Ways to Deal ROC Latest Notice STK-5

The Companies which have not filed their Financial Statement (AOC-4 / 23AC, ACA) or Annual Return (MGT-7) for a period of two immediately preceding financial year […]

CA Amresh Vashisht wrote a new post, Nine Steps for Revocation of Cancelled GST Registration 7 years, 7 months ago

Nine Steps for Revocation of Cancelled GST Registration

{ Application for revocation of cancelled GST registration can be accessed within 30 days, from issuance of the Cancellation Order on the GST Portal, after […]

CA Amresh Vashisht wrote a new post, Common enrolment for transporters for e-Way Bills 7 years, 7 months ago

Common enrolment for transporters for e-Way Bills; Seizure / Confiscation orders made available online

Central Govt. notifies CGST (Sixth Amendment) Rules 2018 from date of their publication in Official Gazette; […]