Ashu Dalmia is Managing Partner of the firm AAP and Co., having office in Connaught Place Delhi. He is rank holder in CA Inter and also at graduation level from Lucknow university. He is has been working extensively in GST training, Consultancy and litigation in India and also handled VAT implementation projects for mid and large corporates in Saudi Arabia. He was special Invitee to Indirect Tax Committee of ICAI for year 2018-19. He is faculty in ICAI to train professionals for GST in India and VAT for UAE. He has authored books on GST:

“GST A Practical Approach” published by Taxman,

“Audit and Annual Return in GST” published by Wolters Kluwer-CCH

GST Referencer and Manual published by LMP.

He has taken more than 300 workshops and trainings on various forums: like ICAI, ASSOCHAM, CII, PHD Chamber of commerce, trade associations in India, UAE and KSA.

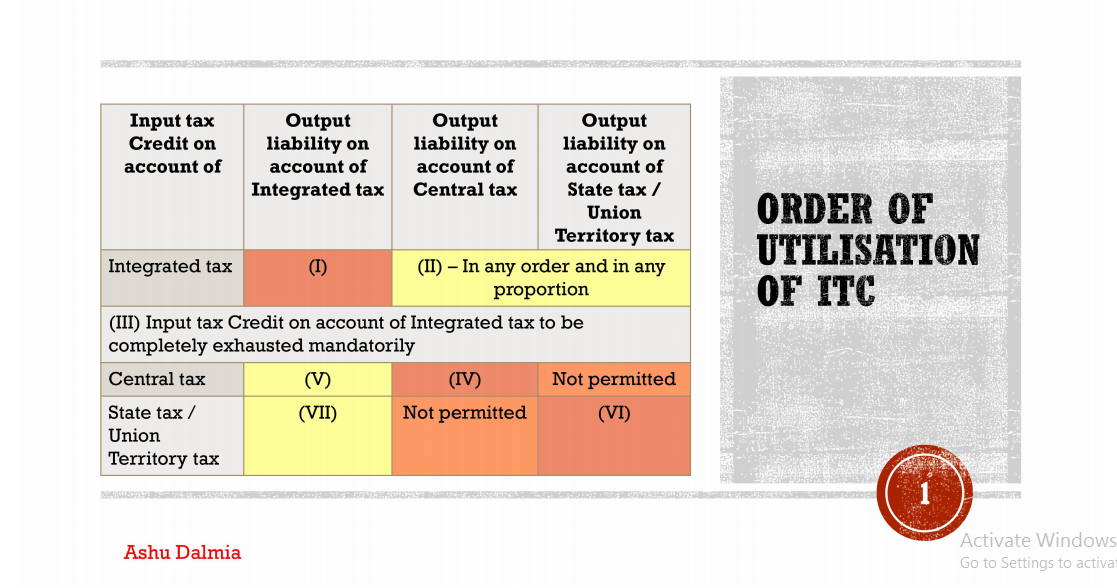

Input Tax Credit on account of

Output liability on account of Integrated Tax

Output liability on account of Central Tax

Output liability on account of State Tax/ Union T […]

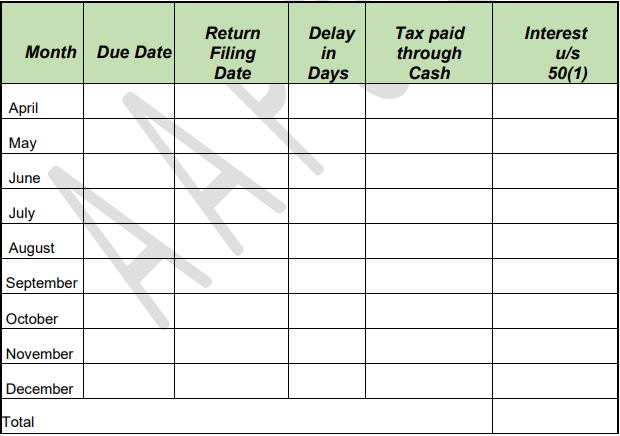

Whether Interest is payable for delay in filing of returns? If interest is payable whether it should be on a gross basis or on a net basis?

Nowadays Revenue Authorities are issuing notices for collection of […]

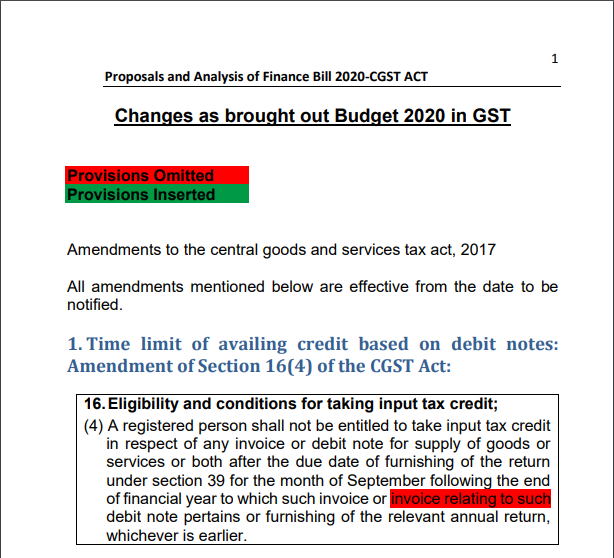

Changes as brought out Budget 2020 in GST

Provisions Omitted

Provisions Inserted

Amendments to the central goods and services tax act, 2017

All amendments mentioned below are effective from the date to be […]

Transition in GST

Transition in GST is going to start very soon. It is important to understand these provisions before the applicability of Law.Provisions for transition in GST are covers in Chapter XXVII. It […]

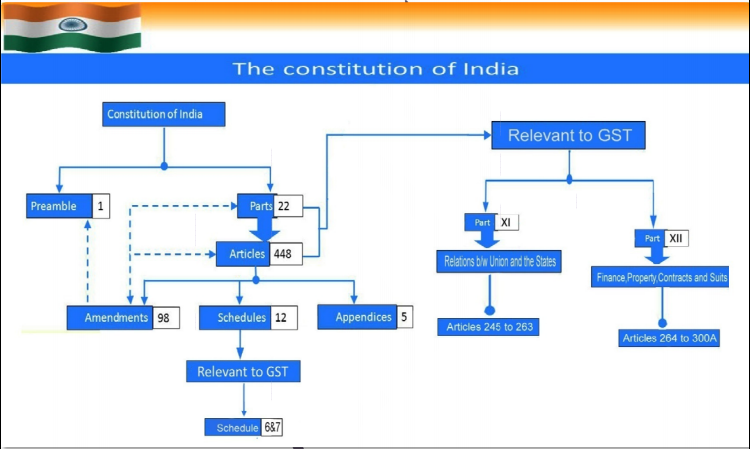

Critical Analysis of GST Constitutional Journey

We all know that the Constitution amendment bill later on passed by parliament and become 101 st constitutional amendment law bring the GST into life. Here I have […]

Ashu Dalmia

@ca-ashu-dalmia

active 5 years, 10 months agoAshu Dalmia

Ashu Dalmia is Managing Partner of the firm AAP and Co., having office in Connaught Place Delhi. He is rank holder in CA Inter and also at graduation level from Lucknow university. He is has been working extensively in GST training, Consultancy and litigation in India and also handled VAT implementation projects for mid and large corporates in Saudi Arabia. He was special Invitee to Indirect Tax Committee of ICAI for year 2018-19. He is faculty in ICAI to train professionals for GST in India and VAT for UAE. He has authored books on GST: “GST A Practical Approach” published by Taxman, “Audit and Annual Return in GST” published by Wolters Kluwer-CCH GST Referencer and Manual published by LMP. He has taken more than 300 workshops and trainings on various forums: like ICAI, ASSOCHAM, CII, PHD Chamber of commerce, trade associations in India, UAE and KSA.

Registered Categories

Location

New Delhi, India

WEBSITE

http://ada.org.inOOPS!

No Packages Added by Ashu Dalmia. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewAshu Dalmia wrote a new post, E-Invoicing mandatory for Businesses having aggregate turnover above Rs.100 crore from 1st Jan’2021 5 years, 2 months ago

E-Invoicing mandatory for Businesses having aggregate turnover above Rs.100 crore from 1st Jan’2021

E- invoices are mandatory for businesses with a turnover of Rs 500 crore and more, which has been put int […]

Ashu Dalmia wrote a new post, ITC Utilization Sequence 5 years, 7 months ago

Order of Utilization of ITC

Input Tax Credit on account of

Output liability on account of Integrated Tax

Output liability on account of Central Tax

Output liability on account of State Tax/ Union T […]

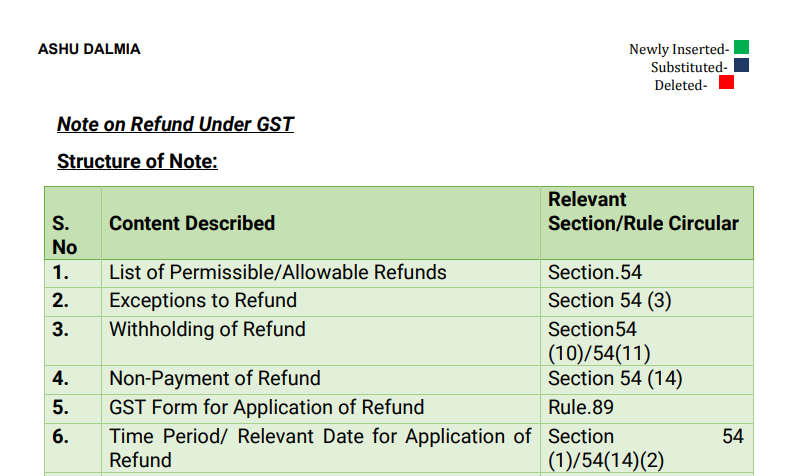

Ashu Dalmia wrote a new post, Note on Refund Under GST 5 years, 7 months ago

Note on Refund Under GST

List of Permissible/Allowable Refunds

Refund of unutilized input tax credit (ITC) on account of exports without payment of tax;

Refund of tax paid on export of services with p […]

Ashu Dalmia wrote a new post, Whether Interest is payable for delay in filing of returns, if yes on net or gross? 5 years, 12 months ago

Whether Interest is payable for delay in filing of returns? If interest is payable whether it should be on a gross basis or on a net basis?

Nowadays Revenue Authorities are issuing notices for collection of […]

Ashu Dalmia wrote a new post, Changes as brought out Budget 2020 in GST 6 years ago

Changes as brought out Budget 2020 in GST

Provisions Omitted

Provisions Inserted

Amendments to the central goods and services tax act, 2017

All amendments mentioned below are effective from the date to be […]

Ashu Dalmia wrote a new post, GSTR 9 & 9C with FEW SAMPLE DISCLOSURES 6 years, 2 months ago

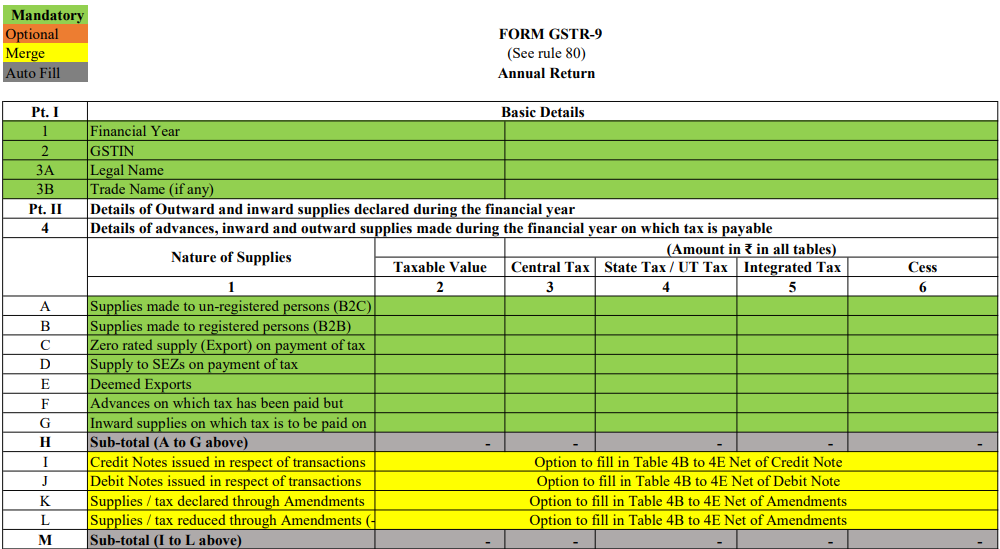

Data in various tables of GSTR 9:

Data in various tables of GSTR 9C:

GSTR 9C: PART – B- CERTIFICATION Changes Notif […]

Ashu Dalmia‘s profile was updated 8 years, 5 months ago

Ashu Dalmia wrote a new post, Transition in GST :PPT By CA Ashu Dalmia 9 years, 2 months ago

Transition in GST

Transition in GST is going to start very soon. It is important to understand these provisions before the applicability of Law.Provisions for transition in GST are covers in Chapter XXVII. It […]

Ashu Dalmia wrote a new post, Critical Analysis of GST Constitutional Journey 9 years, 4 months ago

Critical Analysis of GST Constitutional Journey

We all know that the Constitution amendment bill later on passed by parliament and become 101 st constitutional amendment law bring the GST into life. Here I have […]

Ashu Dalmia became a registered member 10 years, 9 months ago