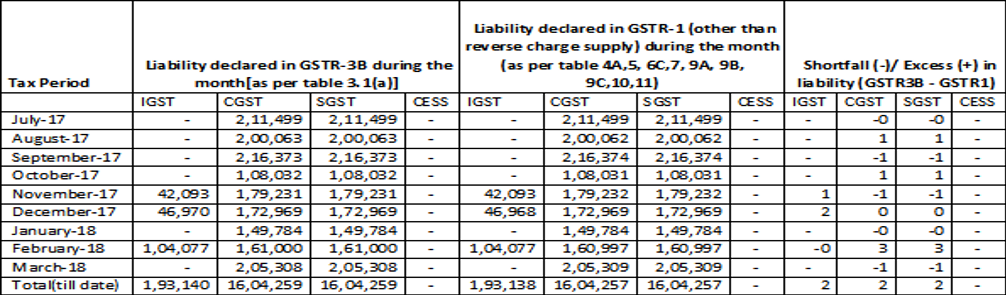

This article is all about things you should do before you think of filling GSTR 9. Don’t just jump to file GSTR 9. First follow these 3 simple steps and then go to filling GSTR 9.

1. Matching “TAX AS PER 3B […]

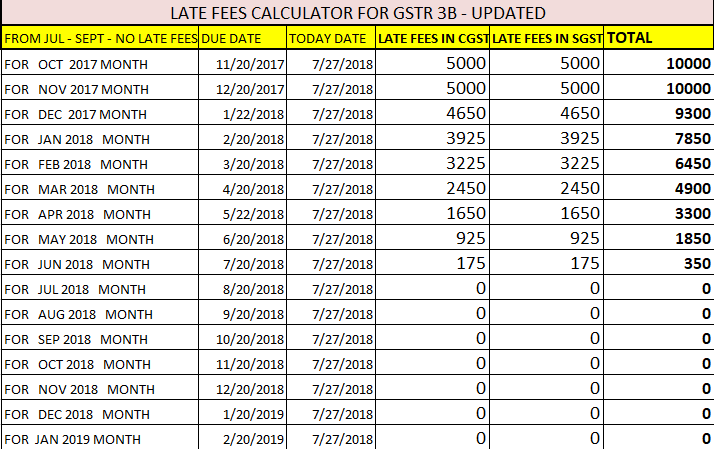

Since GST is being operationalized since Jul-17, One of major concern is how to calculate INTEREST on late payment of GST & Late fees for filling GSTR 3B.

I have attached an Automatic GST Late Fees Calculator […]

11 Advises in Relation to GST before Finalizing the books of Accounts

The end of the financial year is close and liability of various compliances are to be done. Following are the 11 Advises in Relation to GST be […]

Comparison Of Composition Schemes

We had COMPOSITION scheme for GOODS manufacturer or trader – at 1%. Also we already had COMPOSITION scheme for RESTAURANT SERVICE supplier – at 5%. Let us have a Comparison Of […]

10 Tasks to complete for GST before March 2019 Returns

Here is a list of 10 Tasks to complete for GST before March 2019 Returns. It is concerned that you should complete before you file March 19 GSTR 3B & GSTR […]

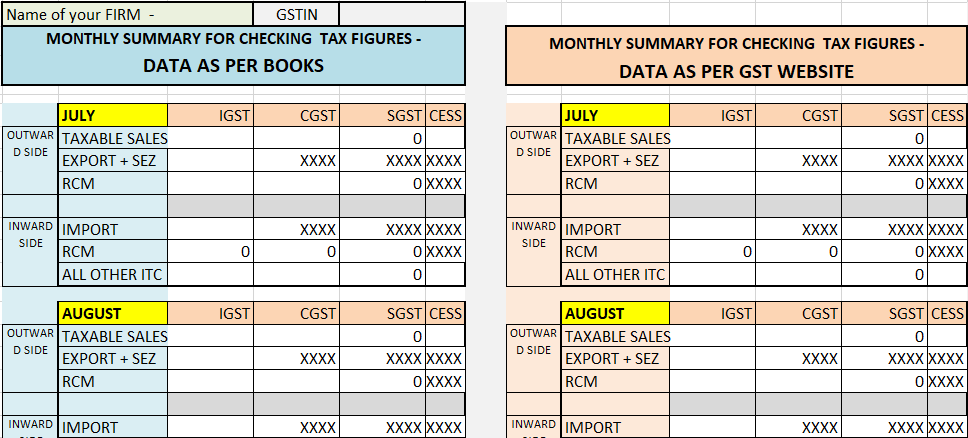

Excel tool for checking monthly tax data of GSTR 3B for FY 17-18

It’s been a year for GST returns and Now it’s season of finalizing books of accounts for 2017-2018 ..(At least for Tax Audit purpose). So, we […]

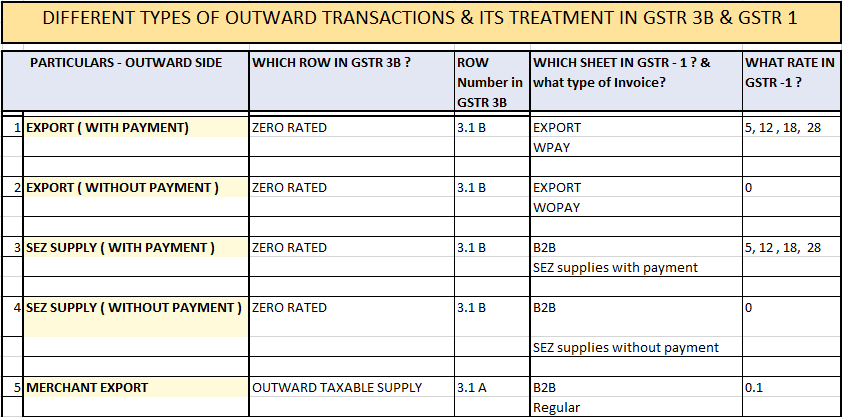

Guide for Treatment of different Business Transactions in GSTR 3B & GSTR 1

It has been A year of GST and we are still figuring out exact treatment of different business transactions like Export, SEZ, Merchant […]

Late Fee Calculator For filing GSTR-3B free download

The problem arises when the taxpayer forgets to file the GST returns on time. In the beginning, the Government has given a lot of extension in the due dates f […]

GST & Accounting Entries in GST ERA – ALSO ITS EFFECT ON GSTR 3B RETURN

Let’s understand this with the help of Example. In the given Example Mr. x has the following transaction of Sale, Purchase, & some e […]

In GST that will be so much litigation in near future majorly in 3 area

1. The first is POS – the place of supply. There might be chances that officers will force you to pay CGST SGST instead IGST that you h […]

Financial planning guide

A financial planning guide for the person who has big dreams. The person who earns 12 Lacs per year which(inclusive of all incomes) can become super rich by following the proper guide. […]

CA Harshil Sheth

@ca-harshil-sheth

active 6 days, 17 hours agoCA Harshil Sheth

OOPS!

No Packages Added by CA Harshil Sheth. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Harshil Sheth wrote a new post, 4 MONTH TIME TABLE FOR EVERY PRACTISING CA 6 years, 7 months ago

A systematic approach to divide your GST & Income Tax work according to Time available & its Gravity.

Some are good at time management and some are not. CA practice has become all about time management. S […]

CA Harshil Sheth wrote a new post, 3 steps to follow before you file GSTR -9 6 years, 8 months ago

This article is all about things you should do before you think of filling GSTR 9. Don’t just jump to file GSTR 9. First follow these 3 simple steps and then go to filling GSTR 9.

1. Matching “TAX AS PER 3B […]

CA Harshil Sheth wrote a new post, GST Late Fees and Interest Calculator on Late Filling 6 years, 8 months ago

Since GST is being operationalized since Jul-17, One of major concern is how to calculate INTEREST on late payment of GST & Late fees for filling GSTR 3B.

I have attached an Automatic GST Late Fees Calculator […]

CA Harshil Sheth wrote a new post, 11 Advises in Relation to GST before Finalizing the books of Accounts 6 years, 9 months ago

11 Advises in Relation to GST before Finalizing the books of Accounts

The end of the financial year is close and liability of various compliances are to be done. Following are the 11 Advises in Relation to GST be […]

CA Harshil Sheth wrote a new post, Comparison Of Composition Schemes 6 years, 10 months ago

Comparison Of Composition Schemes

We had COMPOSITION scheme for GOODS manufacturer or trader – at 1%. Also we already had COMPOSITION scheme for RESTAURANT SERVICE supplier – at 5%. Let us have a Comparison Of […]

CA Harshil Sheth wrote a new post, 10 Tasks to complete for GST before March 2019 Returns 6 years, 10 months ago

10 Tasks to complete for GST before March 2019 Returns

Here is a list of 10 Tasks to complete for GST before March 2019 Returns. It is concerned that you should complete before you file March 19 GSTR 3B & GSTR […]

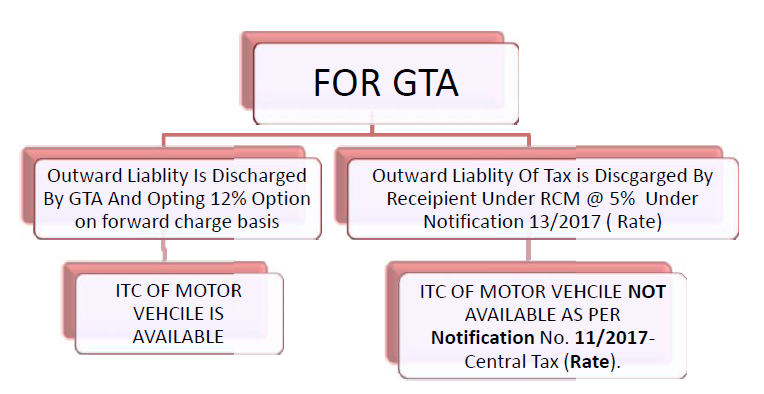

CA Harshil Sheth wrote a new post, Analysis of ITC of/in respect of Motor vehicles 6 years, 10 months ago

Analysis of ITC of/in respect of Motor vehicles

ABSTRACT OF SECTION 17(5) BLOCKED CREDIT (APPLICABILITY AFTER 01-02-2019 ) FOR MOTOR VEHICLE

17(5)(a) motor vehicles for transportation of persons having […]

CA Harshil Sheth wrote a new post, Excel tool for checking monthly tax data of GSTR 3B for FY 17-18 7 years, 4 months ago

Excel tool for checking monthly tax data of GSTR 3B for FY 17-18

It’s been a year for GST returns and Now it’s season of finalizing books of accounts for 2017-2018 ..(At least for Tax Audit purpose). So, we […]

CA Harshil Sheth wrote a new post, Guide for Treatment of different Business Transactions in GSTR 3B & GSTR 1 7 years, 4 months ago

Guide for Treatment of different Business Transactions in GSTR 3B & GSTR 1

It has been A year of GST and we are still figuring out exact treatment of different business transactions like Export, SEZ, Merchant […]

CA Harshil Sheth wrote a new post, Late Fee Calculator For filing GSTR-3B free download 7 years, 5 months ago

Late Fee Calculator For filing GSTR-3B free download

The problem arises when the taxpayer forgets to file the GST returns on time. In the beginning, the Government has given a lot of extension in the due dates f […]

CA Harshil Sheth wrote a new post, GST & Accounting Entries in GST ERA 7 years, 8 months ago

GST & Accounting Entries in GST ERA – ALSO ITS EFFECT ON GSTR 3B RETURN

Let’s understand this with the help of Example. In the given Example Mr. x has the following transaction of Sale, Purchase, & some e […]

CA Harshil Sheth wrote a new post, In GST that will be so much litigation in near future majorly in 3 area 7 years, 8 months ago

In GST that will be so much litigation in near future majorly in 3 area

1. The first is POS – the place of supply. There might be chances that officers will force you to pay CGST SGST instead IGST that you h […]

CA Harshil Sheth wrote a new post, Financial planning guide 7 years, 9 months ago

Financial planning guide

A financial planning guide for the person who has big dreams. The person who earns 12 Lacs per year which(inclusive of all incomes) can become super rich by following the proper guide. […]