Nikhil M Jhanwar is a practicing Chartered Accountant based in North India having a vast experience of 8 years in taxation advisory/compliances, litigation support, drafting replies to Show Cause Notices, and representing clients before the Department in Indian GST and UAE VAT. He has closely worked on GST implementation in India and UAE VAT implementation in particular impact analysis, regulatory support, implementation support, I.T. support, tax advisory, and compliances. Being a Faculty Member of GST by ICAI, he regularly speaks at forums and seminars on various topics of GST. He is a keen writer and his articles have been published in prominent tax journals and websites.

GTAs can exercise GST under forward charge for a financial year without filing declarations for future years unless they revert to RCM. Such declaration is to be exercised till 31st March of the preceding […]

In view of the challenges faced by taxpayers in meeting the statutory and regulatory compliances due to the outbreak of the second wave of COVID-19 pandemic, the Government has issued various notifications […]

The input tax credit is a beneficial piece of legislation but subject to various conditions and limitations prescribed under Section 16 and 17 of CGST Act, 2017. One of the conditions contained in Section […]

I. Compliances before 31st March 2021

A. File GSTR 9 & 9C for F.Y. 2019-20

The due date file GSTR-9 (for taxpayers having aggregate turnover of more than 2 crs.) and GSTR-9C (for taxpayers having aggregate […]

Decoding Indirect tax proposals of Budget 2021

Clarifying the applicability of GST on Societies/Clubs/Associations

W.r.e.f. 1st July 2017 post-enactment of Finance Bill, 2021

GST Insights – New Year Amendments

The Central Government has made critical amendments to CGST Rules, 2017 vide Notification No. 94/2020–Central Tax dated 22.12.2020 to make provisions more stringent and harsh f […]

The validity of the Order of Prohibition passed by DC

Best Judgement assessment

The ex-parte assessment order passed during the lockdown period

GST on Whol […]

A. Decoding the Advance ruling on director’s remuneration

Imagine you are the whole-time director of your company and drawing remuneration in the form of salary, allowances, and perquisites on a monthly basis. N […]

In its 4th and probably final round of extension and modification exercise in filing GSTR-9 and 9C, the Government has issued following yesterday:

1. Notification No. 56/2019-CGST dated 14th November 2019 […]

CA Nikhil M Jhanwar

Paid User

@ca-nikhil-m-jhanwar

active 2 years, 1 month agoCA Nikhil M Jhanwar

Nikhil M Jhanwar is a practicing Chartered Accountant based in North India having a vast experience of 8 years in taxation advisory/compliances, litigation support, drafting replies to Show Cause Notices, and representing clients before the Department in Indian GST and UAE VAT. He has closely worked on GST implementation in India and UAE VAT implementation in particular impact analysis, regulatory support, implementation support, I.T. support, tax advisory, and compliances. Being a Faculty Member of GST by ICAI, he regularly speaks at forums and seminars on various topics of GST. He is a keen writer and his articles have been published in prominent tax journals and websites.

Registered Categories

OOPS!

No Packages Added by CA Nikhil M Jhanwar. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Nikhil M Jhanwar wrote a new post, Key Highlights of 50th GST Council Meeting 2 years, 7 months ago

GTAs can exercise GST under forward charge for a financial year without filing declarations for future years unless they revert to RCM. Such declaration is to be exercised till 31st March of the preceding […]

CA Nikhil M Jhanwar wrote a new post, GST Insights – Relief Measures- COVID-19 2.0 4 years, 9 months ago

In view of the challenges faced by taxpayers in meeting the statutory and regulatory compliances due to the outbreak of the second wave of COVID-19 pandemic, the Government has issued various notifications […]

CA Nikhil M Jhanwar wrote a new post, Amended Section 16(4) to de-link ITC on Debit Note with Invoice fails to get stamping of Gujarat AAR 4 years, 10 months ago

The input tax credit is a beneficial piece of legislation but subject to various conditions and limitations prescribed under Section 16 and 17 of CGST Act, 2017. One of the conditions contained in Section […]

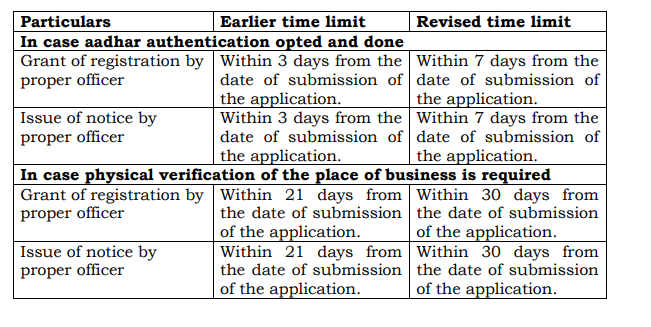

CA Nikhil M Jhanwar wrote a new post, GST Insights- Compliances before 31st March 21 and Changes w.e.f. 1st April 2021 4 years, 11 months ago

I. Compliances before 31st March 2021

A. File GSTR 9 & 9C for F.Y. 2019-20

The due date file GSTR-9 (for taxpayers having aggregate turnover of more than 2 crs.) and GSTR-9C (for taxpayers having aggregate […]

CA Nikhil M Jhanwar wrote a new post, Decoding Indirect tax proposals of Budget 2021 5 years ago

Decoding Indirect tax proposals of Budget 2021

Clarifying the applicability of GST on Societies/Clubs/Associations

W.r.e.f. 1st July 2017 post-enactment of Finance Bill, 2021

Section

Proposed […]

CA Nikhil M Jhanwar wrote a new post, Gist of Quarterly Return Monthly Payment Scheme 5 years, 1 month ago

The gist of Quarterly Return Monthly Payment Scheme

Change in GST Returns Filing System w.e.f. 1st January 2021

Existing System

New System from Jan 2021

Monthly filing of GSTR-3B for all […]

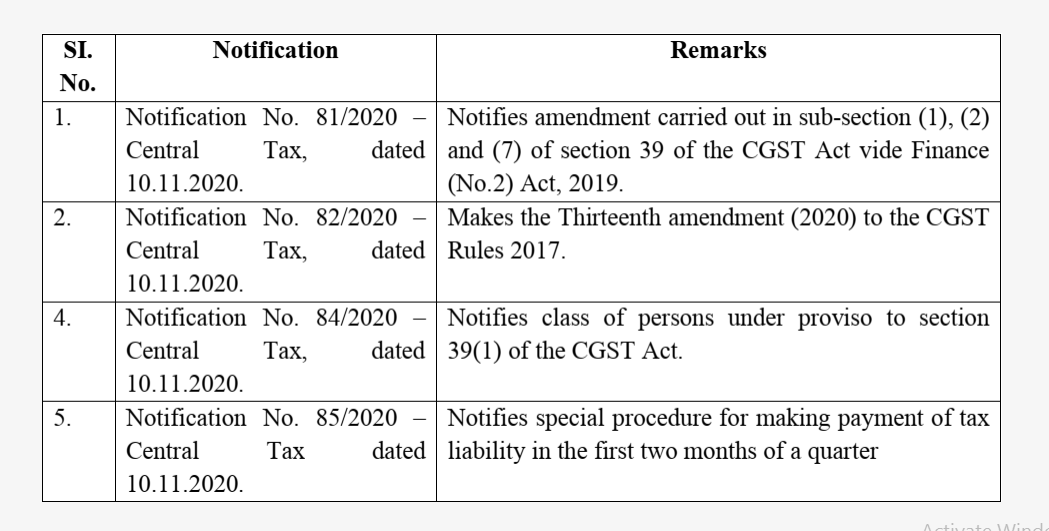

CA Nikhil M Jhanwar wrote a new post, GST Insights – New Year Amendments 5 years, 1 month ago

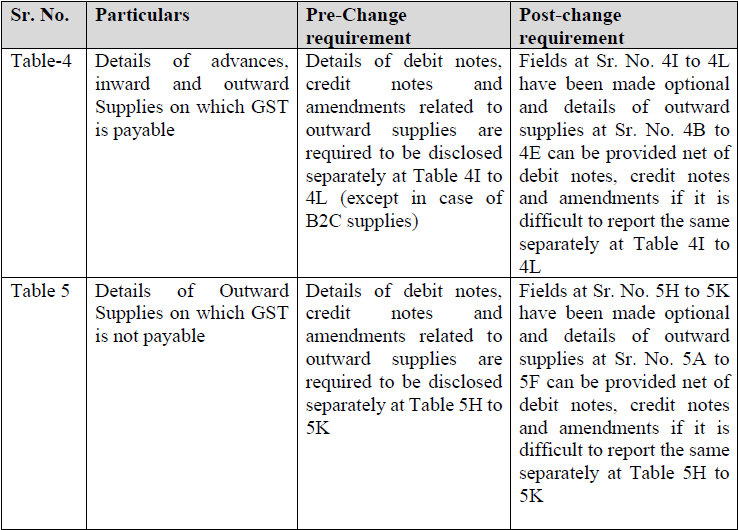

GST Insights – New Year Amendments

The Central Government has made critical amendments to CGST Rules, 2017 vide Notification No. 94/2020–Central Tax dated 22.12.2020 to make provisions more stringent and harsh f […]

CA Nikhil M Jhanwar wrote a new post, Document-wise Download Facility of Table-8A of GSTR-9 5 years, 6 months ago

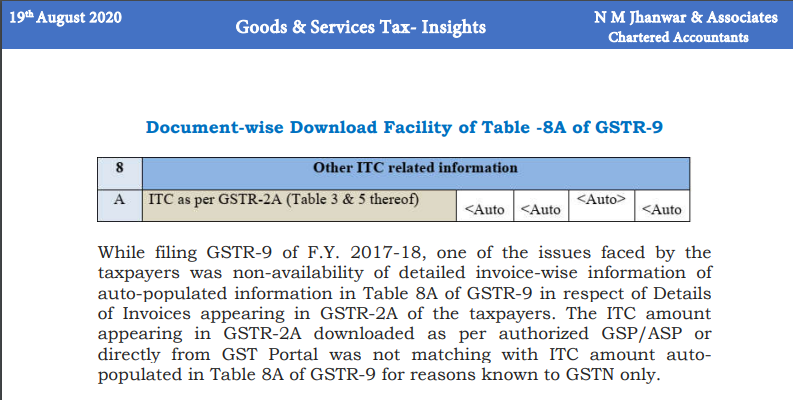

Document-wise Download Facility of Table-8A of GSTR-9

8

Other ITC related Information

A

ITC as per GSTR-2A (Table 3 & 5 thereof)

CA Nikhil M Jhanwar wrote a new post, GST Insights Judicial Pronouncements 5 years, 9 months ago

GST Insights Judicial Pronouncements

The validity of the Order of Prohibition passed by DC

Best Judgement assessment

The ex-parte assessment order passed during the lockdown period

GST on Whol […]

CA Nikhil M Jhanwar wrote a new post, GST on Director’s Remuneration- Whether payable? 5 years, 10 months ago

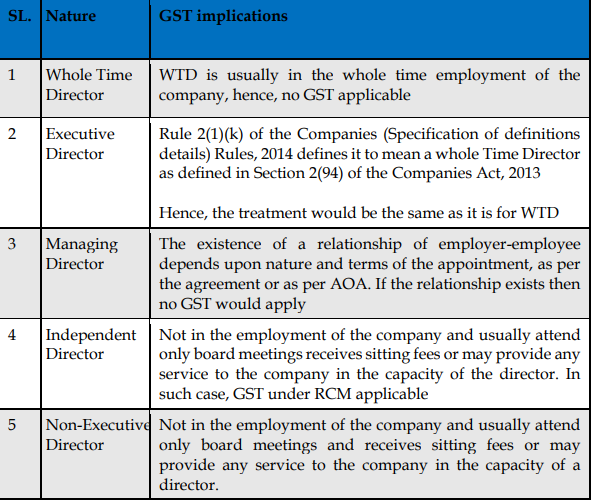

A. Decoding the Advance ruling on director’s remuneration

Imagine you are the whole-time director of your company and drawing remuneration in the form of salary, allowances, and perquisites on a monthly basis. N […]

CA Nikhil M Jhanwar wrote a new post, Note on Recent changes in GSTR-9 & 9C 6 years, 3 months ago

In its 4th and probably final round of extension and modification exercise in filing GSTR-9 and 9C, the Government has issued following yesterday:

1. Notification No. 56/2019-CGST dated 14th November 2019 […]