Mr. Pankaj Gupta is a Fellow Member of the Institute of Chartered

Accountants of India (ICAI) and also Fellow Member of The Institute of

Company Secretaries of India (ICSI). He has his own CA practice at Noida under the Firm Name “ P.R. Gupta & Co.” and has over 40 years of professional experience dealing in Direct Taxes, Indirect Taxes, Corporate Laws, and FEMA Laws, etc. Clientele includes Non-Residents Individuals and corporate entities.

He has remained office-bearer of many professional organizations like ICAI, ICSI, Noida Management Association. He has been instrumental in organizing various professional seminars and has been a speaker at various forums and contributing professional Articles.

Late Fees on Filing of ITR Beyond Due Date

“It is very disappointing to note that mandatory Late fees under 234F for late filing of ITR is being levied by the income tax department by having a misinterpreted d […]

Tax on Presumptive Profit of Business & Profession

“An option has been given to a certain category of an assessee carrying on business or profession to pay income tax on presumptive income”

I. Pre […]

Optional System of Income Tax For Corporates

“An option to corporates has been given to get taxed at reduced rates by foregoing certain deductions/Exemptions. This should benefit a lot of companies”

I. Pre […]

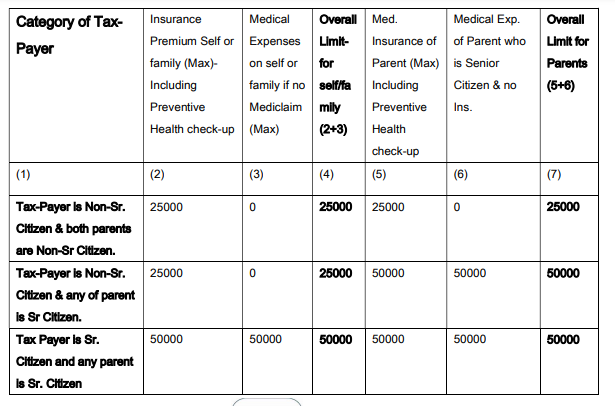

Deductions for Medical Treatment under Income Tax

“A simple provision for claiming the deduction for medical treatment is not so simple to understand. Various intricacies which arises have been discussed in t […]

Ambiguities Due to Extended Due Date for ITR

“CBDT has further extended the due date of filing an income tax return to 31st December 2020 in Non-Audit cases and to 31st January 2021 for Audit cases. However, s […]

Stamp Duty Valuation of Immovable Property

I. Preamble:

Valuation of immovable property for the purpose of stamp duty is an important aspect. The stamp duty is payable as per the provisions of the Registration […]

Signing of Documents Digitally by a Director

I. Preamble:

These days Video Conferencing, Electronic Voting, and Electronic Records are becoming a norm. And rightly so, as it results in saving a lot of resources […]

Professional Services Vs. Technical Services U/s 194J of Income Tax Act, 1961

This analysis has assumed great importance due to the amendment of section 194J by the Finance Act, 2020 with effect from 1st April […]

CA Pankaj Gupta

@ca-pankaj-gupta

Not recently activeCA Pankaj Gupta

Mr. Pankaj Gupta is a Fellow Member of the Institute of Chartered Accountants of India (ICAI) and also Fellow Member of The Institute of Company Secretaries of India (ICSI). He has his own CA practice at Noida under the Firm Name “ P.R. Gupta & Co.” and has over 40 years of professional experience dealing in Direct Taxes, Indirect Taxes, Corporate Laws, and FEMA Laws, etc. Clientele includes Non-Residents Individuals and corporate entities. He has remained office-bearer of many professional organizations like ICAI, ICSI, Noida Management Association. He has been instrumental in organizing various professional seminars and has been a speaker at various forums and contributing professional Articles.

OOPS!

No Packages Added by CA Pankaj Gupta. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Pankaj Gupta wrote a new post, Late Fees on Filing of ITR Beyond Due Date 5 years, 1 month ago

Late Fees on Filing of ITR Beyond Due Date

“It is very disappointing to note that mandatory Late fees under 234F for late filing of ITR is being levied by the income tax department by having a misinterpreted d […]

CA Pankaj Gupta wrote a new post, Tax on Presumptive Profit of Business & Profession 5 years, 1 month ago

Tax on Presumptive Profit of Business & Profession

“An option has been given to a certain category of an assessee carrying on business or profession to pay income tax on presumptive income”

I. Pre […]

CA Pankaj Gupta wrote a new post, Optional System of Income Tax For Corporates 5 years, 2 months ago

Optional System of Income Tax For Corporates

“An option to corporates has been given to get taxed at reduced rates by foregoing certain deductions/Exemptions. This should benefit a lot of companies”

I. Pre […]

CA Pankaj Gupta wrote a new post, Deductions for Medical Treatment under Income Tax 5 years, 2 months ago

Deductions for Medical Treatment under Income Tax

“A simple provision for claiming the deduction for medical treatment is not so simple to understand. Various intricacies which arises have been discussed in t […]

CA Pankaj Gupta wrote a new post, Ambiguities Due to Extension of Due Dates for ITR 5 years, 3 months ago

Ambiguities Due to Extended Due Date for ITR

“CBDT has further extended the due date of filing an income tax return to 31st December 2020 in Non-Audit cases and to 31st January 2021 for Audit cases. However, s […]

CA Pankaj Gupta wrote a new post, Stamp Duty Valuation of Immovable Property 5 years, 6 months ago

Stamp Duty Valuation of Immovable Property

I. Preamble:

Valuation of immovable property for the purpose of stamp duty is an important aspect. The stamp duty is payable as per the provisions of the Registration […]

CA Pankaj Gupta wrote a new post, GST Implications on Association of Apartment Owners 5 years, 6 months ago

GST Implications on Association of Apartment Owners

I. Preamble :

These days the concept of ‘Association of Apartment Owners’ is gaining lot of importance to facilitate the upkeep of the residential projec […]

CA Pankaj Gupta wrote a new post, Signing of Documents Digitally by a Director 5 years, 8 months ago

Signing of Documents Digitally by a Director

I. Preamble:

These days Video Conferencing, Electronic Voting, and Electronic Records are becoming a norm. And rightly so, as it results in saving a lot of resources […]

CA Pankaj Gupta wrote a new post, Professional Services Vs. Technical Services U/s 194J of Income Tax Act, 1961 5 years, 8 months ago

Professional Services Vs. Technical Services U/s 194J of Income Tax Act, 1961

This analysis has assumed great importance due to the amendment of section 194J by the Finance Act, 2020 with effect from 1st April […]

CA Pankaj Gupta wrote a new post, Relaxation in Compliances Under Various Laws Due To COVID-19 Lockdown 5 years, 8 months ago

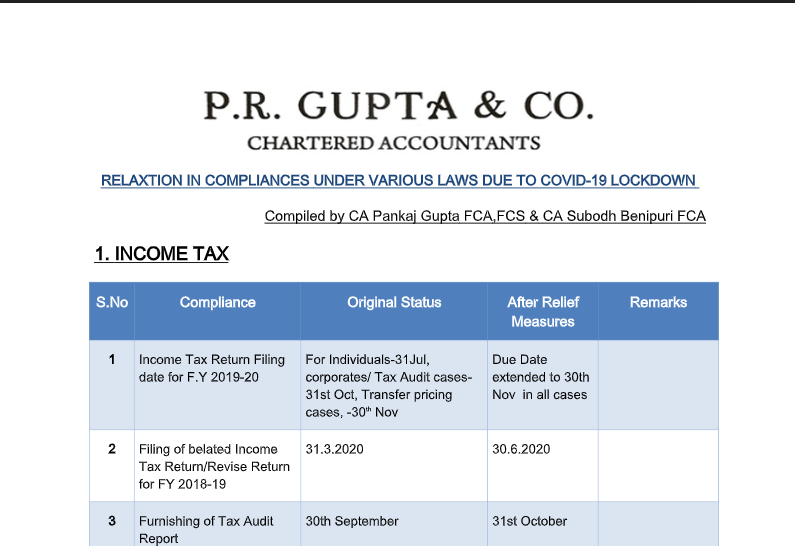

Relaxation in Compliances Under Various Laws Due To COVID-19 Lockdown

1. Income Tax

S.No

Compliance

Original Status

After Relief

Measures

Remarks

1

Income Tax Return Filing

the date for F.Y […]