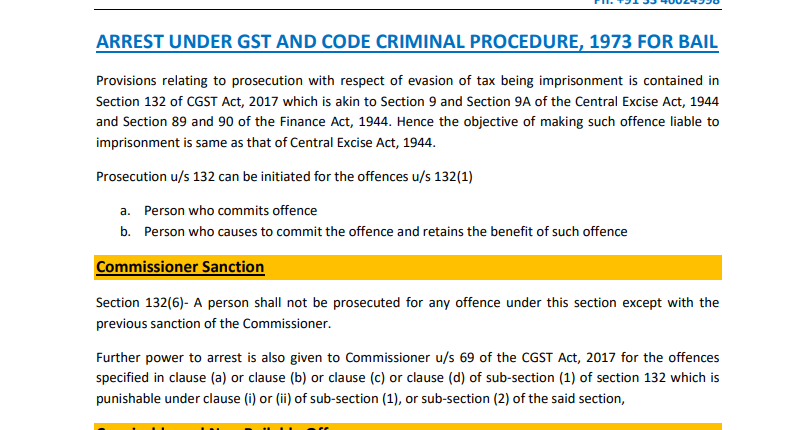

Arrest Under GST And Code Criminal Procedure, 1973 For Bail

Provisions relating to prosecution with respect of evasion of tax being imprisonment is contained in Section 132 of CGST Act, 2017 which is akin to […]

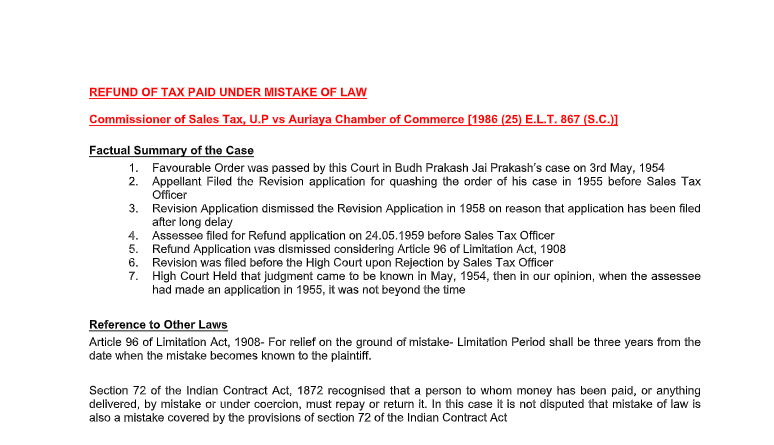

REFUND OF TAX PAID UNDER MISTAKE OF LAW

Commissioner of Sales Tax, U.P vs Auriaya Chamber of Commerce [1986 (25) E.L.T. 867 (S.C.)]

Factual Summary of the Case

1. Favorable Order was passed by this Court in […]

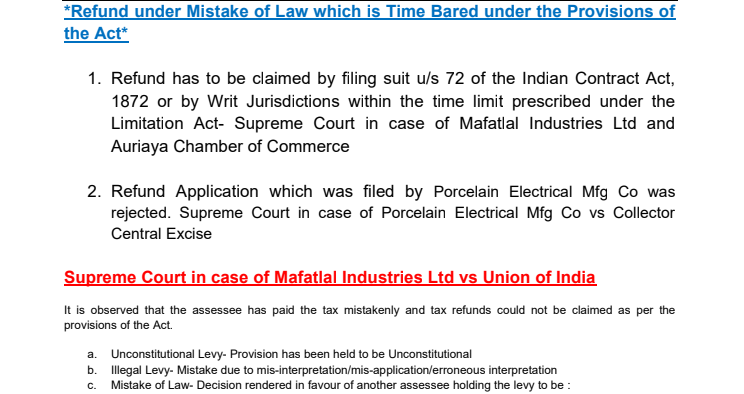

Refund under Mistake of Law which is Time Bared under the Provisions of the Act

1. The refund has to be claimed by filing suit u/s 72 of the Indian Contract Act, 1872 or by Writ Jurisdictions within the time […]

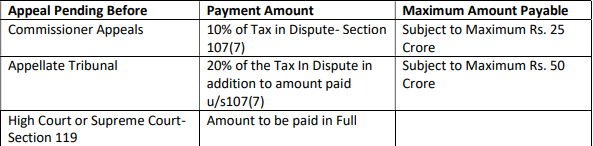

RECOVERY PROCEEDINGS, STAY AND PAYMENT OF TAX

Time Limit for Initiating Recovery Proceedings- Section 78

Legal Provision

A summary of the order issued under section 52 or section 62 or section 63 or section 64 […]

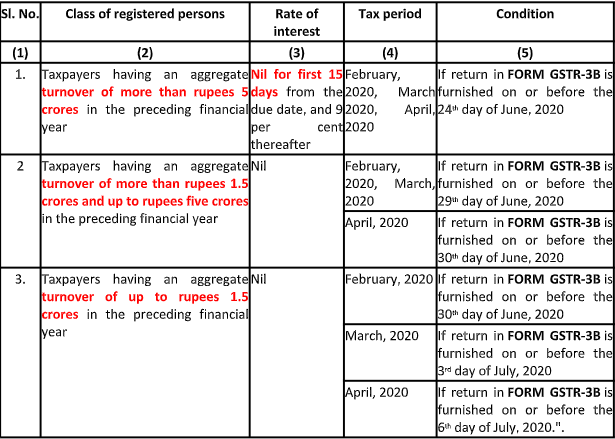

Brief Analysis of Notifications Issued on 3rd April 2020

INTEREST ON DELAY PAYMENT OF TAX PERIOD FOR FEBRUARY, MARCH, APRIL 2020

Notification No- 31/2020 dated 03.04.2020

Introduction:

In a Writ Petition filed before the High Court of Kerala by Alfa Group [2020 (34) G.S.T.L 142]

During the course of the transportation of goods by the Petitioner, the vehicle was intercepted by the […]

AMENDMENTS NOTIFIED BY CENTRAL BOARD OF INDIRECT TAXES (CBIC) ON 23RD and 21ST DAY OF MARCH 2020

GSTR 3B- TIME LIMIT FOR PERIOD APRIL TO SEPTEMBER 2020

Vide Notification No- 29/2020- Central Tax dated […]

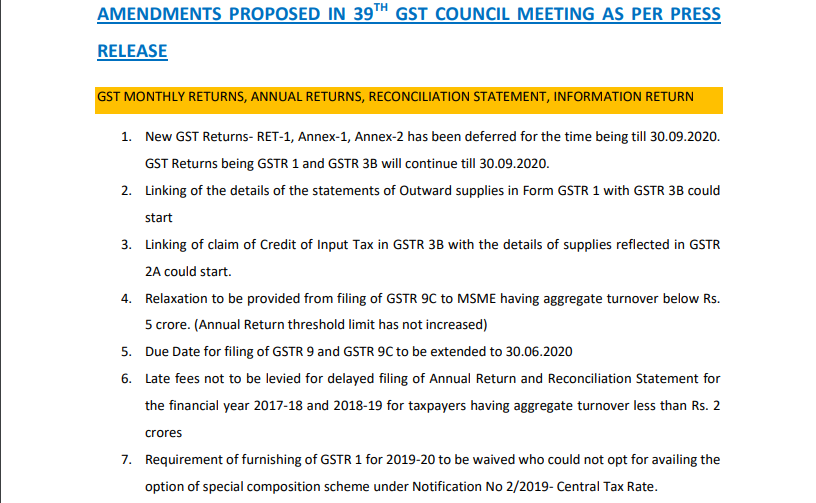

AMENDMENTS PROPOSED IN 39TH GST COUNCIL MEETING AS PER PRESS RELEASE

GST MONTHLY RETURNS, ANNUAL RETURNS, RECONCILIATION STATEMENT, INFORMATION RETURN

1. New GST Returns- RET-1, Annex-1, Annex-2 has been […]

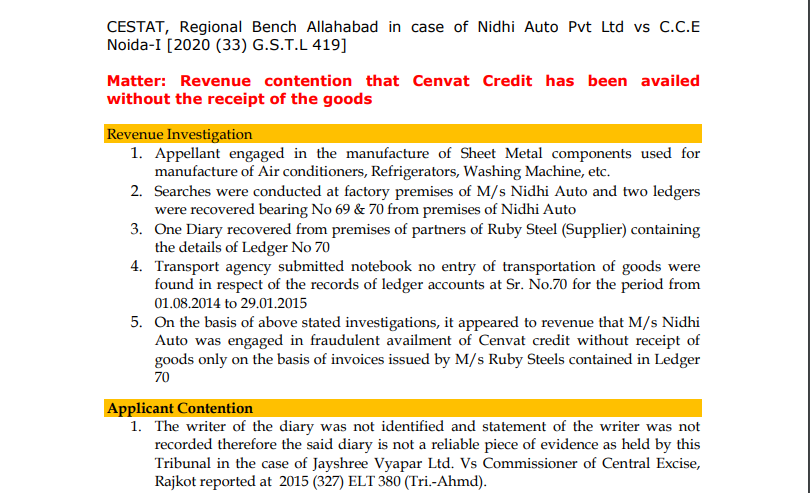

C.C.E Noida-I

Matter:

Revenue contention that Cenvat Credit has been availed without the receipt of the goods.

Revenue Investigation:

1. The appellant engaged in […]

Case covered:

Specsmakers Opticians Pvt Ltd.

Facts of the case:

1. The applicant has stated that they import as well as locally procure Lenses, Frames, Sun Glasses, Contact Lenses as well as Reading […]

Case covered:

Kalyan Jewellers India Ltd

Issue Involved:

Tax Liability on Issue of Gift Vouchers.

Applicant Contention:

1. KJIL, as part of sales promotion, introduced the facility of issuing different t […]

Case covered:

Southern Power Distribution Company of AP Ltd.

Facts of the case:

1. Applicant engaged in the distribution of electricity to consumers and also in the transmission of electricity from […]

Rule 36(4) of CGST Rules, 2017

Rule 36(4) of CGST Rules, 2017 is inserted to curb ITC. The scam of ITC by many suppliers was the main reason behind it. But there are many practical issues related to it’s […]

In an application filed before AAR under GST, Kerala by TATA Coffee Ltd reported in 2020 (32) G.S.T.L 120. Applicant during the course of the plantation of coffee cuts down the excessive trees grown as shade […]

CERTIFICATE TO BE OBTAINED FOR CHARGING LOWER RATE

C.B.I. & C. Instruction F. No. 354/52/2018-TRU

Authenticated document to be relied upon by the developer to charge concessional rate of GST on CLSS […]

Introduction:

Brief Analysis of Writ Petition filed under Article 226 of the Constitution before High Court of Gujarat at Ahmedabad in case of Siddharth Enterprises vs Nodal Officer.

Purpose of Writ:

a. To […]

Brief Analysis of order passed by Hon’ble Appellate Authority of Advance Ruling in respect of appeal filed by MRF Ltd against the order the AAR on the issue of Input Tax Credit on the consideration not paid by […]

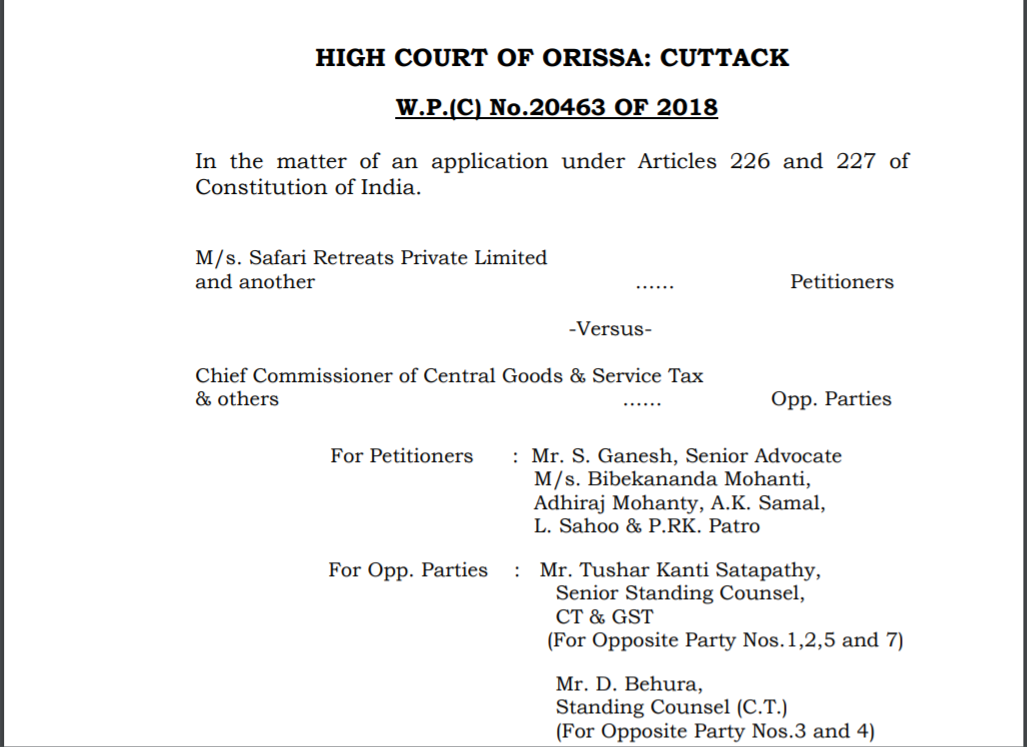

1) An application for a declaration to the effect that Section 17(5)(d) of the Central Tax Goods & Service Tax Act, 2017 as well as of the Odisha GST Act, […]

CA Rachit Agarwal

@ca-rachit-agarwal

active 4 years, 6 months agoCA Rachit Agarwal

OOPS!

No Packages Added by CA Rachit Agarwal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Rachit Agarwal wrote a new post, Arrest Under GST And Code Criminal Procedure, 1973 For Bail 4 years, 7 months ago

Arrest Under GST And Code Criminal Procedure, 1973 For Bail

Provisions relating to prosecution with respect of evasion of tax being imprisonment is contained in Section 132 of CGST Act, 2017 which is akin to […]

CA Rachit Agarwal wrote a new post, Analysis of Case-Commissioner of Sales Tax, U.P V/s Auriaya Chamber of Commerce [1986 (25) E.L.T. 867 (S.C.)] 4 years, 7 months ago

REFUND OF TAX PAID UNDER MISTAKE OF LAW

Commissioner of Sales Tax, U.P vs Auriaya Chamber of Commerce [1986 (25) E.L.T. 867 (S.C.)]

Factual Summary of the Case

1. Favorable Order was passed by this Court in […]

CA Rachit Agarwal wrote a new post, Refund under Mistake of Law which is Time Bared under the Provisions of the Act 4 years, 7 months ago

Refund under Mistake of Law which is Time Bared under the Provisions of the Act

1. The refund has to be claimed by filing suit u/s 72 of the Indian Contract Act, 1872 or by Writ Jurisdictions within the time […]

CA Rachit Agarwal wrote a new post, RECOVERY PROCEEDINGS, STAY AND PAYMENT OF TAX 4 years, 7 months ago

RECOVERY PROCEEDINGS, STAY AND PAYMENT OF TAX

Time Limit for Initiating Recovery Proceedings- Section 78

Legal Provision

A summary of the order issued under section 52 or section 62 or section 63 or section 64 […]

CA Rachit Agarwal wrote a new post, Brief Analysis of Notifications Issued on 3rd April 2020 4 years, 7 months ago

Brief Analysis of Notifications Issued on 3rd April 2020

INTEREST ON DELAY PAYMENT OF TAX PERIOD FOR FEBRUARY, MARCH, APRIL 2020

Notification No- 31/2020 dated 03.04.2020

Our Comments:

Turnover above Rs. 5 […]

CA Rachit Agarwal wrote a new post, No provision under the GST which mandates that the goods shall not be sold at prices below the MRP. 4 years, 7 months ago

Introduction:

In a Writ Petition filed before the High Court of Kerala by Alfa Group [2020 (34) G.S.T.L 142]

During the course of the transportation of goods by the Petitioner, the vehicle was intercepted by the […]

CA Rachit Agarwal wrote a new post, BRIEF ANALYSIS OF AMENDMENTS NOTIFIED ON 23.03.2020 AND 21.3.2020 4 years, 8 months ago

AMENDMENTS NOTIFIED BY CENTRAL BOARD OF INDIRECT TAXES (CBIC) ON 23RD and 21ST DAY OF MARCH 2020

GSTR 3B- TIME LIMIT FOR PERIOD APRIL TO SEPTEMBER 2020

Vide Notification No- 29/2020- Central Tax dated […]

CA Rachit Agarwal wrote a new post, AMENDMENTS PROPOSED IN 39TH GST COUNCIL MEETING AS PER PRESS RELEASE 4 years, 8 months ago

AMENDMENTS PROPOSED IN 39TH GST COUNCIL MEETING AS PER PRESS RELEASE

GST MONTHLY RETURNS, ANNUAL RETURNS, RECONCILIATION STATEMENT, INFORMATION RETURN

1. New GST Returns- RET-1, Annex-1, Annex-2 has been […]

CA Rachit Agarwal wrote a new post, Nidhi Auto Pvt Ltd Vs. CCE Noida: CENVAT without goods receipt 4 years, 8 months ago

Case Covered:

Nidhi Auto Pvt Ltd

Versus

C.C.E Noida-I

Matter:

Revenue contention that Cenvat Credit has been availed without the receipt of the goods.

Revenue Investigation:

1. The appellant engaged in […]

CA Rachit Agarwal wrote a new post, Invoice value be the open market value for supply between distinct persons. 4 years, 9 months ago

Case covered:

Specsmakers Opticians Pvt Ltd.

Facts of the case:

1. The applicant has stated that they import as well as locally procure Lenses, Frames, Sun Glasses, Contact Lenses as well as Reading […]

CA Rachit Agarwal wrote a new post, Tax Liability on Issue of Gift Vouchers. 4 years, 9 months ago

Case covered:

Kalyan Jewellers India Ltd

Issue Involved:

Tax Liability on Issue of Gift Vouchers.

Applicant Contention:

1. KJIL, as part of sales promotion, introduced the facility of issuing different t […]

CA Rachit Agarwal wrote a new post, GST Applicability on the supply of Ancillary Services in relation to the supply of Electricity 4 years, 9 months ago

Case covered:

Southern Power Distribution Company of AP Ltd.

Facts of the case:

1. Applicant engaged in the distribution of electricity to consumers and also in the transmission of electricity from […]

CA Rachit Agarwal wrote a new post, Rule 36(4) of CGST Rules, 2017- Imposition of restriction on the availment of the Input Tax Credit- Practical Difficulties 4 years, 9 months ago

Rule 36(4) of CGST Rules, 2017

Rule 36(4) of CGST Rules, 2017 is inserted to curb ITC. The scam of ITC by many suppliers was the main reason behind it. But there are many practical issues related to it’s […]

CA Rachit Agarwal wrote a new post, Transfer of goods to Govt Depots will come under purview of Schedule I Tata coffee AAR 4 years, 10 months ago

In an application filed before AAR under GST, Kerala by TATA Coffee Ltd reported in 2020 (32) G.S.T.L 120. Applicant during the course of the plantation of coffee cuts down the excessive trees grown as shade […]

CA Rachit Agarwal wrote a new post, Discount to be added in value: Santosh Distributor AAR 4 years, 10 months ago

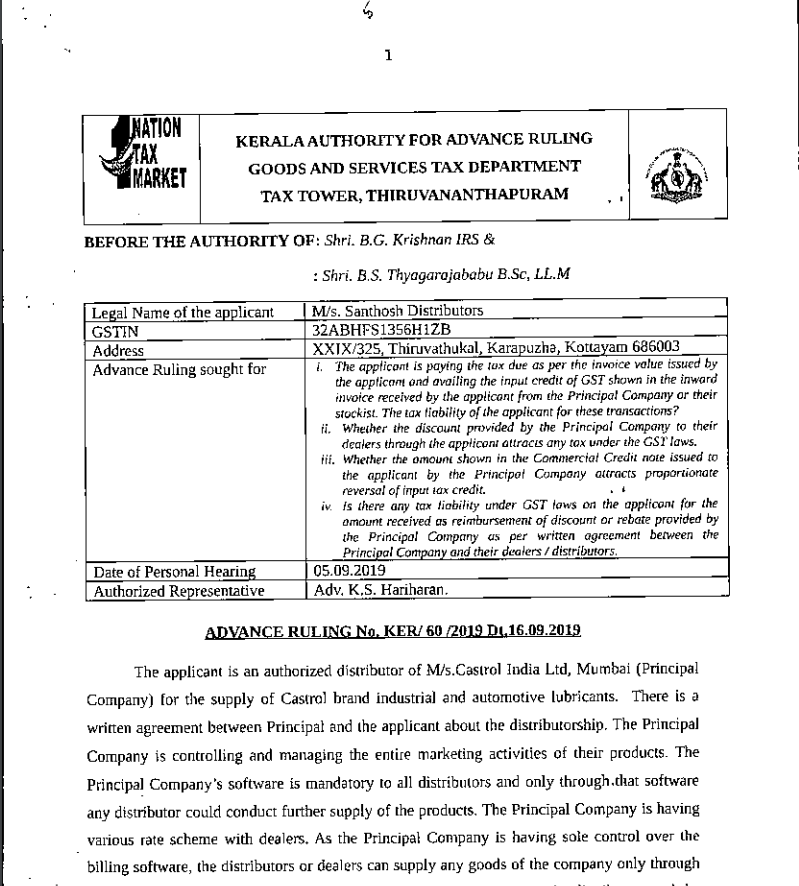

In an application filed before AAR under GST, Kerala by Santosh Distributor reported in 2020 (32) G.S.T.L 105:

Facts of the Case:

1. Applicant is authorized distributor of M/s Castrol India Ltd

2. Castrol […]

CA Rachit Agarwal wrote a new post, CERTIFICATE TO BE OBTAINED FOR CHARGING LOWER RATE 5 years ago

CERTIFICATE TO BE OBTAINED FOR CHARGING LOWER RATE

C.B.I. & C. Instruction F. No. 354/52/2018-TRU

Authenticated document to be relied upon by the developer to charge concessional rate of GST on CLSS […]

CA Rachit Agarwal wrote a new post, Right to transit ITC cant be taken away: Siddharth Enterprises vs Nodal Officer 5 years, 2 months ago

Introduction:

Brief Analysis of Writ Petition filed under Article 226 of the Constitution before High Court of Gujarat at Ahmedabad in case of Siddharth Enterprises vs Nodal Officer.

Purpose of Writ:

a. To […]

CA Rachit Agarwal wrote a new post, Input Tax Credit on Post-sale Discount 5 years, 2 months ago

Brief Analysis of order passed by Hon’ble Appellate Authority of Advance Ruling in respect of appeal filed by MRF Ltd against the order the AAR on the issue of Input Tax Credit on the consideration not paid by […]

CA Rachit Agarwal wrote a new post, Analysis of writ petition of Safari retreats 5 years, 6 months ago

Prayer Sought in Writ Petition of Safari retreats

1) An application for a declaration to the effect that Section 17(5)(d) of the Central Tax Goods & Service Tax Act, 2017 as well as of the Odisha GST Act, […]

CA Rachit Agarwal wrote a new post, ANALYSIS OF ELIGIBILITY OF INPUT TAX CREDIT ON CAPITAL GOODS 5 years, 7 months ago

ANALYSIS OF ELIGIBILITY OF INPUT TAX CREDIT ON CAPITAL GOODS:

As per Section 2(119) of the CGST Act,

“Works Contract” means a contract of building, construction, fabrication, completion, erection, ins […]