After completing graduation in Commerce in 1975 from Hisar (Haryana), I completed my articles from M/s. S. Prasad & Co., Chartered Accountants, Delhi, and passed CA in the year 1980. Since then I have

been in whole-time practice under the name of M/s. Rajiv Jain & Co., and worked as a partner in M/s. K.C.Gupta & Co. from 2008 to 2020. During my tenure in practice, I have excelled in the fields of Direct

and Indirect Taxes, Company Law matters, Company and Tax Audits, including an appearance in ITAT and Service Tax Appellate Tribunal. Gradually I have concentrated on Direct Tax, Sales Tax/VAT and

Service Tax matters. I regularly prepare articles and updates on direct tax, VAT/CST, and Service Tax GST matters, which are being shared among fellow professionals through emails and mobile for sharing

knowledge in view of the continued education programme of ICAI. The object of my involvement in such activities is to share my personal experience relating to human behavior and personality development,

professional experience, and the little knowledge about tax laws, especially with young entrants in practice.

1. Attended Seminar of East Delhi CA CPE Study Circle of NIRC of ICAI on 31.5.2010 as a guest speaker and delivered a lecture on ‘various issued on preparing and filing Income Tax returns for A.Y. 2010-11.

2. Attended Seminar of East Delhi CA CPE Study Circle of NIRC of ICAI on 30.6.2011 as a guest speaker and delivered a lecture on ‘Recent issues in Income Tax Act, 1961 and Capital gains with special reference to Section 54 and 54F “and“ Recent issues in Value Added Tax”.

3. Adjudged and awarded the “Upcoming Speaker of NIRC” award in the year 2013.

4. Attended Seminar of East Delhi CA CPE Study Circle of NIRC of ICAI on 17.4.2013 as a guest speaker and delivered lecture on “Recent amendments in DVAT Act and DVAT Rules”.

5. Attended workshop of NIRC on Indirect Taxes and deliberated as guest speaker 18.4.2013 on “Recent amendments in DVAT Act and DVAT Rules”.

6. Attended Seminar of East End CA CPE Study Circle of NIRC of ICAI on 8.6.2013 as guest speaker and delivered a lecture on “Recent amendments in DVAT Act and DVAT Rules”.

7. Attended Seminar of East Delhi CA CPE Study Circle of NIRC of ICAI on 22.6.2013 as guest speaker and delivered a lecture on “Detailed discussion on DVAT and CST provisions with regard to ADVT Audit Report”.

8. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 7.11.2013 as guest speaker and delivered four hrs. lecture on “ DVAT Audit in Form AR-1”.

9. Attended Seminar of North Campus CPE Study Circle of NIRC of ICAI on 20.11.2013 as guest speaker and delivered a lecture on “ DVAT Audit in Form AR-1”.

10. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 21.11.2013 as guest speaker and delivered a lecture on “ DVAT Audit in Form AR-1”.

11. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 25.8.2014 as guest speaker and delivered a lecture on “ Income Tax Audit u/s 44AB with particular reference to new Forms Audit Report”.

12. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 17.10.2014 as guest speaker and delivered a lecture on “ Income Tax Audit u/s 44AB with particular reference to new Forms Audit Report”.

13. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 31.1.2015 as a guest speaker and delivered a lecture on “ CST Form -9 with particular reference to the filling of form and practical aspects”.

14. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 21.2.2015 as a guest speaker and delivered a lecture on “ CST Form No. - 9, DVAT Form No. DP-1 and Recent Circulars on Income Tax”.

15. Attended Seminar of East Delhi CPE Study Circle of NIRC of ICAI on 13.6.2015 as a guest speaker and delivered a lecture on “ Provisions of Finance (No. 2) Act, 2014 and Finance Act 2015 relevant for AY 2015-16 and FY 2016-17”

16. Attended Seminar of East End CPE Study Circle of NIRC of ICAI and CA. Nitin Kanwar & International Tax C.A. Group on 24.6.2015 as guest speaker and delivered lecture on Provisions of Finance (No. 2) Act, 2014 and Finance Act 2015 relevant for AY 2015-16 and FY 2016-17”

17. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 25.7.2015 as guest speaker and delivered lecture on “ DVAT – Latest Developments – DVAT (2nd Amendment Act), 2015

18. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 28.11.2015 as guest speaker and delivered lecture on “ DVAT – Latest Developments.

19. Attended Seminar of Tri Nagar Keshav Puram CPE Study Circle of NIRC of ICAI on 2.12.2015 as guest speaker and delivered lecture on “ DVAT – Latest Developments”.

20. Awarded for “Commendable Contribution in the activities of profession” by NIRC in the year 2015 on 20.2.2016.

21. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 30.4.2016 as guest speaker and delivered lecture on “ Recent issues on DVAT “ with special reference to returns under DVAT and CST Acts.

22. Attended Seminar of East Delhi CPE Study Circle of NIRC of ICAI on 14.5.2016 as guest speaker and delivered lecture on “ DVAT” and “ICDS”

23. Attended Seminar of Tri Nagar Keshav Puram CPE Study Circle of NIRC of ICAI on 4.6.2016 as guest speaker and delivered lecture on “ TDS/TCS & Advance Tax Amendments in Finance Act,, 2016 with special reference to section 206C as amended by the Finance Act, 2016”.

24. Attended Seminar of Patparganj CPE Study Circle of NIRC of ICAI on 11.6.2016 as guest speaker and delivered lecture on “ TDS/TCS & Advance Tax Amendments in Finance Act,, 2016 with special reference to section 206C as amended by the Finance Act, 2016”.

25. Attended Seminar of East End CPE Study Circle of NIRC of ICAI on 16.6.2016 as guest speaker and delivered lecture on “ Provisions of Section 206C as amended by the Finance Act, 2016”.

26. Attended “workshop on TDS and TCS” organized by NIRC of ICAI on 22.6.2016 as guest speaker and delivered lecture on “ Provisions of Section 206C as amended by the Finance Act, 2016”.

27. Attended Seminar of North Ex Study Circle of NIRC of ICAI on 28.6.2016 as guest speaker and delivered lecture on “Overview of ICDS”.

28. Attended Seminar of North Ex Study Circle of NIRC of ICAI on 29.11.2016 as guest speaker and delivered lecture.

29. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 24.12.2016 as guest speaker and delivered lecture on “Demonetization, 2016” with special reference to “Taxation Law (2nd Amendment) Act, 2016.

30. Recently I have been appointed as “special invitee” in Direct Tax Committee (DTC) of ICAI for the year 2019-20.

31. Attended Seminar of North Ex Study Circle of NIRC of ICAI on 16.9.2019 as a guest speaker and delivered lecture on Tax Audit with a new perspective.

32. I have been reappointed as “special invitee” in the Direct Tax Committee (DTC) of ICAI for the year 2020-21.

33. During the Covid-19 pandemic lockdown period delivered a lecture as a guest speaker in Webinar on 9.4.2020 on Interpretation of Relief Ordinance, 2020 dated 31.3.2020.

34. During the Covid-19 pandemic lockdown period delivered a lecture as a guest speaker in Webinar on 15.9.2020 on Tax Audit and Presumption Taxation under Income Tax Act, 196 for East Delhi Study Circle.

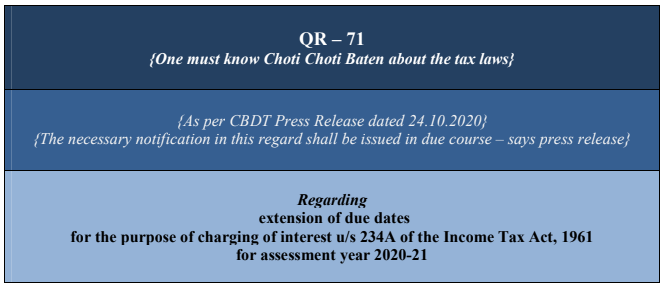

QR – 71 234A Interest for Extended ITRs

{As per CBDT Press Release dated 24.10.2020}

{The necessary notification in this regard shall be issued in due course – says press release}

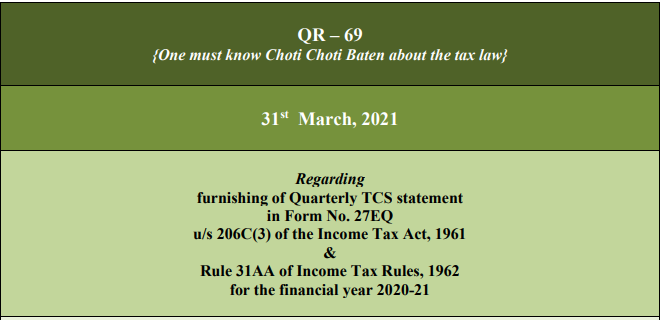

Regarding furnishing of Quarterly TCS statement in Form No. 27EQ u/s 206C(3) of the Income Tax Act, 1961 & Rule 31AA of Income Tax Rules, 1962 for the financial year 2020-21

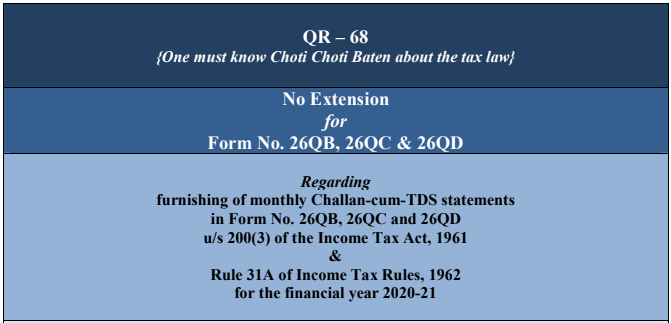

QR – 68 No Extension for Form No. 26QB, 26QC & 26QD

Regarding furnishing of monthly Challan-cum-TDS statements in Form No. 26QB, 26QC and 26QD u/s 200(3) of the Income Tax Act, 1961 & Rule 31A of Income Tax R […]

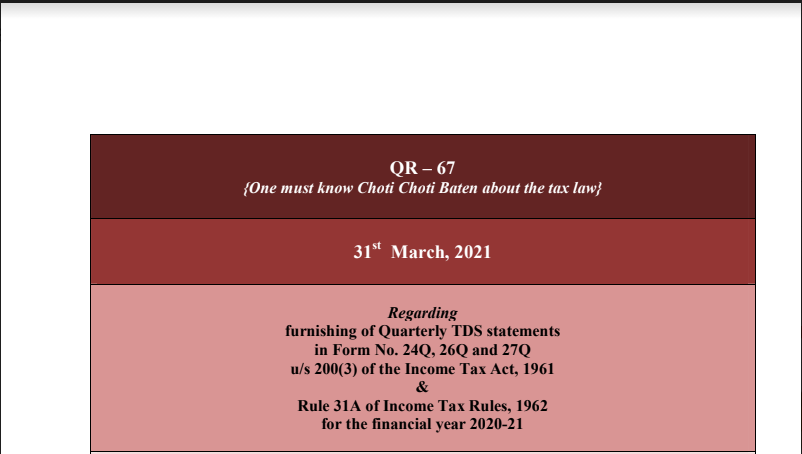

QR – 67 {One must know Choti Choti Baten about the tax law}

Regarding furnishing of Quarterly TDS statements in Form No. 24Q, 26Q and 27Q u/s 200(3) of the Income Tax Act, 1961 & Rule 31A of Income Tax Rules, 1 […]

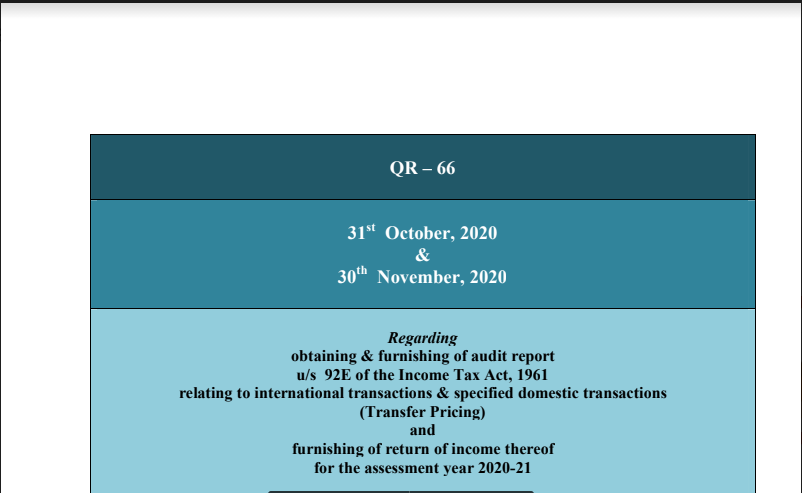

Regarding obtaining & furnishing of the audit report u/s 92E of the Income Tax Act, 1961 relating to international transactions & specified domestic transactions (Transfer Pricing) and furnishing of return of […]

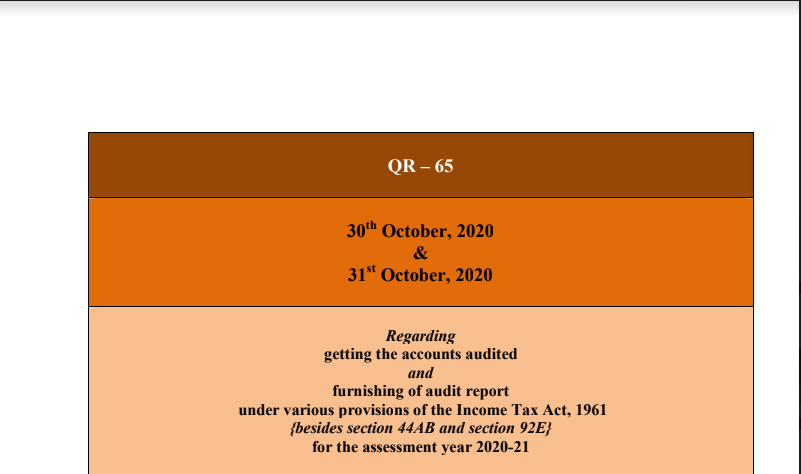

Regarding getting the accounts audited and furnishing of the audit report under various provisions of the Income Tax Act, 1961 {besides section 44AB and section 92E}

CA Rajiv Kumar Jain

@ca-rajiv-kumar-jain

Not recently activeCA Rajiv Kumar Jain

After completing graduation in Commerce in 1975 from Hisar (Haryana), I completed my articles from M/s. S. Prasad & Co., Chartered Accountants, Delhi, and passed CA in the year 1980. Since then I have been in whole-time practice under the name of M/s. Rajiv Jain & Co., and worked as a partner in M/s. K.C.Gupta & Co. from 2008 to 2020. During my tenure in practice, I have excelled in the fields of Direct and Indirect Taxes, Company Law matters, Company and Tax Audits, including an appearance in ITAT and Service Tax Appellate Tribunal. Gradually I have concentrated on Direct Tax, Sales Tax/VAT and Service Tax matters. I regularly prepare articles and updates on direct tax, VAT/CST, and Service Tax GST matters, which are being shared among fellow professionals through emails and mobile for sharing knowledge in view of the continued education programme of ICAI. The object of my involvement in such activities is to share my personal experience relating to human behavior and personality development, professional experience, and the little knowledge about tax laws, especially with young entrants in practice. 1. Attended Seminar of East Delhi CA CPE Study Circle of NIRC of ICAI on 31.5.2010 as a guest speaker and delivered a lecture on ‘various issued on preparing and filing Income Tax returns for A.Y. 2010-11. 2. Attended Seminar of East Delhi CA CPE Study Circle of NIRC of ICAI on 30.6.2011 as a guest speaker and delivered a lecture on ‘Recent issues in Income Tax Act, 1961 and Capital gains with special reference to Section 54 and 54F “and“ Recent issues in Value Added Tax”. 3. Adjudged and awarded the “Upcoming Speaker of NIRC” award in the year 2013. 4. Attended Seminar of East Delhi CA CPE Study Circle of NIRC of ICAI on 17.4.2013 as a guest speaker and delivered lecture on “Recent amendments in DVAT Act and DVAT Rules”. 5. Attended workshop of NIRC on Indirect Taxes and deliberated as guest speaker 18.4.2013 on “Recent amendments in DVAT Act and DVAT Rules”. 6. Attended Seminar of East End CA CPE Study Circle of NIRC of ICAI on 8.6.2013 as guest speaker and delivered a lecture on “Recent amendments in DVAT Act and DVAT Rules”. 7. Attended Seminar of East Delhi CA CPE Study Circle of NIRC of ICAI on 22.6.2013 as guest speaker and delivered a lecture on “Detailed discussion on DVAT and CST provisions with regard to ADVT Audit Report”. 8. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 7.11.2013 as guest speaker and delivered four hrs. lecture on “ DVAT Audit in Form AR-1”. 9. Attended Seminar of North Campus CPE Study Circle of NIRC of ICAI on 20.11.2013 as guest speaker and delivered a lecture on “ DVAT Audit in Form AR-1”. 10. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 21.11.2013 as guest speaker and delivered a lecture on “ DVAT Audit in Form AR-1”. 11. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 25.8.2014 as guest speaker and delivered a lecture on “ Income Tax Audit u/s 44AB with particular reference to new Forms Audit Report”. 12. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 17.10.2014 as guest speaker and delivered a lecture on “ Income Tax Audit u/s 44AB with particular reference to new Forms Audit Report”. 13. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 31.1.2015 as a guest speaker and delivered a lecture on “ CST Form -9 with particular reference to the filling of form and practical aspects”. 14. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 21.2.2015 as a guest speaker and delivered a lecture on “ CST Form No. - 9, DVAT Form No. DP-1 and Recent Circulars on Income Tax”. 15. Attended Seminar of East Delhi CPE Study Circle of NIRC of ICAI on 13.6.2015 as a guest speaker and delivered a lecture on “ Provisions of Finance (No. 2) Act, 2014 and Finance Act 2015 relevant for AY 2015-16 and FY 2016-17” 16. Attended Seminar of East End CPE Study Circle of NIRC of ICAI and CA. Nitin Kanwar & International Tax C.A. Group on 24.6.2015 as guest speaker and delivered lecture on Provisions of Finance (No. 2) Act, 2014 and Finance Act 2015 relevant for AY 2015-16 and FY 2016-17” 17. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 25.7.2015 as guest speaker and delivered lecture on “ DVAT – Latest Developments – DVAT (2nd Amendment Act), 2015 18. Attended Seminar of Shastri Nagar CPE Study Circle of NIRC of ICAI on 28.11.2015 as guest speaker and delivered lecture on “ DVAT – Latest Developments. 19. Attended Seminar of Tri Nagar Keshav Puram CPE Study Circle of NIRC of ICAI on 2.12.2015 as guest speaker and delivered lecture on “ DVAT – Latest Developments”. 20. Awarded for “Commendable Contribution in the activities of profession” by NIRC in the year 2015 on 20.2.2016. 21. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 30.4.2016 as guest speaker and delivered lecture on “ Recent issues on DVAT “ with special reference to returns under DVAT and CST Acts. 22. Attended Seminar of East Delhi CPE Study Circle of NIRC of ICAI on 14.5.2016 as guest speaker and delivered lecture on “ DVAT” and “ICDS” 23. Attended Seminar of Tri Nagar Keshav Puram CPE Study Circle of NIRC of ICAI on 4.6.2016 as guest speaker and delivered lecture on “ TDS/TCS & Advance Tax Amendments in Finance Act,, 2016 with special reference to section 206C as amended by the Finance Act, 2016”. 24. Attended Seminar of Patparganj CPE Study Circle of NIRC of ICAI on 11.6.2016 as guest speaker and delivered lecture on “ TDS/TCS & Advance Tax Amendments in Finance Act,, 2016 with special reference to section 206C as amended by the Finance Act, 2016”. 25. Attended Seminar of East End CPE Study Circle of NIRC of ICAI on 16.6.2016 as guest speaker and delivered lecture on “ Provisions of Section 206C as amended by the Finance Act, 2016”. 26. Attended “workshop on TDS and TCS” organized by NIRC of ICAI on 22.6.2016 as guest speaker and delivered lecture on “ Provisions of Section 206C as amended by the Finance Act, 2016”. 27. Attended Seminar of North Ex Study Circle of NIRC of ICAI on 28.6.2016 as guest speaker and delivered lecture on “Overview of ICDS”. 28. Attended Seminar of North Ex Study Circle of NIRC of ICAI on 29.11.2016 as guest speaker and delivered lecture. 29. Attended Seminar of Laxmi Nagar CPE Study Circle of NIRC of ICAI on 24.12.2016 as guest speaker and delivered lecture on “Demonetization, 2016” with special reference to “Taxation Law (2nd Amendment) Act, 2016. 30. Recently I have been appointed as “special invitee” in Direct Tax Committee (DTC) of ICAI for the year 2019-20. 31. Attended Seminar of North Ex Study Circle of NIRC of ICAI on 16.9.2019 as a guest speaker and delivered lecture on Tax Audit with a new perspective. 32. I have been reappointed as “special invitee” in the Direct Tax Committee (DTC) of ICAI for the year 2020-21. 33. During the Covid-19 pandemic lockdown period delivered a lecture as a guest speaker in Webinar on 9.4.2020 on Interpretation of Relief Ordinance, 2020 dated 31.3.2020. 34. During the Covid-19 pandemic lockdown period delivered a lecture as a guest speaker in Webinar on 15.9.2020 on Tax Audit and Presumption Taxation under Income Tax Act, 196 for East Delhi Study Circle.

OOPS!

No Packages Added by CA Rajiv Kumar Jain. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

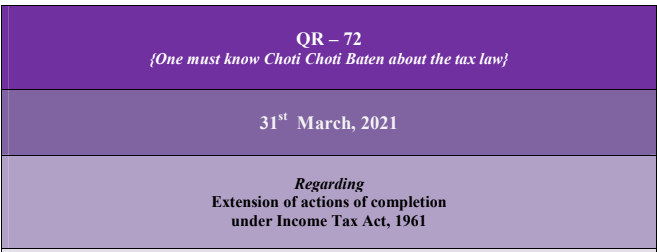

Read InterviewCA Rajiv Kumar Jain wrote a new post, QR – 72 Extension of Actions of Completion 5 years, 2 months ago

QR – 72 Extension of Actions of Completion

Regarding Extension of actions of completion under the Income Tax Act, 1961

1. The Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 dated 3 […]

CA Rajiv Kumar Jain wrote a new post, QR – 71 234A Interest for Extended ITRs 5 years, 2 months ago

QR – 71 234A Interest for Extended ITRs

{As per CBDT Press Release dated 24.10.2020}

{The necessary notification in this regard shall be issued in due course – says press release}

Regarding extension of due […]

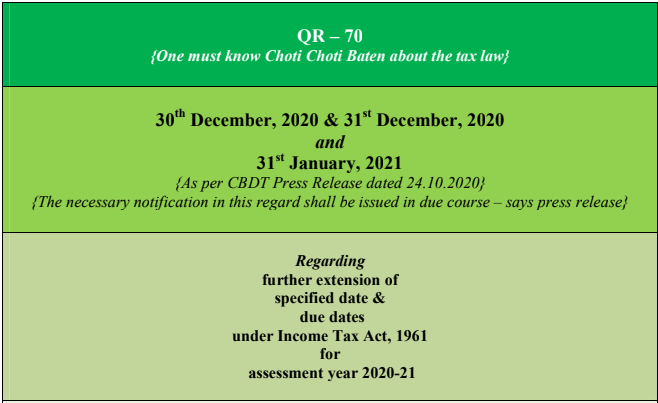

CA Rajiv Kumar Jain wrote a new post, QR – 70 ITR & Audit Further Extension 5 years, 3 months ago

QR – 70 ITR & Audit Further Extension

30th December 2020 & 31st December 2020 and 31st January 2021

{As per CBDT Press Release dated 24.10.2020}

{The necessary notification in this regard shall be issued i […]

CA Rajiv Kumar Jain wrote a new post, QR – 69 furnishing of Quarterly TCS statement 5 years, 3 months ago

Regarding furnishing of Quarterly TCS statement in Form No. 27EQ u/s 206C(3) of the Income Tax Act, 1961 & Rule 31AA of Income Tax Rules, 1962 for the financial year 2020-21

1. Section 206C(3) of the Income Tax […]

CA Rajiv Kumar Jain wrote a new post, QR – 68 No Extension for Form No. 26QB, 26QC & 26QD 5 years, 3 months ago

QR – 68 No Extension for Form No. 26QB, 26QC & 26QD

Regarding furnishing of monthly Challan-cum-TDS statements in Form No. 26QB, 26QC and 26QD u/s 200(3) of the Income Tax Act, 1961 & Rule 31A of Income Tax R […]

CA Rajiv Kumar Jain wrote a new post, QR – 67 Furnishing of Quarterly TDS Statements 5 years, 3 months ago

QR – 67 {One must know Choti Choti Baten about the tax law}

Regarding furnishing of Quarterly TDS statements in Form No. 24Q, 26Q and 27Q u/s 200(3) of the Income Tax Act, 1961 & Rule 31A of Income Tax Rules, 1 […]

CA Rajiv Kumar Jain wrote a new post, QR – 66 Obtaining & Furnishing of Audit Report 5 years, 3 months ago

Regarding obtaining & furnishing of the audit report u/s 92E of the Income Tax Act, 1961 relating to international transactions & specified domestic transactions (Transfer Pricing) and furnishing of return of […]

CA Rajiv Kumar Jain wrote a new post, QR – 65 Getting The Accounts Audited And Furnishing Of The Audit Report 5 years, 3 months ago

Regarding getting the accounts audited and furnishing of the audit report under various provisions of the Income Tax Act, 1961 {besides section 44AB and section 92E}

for the assessment year 2020-21

1. As […]