Order Now $14,550 (2)

-

4 Logo Drafts, Icon based, modern

312 Sold

-

30 Minutes Call with me

12 Sold

-

Monthly Fee

21 Sold

-

1 year shared hosting

ConsultEase.com Interviewed.

Read Interview-

CA Ranjan Mehta wrote a new post, New TDS Provisions 4 years ago

New TDS Provisions introduces w.e.f 1st July 2021

New Section 194Q – Deduction of tax at source on payment of a certain sum for the purchase of goods, was proposed to be inserted in Budget 2021.The same has […]

-

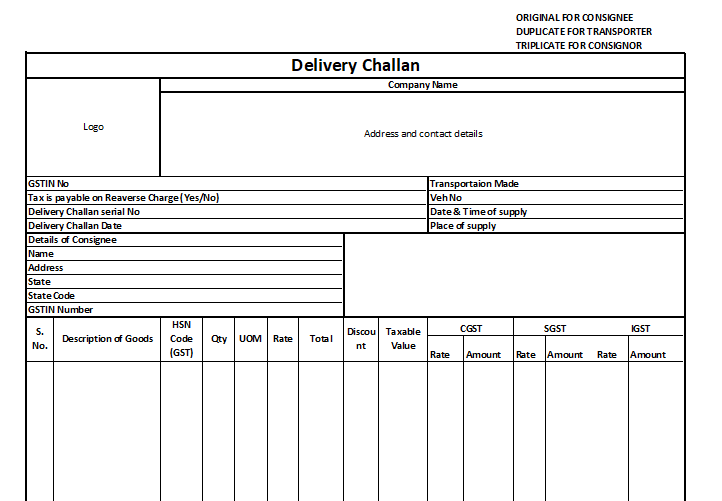

CA Ranjan Mehta wrote a new post, Important Changes in GST w.e.f. 01-10-2019 5 years, 9 months ago

Important Changes in GST w.e.f. 01-10-2019

Reverse ChargeRenting of Motor Vehicle

Services provided by way of renting of motor vehicle by any Individual/Firm/LLP to any Body corporate (companies), covered […] -

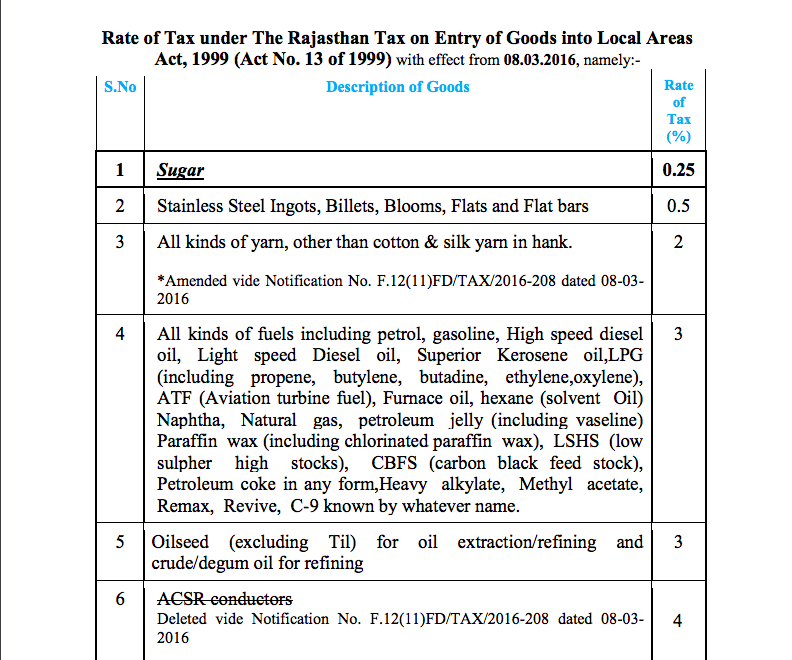

CA Ranjan Mehta wrote a new post, Entry Tax on Import of Goods – What you should know? 6 years, 3 months ago

Entry Tax on Import of Goods – What you should know?

The Govts have started flooding the dealers with series notices over Entry Tax on Import of goods, where goods were brought into the states from out of In […] -

CA Ranjan Mehta wrote a new post, Entry Tax on Import of Goods 6 years, 3 months ago

Entry Tax on Import of Goods – What you should know?

Have you also received a notice for entry tax on import of goods?The Govts have started flooding the dealers with series notices over Entry Tax liability w […]

-

CA Ranjan Mehta wrote a new post, Advisory related to decisions taken in the recent meeting of GST Council 6 years, 6 months ago

Advisory related to decisions taken in the recent meeting of GST Council

Recently GST Council held its 31st meeting on 22nd December 2018. These are recommendations made by them which will be getting affected as […] -

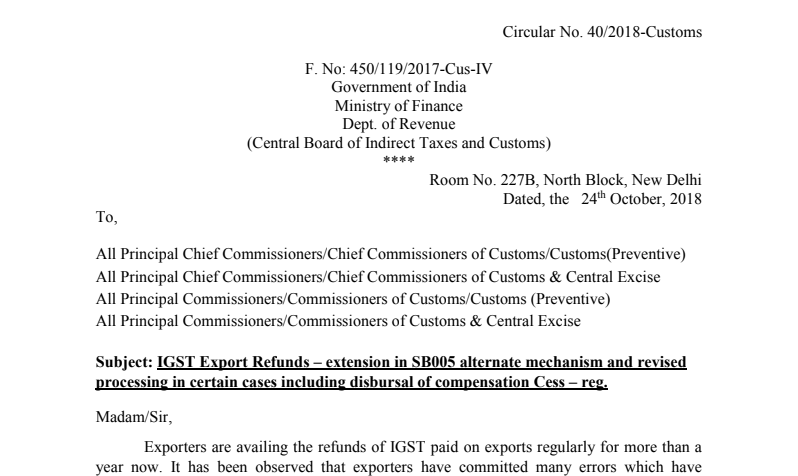

CA Ranjan Mehta wrote a new post, Advisory in relation to Invoicing related to Exports on payment of IGST 6 years, 8 months ago

Advisory in relation to Invoicing related to Exports on payment of IGST

Since the inception of GST, Exports on payment of IGST has been a relief for the exporters who wanted to avail the refunds of their […]

-

CA Ranjan Mehta wrote a new post, Exemptions related to E way Bill 6 years, 11 months ago

Exemptions related to E way Bill

There is some Exemptions related to E way Bill is issued by the Rajasthan government through the Notification issued on 6 August 2018. So, Let us have a Look on the Exemptions r […]

-

CA Ranjan Mehta wrote a new post, Advisory note for GST Compliance to check before finalization of Books 6 years, 12 months ago

Advisory note for GST Compliance to check before finalization of Books

1. Reconcile your GST Input Tax Credit Claimed with Online GSTR -2A. If the credit claimed does not match with credit available online. GSTR […] -

CA Ranjan Mehta wrote a new post, Advisory for GST before finalising the BOA for IT 7 years, 1 month ago

Advisory for GST before finalising the BOA for IT purpose

Financial Year 2017-18 has ended on 31.03.2018 and we are all on the verge of finalising Books of Accounts for that period. Before finalisation of Books […] -

CA Ranjan Mehta wrote a new post, Intra State E-way bill in the state of Rajasthan 7 years, 2 months ago

Intra State E-way bill in the state of Rajasthan

Intra State E-way bills are going in the state of Rajasthan to be applicable w.e.f. 20.05.2018. Here is a brief advisory on that matter:-

1. E-way bill is to be […] -

CA Ranjan Mehta wrote a new post, E Way bill – How to issue and When to issue 7 years, 5 months ago

E Way bill – How to issue and When to issue

The eway bill provisions have been notified in whole country w.e.f. 01.02.2018. Right now these provisions are applicable on Inter-state transactions only. However a f […]

CA Ranjan Mehta

@ca-ranjan-mehta

active 5 years, 10 months ago