GST Appellate Tribunal

The Council adopted the report of the Group of Ministers with certain modifications. The final draft amendments to the GST laws shall be circulated to Members for their comments. The […]

Union budget was presented by the Finance minister. Although we dont expect a lot of changes in GST. But some important amendments are incorporated into GST by FM via FB 2023. Here we have compiled the clausewise […]

Introduction

Most commonly, in contracts of leasing a building or apartment, the property owner collects rent from the tenant along with the reimbursement of electricity charges on an actual basis. In most such […]

ITC is not to be availed if it is in the restricted category of GSTR-2B 2

Reference to Section 43A removed from the conditions for availment of ITC 2

Extension of the due date of availment of ITC to 30th […]

Following is our analysis of the recommendations made in the 43rd GST Council meeting:

Reduced late fees for taxpayers filing GSTR-3B between 1st June 2021 -31st August 2021

➢ Late Fees for GSTR-3Bof the tax p […]

Sectionwise Analysis – GST Amendments (Finance Bill 2021)

1. Transaction between a person (other than an individual) to its members for consideration to be treated as a supply

Source

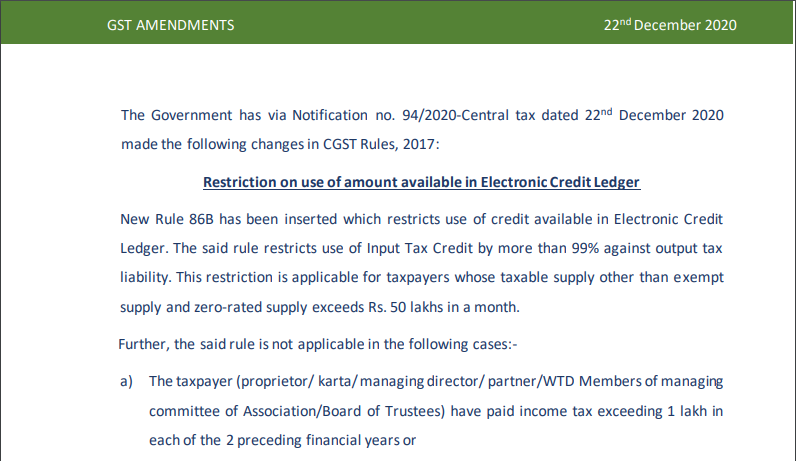

GST Amendments Notified on 22.12.2020

The Government has via Notification no. 94/2020-Central tax dated 22nd December 2020 made the following changes in CGST Rules, 2017:

Restriction on use of amount available […]

Interest on Net Tax Liability – Prospective or Retrospective?

Interest provisions and Brief History

➢ Interest is on failure to pay the tax within the prescribed period

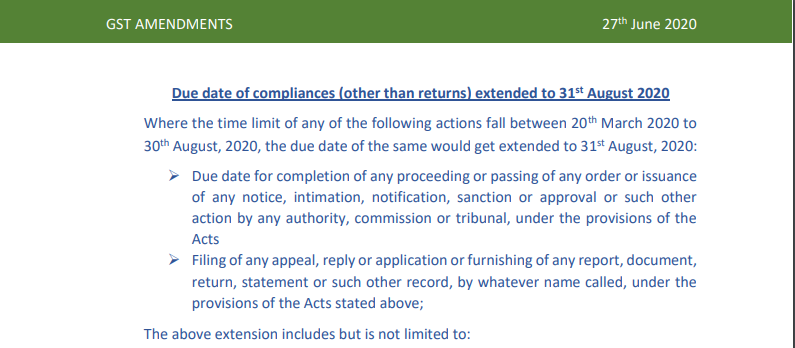

Due date of compliances (other than returns) extended to 31 st August 2020

Where the time limit of any of the following actions falls between 20th March 2020 to 30th August 2020, the due date of the same would […]

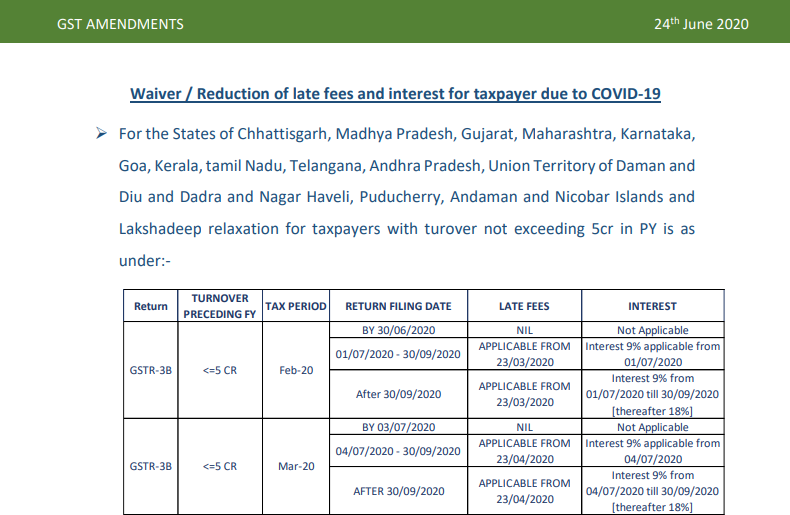

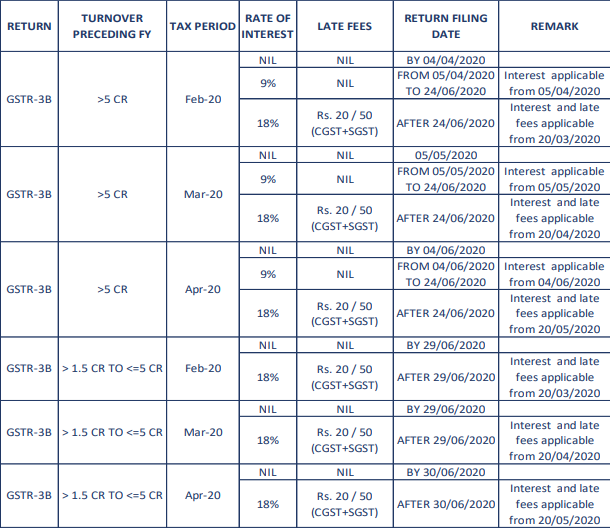

Waiver / Reduction of late fees and interest for taxpayer due to COVID-19

For the States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, […]

All About Interest In GST – Past, Present, and Future Outlook

History of Interest under GST

When the GST got introduced from 1st July 2017, quite a number of registered persons were struggling to come to terms […]

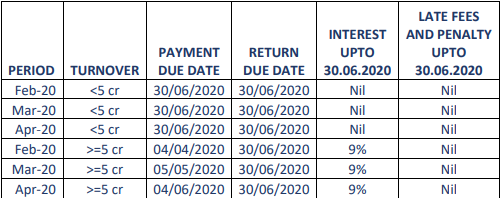

Waiver of Interest and Late fees for GSTR-3B and GSTR-1

Illustration: Calculation of interest and late fees for delayed filing of return for the month of March 2020 (due date of filing being 20.04.2020) may […]

Everything that’s wrong with the refund circular no. 135

Quite a few restrictions have been imposed regarding the refund of taxes through Circular no. 135/05/2020-GST dated 31st March 2020. There are quite a few […]

Following are the proposed GST related relaxations announced by the Finance Minister due to COVID-19 outbreak:

Extension of time limit for filing GSTR-3B

Extension of time limit for filing GSTR-1

There shall […]

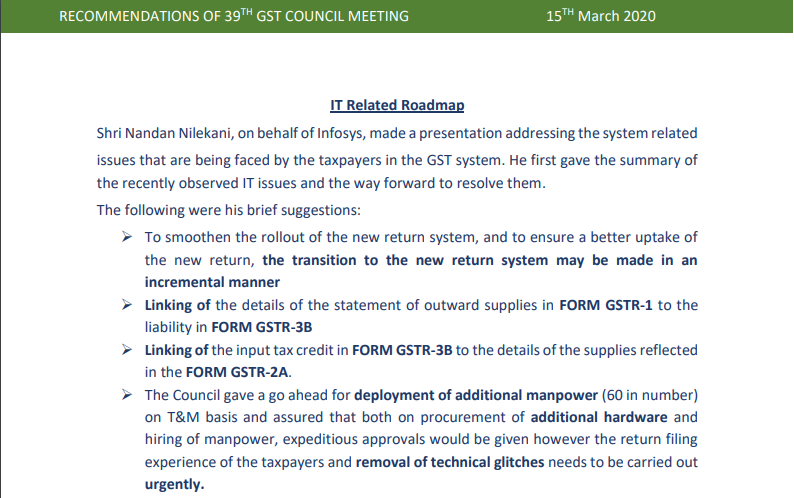

IT Related Roadmap

Shri Nandan Nilekani, on behalf of Infosys, made a presentation addressing the system related issues that are being faced by the taxpayers in the GST system. He first gave a summary of the […]

GST AMENDMENTS – HIGHLIGHTS AT A GLANCE

1. Union Territory to include ‘Ladakh’ & ‘Dadra and Nagar Haveli and Daman and Diu’

Source

Clause 116 of the Finance Bill,2020.

Clause 135 of the Finance Bill, 202 […]

Changes in Job Work rates –

Differently Decoded Effective from 1st October 2019 vide Notification no.20/2019-Central Tax (rate) dated 30th September 2019, a few entries have been inserted/amended with regard to j […]

The 37th GST council meeting which was held on 20.09.2019 made the following recommendations:

LAW & PROCEDURE RECOMMENDATIONS Annual Return related […]

Shubham Khaitan

@ca-shubham-khaitan

active 5 years, 6 months agoShubham Khaitan

Registered Categories

Location

Kolkata, India

OOPS!

No Packages Added by Shubham Khaitan. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewShubham Khaitan wrote a new post, Analysis of the Recommendations of the 49th GST Council Meeting 3 years ago

GST Appellate Tribunal

The Council adopted the report of the Group of Ministers with certain modifications. The final draft amendments to the GST laws shall be circulated to Members for their comments. The […]

Shubham Khaitan wrote a new post, Changes in GST via FB 2023 – Clausewise PDF 3 years ago

Union budget was presented by the Finance minister. Although we dont expect a lot of changes in GST. But some important amendments are incorporated into GST by FM via FB 2023. Here we have compiled the clausewise […]

Shubham Khaitan wrote a new post, GST on reimbursement of electricity charges 3 years, 2 months ago

Introduction

Most commonly, in contracts of leasing a building or apartment, the property owner collects rent from the tenant along with the reimbursement of electricity charges on an actual basis. In most such […]

Shubham Khaitan wrote a new post, Section-Wise Gst Analysis Finance Act 2022 3 years, 4 months ago

ITC is not to be availed if it is in the restricted category of GSTR-2B 2

Reference to Section 43A removed from the conditions for availment of ITC 2

Extension of the due date of availment of ITC to 30th […]

Shubham Khaitan wrote a new post, 43rd GST Council Meeting Recommendations 4 years, 8 months ago

Following is our analysis of the recommendations made in the 43rd GST Council meeting:

Reduced late fees for taxpayers filing GSTR-3B between 1st June 2021 -31st August 2021

➢ Late Fees for GSTR-3Bof the tax p […]

Shubham Khaitan wrote a new post, Waiver of Interest and Late fees for taxpayers 4 years, 9 months ago

Taxpayers having turnover exceeding 5 Crore:

Period

Return

Due Date

Late Fees

Return Filing Date

Interest

Mar-21

GSTR3B

20/04/2021

NIL

By 05/05/2021

9% from 21/04/2021-05/05/2021

Rs. […]

Shubham Khaitan wrote a new post, Sectionwise Analysis – GST Amendments (Finance Bill 2021) 5 years ago

Sectionwise Analysis – GST Amendments (Finance Bill 2021)

1. Transaction between a person (other than an individual) to its members for consideration to be treated as a supply

Source

Clause 99 of the Finance […]

Shubham Khaitan wrote a new post, GST Amendments Notified on 22.12.2020 5 years, 1 month ago

GST Amendments Notified on 22.12.2020

The Government has via Notification no. 94/2020-Central tax dated 22nd December 2020 made the following changes in CGST Rules, 2017:

Restriction on use of amount available […]

Shubham Khaitan wrote a new post, Interest on Net Tax Liability – Prospective or Retrospective? 5 years, 5 months ago

Interest on Net Tax Liability – Prospective or Retrospective?

Interest provisions and Brief History

➢ Interest is on failure to pay the tax within the prescribed period

➢ Section 49 – payment may be through […]

Shubham Khaitan wrote a new post, GST Amendments Notified on 27.06.2020 5 years, 7 months ago

Due date of compliances (other than returns) extended to 31 st August 2020

Where the time limit of any of the following actions falls between 20th March 2020 to 30th August 2020, the due date of the same would […]

Shubham Khaitan wrote a new post, Waiver / Reduction of Late Fees and Interest for Taxpayer due to COVID-19 5 years, 7 months ago

Waiver / Reduction of late fees and interest for taxpayer due to COVID-19

For the States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, […]

Shubham Khaitan wrote a new post, All About Interest In GST – Past, Present, and Future Outlook 5 years, 10 months ago

All About Interest In GST – Past, Present, and Future Outlook

History of Interest under GST

When the GST got introduced from 1st July 2017, quite a number of registered persons were struggling to come to terms […]

Shubham Khaitan wrote a new post, GST notified amendments and relaxations provided as COVID-19 relief measure 5 years, 10 months ago

Waiver of Interest and Late fees for GSTR-3B and GSTR-1

Illustration: Calculation of interest and late fees for delayed filing of return for the month of March 2020 (due date of filing being 20.04.2020) may […]

Shubham Khaitan wrote a new post, Everything that’s wrong with the refund circular no. 135 5 years, 10 months ago

Everything that’s wrong with the refund circular no. 135

Quite a few restrictions have been imposed regarding the refund of taxes through Circular no. 135/05/2020-GST dated 31st March 2020. There are quite a few […]

Shubham Khaitan wrote a new post, Proposed GST related relaxations announced by the Finance Minister due to COVID-19 outbreak 5 years, 11 months ago

Following are the proposed GST related relaxations announced by the Finance Minister due to COVID-19 outbreak:

Extension of time limit for filing GSTR-3B

Extension of time limit for filing GSTR-1

There shall […]

Shubham Khaitan wrote a new post, RECOMMENDATIONS OF 39TH GST COUNCIL MEETING 5 years, 11 months ago

IT Related Roadmap

Shri Nandan Nilekani, on behalf of Infosys, made a presentation addressing the system related issues that are being faced by the taxpayers in the GST system. He first gave a summary of the […]

Shubham Khaitan wrote a new post, SECTIONWISE ANALYSIS – GST AMENDMENTS 6 years ago

GST AMENDMENTS – HIGHLIGHTS AT A GLANCE

1. Union Territory to include ‘Ladakh’ & ‘Dadra and Nagar Haveli and Daman and Diu’

Source

Clause 116 of the Finance Bill,2020.

Clause 135 of the Finance Bill, 202 […]

Shubham Khaitan wrote a new post, SECTIONWISE ANALYSIS – CUSTOMS AMENDMENTS 6 years ago

CUSTOMS AMENDMENTS – HIGHLIGHTS AT A GLANCE

1. Amendment in Section 11(2)(f) under Chapter IV of Custom Act 1962

Source

Clause 105 of the Finance Bill,2020.

Effective Date

Date to be notified by th […]

Shubham Khaitan wrote a new post, Changes in Job Work rates – Differently Decoded 6 years, 4 months ago

Changes in Job Work rates –

Differently Decoded Effective from 1st October 2019 vide Notification no.20/2019-Central Tax (rate) dated 30th September 2019, a few entries have been inserted/amended with regard to j […]

Shubham Khaitan wrote a new post, 37TH GST council meeting analysis 6 years, 5 months ago

37TH GST COUNCIL MEETING RECOMMENDATIONS:

The 37th GST council meeting which was held on 20.09.2019 made the following recommendations:

LAW & PROCEDURE RECOMMENDATIONS Annual Return related […]