A) Introduction of TDS on Purchase of Goods @ 0.1%

a. A new Section 194Q is introduced in Finance Bill 2021 requiring a person to deduct tax at source an amount equal to 0.10 percent for paying any sum to any […]

GST On Sale of Developed Plots–– Gujarat AAR Opens “A Big Pandora Box” for Indian Real Estate Industry

Recently the Gujarat AAR – GST in case of surprisingly has held that i.e. the sale of land/plot after develop […]

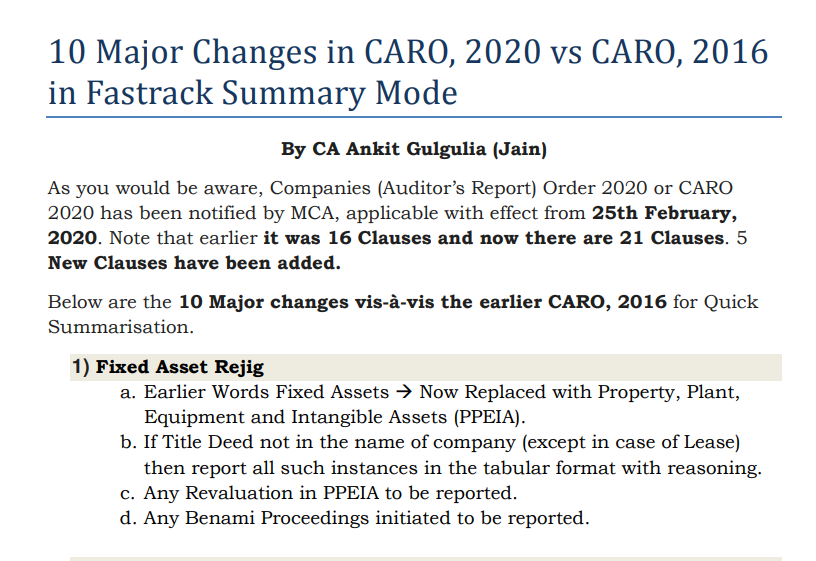

10 Major Changes in CARO, 2020 vs CARO, 2016 in Fastrack Summary Mode

As you would be aware, Companies (Auditor’s Report) Order 2020 or CARO 2020 has been notified by MCA, applicable with effect from 25th F […]

Citation:- Mega Cabs Pvt. Ltd. Versus Union of India & Ors. – 2016 (6) TMI 163 – DELHI HIGH COURT | No :- W.P.(C) 5192/2015 & CM No. 9417/2015 | Dated.- June 3rd, 2016

In the Delhi High Court Mega Cabs Pvt. Ltd. filed writ petition (C) No. 5192/2015 [[Mega Cab v UOI and Anr.] challenging the validity of Rule 5A(2) of the Service Tax Rules as substituted by Notification No. […]

The Digital Media Services has got costlier with the applicability of ‘Krishi Kalyan Cess’ and the ‘Equalisation Levy (EQL)’ or the ‘Google Tax’ from 1st June, 2016

a) Income Tax – Income-Tax (11th Amendment) Rules, 2016.

In the Income-Tax Rules, 1962, after rule 26B, there shall be inserted Rule 26C “Furnishing of evidence of claims by employee for deduction of tax und […]

CA Ankit Gulgulia

Chartered Account and Financial Services Provider

@caankitgulgulia

Not recently activeCA Ankit Gulgulia

Location

New Delhi, India

OOPS!

No Packages Added by CA Ankit Gulgulia. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Ankit Gulgulia wrote a new post, 3 Big Changes in TDS / TCS Provisions w.e.f 1st July, 2021 4 years, 7 months ago

A) Introduction of TDS on Purchase of Goods @ 0.1%

a. A new Section 194Q is introduced in Finance Bill 2021 requiring a person to deduct tax at source an amount equal to 0.10 percent for paying any sum to any […]

CA Ankit Gulgulia‘s profile was updated 5 years, 6 months ago

CA Ankit Gulgulia wrote a new post, GST On Sale of Developed Plots–– Gujarat AAR Opens “A Big Pandora Box” for Indian Real Estate Industry 5 years, 6 months ago

GST On Sale of Developed Plots–– Gujarat AAR Opens “A Big Pandora Box” for Indian Real Estate Industry

Recently the Gujarat AAR – GST in case of surprisingly has held that i.e. the sale of land/plot after develop […]

CA Ankit Gulgulia wrote a new post, 10 Major Changes in CARO, 2020 vs CARO, 2016 in Fastrack Summary Mode 5 years, 11 months ago

10 Major Changes in CARO, 2020 vs CARO, 2016 in Fastrack Summary Mode

As you would be aware, Companies (Auditor’s Report) Order 2020 or CARO 2020 has been notified by MCA, applicable with effect from 25th F […]

CA Ankit Gulgulia wrote a new post, Service Tax Audits by Department – A Detailed Legal & Chronological Analysis 9 years, 8 months ago

Citation:- Mega Cabs Pvt. Ltd. Versus Union of India & Ors. – 2016 (6) TMI 163 – DELHI HIGH COURT | No :- W.P.(C) 5192/2015 & CM No. 9417/2015 | Dated.- June 3rd, 2016

Major Issues to be Decided:-

a) […]

CA Ankit Gulgulia wrote a new post, Service Tax Department Cannot Conduct Audits of Assessees 9 years, 8 months ago

In the Delhi High Court Mega Cabs Pvt. Ltd. filed writ petition (C) No. 5192/2015 [[Mega Cab v UOI and Anr.] challenging the validity of Rule 5A(2) of the Service Tax Rules as substituted by Notification No. […]

CA Ankit Gulgulia wrote a new post, 6% Tax on Digital Advertising w.e.f 1st June, 2016 9 years, 8 months ago

The Digital Media Services has got costlier with the applicability of ‘Krishi Kalyan Cess’ and the ‘Equalisation Levy (EQL)’ or the ‘Google Tax’ from 1st June, 2016

The revenues of most foreign internet com […]

CA Ankit Gulgulia wrote a new post, Latest updates related to service tax, DVAT,Companies Law, Central Excise and income tax 9 years, 8 months ago

Service Tax – Seeks to amend Notification No. 25/2012- Service Tax dated 20.06.2012 (b) services by way of renting of immovable property.”.

(a) services specified in sub-clauses (i),(ii […]

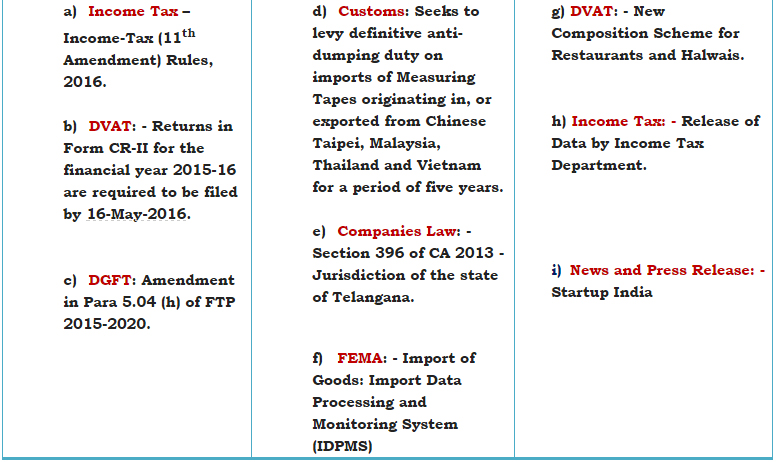

CA Ankit Gulgulia wrote a new post, Updates that Matter: Income Tax,DVAT, DGFT, Customs,Company’s Law 9 years, 9 months ago

a) Income Tax – Income-Tax (11th Amendment) Rules, 2016.

In the Income-Tax Rules, 1962, after rule 26B, there shall be inserted Rule 26C “Furnishing of evidence of claims by employee for deduction of tax und […]

CA Ankit Gulgulia wrote a new post, Updates that Matter (UTM – No. 37) for Income tax, Excise, Customs, GST, Service tax 9 years, 9 months ago

We are pleased to update you vide UTM’s (Key Update Alerts). Please find hereunder our “Updates that Matter

Service Tax: – Extension of time till 29-04-2016 for filing ST-3 Returns.

Due to dif […]

CA Ankit Gulgulia became a registered member 10 years, 8 months ago