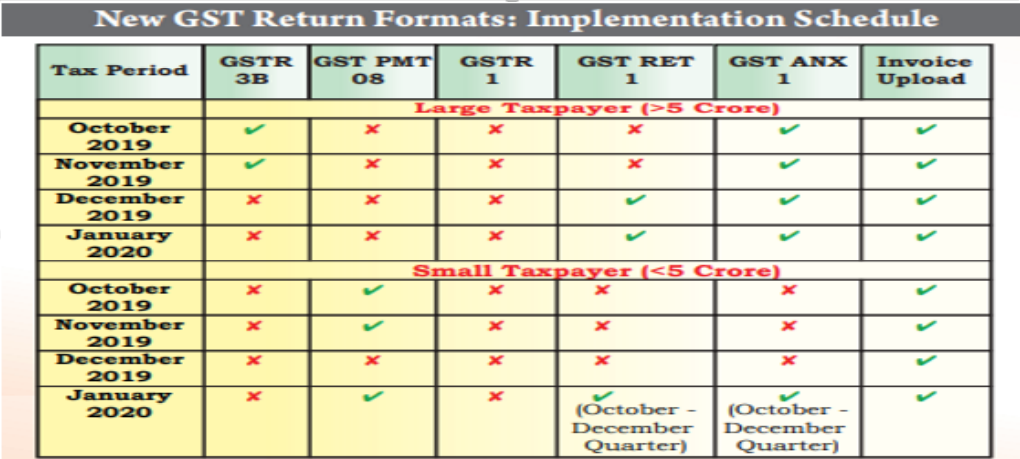

Introduction of New Returns Scheme:

A PPT by CA Vinamar Gupta. In this PPT he has covered the provisions related to new return of GST.

You can download it from the following link.

3rd Revised PPT on New R […]

Extension of Date of Filing GSTR 9 and 9C

Date for GSTR 9 and 9C for 2017-18 has been extended to 31-1-2020. Earlier Extensions for GSTR 9 and 9C are as under:

Area-based Excise Duty exemption does not cover exemption from Education Cess, NCCD

Analysis of Unicorn Industries [2019] 112 taxmann.com 127 (SC) 6-12- 2019

When a particular kind of duty is exempted, other […]

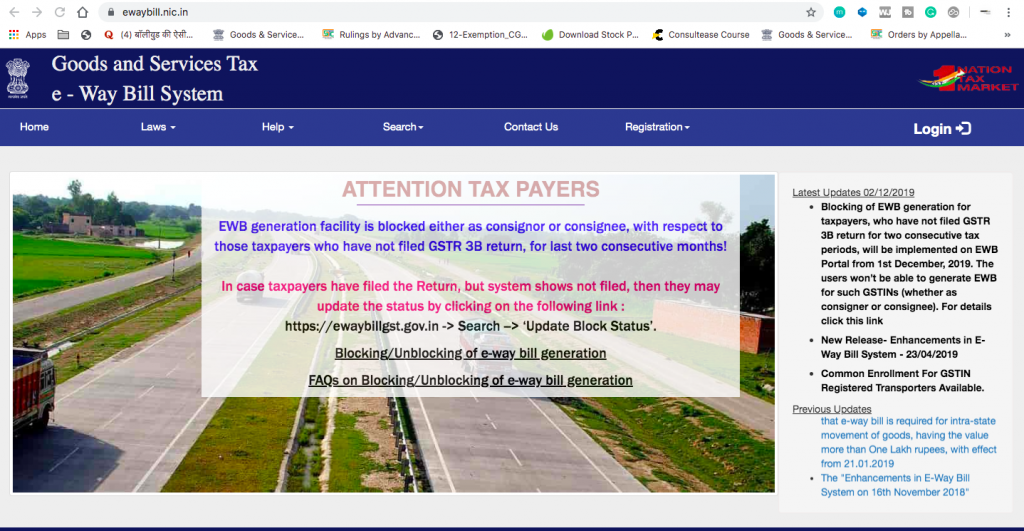

Introduction:

1. As per Rule 138E, non furnishing of CMP-08 for 2 consecutive quarters shall result in blocking of E way bill for Composition Dealers. CMP-08 for April to June 2019 was required to be filed till […]

Master Circular on refund

Circular No. 125/44/2019 – GST dated 18-11-2019: The circular aims at automating the entire refund process. Many a new concepts and procedures for refunds have been laid. At the same […]

Introduction:

Circulars are meant to clarify and simplify the law, but this has rarely been the case with GST circulars which though have, in their earnest attempt tried to explain the law have resulted in […]

Punjab and Haryana High Court has allowed all the tax payers to file or revise TRAN returns by 30-11-2019

In a landmark Judgment by Punjab and Haryana High Court on 4-11-2019 in Adfert Technologies (P.) Ltd, […]

AAR of Santosh Distributors Kerala: Reimbursement of discount is taxable:

Although Circular No. 105 dated 28-06-2019 has been withdrawn by Circular No. 112 dated 3-10-2019. But the ghost of Circular is not yet […]

New Functionality for IGST set off wef 11-06-2019

As per pronouncement made by GSTN, the manner of utilization of ITC as per Rule 88A which was suspended vide Circular No. 98 dated 23-04-2019 till the the new […]

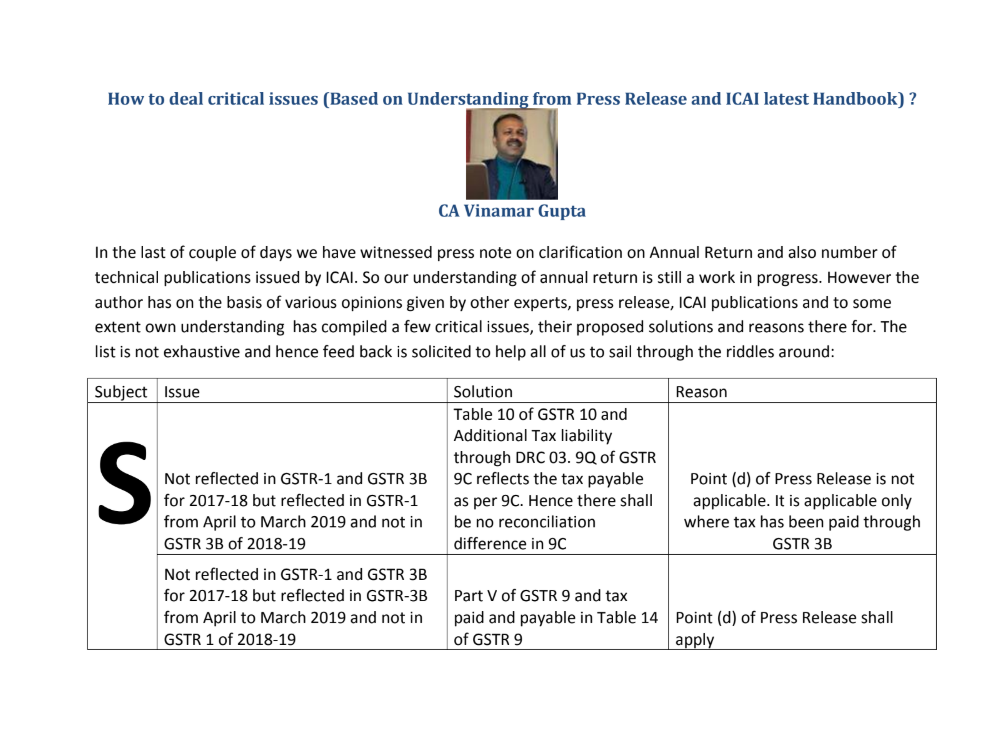

In the last of couple of days we have witnessed press note on clarification on Annual Return and also number of technical publications issued by ICAI. So our understanding of annual return is still a work in […]

Introduction:

The purpose of this article is to provide comprehensive analysis of GSTR-9. It starts with discussion on basic legal provisions. Then it provides some “Important aspects of GSTR-9” . It further […]

CA Vinamar Gupta

@caskumargupta

active 5 years, 7 months agoCA Vinamar Gupta

Location

Amritsar, India

OOPS!

No Packages Added by CA Vinamar Gupta. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Vinamar Gupta wrote a new post, Download PPT on Introduction of New Returns Scheme 5 years, 11 months ago

Introduction of New Returns Scheme:

A PPT by CA Vinamar Gupta. In this PPT he has covered the provisions related to new return of GST.

You can download it from the following link.

3rd Revised PPT on New R […]

CA Vinamar Gupta wrote a new post, Petitioner can not escape liability where GSTR-1 filed but GSTR 3B 5 years, 11 months ago

Petitioner can not escape liability where GSTR-1 filed but GSTR 3B not filed

Held by Madhya Pradesh High Court in Kabeer Reality (P.) Ltd. On 21-11-19* That filing of GSTR-1

but non filing of 3B has twin […]

CA Vinamar Gupta wrote a new post, 38th GST Council Meeting dated 18-12- 2019 5 years, 11 months ago

Extension of Date of Filing GSTR 9 and 9C

Date for GSTR 9 and 9C for 2017-18 has been extended to 31-1-2020. Earlier Extensions for GSTR 9 and 9C are as under:

GSTR-1

Late Fee Waiver […]

CA Vinamar Gupta wrote a new post, Area based Excise Duty exemption does not cover exemption from Education Cess, NCCD 5 years, 12 months ago

Area-based Excise Duty exemption does not cover exemption from Education Cess, NCCD

Analysis of Unicorn Industries [2019] 112 taxmann.com 127 (SC) 6-12- 2019

When a particular kind of duty is exempted, other […]

CA Vinamar Gupta wrote a new post, Blocking of E way Bill w.e.f. 01-12-2019 6 years ago

Introduction:

1. As per Rule 138E, non furnishing of CMP-08 for 2 consecutive quarters shall result in blocking of E way bill for Composition Dealers. CMP-08 for April to June 2019 was required to be filed till […]

CA Vinamar Gupta wrote a new post, Important Take aways from Master Circular on refund 6 years ago

Master Circular on refund

Circular No. 125/44/2019 – GST dated 18-11-2019: The circular aims at automating the entire refund process. Many a new concepts and procedures for refunds have been laid. At the same […]

CA Vinamar Gupta wrote a new post, Conundrum of Circular clarifying 20% ITC restriction 6 years ago

Introduction:

Circulars are meant to clarify and simplify the law, but this has rarely been the case with GST circulars which though have, in their earnest attempt tried to explain the law have resulted in […]

CA Vinamar Gupta wrote a new post, Revise TRAN returns by 30-11-2019: P&H HC 6 years, 1 month ago

Punjab and Haryana High Court has allowed all the tax payers to file or revise TRAN returns by 30-11-2019

In a landmark Judgment by Punjab and Haryana High Court on 4-11-2019 in Adfert Technologies (P.) Ltd, […]

CA Vinamar Gupta wrote a new post, Reimbursement of discount is taxable under GST: AAR Kerala 6 years, 1 month ago

AAR of Santosh Distributors Kerala: Reimbursement of discount is taxable:

Although Circular No. 105 dated 28-06-2019 has been withdrawn by Circular No. 112 dated 3-10-2019. But the ghost of Circular is not yet […]

CA Vinamar Gupta wrote a new post, IGST Set off : Do not fall prey to default set off in portal 6 years, 4 months ago

New Functionality for IGST set off wef 11-06-2019

As per pronouncement made by GSTN, the manner of utilization of ITC as per Rule 88A which was suspended vide Circular No. 98 dated 23-04-2019 till the the new […]

CA Vinamar Gupta wrote a new post, secondary Discounts in GST: clarifications 6 years, 5 months ago

secondary Discounts in GST: Circular No. 105/24/2019-GST dated 28-06-2019. Other relevant References

1 K K Polymers (AAR Rajasthan) dated 13-10-2018 100 taxmann.com 17

2 MRF (AAR Tamilnadu) dated 22/01/2019 […]

CA Vinamar Gupta wrote a new post, Critical Issues in Annual Return 6 years, 6 months ago

In the last of couple of days we have witnessed press note on clarification on Annual Return and also number of technical publications issued by ICAI. So our understanding of annual return is still a work in […]

CA Vinamar Gupta wrote a new post, Clause by clause analysis of GSTR-9 6 years, 6 months ago

Introduction:

The purpose of this article is to provide comprehensive analysis of GSTR-9. It starts with discussion on basic legal provisions. Then it provides some “Important aspects of GSTR-9” . It further […]