Vivek Jalan, from Tax Connect, is a Chartered Accountant & a qualified L.LM & LL.B. He is The Chairman of The Ease of Doing Business Committee therein. He is a member of The Confederation of Indian Industries (CII)- Economic Affairs & Taxation Committee. He is the Member of The Consultative Committee of The Commissioner of SGST. He is also The Member of The Regional Advisory Committee of The Chief Commissioner of CGST. He is advising Large MNCs, PSUs & PAN India Organizations in GST & Income Tax and has offices in Kolkata, Delhi, Bangalore, Mumbai & now Surat.

He is a regular Columnist and guest expert in Economic Times, Times of India, Dalal Street Journal, Money Control, Live mint, CNBC, Hindustan Times, Zee Business, Financial Express, other dailies, and business magazines like Business Today, etc. He is also a guest expert on Taxation matters in All India Radio and other media platforms. He is the Editor of Weekly Bulletin TAX CONNECT, a publication on Indirect Taxes and Direct Taxes which reaches more than 70000 professionals.

The Government of India has introduced the tax implications for cryptocurrency for the first time in the Union Budget 2022, while the Internal Revenue Service (IRS) of the United States (US) first addressed […]

The goal of every tax administration is to foster voluntary In a significant step towards Atmanirbhar Bharat, the Central Board of Indirect Taxes & Customs (CBIC) has reduced the compliances required under the […]

The goal of every tax administration is to foster voluntary compliance with the tax law, and it seeks to accomplish this through a mix of measures directed at rendering high-quality service to the taxpayers, […]

Over the past six months, the taxpayers witnessed the gradual implementation of various e-invoicing provisions based on the turnover of the taxpayers. Various notifications have been issued, prescribing the […]

Since the implementation of GST, the claim of the input tax credit has witnessed multiple amendments with Government’s intention to allow ITC on invoices/debit notes which are uploaded by the suppliers in G […]

In the recent budget in Income Tax, it is proposed to impose a TDS on business promotion expenditure expended by an organisation. It has far-reaching implications, even in the hands of the recipients of the […]

The newly proposed Section 194R of the Income Tax Act in its present form would be a big compliance challenge for businesses as there are multiple types of perquisites & benefits that are extended to their […]

The Hon’ble Finance Minister Smt. Nirmala Sitharaman on 01st February 2022 presented the Union Budget 2022. The budget is a vision document and has given ample scope for the youth to turn into entrepreneurs and i […]

EDITORIAL

Friends,

Recently, a detailed guideline has been issued by The Central Board of Direct Taxes (CBDT) in the matter of how taxes would be calculated on maturity proceeds of ULIPs vide Circular No. 2 of […]

EDITORIAL

GST on transactions between Head office and Branch office has been a contentious issue since the inception of GST as the said transactions were not liable to any tax under the pre-GST regime. A recent […]

EDITORIAL

As a facilitation measure for taxpayers & for assisting the taxpayers in doing a correct self-assessment, a new functionality of interest calculator is being released in GSTR-3B. This functionality will […]

The Harmonized System of Nomenclature or HSN is an internal system of naming goods. Conceptualized by the World Customs Organisation, the main purpose of HSN is to classify goods in a systematic and logical […]

The 46th GST Council meeting, chaired by Hon’ble Finance Minister and comprising state FMs, was held on December 31, 2021, with a single agenda to consider Gujarat’s demand of putting the rate hike on textiles d […]

There are many amendments proposed from 1st January 2022. Among them, the most crucial two which would impact all taxpayers are related to the legal changes for availing ITC and filing GSTR-1 and GSTR-3B which […]

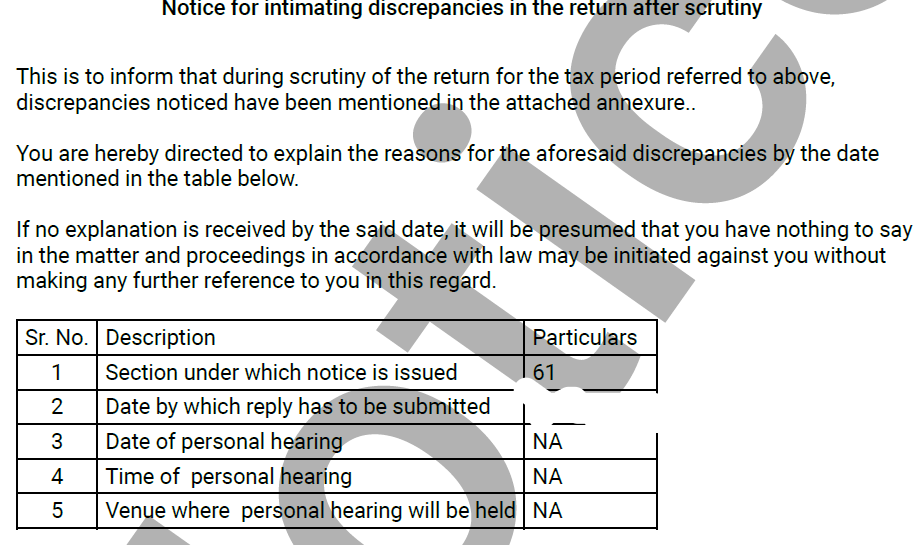

Section 61 of The CGST Act 2017 empowers the revenue authorities to scrutinize the return and related particulars furnished by the taxpayers to verify the correctness of the return and inform him of the […]

It is seen that the CBIC and DGARM have held back many refunds of exporters due to the difference between the FOB Value of exports as reported in the Shipping Bills and the CIF Value as reported in the GST […]

The Central Board of Direct Taxes (CBDT) has rolled out the e-Verification Scheme, 2021 for the Collection of Information of Assessee by the Assessing Officer (AO).

Introduction

Valuation is one of the most crucial aspects for an organisation engaged in the import and export of gems, precious and semi-precious stones considering high-value transactions. This also […]

CA Vivek Jalan

@cavivekjalangmail-com

active 5 years, 8 months agoCA Vivek Jalan

Vivek Jalan, from Tax Connect, is a Chartered Accountant & a qualified L.LM & LL.B. He is The Chairman of The Ease of Doing Business Committee therein. He is a member of The Confederation of Indian Industries (CII)- Economic Affairs & Taxation Committee. He is the Member of The Consultative Committee of The Commissioner of SGST. He is also The Member of The Regional Advisory Committee of The Chief Commissioner of CGST. He is advising Large MNCs, PSUs & PAN India Organizations in GST & Income Tax and has offices in Kolkata, Delhi, Bangalore, Mumbai & now Surat. He is a regular Columnist and guest expert in Economic Times, Times of India, Dalal Street Journal, Money Control, Live mint, CNBC, Hindustan Times, Zee Business, Financial Express, other dailies, and business magazines like Business Today, etc. He is also a guest expert on Taxation matters in All India Radio and other media platforms. He is the Editor of Weekly Bulletin TAX CONNECT, a publication on Indirect Taxes and Direct Taxes which reaches more than 70000 professionals.

OOPS!

No Packages Added by CA Vivek Jalan. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Vivek Jalan wrote a new post, 342nd Issue: 20th March 2022- 26th March 2022 3 years, 11 months ago

The Government of India has introduced the tax implications for cryptocurrency for the first time in the Union Budget 2022, while the Internal Revenue Service (IRS) of the United States (US) first addressed […]

CA Vivek Jalan wrote a new post, 341st Issue: 13th March 2022- 19th March 2022 3 years, 11 months ago

The goal of every tax administration is to foster voluntary In a significant step towards Atmanirbhar Bharat, the Central Board of Indirect Taxes & Customs (CBIC) has reduced the compliances required under the […]

CA Vivek Jalan wrote a new post, 340th Issue: 6th March 2022- 12th March 2022 3 years, 11 months ago

The goal of every tax administration is to foster voluntary compliance with the tax law, and it seeks to accomplish this through a mix of measures directed at rendering high-quality service to the taxpayers, […]

CA Vivek Jalan wrote a new post, 339th Issue: 27th February 2022- 5th March 2022 3 years, 12 months ago

Over the past six months, the taxpayers witnessed the gradual implementation of various e-invoicing provisions based on the turnover of the taxpayers. Various notifications have been issued, prescribing the […]

CA Vivek Jalan wrote a new post, 338th Issue: 20th February 2022- 26th February 2022 4 years ago

Since the implementation of GST, the claim of the input tax credit has witnessed multiple amendments with Government’s intention to allow ITC on invoices/debit notes which are uploaded by the suppliers in G […]

CA Vivek Jalan wrote a new post, TDS U/s 194r & Its Impact on Large & Small Business 4 years ago

In the recent budget in Income Tax, it is proposed to impose a TDS on business promotion expenditure expended by an organisation. It has far-reaching implications, even in the hands of the recipients of the […]

CA Vivek Jalan wrote a new post, 337th Issue: 13th February 2022- 19th February 2022 4 years ago

The newly proposed Section 194R of the Income Tax Act in its present form would be a big compliance challenge for businesses as there are multiple types of perquisites & benefits that are extended to their […]

CA Vivek Jalan wrote a new post, 336th Issue: 6th February 2022- 12th February 2022 4 years ago

The Hon’ble Finance Minister Smt. Nirmala Sitharaman on 01st February 2022 presented the Union Budget 2022. The budget is a vision document and has given ample scope for the youth to turn into entrepreneurs and i […]

CA Vivek Jalan wrote a new post, 335th Issue: 30th January 2022- 5th February 2022 4 years ago

EDITORIAL

Friends,

Recently, a detailed guideline has been issued by The Central Board of Direct Taxes (CBDT) in the matter of how taxes would be calculated on maturity proceeds of ULIPs vide Circular No. 2 of […]

CA Vivek Jalan wrote a new post, 334th Issue: 23rd January 2022- 29th January 2022 4 years, 1 month ago

EDITORIAL

GST on transactions between Head office and Branch office has been a contentious issue since the inception of GST as the said transactions were not liable to any tax under the pre-GST regime. A recent […]

CA Vivek Jalan wrote a new post, 333rd Issue: 16th January 2022- 22nd January 2022 4 years, 1 month ago

EDITORIAL

As a facilitation measure for taxpayers & for assisting the taxpayers in doing a correct self-assessment, a new functionality of interest calculator is being released in GSTR-3B. This functionality will […]

CA Vivek Jalan wrote a new post, 332nd Issue: 9th January 2022- 15th January 2022 4 years, 1 month ago

The Harmonized System of Nomenclature or HSN is an internal system of naming goods. Conceptualized by the World Customs Organisation, the main purpose of HSN is to classify goods in a systematic and logical […]

CA Vivek Jalan wrote a new post, 331st Issue: 2nd January 2022- 8th January 2022 4 years, 1 month ago

The 46th GST Council meeting, chaired by Hon’ble Finance Minister and comprising state FMs, was held on December 31, 2021, with a single agenda to consider Gujarat’s demand of putting the rate hike on textiles d […]

CA Vivek Jalan wrote a new post, Jan’22 GST Return Legal Changes and Precautions 4 years, 1 month ago

There are many amendments proposed from 1st January 2022. Among them, the most crucial two which would impact all taxpayers are related to the legal changes for availing ITC and filing GSTR-1 and GSTR-3B which […]

CA Vivek Jalan wrote a new post, Filing GSTR 9/9c December 2021: Critical Issues for Preparing for Scrutiny 4 years, 2 months ago

Section 61 of The CGST Act 2017 empowers the revenue authorities to scrutinize the return and related particulars furnished by the taxpayers to verify the correctness of the return and inform him of the […]

CA Vivek Jalan wrote a new post, GST Refunds Stuck Due to Difference Between Fob Value and CIF Value: an Analysis 4 years, 2 months ago

It is seen that the CBIC and DGARM have held back many refunds of exporters due to the difference between the FOB Value of exports as reported in the Shipping Bills and the CIF Value as reported in the GST […]

CA Vivek Jalan wrote a new post, 329th Issue: 19th December 2021-25th December 2021 4 years, 2 months ago

The Central Board of Direct Taxes (CBDT) has rolled out the e-Verification Scheme, 2021 for the Collection of Information of Assessee by the Assessing Officer (AO).

The government has empowered the income tax […]

CA Vivek Jalan wrote a new post, Most Litigative Issues on Itc 4 years, 2 months ago

Sales Promotion item is taxable supply at Value u/r 27

KANAHIYA REALTY PRIVATE LIMITED

The supply of hosiery goods followed by the supply of goods under promotional scheme doesn’t satisfy the condition of b […]

CA Vivek Jalan wrote a new post, Valuation & Provisional Assessments Under Customs: Gems, Precious and Semi-Precious Stones – an Understanding 4 years, 2 months ago

Introduction

Valuation is one of the most crucial aspects for an organisation engaged in the import and export of gems, precious and semi-precious stones considering high-value transactions. This also […]

CA Vivek Jalan wrote a new post, Exporters To-Do List in Nov’21 & Dec’21: Rodtep/Agri-Tma & Foreign Trade Policy 4 years, 2 months ago

Process & Procedures for RoDTEP:

The following process would be followed for RoDTEP

(i) Exporters to register their IEC on ICEGATE with a DSC.

(ii) To avail of the scheme exporter shall make a claim for […]