Resolution Plan Approval by NCLT Renders Pending Service Tax Refund Appeal Abated, Rules CESTAT Chandigarh

In a recent decision, the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) Chandigarh ruled […]

The Gujarat High Court has upheld the validity of search and seizure operations conducted by the Income Tax (I-T) department at the residence and office of lawyer […]

Payments made or due to vendors registered under MSME, as defined in the Micro, Small and Medium Enterprises Development (MSMED) Act 2006, are affected. To encourage […]

In a recent development, the Bombay High Court has granted an interim stay on the demand for GST dues on expatriate salary payments by Mercedes-Benz, providing a temporary relief to the auto giant. This decision, […]

In a bid to ease the tax burden on residents and facilitate smoother transactions, the taxation department of the state government has launched a comprehensive awareness campaign promoting its […]

In a recent ruling by the National Company Law Appellate Tribunal (NCLAT) in the case of Kineta Global Ltd. v. IDBI Bank Ltd. & Ors., the issue of disclosing valuation reports to prospective […]

In a recent verdict, the Jharkhand High Court has upheld the income tax addition due to the failure of assessees to substantiate the authenticity of creditors providing cash loans. The decision, […]

The Directorate of Revenue Intelligence (DRI) recently made a significant breakthrough in its ongoing efforts to combat smuggling activities targeting India’s domestic industries. In a […]

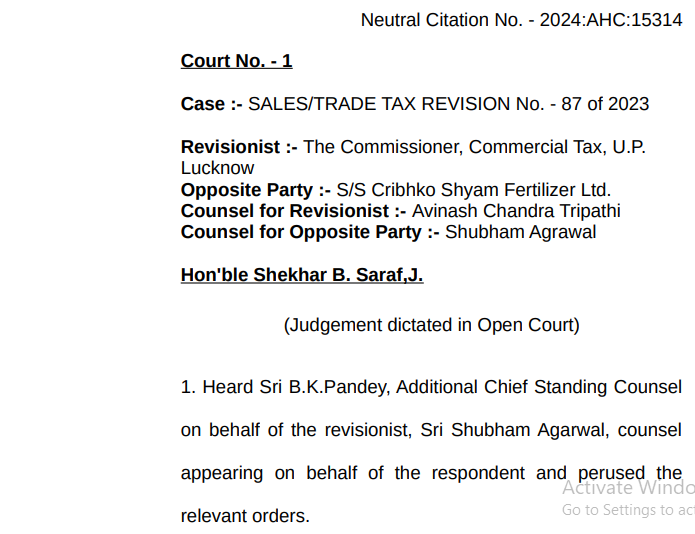

The Allahabad High Court ruled on a case involving the interpretation of Section 13(1)(f) of the Uttar Pradesh Value Added Tax Act, 2008 (UP VAT Ac […]

Background:

The Supreme Court denied bail to a man charged under the Unlawful Activities (Prevention) Act, 1967 (“UAPA”) for allegedly promoting the Khalistani terror movement. The appellant had been in jail for […]

1. Introduction to the QRMP Scheme

The Quarterly Returns with Monthly Payment (QRMP) Scheme is designed to streamline GST compliance for eligible taxpayers, allowing them to submit Form GSTR-1 and Form GSTR-3B […]

The Supreme Court, in response to a Single Judge of the Madras High Court taking suo motu revision against the discharge of Tamil Nadu Revenue Minister KKSSR Ramachandran in a corruption case, […]

Cross-Empowerment of Central and State Authorities Under GST: Judicial Views

The Goods and Service Tax (GST) regime in India has brought about a new system of taxation, where both the central and state […]

Introduction:

The Income Tax Department has introduced significant changes in the Income Tax Return (ITR) forms for the Assessment Year 2024-25, aimed at streamlining the filing process and ensuring compliance […]

Introduction

The recent news of the Reserve Bank of India (RBI) banning Paytm has sparked widespread reactions and even led to the creation of memes. However, this decision didn’t happen overnight and is the […]

Introduction:

The case of Abdus Sami Saifi v. Union of India and Ors. [Civil Writ Petition No. 892/2024] recently came before the Hon’ble Rajasthan High Court, raising crucial questions regarding the validity o […]

Consultease

@consultease-admin

active 4 months, 4 weeks agoConsultease

WEBSITE

https://www.consultease.com/OOPS!

No Packages Added by Consultease. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewConsultease wrote a new post, (no title) 2 years ago

Resolution Plan Approval by NCLT Renders Pending Service Tax Refund Appeal Abated, Rules CESTAT Chandigarh

In a recent decision, the Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) Chandigarh ruled […]

Consultease wrote a new post, High Court Upholds Income Tax Search; Condemns Misconduct 2 years ago

Heading 1: Validity of Income Tax Search Upheld

The Gujarat High Court has upheld the validity of search and seizure operations conducted by the Income Tax (I-T) department at the residence and office of lawyer […]

Consultease wrote a new post, Understanding the Impact of MSME Section 43B: Ensuring Timely Payments and Tax Compliance” 2 years ago

Clarification on MSME Section 43B Impact:

Payments made or due to vendors registered under MSME, as defined in the Micro, Small and Medium Enterprises Development (MSMED) Act 2006, are affected. To encourage […]

Consultease wrote a new post, Important FAQ’s on 43B 2 years ago

Q1: When does the amendment become effective?

A1: The amendment applies from FY 2023-24, corresponding to AY 2024-25.

Q2: What defines an MSME?

A2: MSME classification is based on investment and turnover, […]

Consultease wrote a new post, “High Court Grants Mercedes-Benz Interim GST Relief” 2 years ago

In a recent development, the Bombay High Court has granted an interim stay on the demand for GST dues on expatriate salary payments by Mercedes-Benz, providing a temporary relief to the auto giant. This decision, […]

Consultease wrote a new post, “Unlocking Tax Relief: OTS & ‘Mera Bill’ Drive for Ludhiana Residents” 2 years ago

In a bid to ease the tax burden on residents and facilitate smoother transactions, the taxation department of the state government has launched a comprehensive awareness campaign promoting its […]

Consultease wrote a new post, “Valuation Report Disclosure Debate in Insolvency” 2 years ago

In a recent ruling by the National Company Law Appellate Tribunal (NCLAT) in the case of Kineta Global Ltd. v. IDBI Bank Ltd. & Ors., the issue of disclosing valuation reports to prospective […]

Consultease wrote a new post, “Jharkhand High Court: Upholding Tax Scrutiny on Unverified Cash Loans” 2 years ago

In a recent verdict, the Jharkhand High Court has upheld the income tax addition due to the failure of assessees to substantiate the authenticity of creditors providing cash loans. The decision, […]

Consultease wrote a new post, DRI seized 83.352 MT of Areca Nuts 2 years ago

The Directorate of Revenue Intelligence (DRI) recently made a significant breakthrough in its ongoing efforts to combat smuggling activities targeting India’s domestic industries. In a […]

Consultease wrote a new post, If tax paid is more than ITC , 13(1)(f) will not apply 2 years ago

The Allahabad High Court ruled on a case involving the interpretation of Section 13(1)(f) of the Uttar Pradesh Value Added Tax Act, 2008 (UP VAT Ac […]

Consultease wrote a new post, “Supreme Court Upholds Bail Denial in UAPA Case: Delay Not a Deciding Factor” 2 years ago

Background:

The Supreme Court denied bail to a man charged under the Unlawful Activities (Prevention) Act, 1967 (“UAPA”) for allegedly promoting the Khalistani terror movement. The appellant had been in jail for […]

Consultease wrote a new post, “Streamlining GST: The QRMP Scheme Explained” 2 years ago

1. Introduction to the QRMP Scheme

The Quarterly Returns with Monthly Payment (QRMP) Scheme is designed to streamline GST compliance for eligible taxpayers, allowing them to submit Form GSTR-1 and Form GSTR-3B […]

Consultease wrote a new post, “High Court: Chanda Kochhar’s Arrest Illegal” 2 years ago

Bombay High Court Declares Arrest of Chanda Kochhar and Husband Illegal in ICICI Bank – Videocon Loan Fraud Case

In a significant development, the Bombay High Court has ruled the arrest of […]

Consultease wrote a new post, “Flipkart Triumphs: Supreme Court Greenlights Rs. 6.6 Cr VAT Refund” 2 years ago

“Supreme Court Upholds Delhi High Court Order, Grants Flipkart Rs. 6.6 Cr VAT Refund”

The Supreme Court recently affirmed a significant decision by the Delhi High Court, allowing e-commerce […]

Consultease wrote a new post, “Supreme Court’s Suo Motu Jurisdiction Clarification” 2 years ago

The Supreme Court, in response to a Single Judge of the Madras High Court taking suo motu revision against the discharge of Tamil Nadu Revenue Minister KKSSR Ramachandran in a corruption case, […]

Consultease wrote a new post, Streamlining Tax Disputes: GSTAT’s Journey 2 years ago

1. Legislative Milestones: Central GST (Second Amendment) Bill Approval

Parliament’s Approval of the Bill

Amendments to Age Limits for GSTAT President and Members

Synchronization with Tribunal Reforms […]

Consultease wrote a new post, “GST Cross-Empowerment: Legal Limbo & Taxpayer Rights” 2 years ago

Cross-Empowerment of Central and State Authorities Under GST: Judicial Views

The Goods and Service Tax (GST) regime in India has brought about a new system of taxation, where both the central and state […]

Consultease wrote a new post, Overview of Key Changes in ITR Forms for Assessment Year 2024-25 2 years ago

Introduction:

The Income Tax Department has introduced significant changes in the Income Tax Return (ITR) forms for the Assessment Year 2024-25, aimed at streamlining the filing process and ensuring compliance […]

Consultease wrote a new post, “Paytm Ban: Navigating the Future of Digital Banking” 2 years ago

Introduction

The recent news of the Reserve Bank of India (RBI) banning Paytm has sparked widespread reactions and even led to the creation of memes. However, this decision didn’t happen overnight and is the […]

Consultease wrote a new post, High Court Interim Order in Abdus Sami Saifi v. Union of India and Ors.: Insights and Ramifications 2 years ago

Introduction:

The case of Abdus Sami Saifi v. Union of India and Ors. [Civil Writ Petition No. 892/2024] recently came before the Hon’ble Rajasthan High Court, raising crucial questions regarding the validity o […]