Input Tax Credit under GST

The input tax credit has been defined as per Act in our previous article. It means the credit of Input Taxes paid on inputs, capital goods, and input services. The Input tax in relation […]

Valuation under GST

SECTION 15: VALUE OF TAXABLE SUPPLY[RULE 27 TO RULE 35]

As GST is payable as a percentage of the value of supply, it is thereby important to determine the value of taxable supply as per the […]

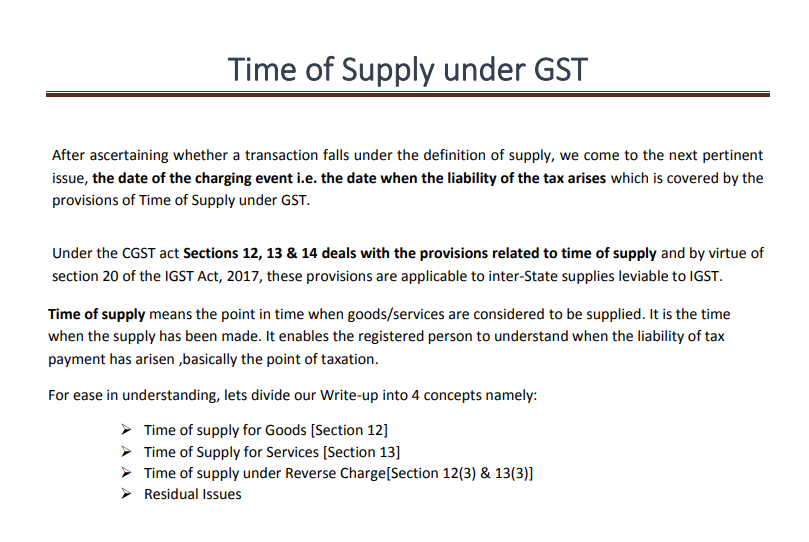

Time of Supply under GST

After ascertaining whether a transaction falls under the definition of supply, we come to the next pertinent issue, the date of the charging event i.e. the date when the liability of the […]

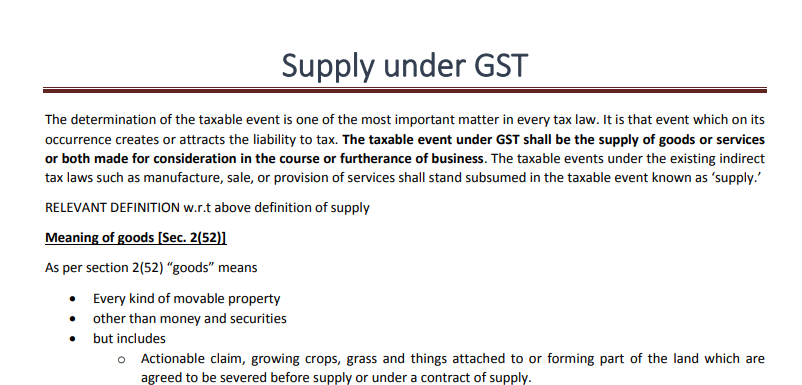

Supply under GST

The determination of the taxable event is one of the most important matters in every tax law. It is that event which on its occurrence creates or attracts the liability to tax. The taxable event […]

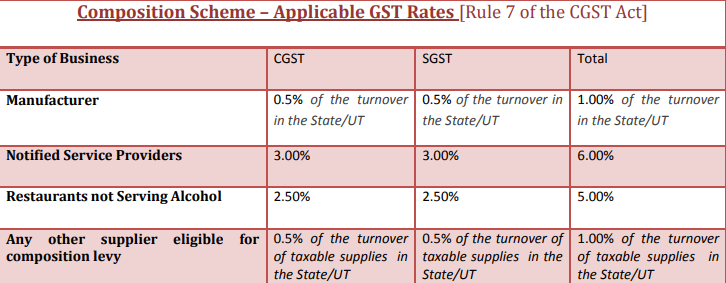

Section 10 – Composition Scheme

GST Composition Scheme-An Introduction

The composition levy is an alternative method of levy of tax designed for small taxpayers whose turnover is up to Rs. 1.5 Crores (Rs. 75 […]

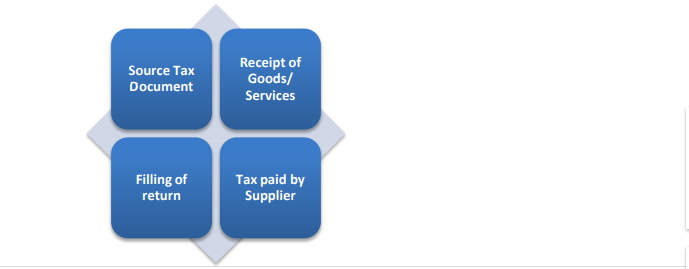

Reverse Charge Mechanism under GST

Section 9(3):

U/S 2(98) of CGST Act Reverse charge is defined as “liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such […]

CA Suraj Goyal

SME & Speaker, Business Advisor on Indian GST Add profile section

Paid User

@goyalsuraj92gmail-com

active 5 years, 10 months agoCA Suraj Goyal

SME & Speaker, Business Advisor on Indian GST

Registered Categories

Location

Kolkata, India

OOPS!

No Packages Added by CA Suraj Goyal. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewSuraj Goyal wrote a new post, Updated Provisions of Input Tax Credit under GST 5 years, 9 months ago

Input Tax Credit under GST

The input tax credit has been defined as per Act in our previous article. It means the credit of Input Taxes paid on inputs, capital goods, and input services. The Input tax in relation […]

Suraj Goyal wrote a new post, Updated provisions of Place of Supply under GST 5 years, 10 months ago

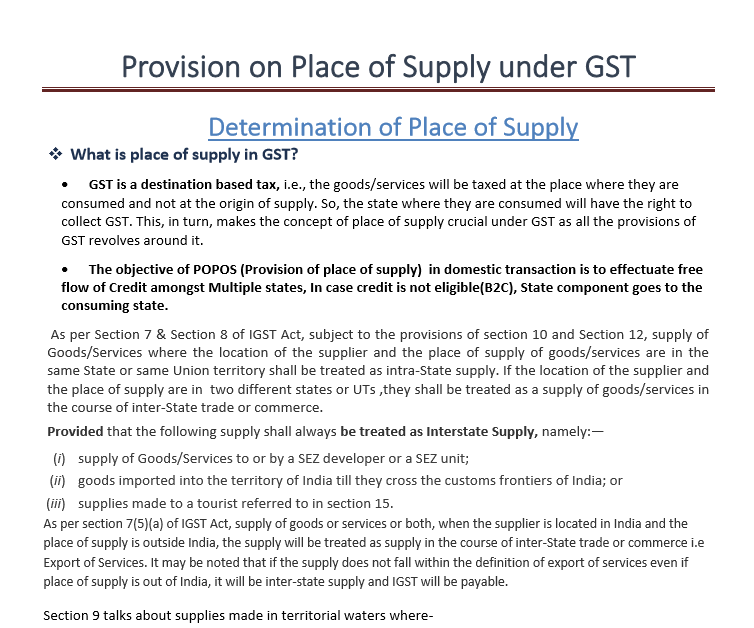

Provision on Place of Supply under GST

Determination of Place of Supply

What is the place of supply in GST?

GST is a destination-based tax, i.e., the goods/services will be taxed at the place where th […]

Suraj Goyal wrote a new post, Updated provisions of Registration under GST 5 years, 10 months ago

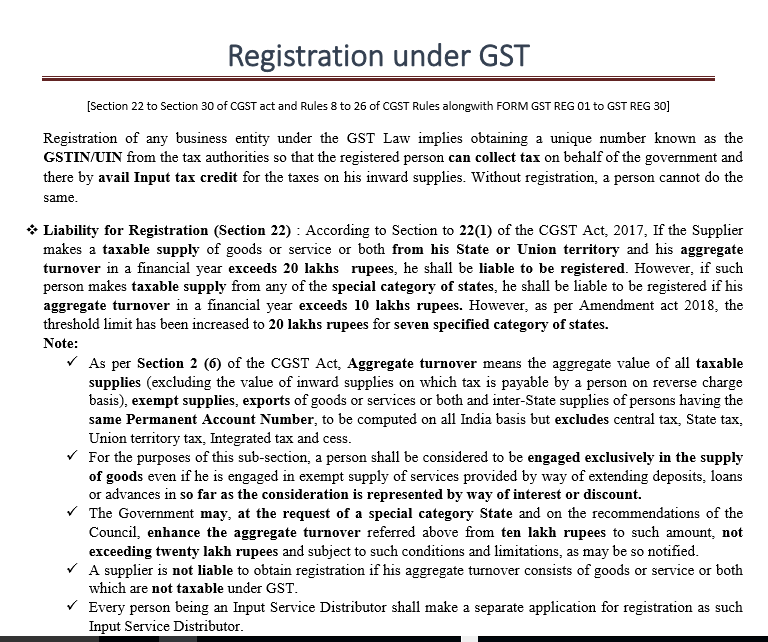

Registration under GST

[Section 22 to Section 30 of CGST Act and Rules 8 to 26 of CGST Rules along with FORM GST REG 01 to GST REG 30]

Registration of any business entity under the GST Law implies obtaining a […]

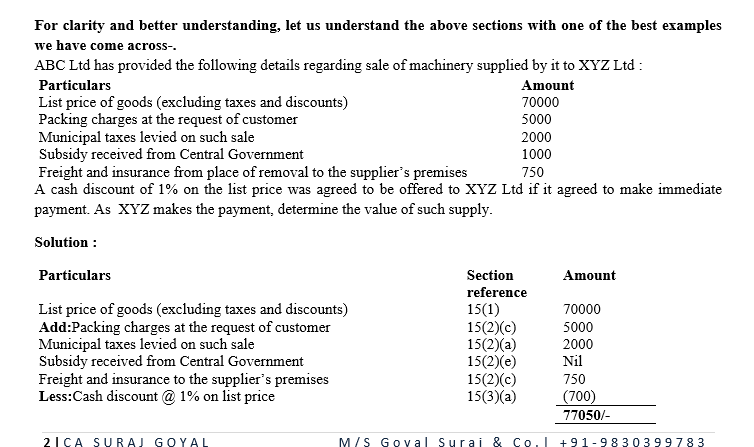

Suraj Goyal wrote a new post, Updated provisions of Valuation under GST 5 years, 10 months ago

Valuation under GST

SECTION 15: VALUE OF TAXABLE SUPPLY[RULE 27 TO RULE 35]

As GST is payable as a percentage of the value of supply, it is thereby important to determine the value of taxable supply as per the […]

Suraj Goyal wrote a new post, Updated provisions of Time of Supply under GST 5 years, 10 months ago

Time of Supply under GST

After ascertaining whether a transaction falls under the definition of supply, we come to the next pertinent issue, the date of the charging event i.e. the date when the liability of the […]

Suraj Goyal wrote a new post, Updated provisions of Supply under GST 5 years, 10 months ago

Supply under GST

The determination of the taxable event is one of the most important matters in every tax law. It is that event which on its occurrence creates or attracts the liability to tax. The taxable event […]

Suraj Goyal wrote a new post, Section 10 – Composition Scheme 5 years, 10 months ago

Section 10 – Composition Scheme

GST Composition Scheme-An Introduction

The composition levy is an alternative method of levy of tax designed for small taxpayers whose turnover is up to Rs. 1.5 Crores (Rs. 75 […]

Suraj Goyal wrote a new post, Reverse Charge Mechanism under GST 5 years, 10 months ago

Reverse Charge Mechanism under GST

Section 9(3):

U/S 2(98) of CGST Act Reverse charge is defined as “liability to pay tax by the recipient of supply of goods or services or both instead of the supplier of such […]