Order Now $14,550 (2)

-

4 Logo Drafts, Icon based, modern

312 Sold

-

30 Minutes Call with me

12 Sold

-

Monthly Fee

21 Sold

-

1 year shared hosting

ConsultEase.com Interviewed.

Read Interview-

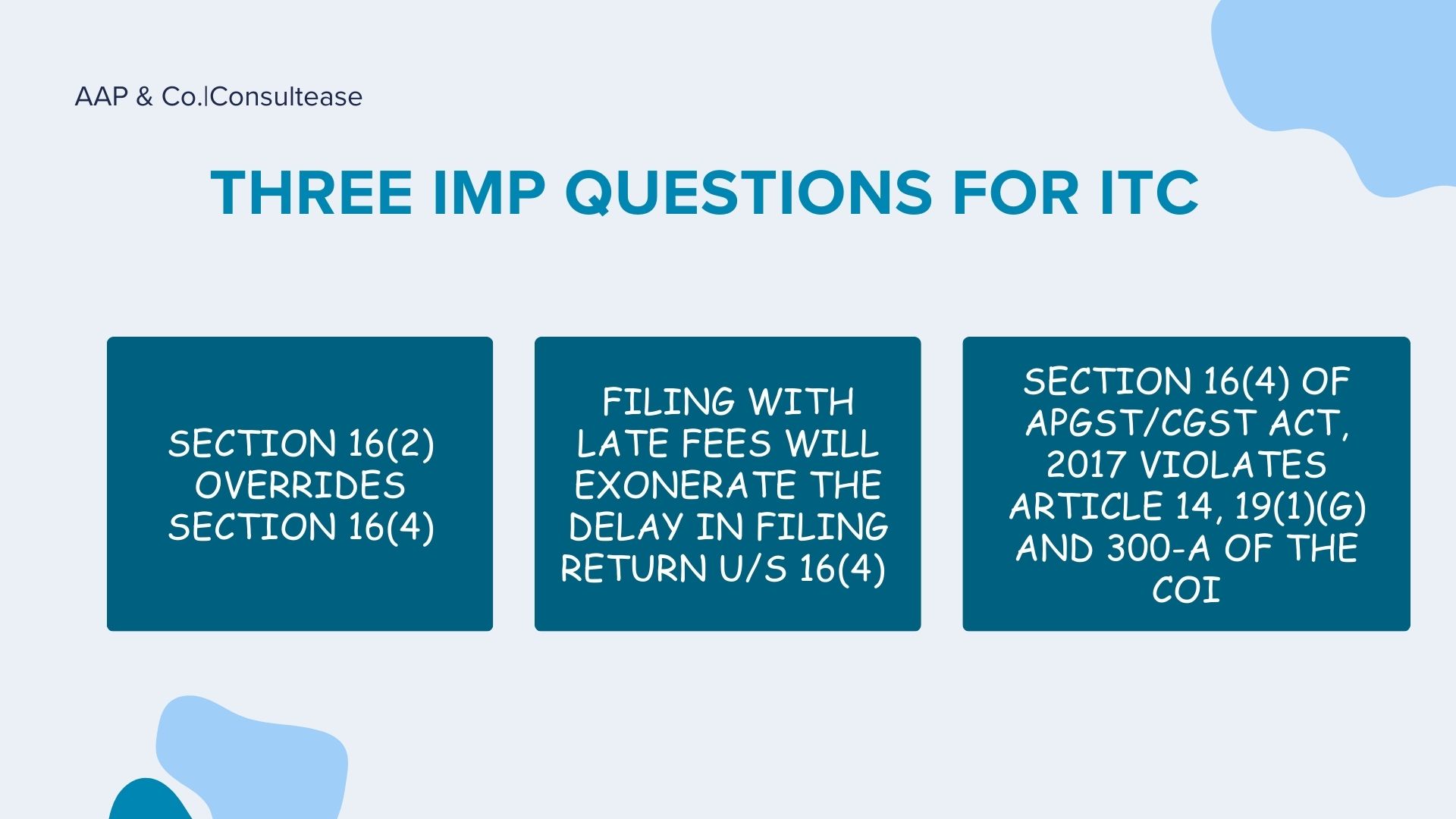

CA Shafaly Girdharwal wrote a new post, Three Most Important Issues in Time Barred ITC Resolved by Court in Thirumalakonda Plywoods Case 2 years, 3 months ago

Appellant – Thirumalakonda Plywoods,

Respondent – The Assistant Commissioner – State Tax, Anantapur Circle – 1, Anantapuramu Division

Facts-

The petitioner prays for a writ of mandamus declaring(a) Sec […]

-

CA Shafaly Girdharwal wrote a new post, Diwakar enterprises Vs CCGST- No tax without authority of law 2 years, 3 months ago

Petitioner- Diwakar Enterprises Pvt. Ltd.

Respondent-Commissioner of CGST and anr. 2020

Court- Punjab & Haryana (Chandigarh)

In this case, the input credit ledger of the taxpayer was blocked. A search was […]

-

CA Shafaly Girdharwal wrote a new post, In the High Court of Madhya Pradesh at INDORE BEFORE Hon’ble Shri Justice Vivek Rusia & Hon’ble Shri Justice Hirdesh on the 13th of June, 2023 – Writ Petition No. 14297 of 2020 2 years, 3 months ago

Petitioner-Agrawal and Brothers Respondent – Union of India, Western Railway Division DRM Office, Ratlam and Office of the Superintendent, CGST, and 2. Central Excise, Range-I Division Ratlam, Court- Madhya […]

-

CA Shafaly Girdharwal wrote a new post, Bright Star Plastic Industries Vs Additional Commissioner of Sales Tax 4 years ago

Case Covered:

M/s. Bright Star Plastic IndustriesVersus

Additional Commissioner of Sales Tax & others

Facts of the Case:The Petitioner is carrying on the business of manufacturing and trade of […]

-

CA Shafaly Girdharwal wrote a new post, How to login at the GST portal and use it 4 years, 3 months ago

What is GST Portal?

GST portal is the portal adopted for GST compliances. If you are a taxpayer in GST you need to use this portal. It has the following functionalities.

Registration of a new […]

-

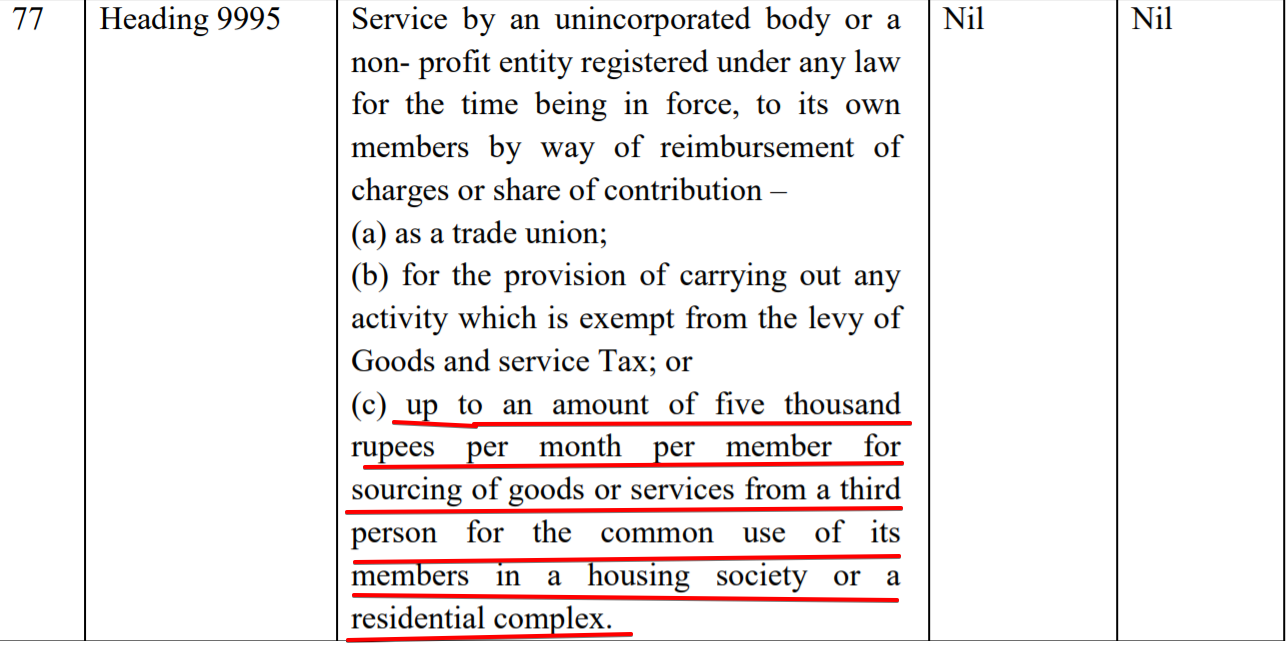

CA Shafaly Girdharwal wrote a new post, GST on services of RWA, Madras high court ends the confusion 4 years, 3 months ago

Introduction

Housing societies are bodies to maintain the societies. They are formed to provide common services. They collect an amount for these services. Generally called RWA or housing societies. There is […]

-

CA Shafaly Girdharwal wrote a new post, FAQ’s on section 206AB and 206CCA on TDS 4 years, 4 months ago

Section 206AB and 206CCA are inserted in the income tax Act. These sections belong to TDS. Some more taxpayers will fall under the TDS provisions. It is introduced to increase tax compliance. Many taxpayers […]

-

CA Shafaly Girdharwal wrote a new post, How To File ITR Using The New Filing Portal of Income Tax 4 years, 4 months ago

Introduction

CBDT has introduced a new income tax return filing portal. Return filing is now way simpler than earlier. In the case of small taxpayers, it can be filed without the help of any professional. It is […]

-

CA Shafaly Girdharwal wrote a new post, Important FAQs About GST Amnesty Scheme 2021 for Waiver of Late Fees 4 years, 4 months ago

Introduction of GST Amnesty Scheme 2021

Amnesty means providing relief from some penal action. Recently GST amnesty scheme 2021 is announced by CBIC. It is a scheme to waive late fees. The fees are accumulated […] -

CA Shafaly Girdharwal wrote a new post, Important amendments in GST via 15/2021 in refund, registration and forms 4 years, 5 months ago

Introduction-

CBIC has issued a notification no. 15/2021. It amended the provisions related to refund, registration, and forms in GST. Let us have a look at those provisions. You can also download the PPT […]

-

CA Shafaly Girdharwal wrote a new post, GST provisions applicable from 1st April 2021 4 years, 7 months ago

Introduction

GST provisions applicable from 1st April 2021 are discussed here in this article. There is a long list of the new provisions. Gradually it is getting riskier to avoid GST compliances. Department is […] -

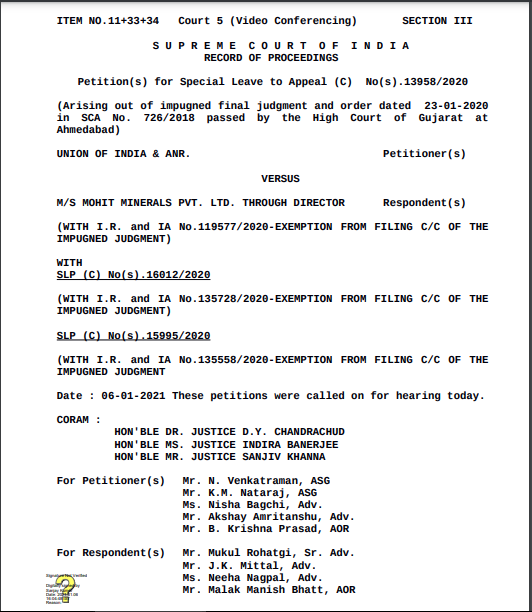

CA Shafaly Girdharwal wrote a new post, [Justin- Notice by Supreme Court] Gujarat High Court Ocean Freight Matters allowing the petitions and pronouncing levy to be ultra vires. 4 years, 9 months ago

Latest Update:

UPON hearing the counsel the Court made the following ORDERThe Supreme court has issued a notice in this case.

We have heard Mr. N Venkatraman and Mr. K M Nataraj, learned Additional […]

-

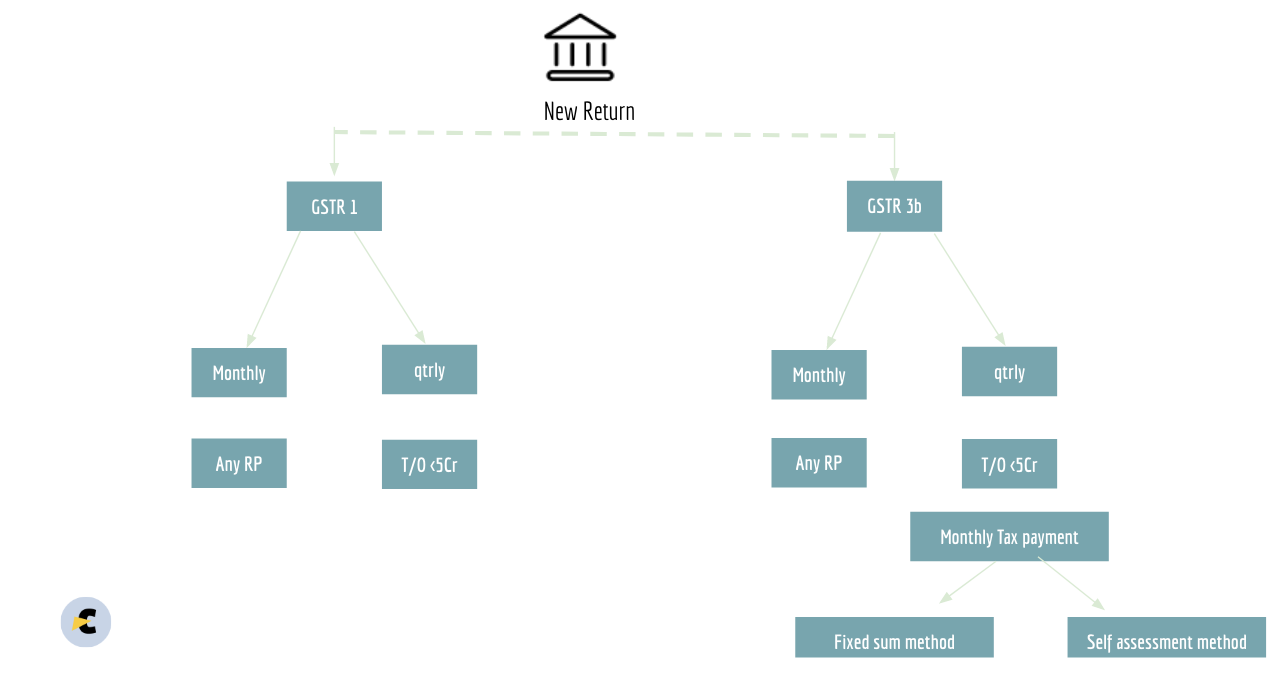

CA Shafaly Girdharwal wrote a new post, FAQ’s on QRMP return scheme of GST [Recent Changes] 4 years, 10 months ago

What are the recent changes related to the QRMP Scheme?

Auto population of GSTR 3b Liability- GSTR 3b contains the data of sale and ITC. It also calculates the final tax liability. This liability is based on […]

-

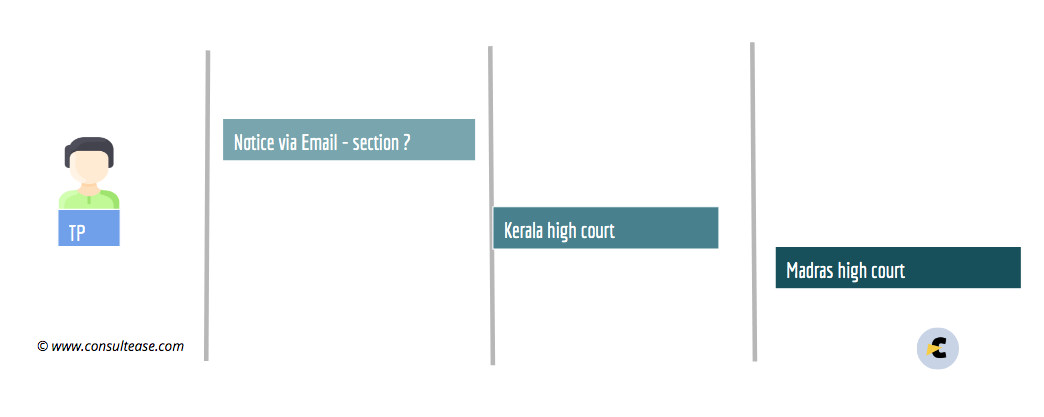

CA Shafaly Girdharwal wrote a new post, Service of GST notice via email, Valid or not ? 4 years, 11 months ago

Service of GST notice via email

Service of notice is an important part of adjudication. The right of being heard can be ensured only by communicating the notice. There are various ways to serve a notice. It can […]

-

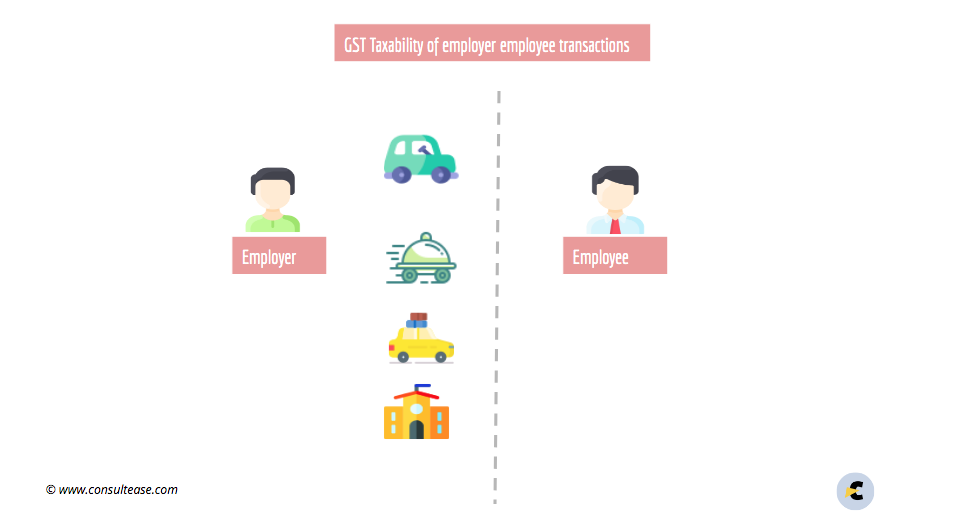

CA Shafaly Girdharwal wrote a new post, GST on supply between employer and employee 4 years, 11 months ago

Introduction- supply between employer and employee in GST

Employers and employees are related persons under the GST Law. Supply between employer and employee may attract the GST. Here we will analyze the linking […]

-

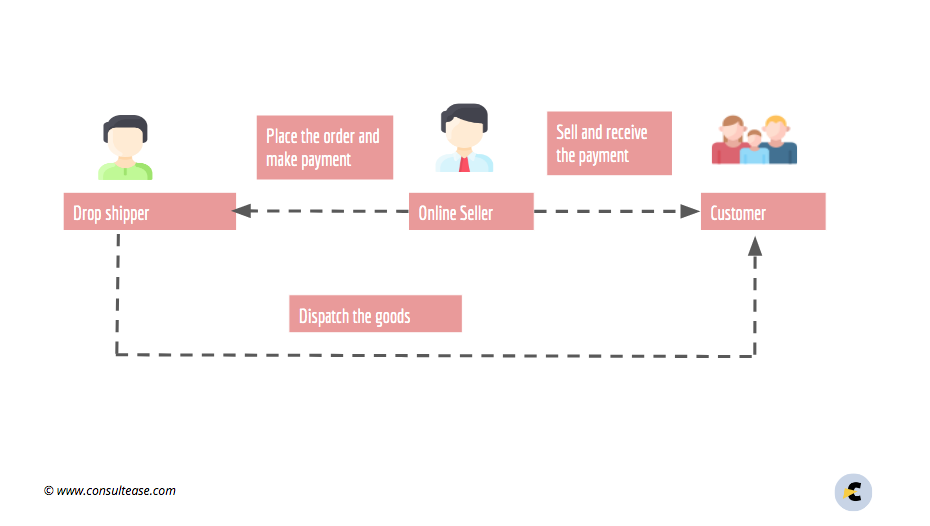

CA Shafaly Girdharwal wrote a new post, Analysis of GST on Drop Shipping business 4 years, 11 months ago

Introduction-

The latest trend in e-commerce is dropshipping. Shopify has expanded its horizons and helped in faster growth. But taxation is also an important aspect. GST on drop shipping business is applicable […]

-

CA Shafaly Girdharwal wrote a new post, [Blockage form 15th Oct] e way bill in GST :When and how to make 5 years ago

Latest Updates related to e way bill in GST.

The E-way bill can be blocked if the GSTR 3b is not filed for 2 months. This provision is applicable from 15th October. Initially, it is applicable for the taxpayers […]

-

CA Shafaly Girdharwal wrote a new post, Important changes in GST returns, GSTR 3b and 1 5 years ago

Introduction-

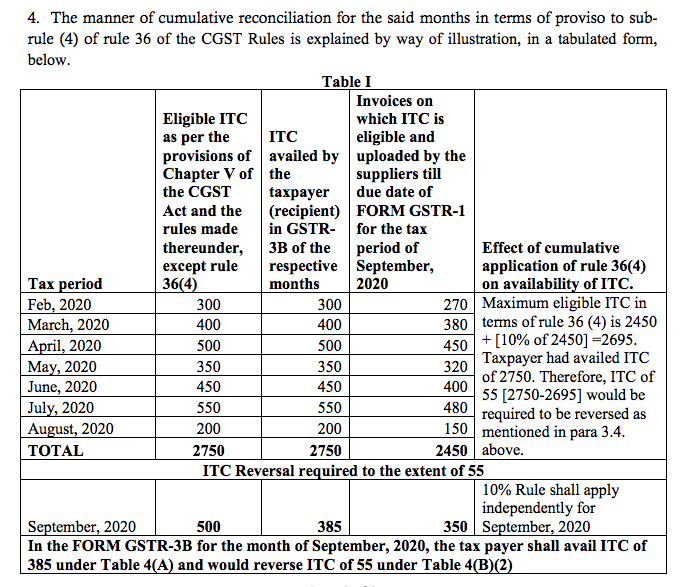

Due to lockdown, CBIC has amended the due date of GST returns. Also, the Input tax credit for 36(4) can also be adjusted cumulatively till June 2021. These changes are introduced via various […]

-

CA Shafaly Girdharwal wrote a new post, Composition late fees waiver- 5 things to know 5 years, 1 month ago

Composition late fees waiver-

The best relief of GST for small taxpayers. Late fees of composition dealers are waived off. But there are conditions and restrictions. Please read all of these carefully before you […]

-

CA Shafaly Girdharwal wrote a new post, GST Provisions need relaxation in COVID time 5 years, 1 month ago

Provisions need relaxation in COVID time

Many provisions of GST are made to handle the fraudsters. They are strict and restrictive. Many of them enable the department with extreme power. These provisions need […] - Load More

Karan Sharma

GST Suvidha

Paid User

@magic123

active 5 years, 6 months ago