GST Case 7- Cochin Plantations Ltd

In GST case of M/s. Cochin Plantation Ltd. The applicant has raised the question regarding the quit rent/lease rent paid to the government for agricultural […]

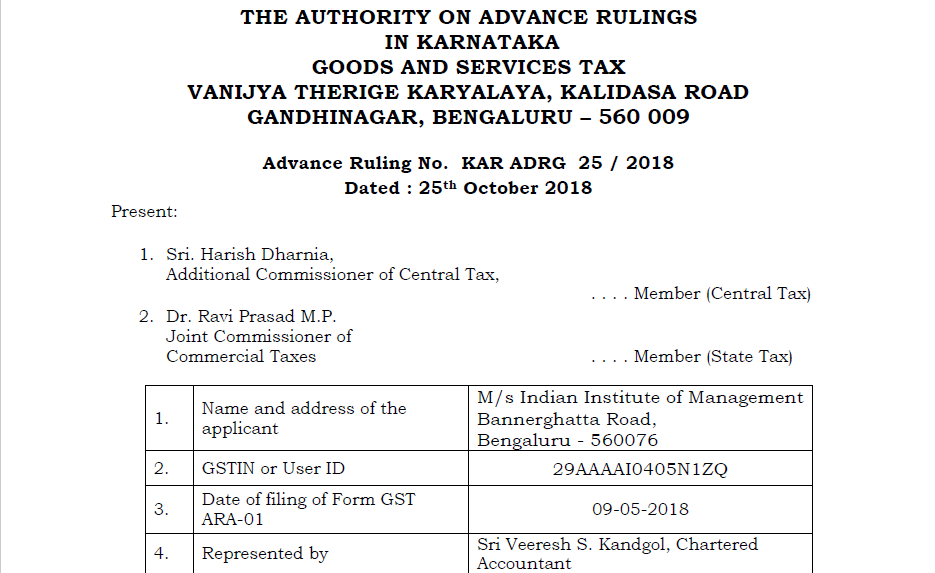

Original order of GST AAR of M/s Indian Institute of Management

Following is the original order of GST AAR of M/s Indian Institute of Management. In which the question tax liability of the services provided by […]

Checklist for GST Annual return

The due date for filing the GST Annual return is very near. So, let us discuss the checklist for GST Annual return to make the process easier for the taxpayer and […]

Services To Foreign University Not Export But Taxable Under GST

Since there was confusion prevalent on the issue of taxability of such services and whether such services can be considered as export of service or […]

Who is required to collect TCS in GST?

Every electronic commerce operator, not being an agent, shall collect an amount of TCS in GST. As per the Notification No. 51/2018, the provisions of the TCS will be […]

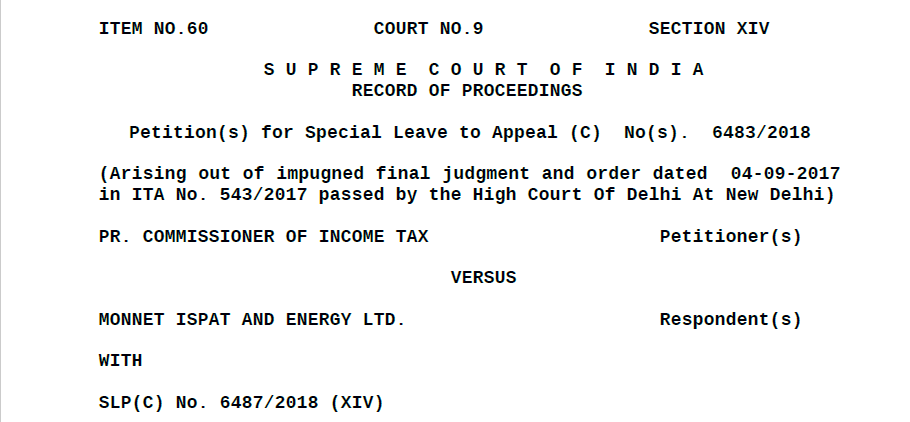

Insolvency and Bankruptcy Code override other enactments: Supreme Court

The Supreme Court of India has announced the order on 10 August 2018 regarding the Insolvency and Bankruptcy Code. In which the Supreme […]

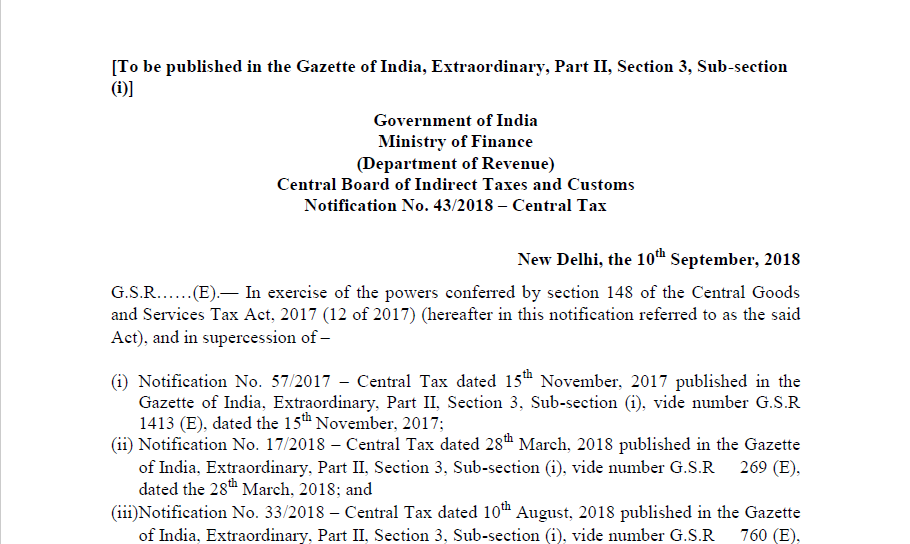

Notification No. 43/2018 – Central Tax

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 43/2018 – Central Tax

New Delhi, the […]

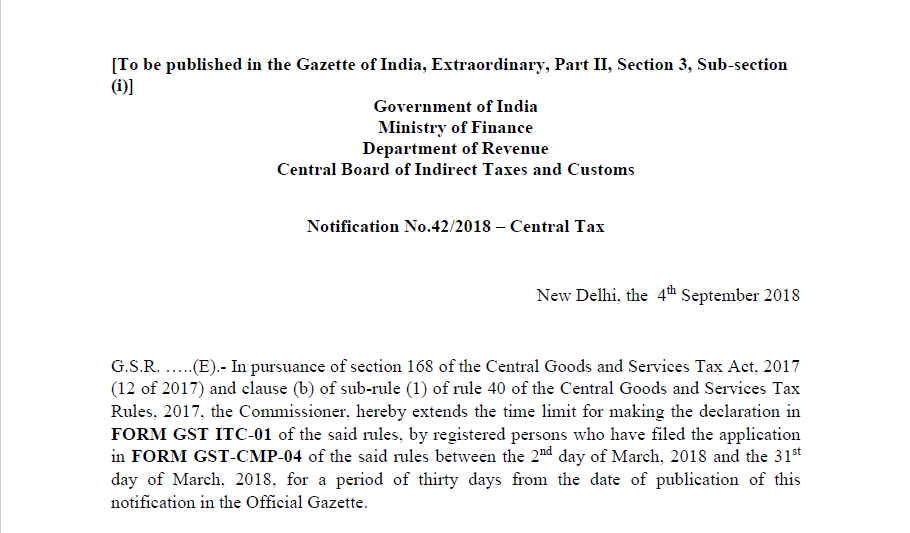

Notification No.42/2018 – Central Tax

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

Notification No.42/2018 – Central Tax

New Delhi, the 4th Sep […]

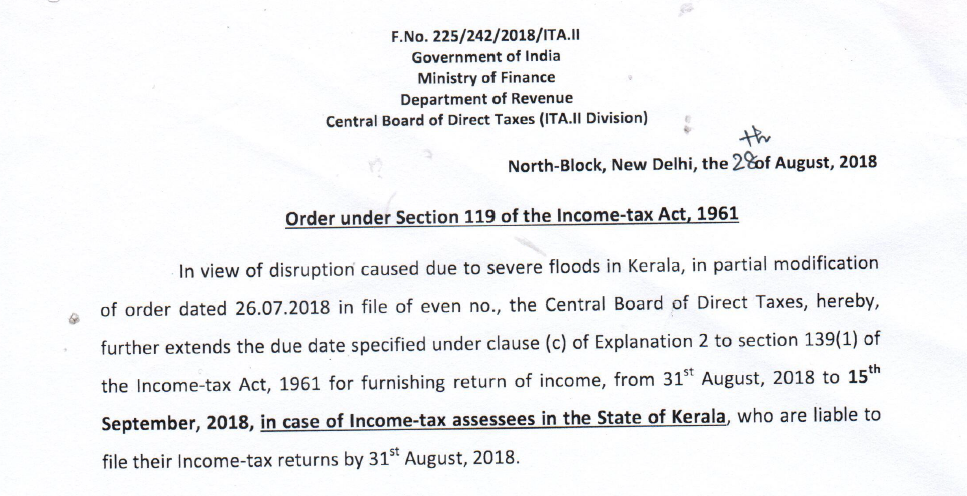

Extension of date for filing ITR in the State of Kerala

On 28th August 2018, Government of India has issued a Notification. In which, the extension of date for filing ITR in the State of Kerala was issued. The […]

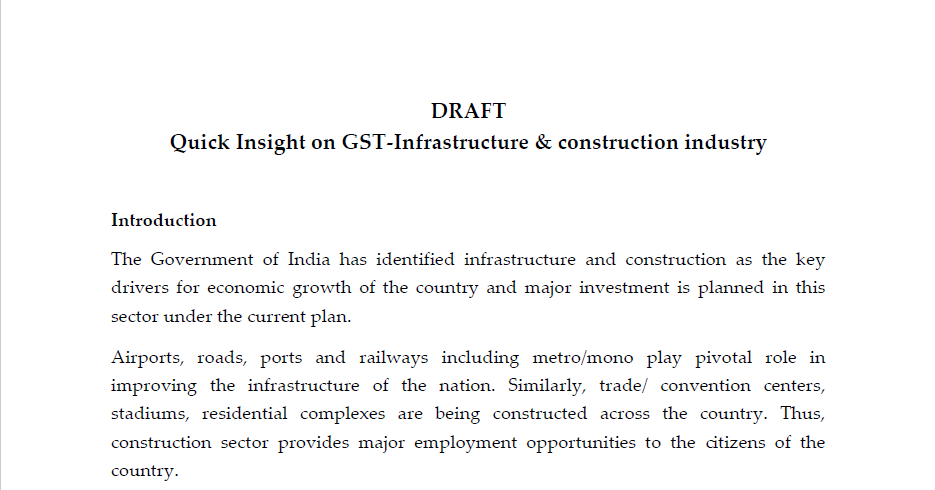

Infrastructure & construction industry under GST

After the introduction of GST, various industries are affected due to it. Let us discuss the situation of Infrastructure & construction industry under […]

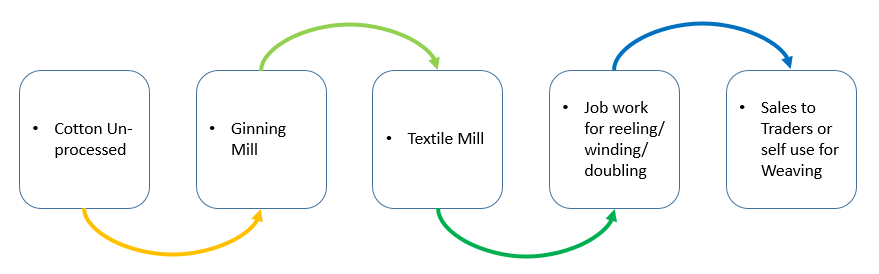

Textile industries under GST

After the introduction of GST, various industries are affected due to it. Let us discuss the situation of Textile industries under GST.

1. Introduction:

India’s textiles sector is […]

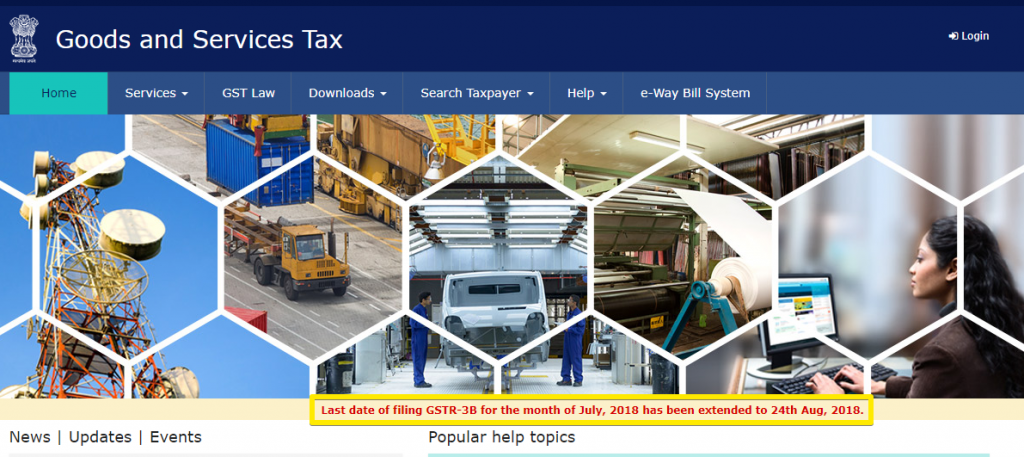

The date for Filing GSTR-3B Extends till 24 August 2018

On the last day of filing the GSTR-3B, the Date for Filing GSTR-3B Extends till 24 August 2018. The taxpayers were facing lot fo the problems while filing […]

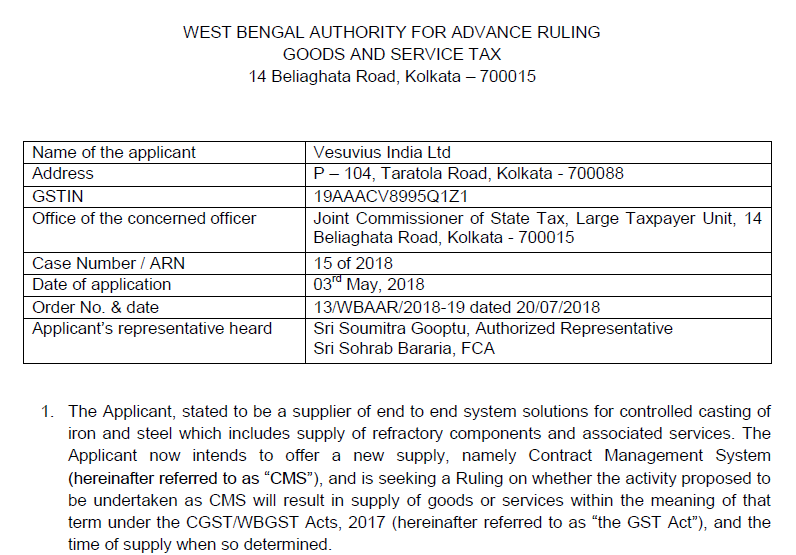

The time of supply will be the Date of Invoice in case of continuous supply of service: AAR

An advance ruling is given by the Authority of the advance ruling of West Bengal. The Applicant stated to be a supplier […]

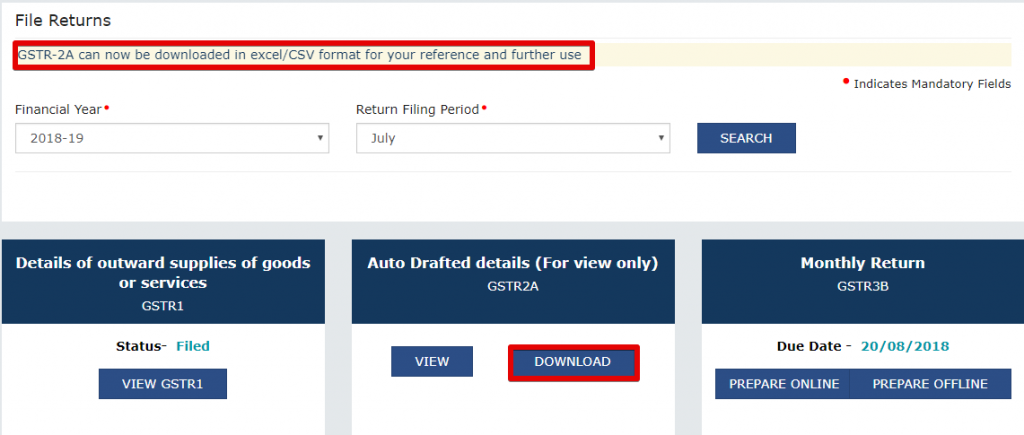

GSTR 2A in Excel Available now

The taxpayers are facing the difficulty of reconciling the credit availed and the credit which was reflected in the GSTR 2A. Because the file was not available to the taxpayer in […]

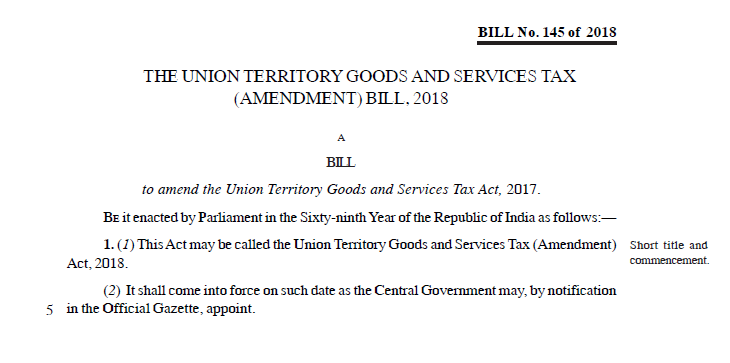

The Union Territory Goods and Services Tax (Amendment) Bill, 2018

Following is the text of the Bill:

BE it enacted by Parliament in the Sixty-ninth Year of the Republic of India as follows:—

1. (1) This Act ma […]

Calculation Under Section 80D

People love the people near them and care about them. And for that reason, people mostly take the medical insurance for the loved ones to keep them more safe and secure. The medical […]

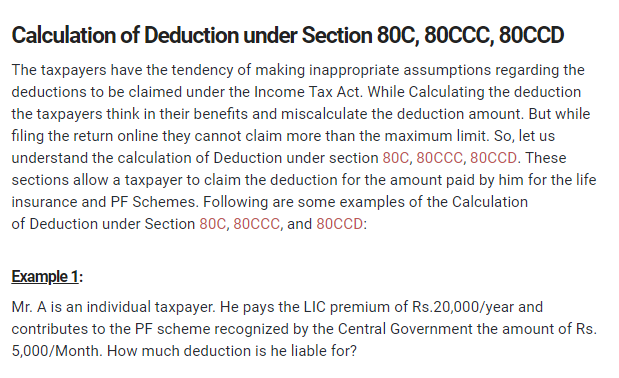

Calculation of Deduction under Section 80C, 80CCC, 80CCD

The taxpayers have the tendency of making inappropriate assumptions regarding the deductions to be claimed under the Income Tax Act. While Calculating the […]

Section 80CCC of Income Tax Act

Section 80CCC is the very important Part of the deduction available to Individual and HUF form their gross Income. Section 80CCC provides the deduction for the Contribution to […]

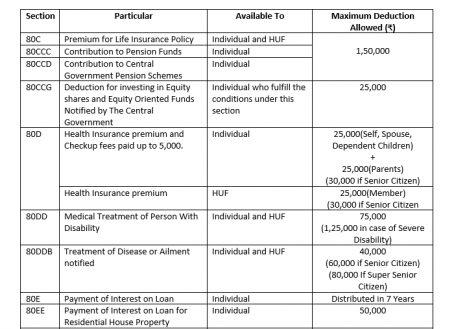

Deduction available to Individual and HUF from Gross Income under IT Act

The date for filing the Income Tax Return may have extended by the Government from 31st July 2018 to 31st August 2018. But still, the […]

Companies (Appointment and Qualification of Directors) fourth Amendment Rules, 2018.

Government of India

MINISTRY OF CORPORATE AFFAIRS

Notification

New Delhi, 5th July 2018

G.S.R. (E).-In exercise of the […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 5 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewNeeraj Kumar Rohila wrote a new post, GST Case 7- M/s. Cochin Plantations Ltd 7 years, 2 months ago

GST Case 7- Cochin Plantations Ltd

In GST case of M/s. Cochin Plantation Ltd. The applicant has raised the question regarding the quit rent/lease rent paid to the government for agricultural […]

Neeraj Kumar Rohila wrote a new post, Original order of GST AAR of M/s Indian Institute of Management 7 years, 2 months ago

Original order of GST AAR of M/s Indian Institute of Management

Following is the original order of GST AAR of M/s Indian Institute of Management. In which the question tax liability of the services provided by […]

Neeraj Kumar Rohila wrote a new post, Checklist for GST Annual return 7 years, 3 months ago

Checklist for GST Annual return

The due date for filing the GST Annual return is very near. So, let us discuss the checklist for GST Annual return to make the process easier for the taxpayer and […]

Neeraj Kumar Rohila wrote a new post, Services To Foreign University Not Export But Taxable Under GST 7 years, 3 months ago

Services To Foreign University Not Export But Taxable Under GST

Since there was confusion prevalent on the issue of taxability of such services and whether such services can be considered as export of service or […]

Neeraj Kumar Rohila wrote a new post, FAQ’s on TCS in GST to be applicable from 1st Oct 2018 7 years, 4 months ago

Who is required to collect TCS in GST?

Every electronic commerce operator, not being an agent, shall collect an amount of TCS in GST. As per the Notification No. 51/2018, the provisions of the TCS will be […]

Neeraj Kumar Rohila wrote a new post, Insolvency and Bankruptcy Code override other enactments: Supreme Court 7 years, 4 months ago

Insolvency and Bankruptcy Code override other enactments: Supreme Court

The Supreme Court of India has announced the order on 10 August 2018 regarding the Insolvency and Bankruptcy Code. In which the Supreme […]

Neeraj Kumar Rohila wrote a new post, Notification No. 43/2018 – Central Tax 7 years, 4 months ago

Notification No. 43/2018 – Central Tax

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Indirect Taxes and Customs

Notification No. 43/2018 – Central Tax

New Delhi, the […]

Neeraj Kumar Rohila wrote a new post, Notification No.42/2018 – Central Tax 7 years, 5 months ago

Notification No.42/2018 – Central Tax

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

Notification No.42/2018 – Central Tax

New Delhi, the 4th Sep […]

Neeraj Kumar Rohila wrote a new post, Extension of date for filing ITR in the State of Kerala 7 years, 5 months ago

Extension of date for filing ITR in the State of Kerala

On 28th August 2018, Government of India has issued a Notification. In which, the extension of date for filing ITR in the State of Kerala was issued. The […]

Neeraj Kumar Rohila wrote a new post, Infrastructure & construction industry under GST 7 years, 5 months ago

Infrastructure & construction industry under GST

After the introduction of GST, various industries are affected due to it. Let us discuss the situation of Infrastructure & construction industry under […]

Neeraj Kumar Rohila wrote a new post, Textile industries under GST 7 years, 5 months ago

Textile industries under GST

After the introduction of GST, various industries are affected due to it. Let us discuss the situation of Textile industries under GST.

1. Introduction:

India’s textiles sector is […]

Neeraj Kumar Rohila wrote a new post, Date for Filing GSTR-3B Extends 7 years, 5 months ago

The date for Filing GSTR-3B Extends till 24 August 2018

On the last day of filing the GSTR-3B, the Date for Filing GSTR-3B Extends till 24 August 2018. The taxpayers were facing lot fo the problems while filing […]

Neeraj Kumar Rohila wrote a new post, The time of supply will be the Date of Invoice in case of continuous supply of service: AAR 7 years, 5 months ago

The time of supply will be the Date of Invoice in case of continuous supply of service: AAR

An advance ruling is given by the Authority of the advance ruling of West Bengal. The Applicant stated to be a supplier […]

Neeraj Kumar Rohila wrote a new post, GSTR 2A in Excel Available now 7 years, 5 months ago

GSTR 2A in Excel Available now

The taxpayers are facing the difficulty of reconciling the credit availed and the credit which was reflected in the GSTR 2A. Because the file was not available to the taxpayer in […]

Neeraj Kumar Rohila wrote a new post, The Union Territory Goods and Services Tax (Amendment) Bill, 2018 7 years, 5 months ago

The Union Territory Goods and Services Tax (Amendment) Bill, 2018

Following is the text of the Bill:

BE it enacted by Parliament in the Sixty-ninth Year of the Republic of India as follows:—

1. (1) This Act ma […]

Neeraj Kumar Rohila wrote a new post, Calculation Under Section 80D 7 years, 5 months ago

Calculation Under Section 80D

People love the people near them and care about them. And for that reason, people mostly take the medical insurance for the loved ones to keep them more safe and secure. The medical […]

Neeraj Kumar Rohila wrote a new post, Calculation of Deduction u/s 80C, 80CCC, 80CCD 7 years, 6 months ago

Calculation of Deduction under Section 80C, 80CCC, 80CCD

The taxpayers have the tendency of making inappropriate assumptions regarding the deductions to be claimed under the Income Tax Act. While Calculating the […]

Neeraj Kumar Rohila wrote a new post, Section 80CCC of Income Tax Act 7 years, 6 months ago

Section 80CCC of Income Tax Act

Section 80CCC is the very important Part of the deduction available to Individual and HUF form their gross Income. Section 80CCC provides the deduction for the Contribution to […]

Neeraj Kumar Rohila wrote a new post, Deduction available to Individual and HUF 7 years, 6 months ago

Deduction available to Individual and HUF from Gross Income under IT Act

The date for filing the Income Tax Return may have extended by the Government from 31st July 2018 to 31st August 2018. But still, the […]

Neeraj Kumar Rohila wrote a new post, Companies (Appointment and Qualification of Directors) fourth Amendment Rules, 2018. 7 years, 6 months ago

Companies (Appointment and Qualification of Directors) fourth Amendment Rules, 2018.

Government of India

MINISTRY OF CORPORATE AFFAIRS

Notification

New Delhi, 5th July 2018

G.S.R. (E).-In exercise of the […]