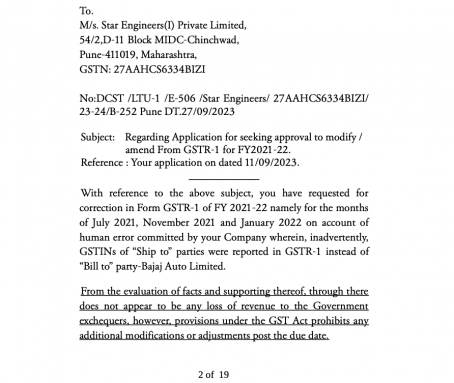

In this case rectification was allowed by the court. We have very strong jurisprudence related to the rectification in bona fide cases.

Case Details-

Start Engineers Pvt Ltd

When the courts allowed the rectification-

The scheme of GST always allowed the rectification in return. But in many cases the portal restricted it. But initial hiccups of GSTIN made it difficult. In many cases […]

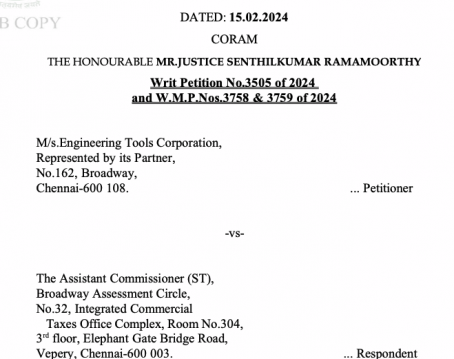

No ITC reversal-

In a recent judgment the court has observed that the ITC shouldn’t be denied merely on fact that the registration of supplier is cancelled.

The contentions of the petitioner were rejected […]

When registrations are cancelled by the departments-

In many cases the department is cancelling the registrations of suppliers. There can be various stances when a registration can be cancelled.-

1- Why an SCN is issued ?

The Show cause notice gets its power from the principles of natural justice. Although most of the statutes provide for its issuance. But even if it is not written in any statute, SCN is […]

Restaurant Penalised for Overcharging GST on Packaged Drinking Water

The Sambalpur District Consumer Court penalised a restaurant on VSS Marg in Sambalpur for charging GST on a packaged drinking water bottle, in […]

ICAI Releases February 2024 Edition

The Institute of Chartered Accountants of India (ICAI) has recently launched the February 2024 edition of “Compliances of GST in the Banking Sector.” This […]

ICAI Unveils February 2024 Edition: “Navigating GST Compliance in the Banking Sector”

The Institute of Chartered Accountants of India (ICAI) has launched the much-anticipated February 2024 edi […]

A recruitment consultancy, often called a staffing or employment agency, connects employers with suitable candidates for job vacancies. These consultancies play a crucial role in hiring by sourcing, screening, and […]

Streamlining Norm Fixation Process: DGFT Issues Public Notice

The Directorate General of Foreign Trade (DGFT) has issued Public Notice No. 15/2023 dated March 14, 2024, introducing amendments to […]

Insurance Sector Challenges GST Tax Demand

Amidst mounting concerns over a hefty Goods and Services Tax (GST) tax demand, insurance companies are mulling legal action to seek clarity on the […]

Introduction

The Ministry of Home Affairs (MHA) has announced a significant welfare measure aimed at benefiting serving and retired personnel of Central Armed Police Forces (CAPFs), Central […]

Introduction:

The Central Board of Indirect Tax and Customs (CBIC) has introduced a novel approach to investigating the tax liabilities of multinational corporations (MNCs) through the […]

Revolutionizing Infrastructure: New GST Bhawan and Residential Quarters in Hyderabad

In a significant stride towards infrastructure development, the Revenue Secretary, Shri Sanjay Malhotra, […]

Government Mulls Amendments to MSME Development Act for Prompt Payment

The central government is considering further empowering provisions to ensure prompt settlement of delayed payments to […]

Boosting GST Collection: Congress Guarantee Schemes

Chief Minister Siddaramaiah has attributed the surge in Goods and Services Tax (GST) collection in Karnataka to the effective implementation […]

Insurance Companies Navigate Legal Waters Amidst GST Commission Tax Demand

In a bid to resolve a looming tax conundrum, insurance companies are contemplating legal action regarding a tax […]

Empowering Police Welfare: Ministry of Home Affairs Offers 50% GST Relief

In an effort to bolster the welfare of law enforcement personnel across the nation, the Ministry of Home Affairs has […]

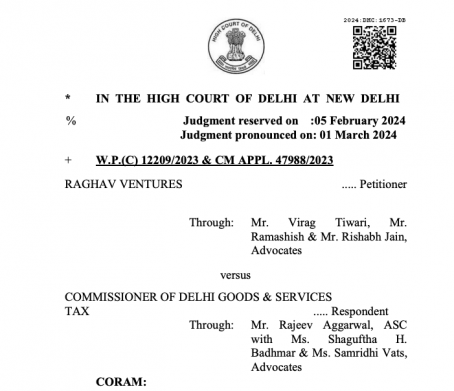

In a recent decision the Delhi high court has held that the TP is eligible for interest on refund. In GST the rate of interest on refund is 6%. It is mandatory even if the TP has not asked for it specifically for […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 6 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Rectification of return allowed by Bombay high court 1 year, 10 months ago

In this case rectification was allowed by the court. We have very strong jurisprudence related to the rectification in bona fide cases.

Case Details-

Start Engineers Pvt Ltd

Versus

Union of […]

CA Shafaly Girdharwal wrote a new post, 10 times when court allowed to rectify GST returns to claim ITC 1 year, 11 months ago

When the courts allowed the rectification-

The scheme of GST always allowed the rectification in return. But in many cases the portal restricted it. But initial hiccups of GSTIN made it difficult. In many cases […]

CA Shafaly Girdharwal wrote a new post, ITC shall not be rejected for cancellation of registration of supplier- HC 1 year, 11 months ago

No ITC reversal-

In a recent judgment the court has observed that the ITC shouldn’t be denied merely on fact that the registration of supplier is cancelled.

The contentions of the petitioner were rejected […]

CA Shafaly Girdharwal wrote a new post, Judgments on ITC reversal for retro cancellation of regitration of supplier 1 year, 11 months ago

When registrations are cancelled by the departments-

In many cases the department is cancelling the registrations of suppliers. There can be various stances when a registration can be cancelled.-

When the […]

CA Shafaly Girdharwal wrote a new post, Judgments on Cryptic Notices which are invalid 1 year, 11 months ago

1- Why an SCN is issued ?

The Show cause notice gets its power from the principles of natural justice. Although most of the statutes provide for its issuance. But even if it is not written in any statute, SCN is […]

ConsultEase Administrator wrote a new post, Restaurant Penalised for Overcharging GST on Water Bottle 1 year, 11 months ago

Restaurant Penalised for Overcharging GST on Packaged Drinking Water

The Sambalpur District Consumer Court penalised a restaurant on VSS Marg in Sambalpur for charging GST on a packaged drinking water bottle, in […]

ConsultEase Administrator wrote a new post, ICAI’s Latest: Understanding GST Compliance in Banking 1 year, 11 months ago

ICAI Releases February 2024 Edition

The Institute of Chartered Accountants of India (ICAI) has recently launched the February 2024 edition of “Compliances of GST in the Banking Sector.” This […]

ConsultEase Administrator wrote a new post, Navigating GST Compliance: ICAI’s Latest Banking Sector Guide 1 year, 11 months ago

ICAI Unveils February 2024 Edition: “Navigating GST Compliance in the Banking Sector”

The Institute of Chartered Accountants of India (ICAI) has launched the much-anticipated February 2024 edi […]

ConsultEase Administrator wrote a new post, Advantages of Recruitment Consultancy 1 year, 11 months ago

A recruitment consultancy, often called a staffing or employment agency, connects employers with suitable candidates for job vacancies. These consultancies play a crucial role in hiring by sourcing, screening, and […]

ConsultEase Administrator wrote a new post, DGFT Enhances Norm Fixation Process: Streamlining Trade Operations 1 year, 11 months ago

Streamlining Norm Fixation Process: DGFT Issues Public Notice

The Directorate General of Foreign Trade (DGFT) has issued Public Notice No. 15/2023 dated March 14, 2024, introducing amendments to […]

ConsultEase Administrator wrote a new post, Insurance Industry Challenges GST Taxation on Co-Insurance Commissions 1 year, 11 months ago

Insurance Sector Challenges GST Tax Demand

Amidst mounting concerns over a hefty Goods and Services Tax (GST) tax demand, insurance companies are mulling legal action to seek clarity on the […]

ConsultEase Administrator wrote a new post, GST Relief for Security Personnel: MHA’s Welfare Initiative 1 year, 11 months ago

Introduction

The Ministry of Home Affairs (MHA) has announced a significant welfare measure aimed at benefiting serving and retired personnel of Central Armed Police Forces (CAPFs), Central […]

ConsultEase Administrator wrote a new post, CBIC Adopts New Approach to GST Investigations for MNCs 1 year, 11 months ago

Introduction:

The Central Board of Indirect Tax and Customs (CBIC) has introduced a novel approach to investigating the tax liabilities of multinational corporations (MNCs) through the […]

ConsultEase Administrator wrote a new post, Modernizing Hyderabad: The New GST Bhawan Project 1 year, 11 months ago

Revolutionizing Infrastructure: New GST Bhawan and Residential Quarters in Hyderabad

In a significant stride towards infrastructure development, the Revenue Secretary, Shri Sanjay Malhotra, […]

ConsultEase Administrator wrote a new post, MSME Payment Reform: Government Considers Amendments 1 year, 11 months ago

Government Mulls Amendments to MSME Development Act for Prompt Payment

The central government is considering further empowering provisions to ensure prompt settlement of delayed payments to […]

ConsultEase Administrator wrote a new post, State Guarantee Schemes Drive GST Growth in Karnataka 1 year, 11 months ago

Boosting GST Collection: Congress Guarantee Schemes

Chief Minister Siddaramaiah has attributed the surge in Goods and Services Tax (GST) collection in Karnataka to the effective implementation […]

ConsultEase Administrator wrote a new post, Insurance Industry Faces GST Commission Tax Dispute 1 year, 11 months ago

Insurance Companies Navigate Legal Waters Amidst GST Commission Tax Demand

In a bid to resolve a looming tax conundrum, insurance companies are contemplating legal action regarding a tax […]

ConsultEase Administrator wrote a new post, Ministry of Home Affairs Grants 50% GST Relief for Police Welfare 1 year, 11 months ago

Empowering Police Welfare: Ministry of Home Affairs Offers 50% GST Relief

In an effort to bolster the welfare of law enforcement personnel across the nation, the Ministry of Home Affairs has […]

CA Shafaly Girdharwal wrote a new post, Interest is payable even if not asked by TP-HC 1 year, 11 months ago

In a recent decision the Delhi high court has held that the TP is eligible for interest on refund. In GST the rate of interest on refund is 6%. It is mandatory even if the TP has not asked for it specifically for […]

ConsultEase Administrator wrote a new post, CESTAT Ruling: Clarifying Service Tax Imposition Criteria 1 year, 11 months ago

CESTAT Ruling on Service Tax Imposition

The Delhi Bench of Customs, Excise, and Service Tax Appellate Tribunal (CESTAT) recently ruled that the imposition of service tax requires the […]