Central Government amends the Schedule-III of the Companies Act, 2013 in the exercise of the powers conferred by Section 467 of the Companies Act, 2013. These shall come into effect from […]

Introduction:

MCA Notifies Companies (Audit and Auditors) Amendment Rules, 2021 in the exercise of powers conferred by sections 139, 143, 147, and 148 read with sub-sections (1) and (2) of section 469 of the […]

The Commissioner

Facts of the Case:

W.P.(MD)No.10186 of 2014 has been filed by the importer/company, while the other writ petition has been filed by the […]

Introduction:

The UP AAR in the case of M/S. Dwarikesh Sugar Industries Limited held that expenses incurred towards Corporate Social Responsibility (CSR) by the Company in order to comply with requirements under […]

Case Covered:

M/s Ion Trading India Pvt Ltd

Facts of the Case:

M/s ION Trading India Private Limited, Building No. 2, Infospace, 4-6th Floor, Block-B, Plot-2, Sector-62, Noida, Uttar Pradesh (here in after […]

Press Note: CBIC

Unconfirmed reports have appeared in certain sections of the media that some GST officers are using unauthorized communication means such as phone calls, WhatsApp, and messages asking taxpayers […]

Additional Director General, Directorate General of Goods And Service Tax Intelligence

Facts of the Case:

This is an application filed by the petitioner to […]

Introduction

GST provisions applicable from 1st April 2021 are discussed here in this article. There is a long list of the new provisions. Gradually it is getting riskier to avoid GST compliances. Department is […]

Chapter 1 Banking Sector – An Overview

Service Tax Applicability On Banks

Service Tax was introduced in India on 01.07.1994. However, Banking and Other Financial Services had been brought within the ambit of S […]

These FAQs On E-Invoicing in GST are drafted

1. What is ‘e-invoicing’?

Ans. E-Invoicing means a system in which notified class of registered person uploads specified particulars of B2B Invoices on Invoice Reg […]

Income tax assessments are being done in a faceless manner, this was stated by Shri Anurag Singh Thakur, Union Minister of State for Finance & Corporate Affairs, in a written reply to a question in Rajya […]

The Assistant Commissioner

Facts of the Case:

This batch of 23 Writ Petitions has been filed by assessees under the Tamil Nadu Goods and Service Tax Act, 2017 […]

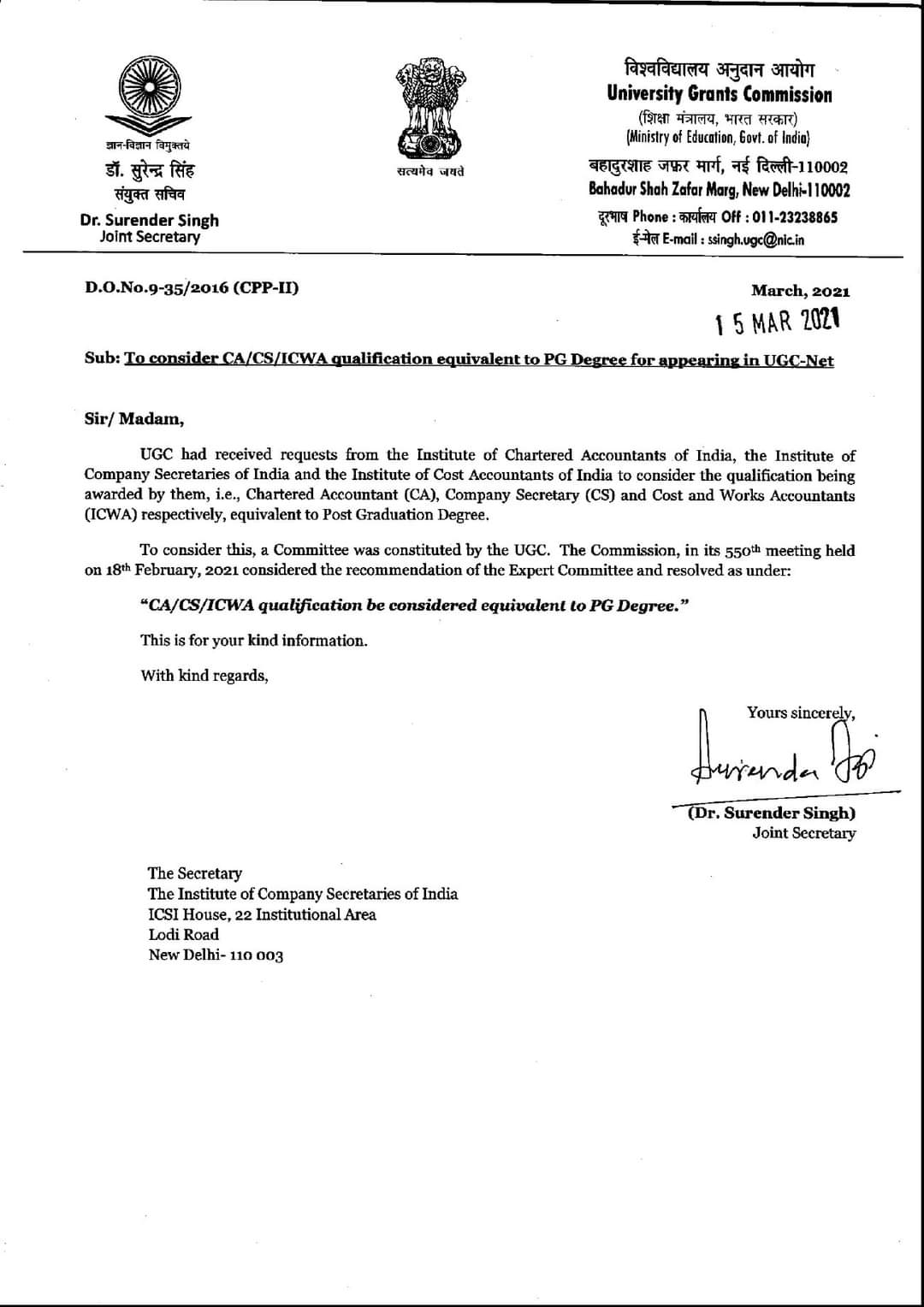

University Grants Commission

Bahadur Shah Zafar Marg, New Delhi-110002

off: 011-23238865

E-mail: ssingh.ugc@nic.in

Dr. Surender Singh

Joint Secretary

D.O.No.9-35/2016 (CPP-II)

15 March 2021

Sub: To […]

Union of India

Facts of the Case:

By this writ application under Article 226 of the Constitution of India, the writ applicant, a company, has prayed for […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 6 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, MCA Notifies Amendments in Schedule-III of Companies Act, 2013 Effective From 01.04.2021 4 years, 10 months ago

Central Government amends the Schedule-III of the Companies Act, 2013 in the exercise of the powers conferred by Section 467 of the Companies Act, 2013. These shall come into effect from […]

ConsultEase Administrator wrote a new post, Important Changes in MCA Compliances from 1.04.2021 4 years, 11 months ago

Introduction:

MCA Notifies Companies (Audit and Auditors) Amendment Rules, 2021 in the exercise of powers conferred by sections 139, 143, 147, and 148 read with sub-sections (1) and (2) of section 469 of the […]

ConsultEase Administrator wrote a new post, Madras HC in the case of Quantum Coal Energy (P) Ltd 4 years, 11 months ago

Case Covered:

Quantum Coal Energy (P) Ltd

Versus

The Commissioner

Facts of the Case:

W.P.(MD)No.10186 of 2014 has been filed by the importer/company, while the other writ petition has been filed by the […]

ConsultEase Administrator wrote a new post, Madras HC in the case of Sri Kanniga Parameswari Modern Rice Mill Versus The State Tax Officer 4 years, 11 months ago

Case Covered:

Sri Kanniga Parameswari Modern Rice Mill

Versus

The State Tax Officer

Common Order:

Mr.ANR.Jayaprathap learned Government Advocate accepts notice for the respondent and is armed with […]

ConsultEase Administrator wrote a new post, Trade Notice No. 47/2020-21 4 years, 11 months ago

Trade Notice No. 47/2020-21

Subject: Issuance of Import Authorization for ‘Restricted’ items from DGFT HQs w.e.f. March 22, 2021.

Reference is invited to Trade Notice No. 49 dt. 15.03.2019 vide which a new m […]

ConsultEase Administrator wrote a new post, Uttar Pradesh AAR in the case of M/s. Dwarikesh Sugar Industries Limited 4 years, 11 months ago

Introduction:

The UP AAR in the case of M/S. Dwarikesh Sugar Industries Limited held that expenses incurred towards Corporate Social Responsibility (CSR) by the Company in order to comply with requirements under […]

ConsultEase Administrator wrote a new post, Gujarat HC in the case of JAP Modular Furniture Concepts (P) Ltd. 4 years, 11 months ago

Case Covered:

JAP Modular Furniture Concepts (P) Ltd.

Versus

State of Gujarat

Facts of the Case:

By this writ application under Article 226 of the Constitution of India, the writ applicants have prayed […]

ConsultEase Administrator wrote a new post, Uttar Pradesh AAAR In M/s Ion Trading India Pvt Ltd 4 years, 11 months ago

Case Covered:

M/s Ion Trading India Pvt Ltd

Facts of the Case:

M/s ION Trading India Private Limited, Building No. 2, Infospace, 4-6th Floor, Block-B, Plot-2, Sector-62, Noida, Uttar Pradesh (here in after […]

ConsultEase Administrator wrote a new post, Most Important Clarification by CBIC on Unauthorized Demands by Tax Officers 4 years, 11 months ago

Press Note: CBIC

Unconfirmed reports have appeared in certain sections of the media that some GST officers are using unauthorized communication means such as phone calls, WhatsApp, and messages asking taxpayers […]

ConsultEase Administrator wrote a new post, Andhra Pradesh HC in the case of M/s. OSTRO Anantapura Private Limited 4 years, 11 months ago

Case Covered:

M/s. OSTRO Anantapura Private Limited

Facts of the Case:

The petitioner’s case is thus:

a) The petitioner is M/s. OSTRO Anantapura Private Limited, Anantapuram, and a Company engaged in the b […]

ConsultEase Administrator wrote a new post, Delhi HC in the case of M/s. Mridul Tobie Inc. 4 years, 11 months ago

Case Covered:

M/s. Mridul Tobie Inc.

Versus

Additional Director General, Directorate General of Goods And Service Tax Intelligence

Facts of the Case:

This is an application filed by the petitioner to […]

Advocate Pradeep Kumar wrote a new post, Onus to Pay Fresh Tax or Increase in Rate of GST in Supply of Goods or Services 4 years, 11 months ago

The onus to Pay Fresh Tax or Increase in Rate of GST in Supply of Goods or Services

In day-to-day life, invariably Agreements are entered into with the Principal who is Government or Government Department […]

CA Shafaly Girdharwal wrote a new post, GST provisions applicable from 1st April 2021 4 years, 11 months ago

Introduction

GST provisions applicable from 1st April 2021 are discussed here in this article. There is a long list of the new provisions. Gradually it is getting riskier to avoid GST compliances. Department is […]

ConsultEase Administrator wrote a new post, Compliances of GST in Banking Sector: ICAI 4 years, 11 months ago

Chapter 1 Banking Sector – An Overview

Service Tax Applicability On Banks

Service Tax was introduced in India on 01.07.1994. However, Banking and Other Financial Services had been brought within the ambit of S […]

ConsultEase Administrator wrote a new post, FAQs On E-Invoicing in GST- How, when and who is liable 4 years, 11 months ago

These FAQs On E-Invoicing in GST are drafted

1. What is ‘e-invoicing’?

Ans. E-Invoicing means a system in which notified class of registered person uploads specified particulars of B2B Invoices on Invoice Reg […]

ConsultEase Administrator wrote a new post, 82,072 assessment cases completed in faceless manner till 10th March 2021: PIB 4 years, 11 months ago

Income tax assessments are being done in a faceless manner, this was stated by Shri Anurag Singh Thakur, Union Minister of State for Finance & Corporate Affairs, in a written reply to a question in Rajya […]

ConsultEase Administrator wrote a new post, Madras HC in the case of M/s.DMR Constructions Versus The Assistant Commissioner 4 years, 11 months ago

Case Covered:

M/s.DMR Constructions

Versus

The Assistant Commissioner

Facts of the Case:

This batch of 23 Writ Petitions has been filed by assessees under the Tamil Nadu Goods and Service Tax Act, 2017 […]

ConsultEase Administrator wrote a new post, UGC to consider CA/CS/ICWA qualification equivalent to PG Degree for appearing in UGC-Net. 4 years, 11 months ago

University Grants Commission

Bahadur Shah Zafar Marg, New Delhi-110002

off: 011-23238865

E-mail: ssingh.ugc@nic.in

Dr. Surender Singh

Joint Secretary

D.O.No.9-35/2016 (CPP-II)

15 March 2021

Sub: To […]

ConsultEase Administrator wrote a new post, Gujarat HC in the case of Messrs Mahalaxmi Rubtech Ltd. Versus Union of India 4 years, 11 months ago

Case Covered:

Messrs Mahalaxmi Rubtech Ltd.

Versus

Union of India

Facts of the Case:

By this writ application under Article 226 of the Constitution of India, the writ applicant, a company, has prayed for […]

ConsultEase Administrator wrote a new post, Karnataka HC in the case of Mr. Virendra Khanna Versus State of Karnataka 4 years, 11 months ago

Case Covered:

Mr. Virendra Khanna

Versus

State of Karnataka

Facts of the Case:

In the petition, it is contended that:

The petitioner is an IT Engineer, having studied in M/s RV College of Engineering, […]