The Tribunals Reforms (Rationalization And Conditions Of Service) Bill, 2021

A BILL further to amend the Cinematograph Act, 1952, the Customs Act, 1962, the Airports Authority of India Act, 1994, the Trade Marks […]

DGGI

Facts of the Case:

The present petition has been filed under section 438 Cr.P.C. seeking anticipatory bail to the petitioner in relation to the […]

The Commissioner of GST And Central Excise

Order:

Learned counsel for the petitioner submits that indisputably assessment for the relevant period has not been completed by […]

The Deputy Director, The Directorate of Enforcement

Facts of the Case:

First Leasing Company of India Limited (in short “FLCI”) was a company incorporated under the […]

Notification No. 2/2021-Customs

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. […]

Notification

S.O.471(E).- In exercise of powers conferred by section 3 of the Direct Tax Vivad se Vishwas Act, 2020 (3 of 2020), the Central Government hereby makes the following amendment in the notification of […]

Amendments to GST Acts through Finance Bill 2021

Central Goods and Services Tax

Amendment of section 7.

In the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the Central Goods and Services […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 6 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, The Tribunals Reforms (Rationalization And Conditions Of Service) Bill, 2021 5 years ago

The Tribunals Reforms (Rationalization And Conditions Of Service) Bill, 2021

A BILL further to amend the Cinematograph Act, 1952, the Customs Act, 1962, the Airports Authority of India Act, 1994, the Trade Marks […]

ConsultEase Administrator wrote a new post, Delhi HC in the case of Lupita Saluja Versus DGGI 5 years ago

Case Covered:

Lupita Saluja

Versus

DGGI

Facts of the Case:

The present petition has been filed under section 438 Cr.P.C. seeking anticipatory bail to the petitioner in relation to the […]

ConsultEase Administrator wrote a new post, Delhi HC in the case of Del Small Ice Cream Manufacturers Welfare’s Association Versus Union of India 5 years ago

Case Covered:

Del Small Ice Cream Manufacturers Welfare’s Association

Versus

Union of India

Facts of the Case:

The petitioner, claiming to represent the interest of more than 50 small scale ice cream […]

ConsultEase Administrator wrote a new post, Gujarat HC in the case of M/s Hemani Intermediates Private Limited Versus Union of India 5 years ago

Case Covered:

M/s Hemani Intermediates Private Limited

Versus

Union of India

Oral Order:

This is one more matter amongst many other matters that have come up before this Court in the last on […]

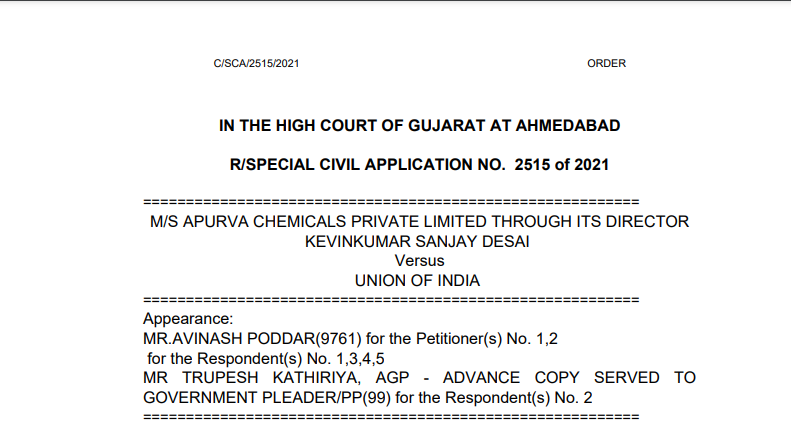

ConsultEase Administrator wrote a new post, Gujarat HC in the case of M/s Apurva Chemicals Private Limited Versus Union of India 5 years ago

Case Covered:

M/s Apurva Chemicals Private Limited

Versus

Union of India

Oral Order:

We have heard Mr. Avinash Poddar, the learned counsel appearing for the writ applicant.

This is one more matter whe […]

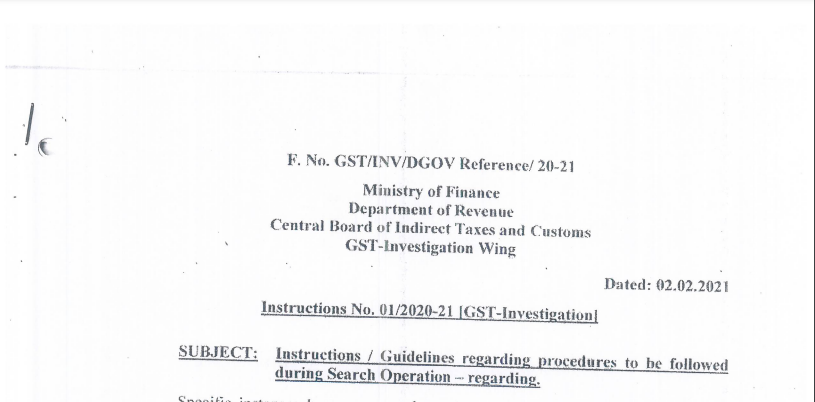

ConsultEase Administrator wrote a new post, Instruction No. 1/2020-21 [GST-Investigation] 5 years ago

Instruction No. 1/2020-21 [GST-Investigation]

Subject: Instructions/Guidelines regarding procedures to be followed during Search Operation-regarding.

Specific instances have come to the notice of the Board and […]

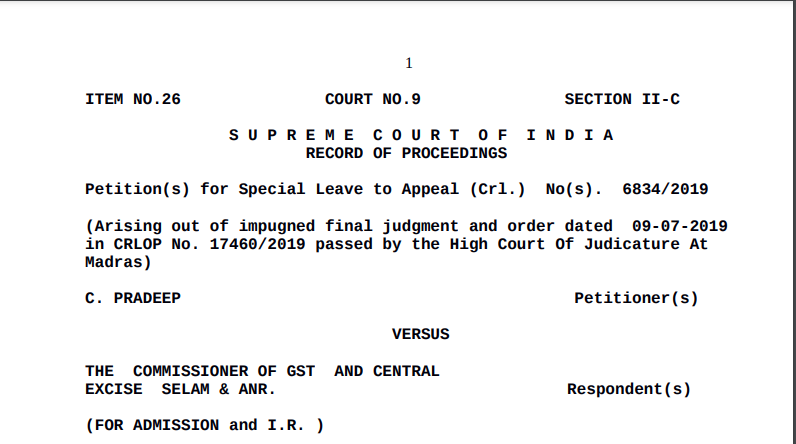

ConsultEase Administrator wrote a new post, Supreme Court in the case of C. Pradeep Versus The Commissioner of GST And Central Excise 5 years ago

Case Covered:

C. Pradeep

Versus

The Commissioner of GST And Central Excise

Order:

Learned counsel for the petitioner submits that indisputably assessment for the relevant period has not been completed by […]

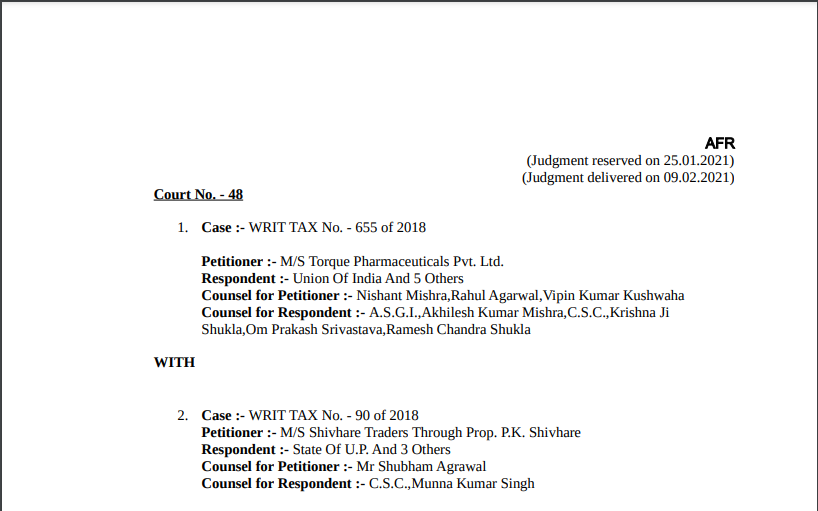

ConsultEase Administrator wrote a new post, Allahabad HC in the case of M/s Torque Pharmaceuticals Pvt. Ltd. Versus Union Of India 5 years ago

Case Covered:

M/s Torque Pharmaceuticals Pvt. Ltd.

Versus

Union Of India

Facts of the Case:

Briefly stated facts of the present case are that the impugned orders passed in this batch of writ petitions are […]

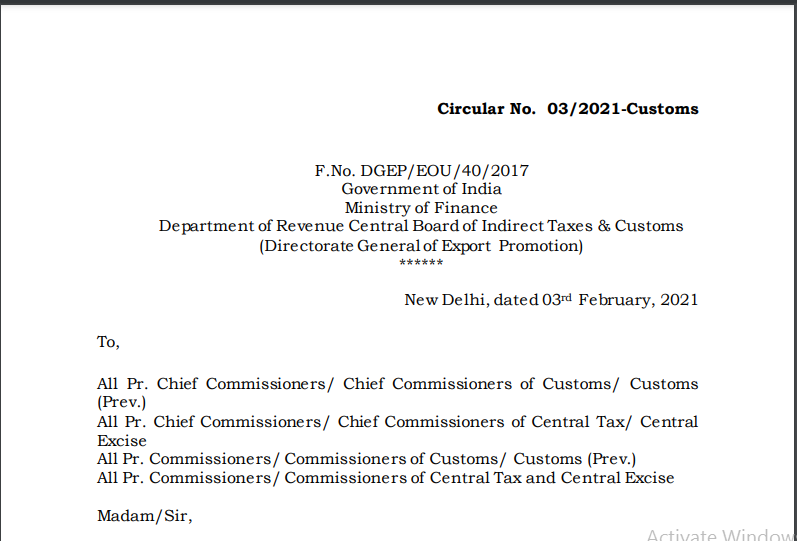

ConsultEase Administrator wrote a new post, Circular No. 03/2021-Customs 5 years ago

Circular No. 03/2021-Customs

To,

All Pr. Chief Commissioners/ Chief Commissioners of Customs/ Customs (Prev.)

All Pr. Chief Commissioners/ Chief Commissioners of Central Tax/ Central Excise

All Pr. […]

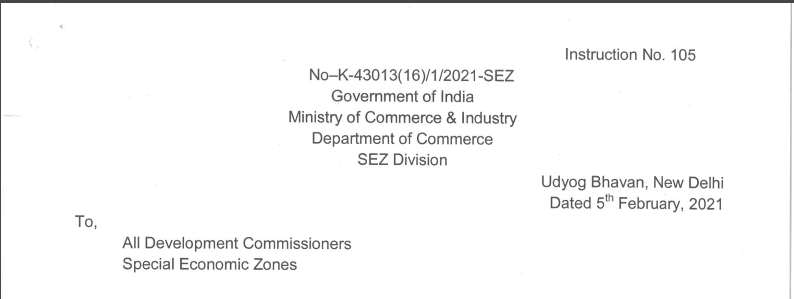

ConsultEase Administrator wrote a new post, One-time waiver of Custom Duty as well as inspection 5 years ago

Instruction No. 105

To,

All Development Commissioners

Special Economic Zones

Subject: One-time waiver of Custom Duty as well as inspection requirement in case of de-bounding of IT/ITeS Units in SEZs and […]

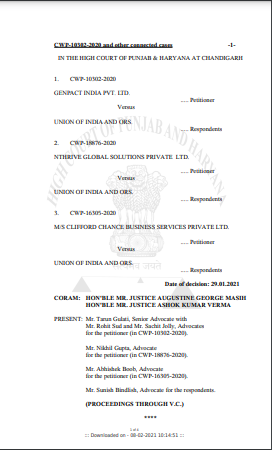

ConsultEase Administrator wrote a new post, Punjab & Haryana HC in the case of Genpact India Pvt. Ltd. Versus Union of India 5 years ago

Case Covered:

Genpact India Pvt. Ltd.

Versus

Union of India

Facts of the Case:

By this order, we propose to dispose of three writ petitions i.e. CWP Nos. 10302, 18876, and 16305-2020.

In CWP Nos. 10302 […]

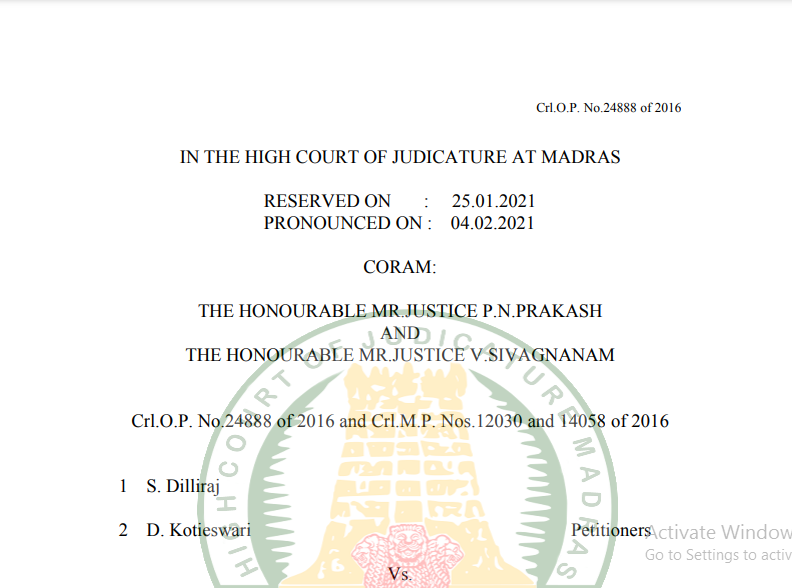

ConsultEase Administrator wrote a new post, Madras HC in the case of S. Dilliraj Versus The Deputy Director 5 years ago

Case Covered:

S. Dilliraj

Versus

The Deputy Director, The Directorate of Enforcement

Facts of the Case:

Undisputed facts:

First Leasing Company of India Limited (in short “FLCI”) was a company inc […]

ConsultEase Administrator wrote a new post, Madras HC in the case of R. Viswanathan Versus The Assistant Director 5 years ago

Case Covered:

R. Viswanathan

Versus

The Assistant Director, Directorate of Enforcement

Facts of the Case:

The incontrovertible facts are as under:

Viswanathan (1 st petitioner/A.1) was into the […]

ConsultEase Administrator wrote a new post, Madras HC in the case of L.Sivaramakrishnan Versus The Deputy Director 5 years ago

Case Covered:

L.Sivaramakrishnan

Versus

The Deputy Director, The Directorate of Enforcement

Facts of the Case:

First Leasing Company of India Limited (in short “FLCI”) was a company incorporated under the […]

ConsultEase Administrator wrote a new post, Gujarat HC in the case of M/s Bharat Acid And Chemicals Versus Union of India 5 years ago

Case Covered:

M/s Bharat Acid And Chemicals

Versus

Union of India

Related Topic:

Gujarat HC in the case of Cosmo Films Limited Versus Union of India

Facts of the case:

The facts of this case are very […]

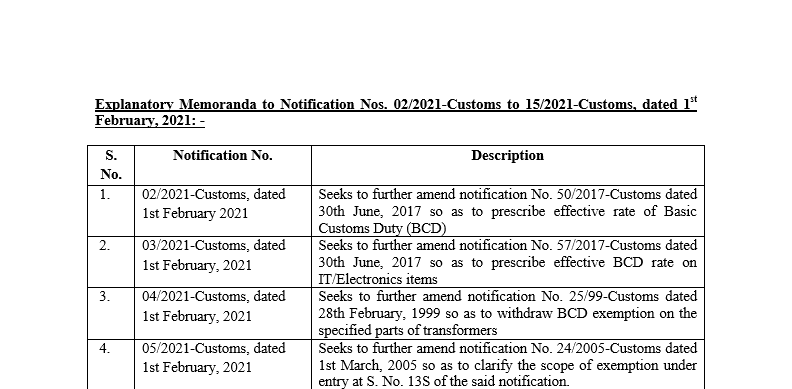

ConsultEase Administrator wrote a new post, Explanatory Memoranda to Notification Nos. 02/2021-Customs to 15/2021-Customs, dated 1st February, 2021 5 years ago

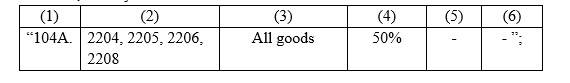

Explanatory Memoranda to Notification Nos. 02/2021-Customs to 15/2021-Customs, dated 1st February 2021

S. No.

Notification No.

Description

1

02/2021-Customs, dated 1st February 2021

Seeks to […]

ConsultEase Administrator wrote a new post, Notification No. 2/2021-Customs 5 years ago

Notification No. 2/2021-Customs

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II, SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification No. […]

ConsultEase Administrator wrote a new post, DTVSV Scheme Extension: CBDT 5 years ago

Notification

S.O.471(E).- In exercise of powers conferred by section 3 of the Direct Tax Vivad se Vishwas Act, 2020 (3 of 2020), the Central Government hereby makes the following amendment in the notification of […]

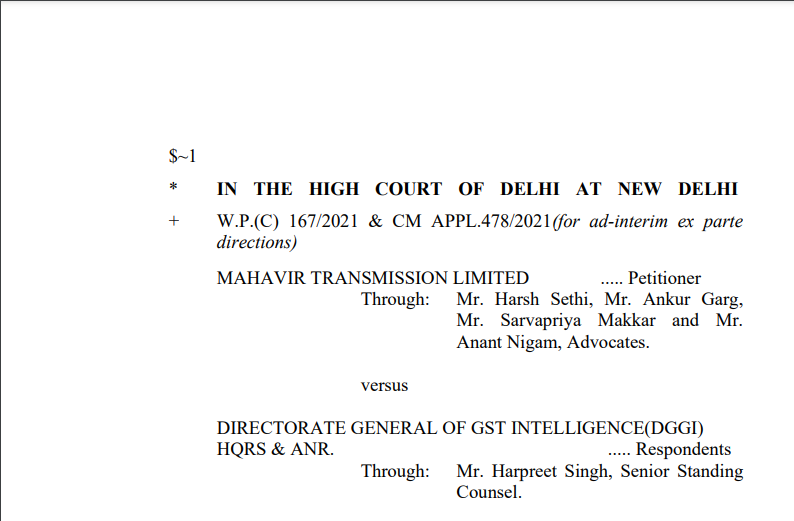

ConsultEase Administrator wrote a new post, Delhi HC in the case of Mahavir Transmission Limited Versus Directorate General of GST Intelligence 5 years ago

Case Covered:

Mahavir Transmission Limited

Versus

Directorate General of GST Intelligence(DGGI)

Facts of the Case:

The present petition inter-alia seeks quashing of the impugned Letters dated 31st […]

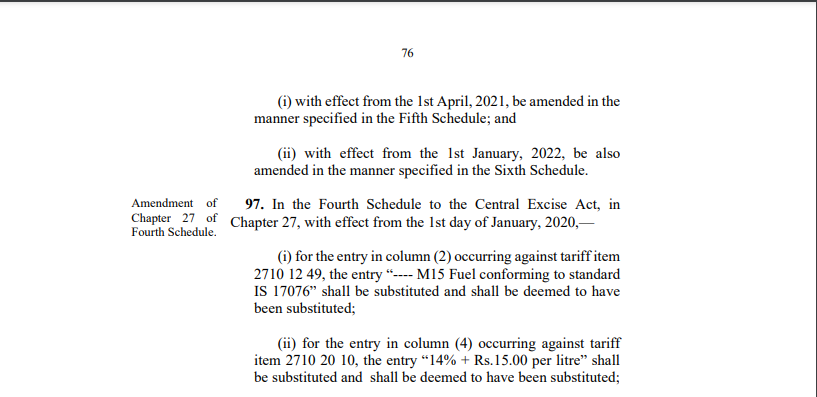

ConsultEase Administrator wrote a new post, Amendments to GST Acts through Finance Bill 2021 5 years ago

Amendments to GST Acts through Finance Bill 2021

Central Goods and Services Tax

Amendment of section 7.

In the Central Goods and Services Tax Act, 2017 (hereinafter referred to as the Central Goods and Services […]