Introduction:

In a bid to modernize and streamline import duty payments, the Indian government has introduced the Electronic Cash Ledger (ECL) as the designated mode of payment for goods […]

Introduction:

In a landmark endeavor aimed at revolutionizing regional trade efficiency, Union Finance Minister Smt. Nirmala Sitharaman inaugurated the Electronic Data Interchange (EDI) at […]

Introduction

Indirect tax experts are seeking clarity on the levy of Goods and Services Tax (GST) on corporate guarantees provided by Indian companies on behalf of their subsidiaries. A […]

Promising Start to Q4

India’s economy kicked off the fourth quarter on a positive note, as indicated by the National Council of Applied Economic Research (NCAER) in its latest economic r […]

Effective March 1, businesses with a turnover exceeding ₹5 crore will face new GST rules. They must now include e-invoice details for all B2B transactions to generate e […]

Introduction

The Indian Auto LPG Coalition (IAC) has urged the national government to reduce the Goods and Services Tax (GST) on Auto LPG from 18% to 5%, aligning with recent adjustments in […]

Cracking the Case: Unveiling the Intricate GST Scam

The relentless pursuit of the Jamshedpur GST Intelligence team has led to a significant breakthrough in the arrest of Shiv Kumar Deora in […]

Dismantling the ‘Mutuality’ Argument: DGGI’s Case Against IMA

The Directorate General of GST Intelligence (DGGI) has presented additional evidence before the Kerala High Court, challenging the […]

Overcoming Regulatory Challenges: OTAs in the Bus Ticketing Industry

Online travel agencies (OTAs) are currently spearheading the expansion of the bus ticketing segment, which has emerged as a […]

DGFT Notification Allows Merchanting Trade within Single Foreign Country

The Directorate General of Foreign Trade (DGFT) has issued a significant amendment to the Foreign Trade Policy, 2023, […]

Comment-

Every exporter using Paypal should be aware of this judgment. VEry important as in many cases the refund of tax on export was denied if the payment is received in rupees. In the case of an amount […]

Comment-

A search was conducted at the premises of the taxpayer. Lateron the same officer issues the notice. The SC decision in case of Ashok Kumar Yadav and others v. State of Haryana and others, (1985) 4 SCC […]

Comment-

This is one of the controversial judgments in GST. As we all know that many of us are deprived of our valid input tax credit because it was not claimed in GTSR 3b.

Introduction:

The Hon’ble Madras High Court recently ruled in the case of India Cement Limited v. Commissioner of Customs regarding the eligibility of CENVAT credit for electricity supplied t […]

Introduction:

In a significant operation against the illegal import of foreign-origin cigarettes and other contrabands, the Customs Commissionerate in Indore, under the Bhopal Zone, executed […]

Introduction:

The Hon’ble Madras High Court, in the case of M/s. Great Heights Developers LLP v. Additional Commissioner Office of the Commissioner of CGST & Central Excise, Chennai, allowed a […]

Introduction:

A recent scam has come to light in Uttar Pradesh, where fraudsters have been using hand pumps to claim fake refunds under the Inverted Duty Structure (IDS) mechanism of the Goods […]

Introduction:

In the case of Kantilal Bhaguji Mohite v. Commissioner, Central Excise and Service Tax-Pune III [Special Leave to Appeal (C) No. (s). 11203/2019 dated February 14, 2024], the […]

Introduction:

Advisory No. 625 was released by the Goods and Services Tax Network (GSTN) on February 28, 2024, aiming to address instances of delayed registration despite successful Aadhaar authentication among […]

Introduction:

Telangana Chief Minister Revanth Reddy recently chaired a crucial review meeting to address the state’s revenue shortfall and discuss the regularisation of unapproved layouts. […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 6 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, “Streamlining Import Duty Payments: The ECL Initiative” 1 year, 11 months ago

Introduction:

In a bid to modernize and streamline import duty payments, the Indian government has introduced the Electronic Cash Ledger (ECL) as the designated mode of payment for goods […]

ConsultEase Administrator wrote a new post, Revolutionizing Regional Trade: India’s Digital Leap in the North East 1 year, 11 months ago

Introduction:

In a landmark endeavor aimed at revolutionizing regional trade efficiency, Union Finance Minister Smt. Nirmala Sitharaman inaugurated the Electronic Data Interchange (EDI) at […]

ConsultEase Administrator wrote a new post, “Deciphering GST on Corporate Guarantees: Navigating Uncertainties” 1 year, 11 months ago

Introduction

Indirect tax experts are seeking clarity on the levy of Goods and Services Tax (GST) on corporate guarantees provided by Indian companies on behalf of their subsidiaries. A […]

ConsultEase Administrator wrote a new post, “India’s Economic Outlook: A Promising Start to Q4” 1 year, 11 months ago

Promising Start to Q4

India’s economy kicked off the fourth quarter on a positive note, as indicated by the National Council of Applied Economic Research (NCAER) in its latest economic r […]

ConsultEase Administrator wrote a new post, March 2024: Key Changes Affecting Businesses and Consumers 1 year, 11 months ago

GST Rules Update:

Effective March 1, businesses with a turnover exceeding ₹5 crore will face new GST rules. They must now include e-invoice details for all B2B transactions to generate e […]

ConsultEase Administrator wrote a new post, Driving Sustainability: Lowering GST on Auto LPG 1 year, 11 months ago

Introduction

The Indian Auto LPG Coalition (IAC) has urged the national government to reduce the Goods and Services Tax (GST) on Auto LPG from 18% to 5%, aligning with recent adjustments in […]

ConsultEase Administrator wrote a new post, “Unmasking the GST Scam: The Shiv Kumar Deora Saga” 1 year, 11 months ago

Cracking the Case: Unveiling the Intricate GST Scam

The relentless pursuit of the Jamshedpur GST Intelligence team has led to a significant breakthrough in the arrest of Shiv Kumar Deora in […]

ConsultEase Administrator wrote a new post, “IMA vs. DGGI: Unveiling the Charitable Status Debate” 1 year, 11 months ago

Dismantling the ‘Mutuality’ Argument: DGGI’s Case Against IMA

The Directorate General of GST Intelligence (DGGI) has presented additional evidence before the Kerala High Court, challenging the […]

ConsultEase Administrator wrote a new post, “Roadblocks and Routes: OTAs in Bus Ticketing” 1 year, 11 months ago

Overcoming Regulatory Challenges: OTAs in the Bus Ticketing Industry

Online travel agencies (OTAs) are currently spearheading the expansion of the bus ticketing segment, which has emerged as a […]

ConsultEase Administrator wrote a new post, “DGFT Allows Merchanting Trade Within Single Foreign Country” 1 year, 11 months ago

DGFT Notification Allows Merchanting Trade within Single Foreign Country

The Directorate General of Foreign Trade (DGFT) has issued a significant amendment to the Foreign Trade Policy, 2023, […]

CA Shafaly Girdharwal wrote a new post, Exporters receiving payment via Paypal are eligible for GST refund- HC 1 year, 11 months ago

Comment-

Every exporter using Paypal should be aware of this judgment. VEry important as in many cases the refund of tax on export was denied if the payment is received in rupees. In the case of an amount […]

CA Shafaly Girdharwal wrote a new post, The officer searched u/s 67of GST can’t adjudicate- Madras HC 1 year, 11 months ago

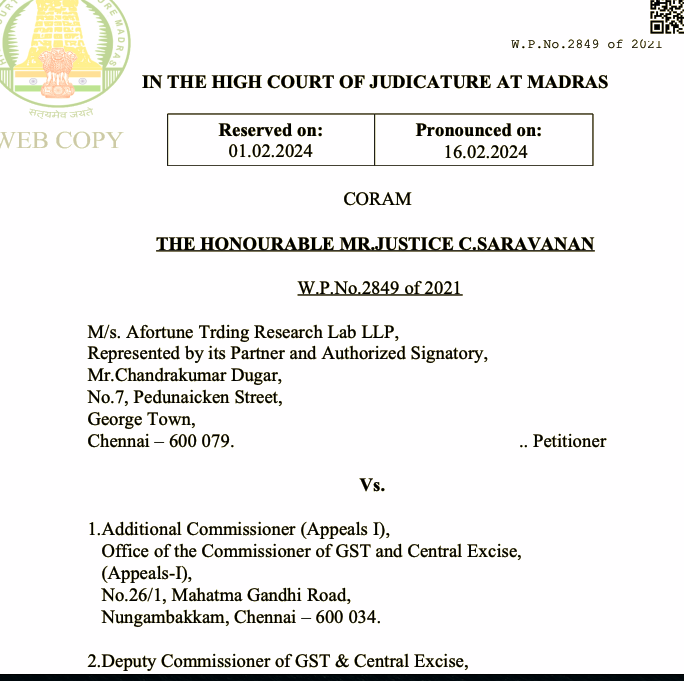

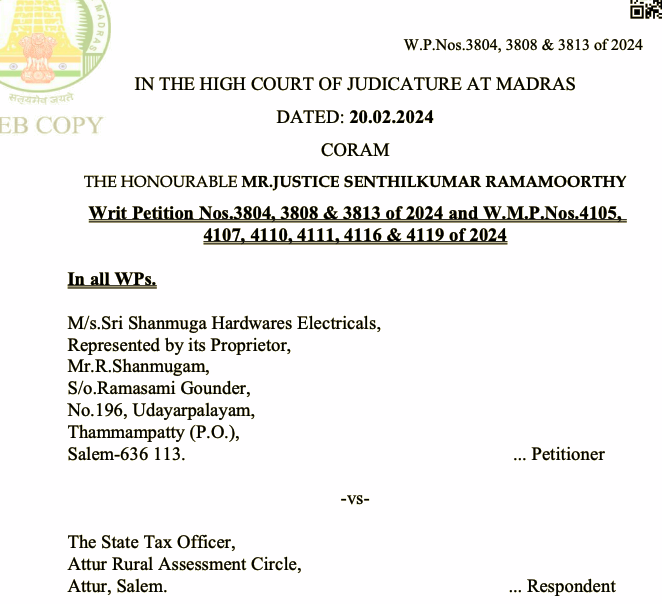

Comment-

A search was conducted at the premises of the taxpayer. Lateron the same officer issues the notice. The SC decision in case of Ashok Kumar Yadav and others v. State of Haryana and others, (1985) 4 SCC […]

CA Shafaly Girdharwal wrote a new post, ITC cant be rejected only because it was not claimed in GSTR 3B-HC 1 year, 11 months ago

Comment-

This is one of the controversial judgments in GST. As we all know that many of us are deprived of our valid input tax credit because it was not claimed in GTSR 3b.

This is the normal understanding […]

ConsultEase Administrator wrote a new post, “Madras HC: CENVAT Credit for Sister Unit Electricity” 1 year, 11 months ago

Introduction:

The Hon’ble Madras High Court recently ruled in the case of India Cement Limited v. Commissioner of Customs regarding the eligibility of CENVAT credit for electricity supplied t […]

ConsultEase Administrator wrote a new post, “Customs Crackdown: Seizure and Destruction of Smuggled Contraband” 1 year, 11 months ago

Introduction:

In a significant operation against the illegal import of foreign-origin cigarettes and other contrabands, the Customs Commissionerate in Indore, under the Bhopal Zone, executed […]

Prem wrote a new post, “Madras HC: Medical Reasons Valid for GST Appeal Delay” 1 year, 11 months ago

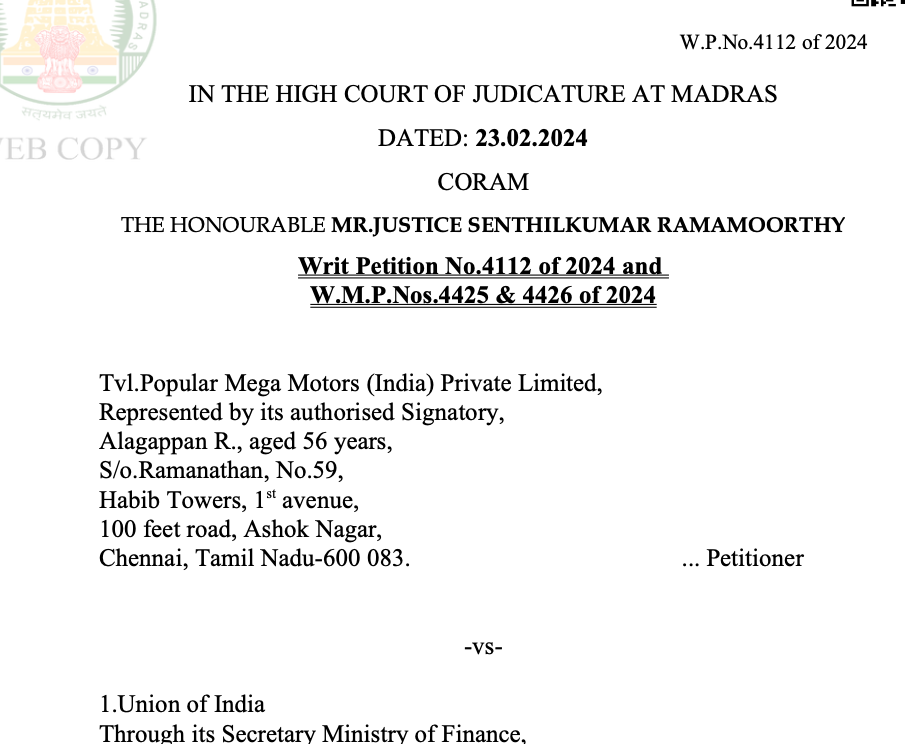

Introduction:

The Hon’ble Madras High Court, in the case of M/s. Great Heights Developers LLP v. Additional Commissioner Office of the Commissioner of CGST & Central Excise, Chennai, allowed a […]

ConsultEase Administrator wrote a new post, Fake Inverted rated refund using hand pumps 1 year, 11 months ago

Introduction:

A recent scam has come to light in Uttar Pradesh, where fraudsters have been using hand pumps to claim fake refunds under the Inverted Duty Structure (IDS) mechanism of the Goods […]

ConsultEase Administrator wrote a new post, Supreme Court Upholds Pre-Deposit Requirement in Central Excise Appeals 1 year, 11 months ago

Introduction:

In the case of Kantilal Bhaguji Mohite v. Commissioner, Central Excise and Service Tax-Pune III [Special Leave to Appeal (C) No. (s). 11203/2019 dated February 14, 2024], the […]

ConsultEase Administrator wrote a new post, Streamlining Aadhaar-Based GST Registration: Advisory No. 625 1 year, 11 months ago

Introduction:

Advisory No. 625 was released by the Goods and Services Tax Network (GSTN) on February 28, 2024, aiming to address instances of delayed registration despite successful Aadhaar authentication among […]

ConsultEase Administrator wrote a new post, Telangana CM’s Initiatives: Tackling Revenue Shortfall and Layout Regularisation 1 year, 11 months ago

Introduction:

Telangana Chief Minister Revanth Reddy recently chaired a crucial review meeting to address the state’s revenue shortfall and discuss the regularisation of unapproved layouts. […]