Comment

The order was issued before hearing the appellant. The order is cryptic and it is template based and doesn’t mention the reason for the demand raised.

Details of the case

Comment

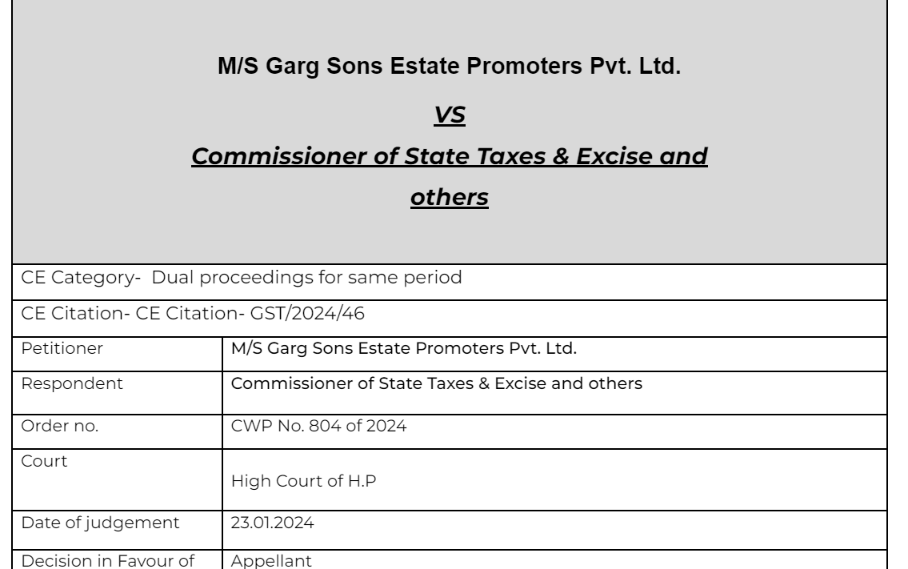

Duplicate proceedings for same period not allowed The proceedings were already in process. A summon was issued to the taxpayer. Court held that dual proceedings for the same period are not possible. The […]

Introduction

The Directorate General of Goods and Services Tax Intelligence (DGGI) has launched a sweeping investigation into suspected tax evasion by leading commercial coaching centers […]

Comment

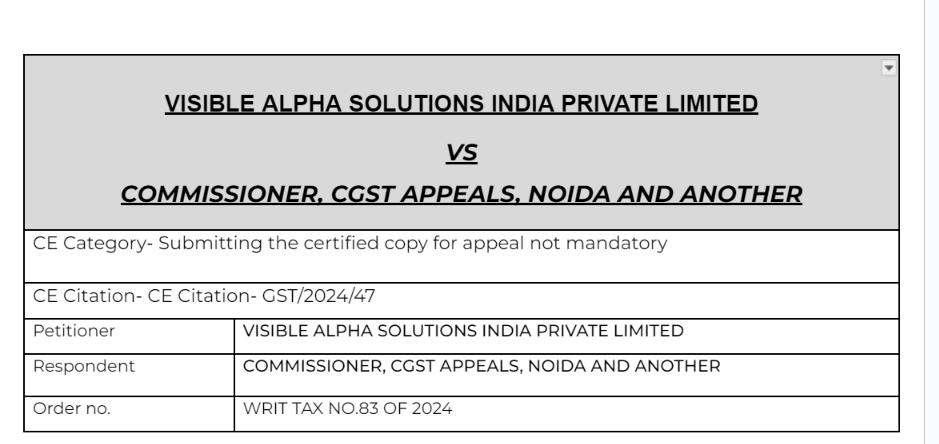

The appeal was filed online in this case. But the TP couldnt file the certified hard copy. The honourable court dropped the order rejecting the appeals declaring them time barred. It was clarified by the […]

Comment

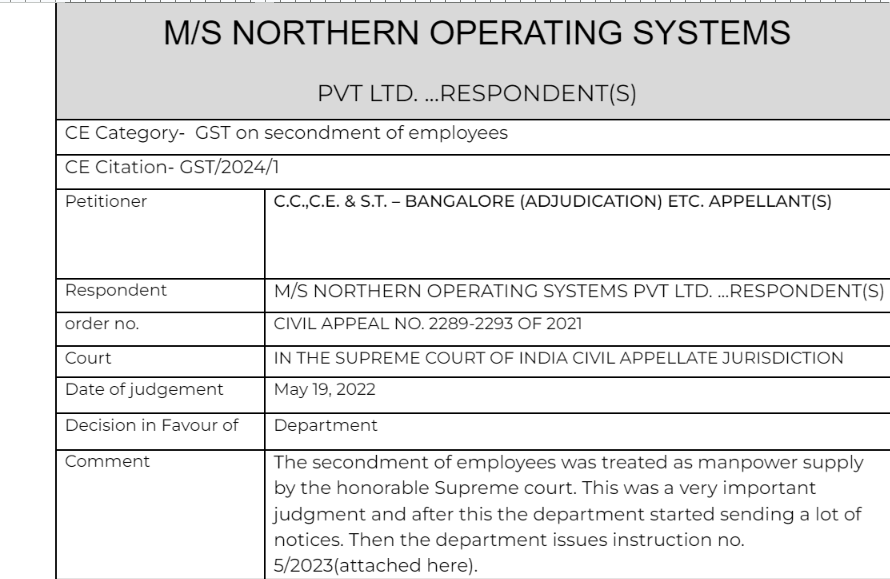

The secondment of employees was treated as manpower supply by the honorable Supreme court. This was a very important judgment and after this the department started sending a lot of notices. Then the […]

Background:

In a recent landmark ruling, the Delhi High Court awarded Rs. 12 lakhs in costs and damages to Castrol Limited in a trademark dispute against two individuals manufacturing engine […]

Scheme Uncovered:

The State Goods and Services Tax (SGST) Department, in collaboration with Bhavnagar police, uncovers a sophisticated scheme involving the creation of fake GST registrations and issuance of […]

Karnataka AAR Rules Manpower Services to Panchayats and Municipalities Exempt from GST

In a recent landmark ruling, the Karnataka Authority for Advance Ruling (AAR) addressed the issue of Goods and Services Tax […]

Navigating Import Compliance: CBIC’s Directives

In a proactive step towards ensuring import compliance, the Central Board of Indirect Taxes and Customs (CBIC) has issued Instruction No. 03/2024-Customs on […]

The Customs, Excise & Service Tax Appellate Tribunal (CESTAT) in Bangalore has made a significant ruling regarding the classification of web cameras under the Customs Tariff Act. In the case of M/s. Xiaomi […]

The government is currently assessing the financial viability of extending export benefits under the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme to units located in export-oriented units […]

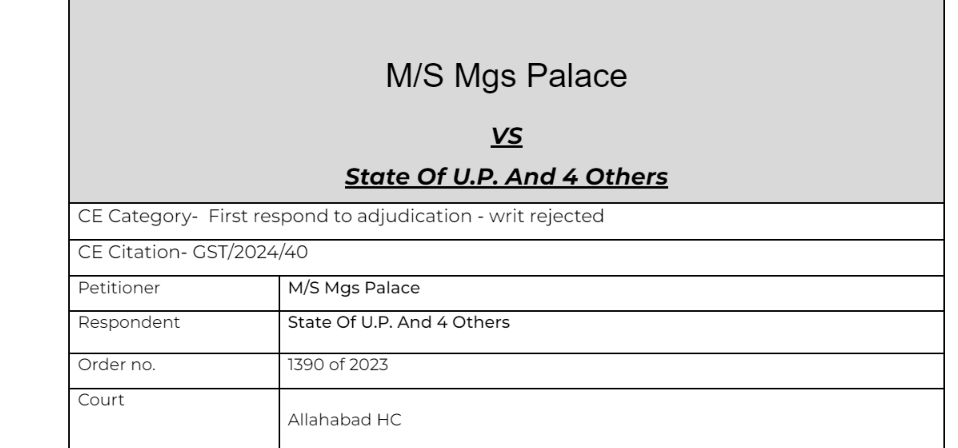

In a recent ruling by the Honorable Allahabad High Court in the case of Mgs Palace v. State of Uttar Pradesh [Writ Tax No. 1390 of 2023 dated January 03, 2024], a significant legal principle regarding tax […]

Introduction:

The Central Board of Indirect Tax and Customs (CBIC) is set to introduce new guidelines aimed at refining the conduct of Directorate General of Goods and Services Tax […]

In the legal case of Fairdeal Metals Ltd. versus the Assistant Commissioner of Revenue, State Tax, Bureau of Investigation (NB), the Calcutta High Court reached a decision regarding the […]

Introduction:

In a recent ruling by the Telangana Authority of Advance Ruling (AAR), the All India Institute of Medical Sciences (AIIMS) was denied GST exemption on pure services received from […]

In a significant development, the Punjab Excise and Taxation Department, in collaboration with the Fatehgarh Sahib police, has apprehended a GST fraudster for fraudulently claiming Rs 3.65 […]

Neeraj Kumar Rohila

Learn what you can, nothing is useless.

Paid User

@neerajrohilla

active 4 years, 6 months agoNeeraj Kumar Rohila

A Learner, who wants to learn from the experience.

Registered Categories

Location

New Delhi, India

WEBSITE

http://www.consultease.comOOPS!

No Packages Added by Neeraj Kumar Rohila. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, A cost of Rs. 50,000 levied on conducting the search during moratorium period by the GST department 1 year, 11 months ago

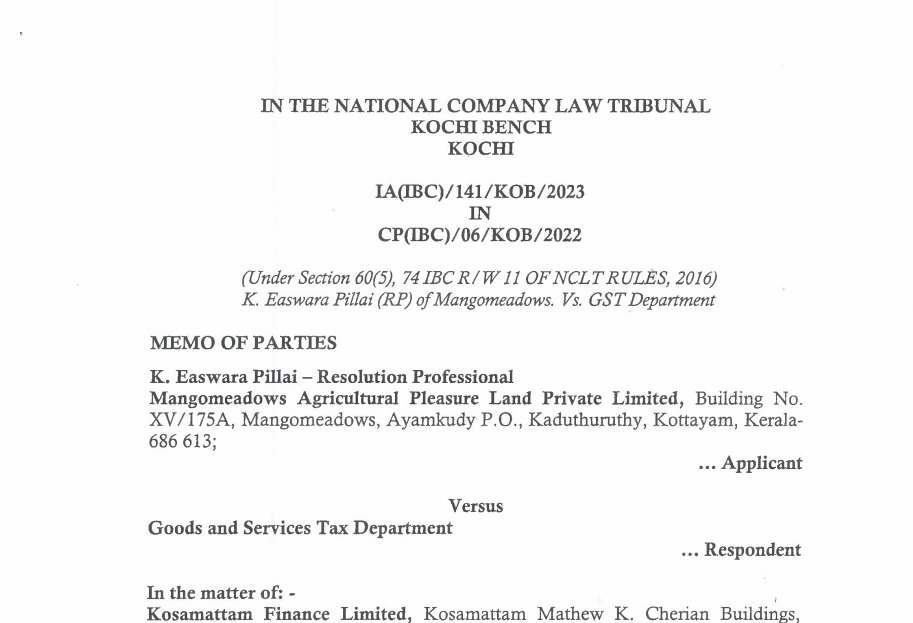

Brief summary of the case-

CE Category- NCLAT interplay with GST

Author can be reached at shaifaly.ca@gmail.com

A cost of Rs. 50,000 was levied on the department for conducting search during the moratorium […]

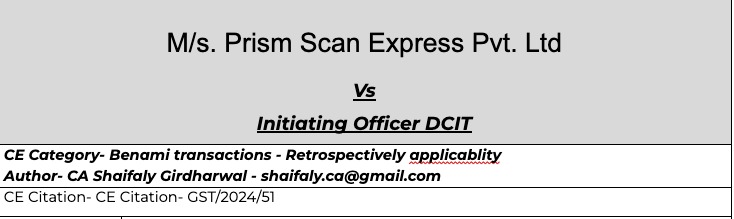

CA Shafaly Girdharwal wrote a new post, Benami Act will apply to past transactions where the property is “held” even after its applicability 1 year, 11 months ago

Commentary-

An important judgment where the Apex courts judgment was clarified so as to cover the past transactions in Benami

The applicability of Benami Act was settled by the Apex court in case of […]

ConsultEase Administrator wrote a new post, Non speaking GST order quashed by Delhi high court 1 year, 11 months ago

Comment

The order was issued before hearing the appellant. The order is cryptic and it is template based and doesn’t mention the reason for the demand raised.

Details of the case

Pleading

1. Petitioner […]

ConsultEase Administrator wrote a new post, Writ rejected as appellant need to reply Adjudicating authority first 1 year, 11 months ago

Comment

Writ was rejected by the court. The appellant was asked to first make reply to the adjudicating authority.

Details of the case

Pleading

Challenge has been raised to the adjudication notice issued […]

ConsultEase Administrator wrote a new post, Duplicate proceedings for same period not allowed 1 year, 11 months ago

Comment

Duplicate proceedings for same period not allowed The proceedings were already in process. A summon was issued to the taxpayer. Court held that dual proceedings for the same period are not possible. The […]

ConsultEase Administrator wrote a new post, Uncovering Alleged Tax Evasion in India’s Commercial Coaching Centers 1 year, 11 months ago

Introduction

The Directorate General of Goods and Services Tax Intelligence (DGGI) has launched a sweeping investigation into suspected tax evasion by leading commercial coaching centers […]

ConsultEase Administrator wrote a new post, No need to file certified copy of appeal 1 year, 11 months ago

Comment

The appeal was filed online in this case. But the TP couldnt file the certified hard copy. The honourable court dropped the order rejecting the appeals declaring them time barred. It was clarified by the […]

ConsultEase Administrator wrote a new post, GST on secondment of employees -SC judgment and instruction of CBIC 1 year, 11 months ago

Comment

The secondment of employees was treated as manpower supply by the honorable Supreme court. This was a very important judgment and after this the department started sending a lot of notices. Then the […]

ConsultEase Administrator wrote a new post, Delhi High Court Ruling: Castrol Limited vs. Newcast Roi Racing 1 year, 11 months ago

Background:

In a recent landmark ruling, the Delhi High Court awarded Rs. 12 lakhs in costs and damages to Castrol Limited in a trademark dispute against two individuals manufacturing engine […]

ConsultEase Administrator wrote a new post, Crackdown on GST Fake Billing Scam: Arrest of Conspirators 1 year, 11 months ago

Scheme Uncovered:

The State Goods and Services Tax (SGST) Department, in collaboration with Bhavnagar police, uncovers a sophisticated scheme involving the creation of fake GST registrations and issuance of […]

ConsultEase Administrator wrote a new post, Karnataka AAR: GST Exemption for Panchayat and Municipality Services 1 year, 11 months ago

Karnataka AAR Rules Manpower Services to Panchayats and Municipalities Exempt from GST

In a recent landmark ruling, the Karnataka Authority for Advance Ruling (AAR) addressed the issue of Goods and Services Tax […]

ConsultEase Administrator wrote a new post, “Import Compliance: CBIC’s Boric Acid Guidelines 1 year, 11 months ago

Navigating Import Compliance: CBIC’s Directives

In a proactive step towards ensuring import compliance, the Central Board of Indirect Taxes and Customs (CBIC) has issued Instruction No. 03/2024-Customs on […]

ConsultEase Administrator wrote a new post, Top 8 Services Provided by Professional Transcreation Agencies in Malaysia 1 year, 11 months ago

The ability to effectively communicate across cultural boundaries is crucial.

Language plays a pivotal role in bridging these gaps and ensuring that businesses and individuals can effectively connect with their […]

ConsultEase Administrator wrote a new post, CESTAT: Web Cameras Classified Under Chapter Heading 8473 1 year, 12 months ago

The Customs, Excise & Service Tax Appellate Tribunal (CESTAT) in Bangalore has made a significant ruling regarding the classification of web cameras under the Customs Tariff Act. In the case of M/s. Xiaomi […]

ConsultEase Administrator wrote a new post, Evaluating RoDTEP Scheme Extension to EOUs and SEZs 1 year, 12 months ago

The government is currently assessing the financial viability of extending export benefits under the Remission of Duties and Taxes on Exported Products (RoDTEP) scheme to units located in export-oriented units […]

ConsultEase Administrator wrote a new post, “High Court’s Tax Probe Decision: Balancing Subjectivity and Jurisdiction 1 year, 12 months ago

In a recent ruling by the Honorable Allahabad High Court in the case of Mgs Palace v. State of Uttar Pradesh [Writ Tax No. 1390 of 2023 dated January 03, 2024], a significant legal principle regarding tax […]

ConsultEase Administrator wrote a new post, Enhancing Tax Probe Protocol: CBIC’s Circular to DGGI Officials 1 year, 12 months ago

Introduction:

The Central Board of Indirect Tax and Customs (CBIC) is set to introduce new guidelines aimed at refining the conduct of Directorate General of Goods and Services Tax […]

ConsultEase Administrator wrote a new post, “Tax Justice Prevails: Fairdeal Metals Exonerated” 1 year, 12 months ago

In the legal case of Fairdeal Metals Ltd. versus the Assistant Commissioner of Revenue, State Tax, Bureau of Investigation (NB), the Calcutta High Court reached a decision regarding the […]

ConsultEase Administrator wrote a new post, AIIMS Denied GST Exemption: Implications and Resilience 1 year, 12 months ago

Introduction:

In a recent ruling by the Telangana Authority of Advance Ruling (AAR), the All India Institute of Medical Sciences (AIIMS) was denied GST exemption on pure services received from […]

Prem wrote a new post, “Punjab Excise Department’s Major GST Fraud Bust” 1 year, 12 months ago

In a significant development, the Punjab Excise and Taxation Department, in collaboration with the Fatehgarh Sahib police, has apprehended a GST fraudster for fraudulently claiming Rs 3.65 […]