PK Mittal

BCom Delhi university 1975

LLB Delhi University 1978

FCS Fellow Member of ICSI 1992

1982 to 1992 as CS in Corporate

Head Legal Apollo Tyres Ltd 1986 to 1992

1993 onwards Advocate in Delhi High Court CESTAT NCLT = Practcising Indirect Tax and Corporate laws 1993 to till date.

Written more than 100 Article on Company Law and Corporate laws Indirect Tax

Speaker on Indirect Tax Co Law and IBC in various Seminars Workshop organised by ICAI ICSI and ICMA and other organisations

Convenor Core Group on GST of ICSI

Recipient of “Service” Defined

The term ‘recipient’ is not defined in the IGST Act. However, sub-section (24) of Section 2 of the IGST Act states that the words and expression not defined in the IGST Act but def […]

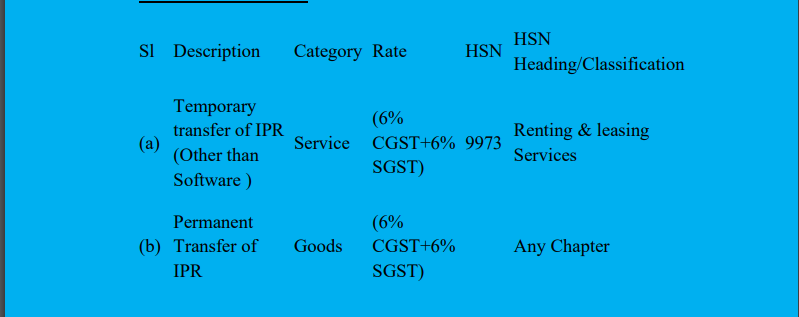

Intellectual Property Rights Taxability Under GST Laws

In this article, an attempt has been made to explain the taxability of Intellectual Property Rights (hereinafter called IPR) on the touchstone of Goods & […]

The Orissa High Court 2019-TOIL01088, in the case of Safari Retreats (P) Ltd, which permitted availement of ITC on GST paid on raw materials such Cement, Steel, Sand, […]

EXCLUSIVE JURISDICTION OF NCLT IN ALL MATTERS UNDER COMPANIES ACT, 2013.

This small note deals with the jurisdiction of courts. Many a time, in small cities, people tend to file civil suits under the Specific […]

Do Companies Act, 2013, and Rules Empower The ROC to De-activate “DIN” of Any Director Which was Allotted Under Section 154 of The Companies Act, 2013 ?.

In this article, an attempt has been made whether the ROC […]

Payment of Tax &, Interest Under “Self Assessment And Finalisation of Provisional Assessment Under GST.

In this article, we will analyze various terms “self-assessment”, “provisional assessment” and “finaliza […]

Case Covered:

Union of India & Another Etc. Etc.

Versus

M/s V.V.F Limited & Another Etc. Etc.

Introduction:

The SC in the case of Union of India Vs VVF Ltd Appeal No.2256=2263/2020 dt 22.4.2020 allowed th […]

AMOUNT PAID DURING INVESTIGATION WHETHER INTEREST PAYABLE ON REFUND

In this article, an attempt has been by the Author to explain exhaustively various situations in which the assessee would be entitled to claim […]

THE POSITION OF LEVY OF SERVICE TAX ON CLUB SERVICE DURING PRE GST REGIME

Further SC in the case of State of West Bengal Vs Calcutta Club Ltd MANU/SC/1367/2019 has held that from 2005 onwards the Finance Act 1994 […]

SCN IS MUST – NO DEMAND OR COERCIVE ACTION WITHOUT SCN & PERSONAL HEARING.

The Department, of late, has been issuing letters/communications seeking to recover the amount of interest, commenced recovering p […]

QUANTUM OF PENALTY – HOW AND WHEN – WHETHER MENS REA IS ONE OF THE ESSENTIAL INGREDIENT.

In the recent past, the Department is threatening the assessee with the imposition of the penalty for infraction of var […]

Taxability of Salary, Allowances, Commission, Benefits, Perks, Under GST – Both Non-Executive And Executive Director of a Company.

As we all know there are are two types of Directors under the Companies Act, 2 […]

SALE OF PLEDGED SHARES – CORONA EFFECT – PROCEDURE TO BE FOLLOWED

In the last two months, Corona Virus had played havoc with the Stock Market resulting in an unprecedented and steep fall in the share price in t […]

ORDER IS COMMUNICATED

1: The Division Bench of Gujarat High court in the case of Gujarat State Electricity Board Vs. Vipul Kumar MANU/GJ/2442/2019 has discussed the entire law on the issue of service of […]

FORCE MAJEURE –CORONA VIRUS- ITS IMPLICATIONS

Force majeure meaning “superior force” chance occurrence, unavoidable accident, is a common clause in contracts that essentially frees both parties from liability o […]

LIABILITY OF NON-EXECUTIVE, INDEPENDENT DIRECTOR & NOMINEE DIRECTOR OF A COMPANY UNDER VARIOUS CORPORATE LAWS & GST ACT.

It is very common that under various Corporate Laws such Companies Act, 2013, SEBI Act, […]

LIABILITY TO PAY INTEREST IS IT ABSOLUTE OR CONDITIONAL – WHETHER REVERSAL FROM CASH OR ITC.

The question of payment of interest by the assessee arises under various provisions of Central Goods & Services Act, […]

SECTION 107 CGST ACT: PRINCIPLE GOVERNING FILING OF APPEAL BEFORE FIRST APPELLATE AUTHORITY.

Section 107 of Central Goods & Service Tax, 2017 (hereinafter called the GST Act) says that any person aggrieved with […]

PRINCIPLE GOVERNING CONDONATION OF DELAY IN FILING OF APPEAL

On many occasions, the appeal, as provided under various fiscal laws, could not be filed due to various reasons and, therefore, the appeal has to be […]

Introduction:

In this article, an attempt has been by the Author to explain exhaustively various situations in which the assessee would be entitled to claim interest in the event of delay in refund of amount […]

Advocate Pradeep Kumar

@pkm

Not recently activeAdvocate Pradeep Kumar

PK Mittal BCom Delhi university 1975 LLB Delhi University 1978 FCS Fellow Member of ICSI 1992 1982 to 1992 as CS in Corporate Head Legal Apollo Tyres Ltd 1986 to 1992 1993 onwards Advocate in Delhi High Court CESTAT NCLT = Practcising Indirect Tax and Corporate laws 1993 to till date. Written more than 100 Article on Company Law and Corporate laws Indirect Tax Speaker on Indirect Tax Co Law and IBC in various Seminars Workshop organised by ICAI ICSI and ICMA and other organisations Convenor Core Group on GST of ICSI

OOPS!

No Packages Added by Advocate Pradeep Kumar. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewAdvocate Pradeep Kumar wrote a new post, Whether GST is Payable on IPR Vol-III 5 years, 8 months ago

Recipient of “Service” Defined

The term ‘recipient’ is not defined in the IGST Act. However, sub-section (24) of Section 2 of the IGST Act states that the words and expression not defined in the IGST Act but def […]

Advocate Pradeep Kumar wrote a new post, Intellectual Property Rights Taxability Under GST Laws 5 years, 8 months ago

Intellectual Property Rights Taxability Under GST Laws

In this article, an attempt has been made to explain the taxability of Intellectual Property Rights (hereinafter called IPR) on the touchstone of Goods & […]

Advocate Pradeep Kumar wrote a new post, Blocked Credit Under Section 17(5) 5 years, 8 months ago

Blocked Credit Under Section 17(5):

The Orissa High Court 2019-TOIL01088, in the case of Safari Retreats (P) Ltd, which permitted availement of ITC on GST paid on raw materials such Cement, Steel, Sand, […]

Advocate Pradeep Kumar wrote a new post, Exclusive Jurisdiction of NCLT In All Matters Under Companies Act, 2013. 5 years, 8 months ago

EXCLUSIVE JURISDICTION OF NCLT IN ALL MATTERS UNDER COMPANIES ACT, 2013.

This small note deals with the jurisdiction of courts. Many a time, in small cities, people tend to file civil suits under the Specific […]

Advocate Pradeep Kumar wrote a new post, Do Companies Act, 2013, and Rules Empower The ROC to De-activate “DIN” of Any Director Which was Allotted Under Section 154 of The Companies Act, 2013 ?. 5 years, 9 months ago

Do Companies Act, 2013, and Rules Empower The ROC to De-activate “DIN” of Any Director Which was Allotted Under Section 154 of The Companies Act, 2013 ?.

In this article, an attempt has been made whether the ROC […]

Advocate Pradeep Kumar wrote a new post, Payment of Tax &, Interest Under “Self Assessment And Finalisation of Provisional Assessment Under GST by Pradeep K Mittal. 5 years, 9 months ago

Payment of Tax &, Interest Under “Self Assessment And Finalisation of Provisional Assessment Under GST.

In this article, we will analyze various terms “self-assessment”, “provisional assessment” and “finaliza […]

Advocate Pradeep Kumar wrote a new post, Supreme Court in the case of Union of India Versus M/s V.V.F Limited 5 years, 9 months ago

Case Covered:

Union of India & Another Etc. Etc.

Versus

M/s V.V.F Limited & Another Etc. Etc.

Introduction:

The SC in the case of Union of India Vs VVF Ltd Appeal No.2256=2263/2020 dt 22.4.2020 allowed th […]

Advocate Pradeep Kumar wrote a new post, Amount Paid During Investigation Whether Interest Payable On Refund 5 years, 9 months ago

AMOUNT PAID DURING INVESTIGATION WHETHER INTEREST PAYABLE ON REFUND

In this article, an attempt has been by the Author to explain exhaustively various situations in which the assessee would be entitled to claim […]

Advocate Pradeep Kumar wrote a new post, The Position of Levy of Service Tax on Club Service During Pre GST Regime 5 years, 9 months ago

THE POSITION OF LEVY OF SERVICE TAX ON CLUB SERVICE DURING PRE GST REGIME

Further SC in the case of State of West Bengal Vs Calcutta Club Ltd MANU/SC/1367/2019 has held that from 2005 onwards the Finance Act 1994 […]

Advocate Pradeep Kumar wrote a new post, SCN Is Must – No Demand Or Coercive Action Without SCN & Personal Hearing. 5 years, 9 months ago

SCN IS MUST – NO DEMAND OR COERCIVE ACTION WITHOUT SCN & PERSONAL HEARING.

The Department, of late, has been issuing letters/communications seeking to recover the amount of interest, commenced recovering p […]

Advocate Pradeep Kumar wrote a new post, Quantum of Penalty – How And When – Whether Mens Rea Is One of The Essential Ingredient. 5 years, 9 months ago

QUANTUM OF PENALTY – HOW AND WHEN – WHETHER MENS REA IS ONE OF THE ESSENTIAL INGREDIENT.

In the recent past, the Department is threatening the assessee with the imposition of the penalty for infraction of var […]

Advocate Pradeep Kumar wrote a new post, Taxability of Salary, Allowances, Commission, Benefits, Perks, Under GST – Both Non-Executive And Executive Director of a Company. 5 years, 9 months ago

Taxability of Salary, Allowances, Commission, Benefits, Perks, Under GST – Both Non-Executive And Executive Director of a Company.

As we all know there are are two types of Directors under the Companies Act, 2 […]

Advocate Pradeep Kumar wrote a new post, SALE OF PLEDGED SHARES – CORONA EFFECT – PROCEDURE TO BE FOLLOWED 5 years, 10 months ago

SALE OF PLEDGED SHARES – CORONA EFFECT – PROCEDURE TO BE FOLLOWED

In the last two months, Corona Virus had played havoc with the Stock Market resulting in an unprecedented and steep fall in the share price in t […]

Advocate Pradeep Kumar wrote a new post, Order is Communicated 5 years, 10 months ago

ORDER IS COMMUNICATED

1: The Division Bench of Gujarat High court in the case of Gujarat State Electricity Board Vs. Vipul Kumar MANU/GJ/2442/2019 has discussed the entire law on the issue of service of […]

Advocate Pradeep Kumar wrote a new post, FORCE MAJEURE –CORONA VIRUS- ITS IMPLICATIONS 5 years, 10 months ago

FORCE MAJEURE –CORONA VIRUS- ITS IMPLICATIONS

Force majeure meaning “superior force” chance occurrence, unavoidable accident, is a common clause in contracts that essentially frees both parties from liability o […]

Advocate Pradeep Kumar wrote a new post, LIABILITY OF NON-EXECUTIVE, INDEPENDENT DIRECTOR & NOMINEE DIRECTOR OF A COMPANY UNDER VARIOUS CORPORATE LAWS & GST ACT. 5 years, 10 months ago

LIABILITY OF NON-EXECUTIVE, INDEPENDENT DIRECTOR & NOMINEE DIRECTOR OF A COMPANY UNDER VARIOUS CORPORATE LAWS & GST ACT.

It is very common that under various Corporate Laws such Companies Act, 2013, SEBI Act, […]

Advocate Pradeep Kumar wrote a new post, LIABILITY TO PAY INTEREST IS IT ABSOLUTE OR CONDITIONAL – WHETHER REVERSAL FROM CASH OR ITC. 5 years, 10 months ago

LIABILITY TO PAY INTEREST IS IT ABSOLUTE OR CONDITIONAL – WHETHER REVERSAL FROM CASH OR ITC.

The question of payment of interest by the assessee arises under various provisions of Central Goods & Services Act, […]

Advocate Pradeep Kumar wrote a new post, PRINCIPLE GOVERNING FILING OF APPEAL BEFORE FIRST APPELLATE AUTHORITY. 5 years, 10 months ago

SECTION 107 CGST ACT: PRINCIPLE GOVERNING FILING OF APPEAL BEFORE FIRST APPELLATE AUTHORITY.

Section 107 of Central Goods & Service Tax, 2017 (hereinafter called the GST Act) says that any person aggrieved with […]

Advocate Pradeep Kumar wrote a new post, PRINCIPLE GOVERNING CONDONATION OF DELAY IN FILING OF APPEAL 5 years, 10 months ago

PRINCIPLE GOVERNING CONDONATION OF DELAY IN FILING OF APPEAL

On many occasions, the appeal, as provided under various fiscal laws, could not be filed due to various reasons and, therefore, the appeal has to be […]

Advocate Pradeep Kumar wrote a new post, Delay in refund – Right of assessee to claim interest from department 6 years ago

Introduction:

In this article, an attempt has been by the Author to explain exhaustively various situations in which the assessee would be entitled to claim interest in the event of delay in refund of amount […]