As a result of this development, individuals can now participate in court proceedings at the Gujarat High Court either in person or virtually, using video conference technology.

Cases Covered:

M/s. M. L. Dalmiya & Co. Ltd. & Anr.

Vs

The Additional Commissioner CGST & CX

Facts of the Cases:

I’m pleased to announce that the Hon’ble Calcutta High Court, where the case was argued by […]

In this judgement a SCN was sent to the taxpayer. Instead of going to the appeal the appellant went to the court. A writ under article 226 of Constitution of India was filed. The contention of taxpayer was that […]

Stocks as a whole can be confusing to navigate as a beginner. Especially when every expert out there is trying to use some “stock lingo”. Sometimes it helps, but sometimes all it does is intimidate you […]

People have a number of impulses, and one of them is the propensity to cheat to acquire advantages and illicit benefits. Companies increasingly find that they encounter human avarice and the desire to elevate […]

CGST Rule 107: Certification of copies of the advance rulings pronounced by the Appellate Authority

CGST Rule 107 –

A copy of the advance ruling pronounced by the Appellate Authority for Advance Ruling and duly […]

CGST Rule 106: Form and manner of appeal to the Appellate Authority for Advance Ruling

CGST Rule 106

(1) An appeal against the advance ruling issued under sub-section (6) of section 98 shall be made by an […]

1) Increase in incentives by 2%

Export incentives under Merchandise Exports from India (MEIS) have been increased by 2% across the board for labour intensive MSME sectors leading to additional annual […]

Prem

designer

Paid User

@prem

active 1 week agoPrem

gst taxation

2.0Registered Categories

Location

Adilabad, India

OOPS!

No Packages Added by Prem. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewPrem wrote a new post, Case-4 101 historical cases which changed India. Doctrine of basic structure of Constitution of India. 2 years, 2 months ago

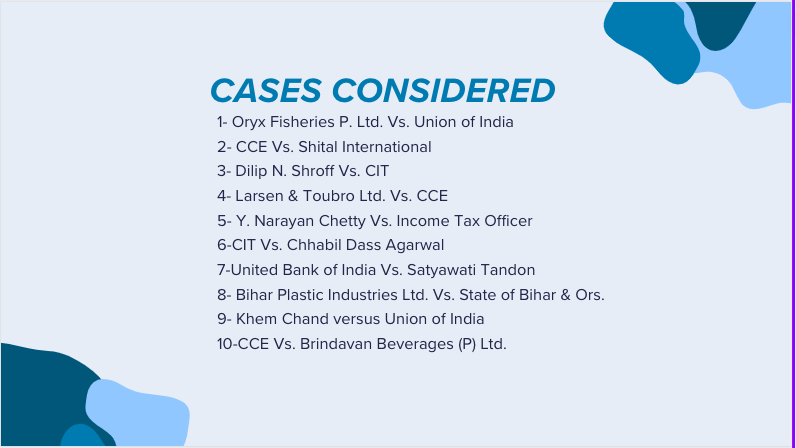

Cases Covered:

Kesavananda Bharati Sripadagalvaru & Ors. v. State of Kerala & Anr

We all understand that the government of India has the right to amend the Constitution of India. But can they amend everything. […]

Prem wrote a new post, Hybrid mode of hearing for all benches, said Gujarat high court(Pdf Attach) 2 years, 2 months ago

As a result of this development, individuals can now participate in court proceedings at the Gujarat High Court either in person or virtually, using video conference technology.

The hybrid system, which was […]

Prem wrote a new post, Adjournments should be given in case of genuine problem of Applicant(Pdf Attach) 2 years, 2 months ago

Cases covered:

M/s.Vadivel Pyro Works, VS The State Tax Officer

Citations:

Pinstar Automotive India Private Limited Vs. Additional Commissioner

Facts of the cases:

The audit of petitioner was conducted by […]

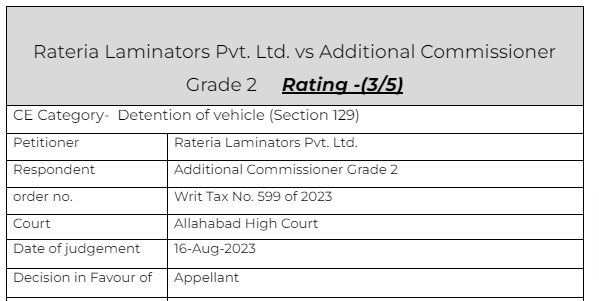

Prem wrote a new post, Detention memo should be a speaking order (Pdf Attach) 2 years, 2 months ago

Case Covered:

Rateria Laminators Pvt. Ltd. vs Additional Commissioner Grade 2

Citation:

1. Bharti Airtel Ltd. vs. State of U.P.

2. Assistant Commissioner (ST) vs. Satyam Shivam Papers Pvt. Ltd.

3. […]

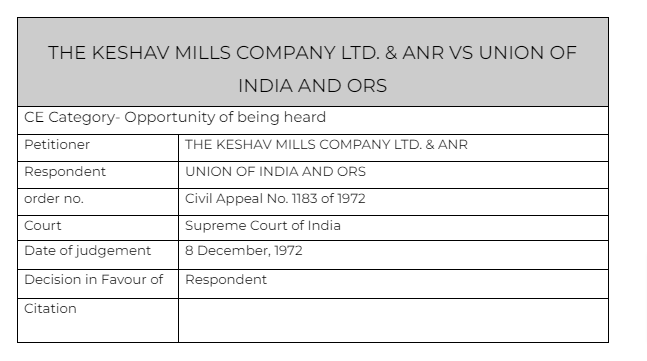

Prem wrote a new post, Exception for opportunity of being heard – Keshav Mills (Pdf Attach) 2 years, 2 months ago

Cases Covered:

THE KESHAV MILLS COMPANY LTD. & ANR VS UNION OF INDIA AND ORS

Facts of the Cases:

This is one of the historical cases related to the principle of natural justice. Every person should be […]

Prem wrote a new post, Service tax scn issued after GST 2 years, 2 months ago

Cases Covered:

M/s. M. L. Dalmiya & Co. Ltd. & Anr.

Vs

The Additional Commissioner CGST & CX

Facts of the Cases:

I’m pleased to announce that the Hon’ble Calcutta High Court, where the case was argued by […]

Prem wrote a new post, Important GST judgement on ITC reversal for default of supplier 2 years, 4 months ago

Brief details of the judgement-

Case- SUNCRAFT ENERGY PRIVATE LIMITED AND ANOTHER VERSUS THE ASSISTANT COMMISSIONER

Court- Calcutta High court

Issue- Liability of reversal of ITC by recipient for default of […]

Prem wrote a new post, SCN Quashed in Case of Nikas Services Pvt Ltd as Vague 2 years, 4 months ago

In this judgement a SCN was sent to the taxpayer. Instead of going to the appeal the appellant went to the court. A writ under article 226 of Constitution of India was filed. The contention of taxpayer was that […]

Prem wrote a new post, Things To Consider Before Opting For A Stock Market Investment 2 years, 4 months ago

Stocks as a whole can be confusing to navigate as a beginner. Especially when every expert out there is trying to use some “stock lingo”. Sometimes it helps, but sometimes all it does is intimidate you […]

Prem wrote a new post, Are Gun Businesses Taxed the Same as Other Businesses? 2 years, 5 months ago

In this article, we’ll be exploring if gun businesses are taxed the same as other businesses…

Gun businesses, which encompass firearm manufacturers, distributors, and retailers, operate in a highly reg […]

Prem wrote a new post, What Are the Most Common Insurance Fraud Claims? 2 years, 7 months ago

People have a number of impulses, and one of them is the propensity to cheat to acquire advantages and illicit benefits. Companies increasingly find that they encounter human avarice and the desire to elevate […]

Prem changed their profile picture 4 years, 6 months ago

Prem posted an update 4 years, 9 months ago

Wednesday post

Prem wrote a new post, CGST Rule 107 : Certification of copies of the advance rulings 5 years, 4 months ago

CGST Rule 107: Certification of copies of the advance rulings pronounced by the Appellate Authority

CGST Rule 107 –

A copy of the advance ruling pronounced by the Appellate Authority for Advance Ruling and duly […]

Prem wrote a new post, CGST Rule 106: Form and manner of appeal to the Appellate Authority for Advance Ruling 5 years, 5 months ago

CGST Rule 106: Form and manner of appeal to the Appellate Authority for Advance Ruling

CGST Rule 106

(1) An appeal against the advance ruling issued under sub-section (6) of section 98 shall be made by an […]

Prem‘s profile was updated 7 years, 1 month ago

Prem‘s profile was updated 7 years, 2 months ago

Prem‘s profile was updated 7 years, 9 months ago

Prem Chand and Consultease Administrator are now friends 7 years, 11 months ago

Consultease Administrator are now friends 7 years, 11 months ago

Prem wrote a new post, Key Highlights of Mid Term Review of Foreign Trade Policy 2015-20 7 years, 11 months ago

1) Increase in incentives by 2%

Export incentives under Merchandise Exports from India (MEIS) have been increased by 2% across the board for labour intensive MSME sectors leading to additional annual […]