Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Hotel booking by a tour operator:

In many cases, tour operators arrange for a hotel room only. They may be doing only an isolated part of ths entire service and not delivering the whole tour. Now the question is […]

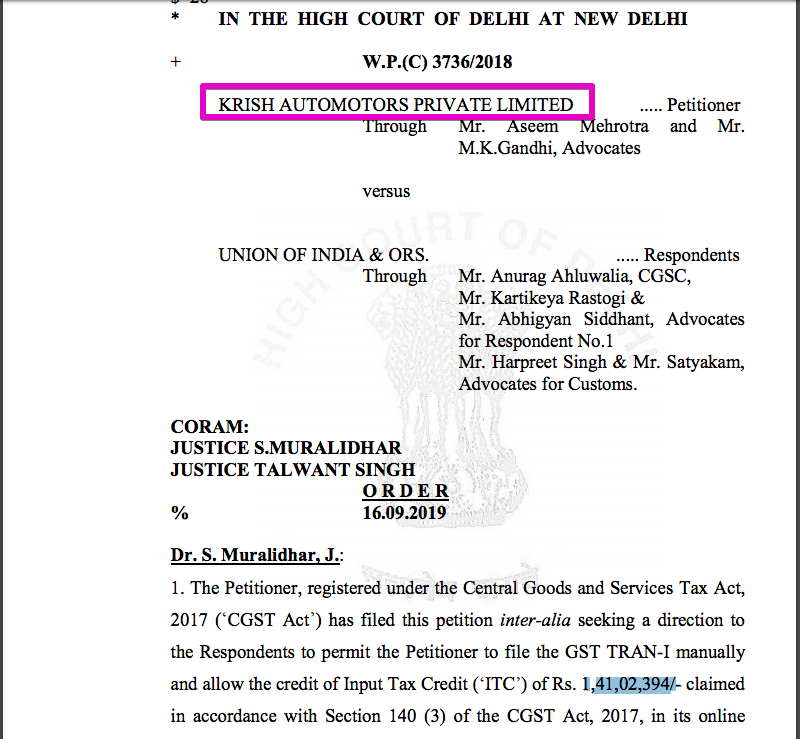

Manual filing of Tran 1 :

In case of KRISH AUTOMOTORS PRIVATE LIMITED Delhi HC allowed the filing of tran 1 manually. Delhi high court also allowed the applicant to take the ITC of Rs. 1,41,02,394/- Again ma […]

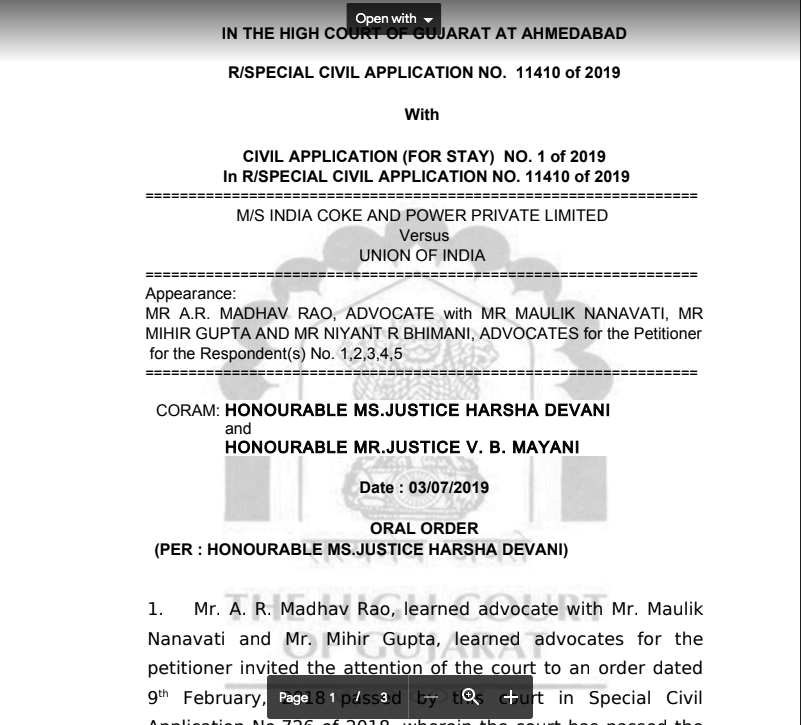

Litigation on RCM on Ocean Freight: From Mohit Minerals to M/s India Coke and power private limited.

It started many months back. The importers were notified by notification no. 10/2017 IGST , entry no. 10. It […]

Rumors about scrap of GSTR 9 & 9C:

There is some news about scrapping the requirement of filing GSTR 9 &9C. Taxpayers having turnover upto Rs. 5 Crore may get relief from filing GSTR 9 &9C. What it means for a […]

Introduction:

AAAR of Maharastra held the decision of AAR. The case of Bajaj finance limited was taken to AAAR. late payment penalty does not interest, held by AAR. It is confirmed by AAAR.

Facts of the […]

Introduction:

This article is for issues related to export refund. We want to promote exports, yes. The government provides many benefits for the exporters. But lack of knowledge restricts many exporters. Many […]

Export of service under the lense of GST authorities:

Export of service can get you in trouble. take care of following issues before you send a quote. If it falls in an intermediary or if the PoS is in India, you […]

State Benches of (GSTAT) the Goods and Services Tax Appellate Tribunal

Following is the list of state benches of (GSTAT)

MINISTRY OF FINANCE (Department of Revenue) NOTIFICATION

New Delhi, the 21st […]

List of exempted services in GST:

We have compiled a list of exempted services in GST. We have divided them into various categories. You can find the taxability of your service using this […]

GST practitioners khatre me:

In a recent case, a GST practitioner was held guilty for fraud. Let us have a look at the entire case.

5 tips to make your GST practice safe:

Top 13 high court decisions in GST

We have compiled a list of top 13 high court decisions in GST. It is helpful for all consultants. It is based on the importance of a decision. Their original orders links are […]

No interest for availed ITC: A huge relief for taxpayers in GST:

The litigation in GST is getting heat. every day a new decision is making history. HC are bringing huge relief to the taxpayers. This one is about […]

interest on pending IGST refund of exporters:

The decision of Gujrat high court in case of M/S SARAF NATURAL STONE Vs UOI Gujrat High court is important. It is held that interest is payable on the pending […]

Charitable activity in GST :

There is an exemption for charitable activity in GST. Entry no. 1 of notification no. 12/2017 covers the exemption for charitable activity.

ITC of 2017-18: Can we claim it till filing of annual return?

The first year of GST. Can we claim the missed ITC? Last date to claim ITC for FY 2017-18. CBIC also clarified via press release that time limit in […]

Amendment in interest provisions:

Section 50(1) of CGST Act is proposed to be amended. Finance bill 2019 has proposed a change. It contains the provisions related to interest in GST. After the Telangana High […]

Finance bill 2019 introduced new changes in CGST Act:

Clauses 91 to 112 of finance bill 2019 introduced changes in CGST Act. These changes are important. Following is a brief table of all […]

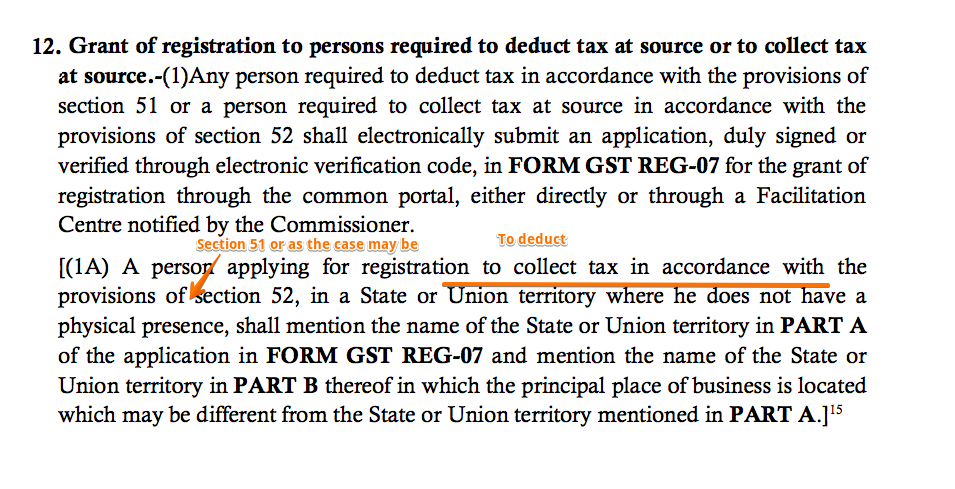

Introduction:Changes via CGST (fifth amendment) Rules

Notification no. 33/2019 – Central Tax has changed the CGST rules. Following changes are incorporated in CGST rules.Changes via CGST (fifth amendment) Ru […]

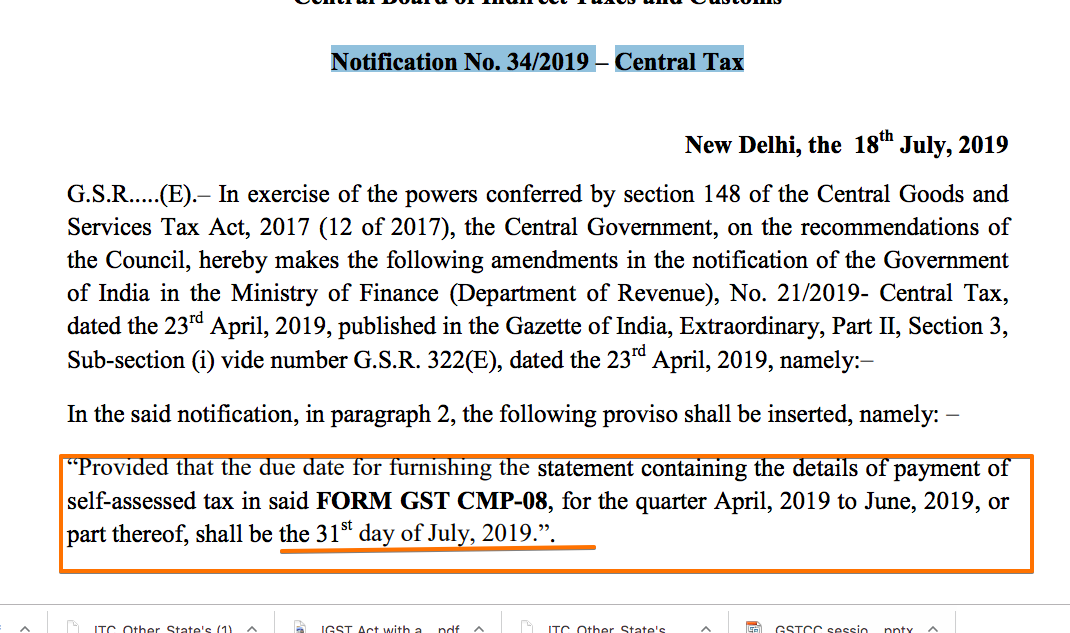

Finally the due date of CMP 08 is extended by CBIC. Notification no. 34/2019 – Central Tax issued on 18th July 2019 extended the date for filing of CMP 08. Taxpayers was in amess as the form was not live on the p […]

IGST Act PDF with all amendments:

Dear all, You can download the IGST Act PDF with all amendments to date. It is amended by following two amendment Acts.

IGST Amendment Act 2018

Finance Bill 2019 (proposed […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 6 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Booking hotel is classifiable under SAC 998552 6 years, 5 months ago

Hotel booking by a tour operator:

In many cases, tour operators arrange for a hotel room only. They may be doing only an isolated part of ths entire service and not delivering the whole tour. Now the question is […]

CA Shafaly Girdharwal wrote a new post, ITC of Rs. 1,41,02,394/- allowed by Delhi HC on manual filing of Tran 1 6 years, 5 months ago

Manual filing of Tran 1 :

In case of KRISH AUTOMOTORS PRIVATE LIMITED Delhi HC allowed the filing of tran 1 manually. Delhi high court also allowed the applicant to take the ITC of Rs. 1,41,02,394/- Again ma […]

CA Shafaly Girdharwal wrote a new post, Litigation on RCM on Ocean freight: 2019 6 years, 5 months ago

Litigation on RCM on Ocean Freight: From Mohit Minerals to M/s India Coke and power private limited.

It started many months back. The importers were notified by notification no. 10/2017 IGST , entry no. 10. It […]

CA Shafaly Girdharwal wrote a new post, Do we really want the scrap of GSTR 9 & 9C ? 6 years, 5 months ago

Rumors about scrap of GSTR 9 & 9C:

There is some news about scrapping the requirement of filing GSTR 9 &9C. Taxpayers having turnover upto Rs. 5 Crore may get relief from filing GSTR 9 &9C. What it means for a […]

CA Shafaly Girdharwal wrote a new post, late payment penalty is not interest: Maha AAR & AAAR 6 years, 5 months ago

Introduction:

AAAR of Maharastra held the decision of AAR. The case of Bajaj finance limited was taken to AAAR. late payment penalty does not interest, held by AAR. It is confirmed by AAAR.

Facts of the […]

CA Shafaly Girdharwal wrote a new post, export refund: 5 checks to ensure timely 6 years, 5 months ago

Introduction:

This article is for issues related to export refund. We want to promote exports, yes. The government provides many benefits for the exporters. But lack of knowledge restricts many exporters. Many […]

CA Shafaly Girdharwal wrote a new post, Export of service? check this before quoting 6 years, 5 months ago

Export of service under the lense of GST authorities:

Export of service can get you in trouble. take care of following issues before you send a quote. If it falls in an intermediary or if the PoS is in India, you […]

CA Shafaly Girdharwal wrote a new post, list of State Benches of (GSTAT) 6 years, 6 months ago

State Benches of (GSTAT) the Goods and Services Tax Appellate Tribunal

Following is the list of state benches of (GSTAT)

MINISTRY OF FINANCE (Department of Revenue) NOTIFICATION

New Delhi, the 21st […]

CA Shafaly Girdharwal wrote a new post, Exempted services in GST update till date 6 years, 7 months ago

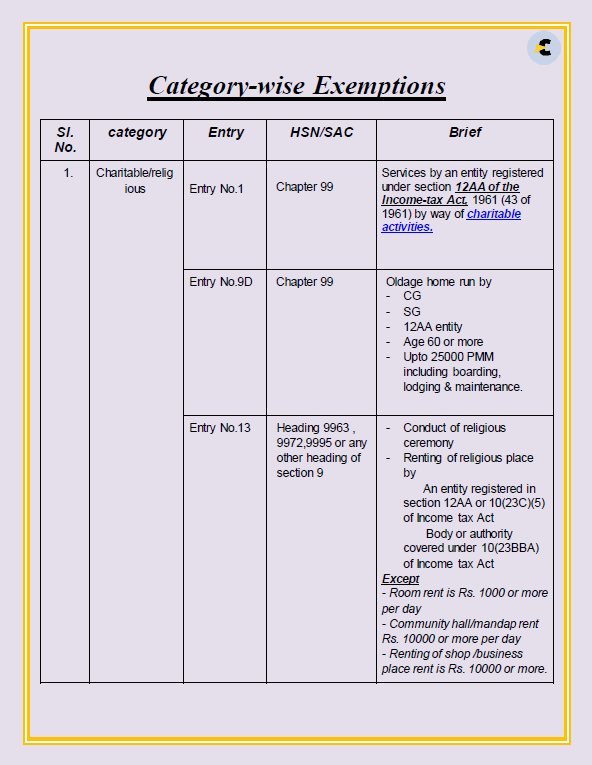

List of exempted services in GST:

We have compiled a list of exempted services in GST. We have divided them into various categories. You can find the taxability of your service using this […]

CA Shafaly Girdharwal wrote a new post, Caution for all GST practitioners 6 years, 7 months ago

GST practitioners khatre me:

In a recent case, a GST practitioner was held guilty for fraud. Let us have a look at the entire case.

5 tips to make your GST practice safe:

Always verify the documents. Get […]

CA Shafaly Girdharwal wrote a new post, Top 13 high court decisions in GST 6 years, 7 months ago

Top 13 high court decisions in GST

We have compiled a list of top 13 high court decisions in GST. It is helpful for all consultants. It is based on the importance of a decision. Their original orders links are […]

CA Shafaly Girdharwal wrote a new post, No interest for availed ITC: Patna HC 6 years, 7 months ago

No interest for availed ITC: A huge relief for taxpayers in GST:

The litigation in GST is getting heat. every day a new decision is making history. HC are bringing huge relief to the taxpayers. This one is about […]

CA Shafaly Girdharwal wrote a new post, 9% interest on pending IGST refund: Guj HC 6 years, 7 months ago

interest on pending IGST refund of exporters:

The decision of Gujrat high court in case of M/S SARAF NATURAL STONE Vs UOI Gujrat High court is important. It is held that interest is payable on the pending […]

CA Shafaly Girdharwal wrote a new post, what is charitable activity in GST ? 6 years, 7 months ago

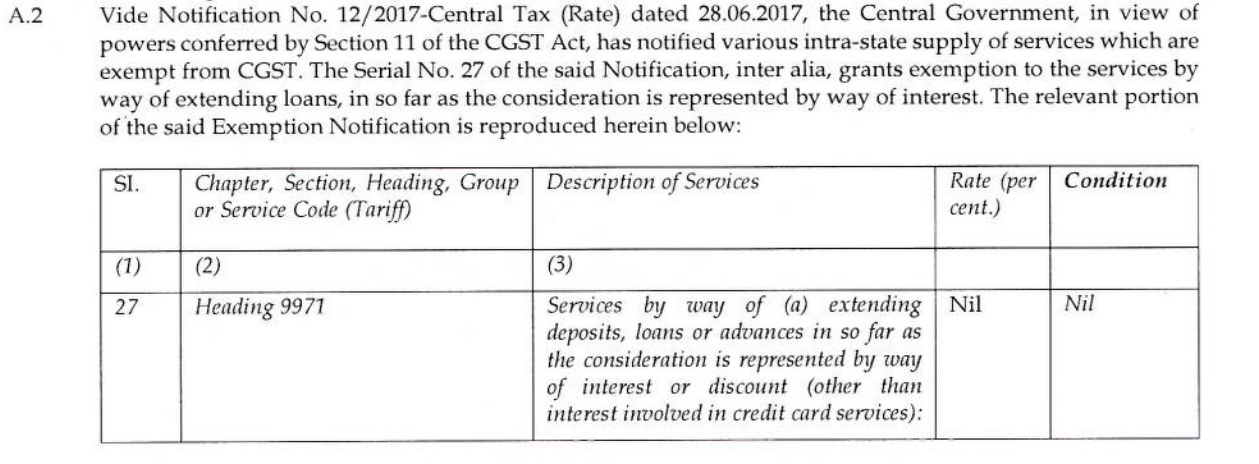

Charitable activity in GST :

There is an exemption for charitable activity in GST. Entry no. 1 of notification no. 12/2017 covers the exemption for charitable activity.

Exemption for taxpayers engaged i […]

CA Shafaly Girdharwal wrote a new post, Can we still claim ITC of 2017-18? 6 years, 7 months ago

ITC of 2017-18: Can we claim it till filing of annual return?

The first year of GST. Can we claim the missed ITC? Last date to claim ITC for FY 2017-18. CBIC also clarified via press release that time limit in […]

CA Shafaly Girdharwal wrote a new post, Amendment in interest provisions is retrospective 6 years, 7 months ago

Amendment in interest provisions:

Section 50(1) of CGST Act is proposed to be amended. Finance bill 2019 has proposed a change. It contains the provisions related to interest in GST. After the Telangana High […]

CA Shafaly Girdharwal wrote a new post, Proposed changes in CGST Act by FB 2019 6 years, 7 months ago

Finance bill 2019 introduced new changes in CGST Act:

Clauses 91 to 112 of finance bill 2019 introduced changes in CGST Act. These changes are important. Following is a brief table of all […]

CA Shafaly Girdharwal wrote a new post, Changes via CGST (fifth amendment) Rules 6 years, 7 months ago

Introduction:Changes via CGST (fifth amendment) Rules

Notification no. 33/2019 – Central Tax has changed the CGST rules. Following changes are incorporated in CGST rules.Changes via CGST (fifth amendment) Ru […]

CA Shafaly Girdharwal wrote a new post, Due date of CMP 08 is extended to 31st July 6 years, 7 months ago

Finally the due date of CMP 08 is extended by CBIC. Notification no. 34/2019 – Central Tax issued on 18th July 2019 extended the date for filing of CMP 08. Taxpayers was in amess as the form was not live on the p […]

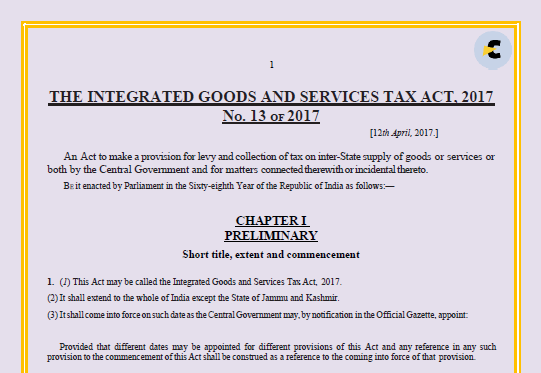

CA Shafaly Girdharwal wrote a new post, IGST Act PDF with all amendments till date 6 years, 7 months ago

IGST Act PDF with all amendments:

Dear all, You can download the IGST Act PDF with all amendments to date. It is amended by following two amendment Acts.

IGST Amendment Act 2018

Finance Bill 2019 (proposed […]