Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

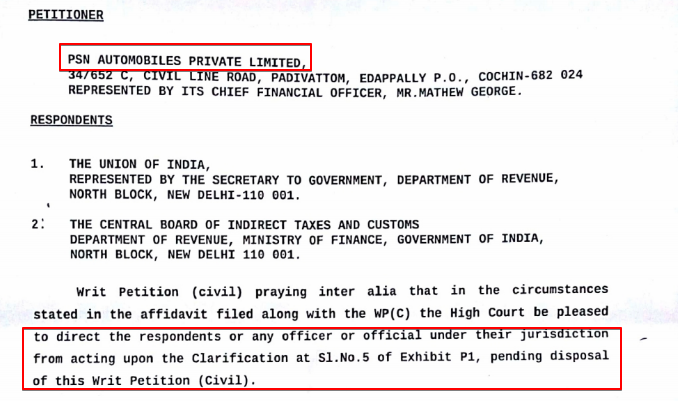

Stay on circular adding TCS for calculation of GST:

Circular no. 76/50/2018 dated 31st December 2018 clarified the calculation of GST in case of TCS. In some cases TCS deduction is required under the provisions […]

GoM constituted to bring in real estate into GST:

A GoM is constituted to bring in real estate into GST. A 7-Member Group of Ministers (GOM) has been constituted for boosting Real Estate Sector under GST regime […]

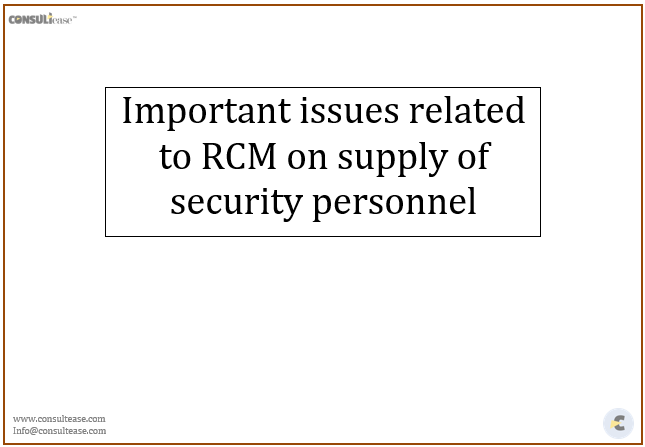

Important issues related to RCM on supply of security personnel

RCM on the supply of security personnel: Notification No. 29/2018- Central Tax (Rate) introduced the RCM on supply of security personnel. The […]

Car is used personal effect once delivery is taken: HC

In a landmark judgement Kerala high court held that car is not liable for detention once delivery is taken. In this case a car was purchased from other […]

Reason shall be recorded in writing for attachment:

Reason shall be recorded in writing for attachment for section 83 of CGST Act. In case of Steel Patran rolling mills Vs. Assistant commissioner HC held […]

FAQ’s on GST annual return

Annual return of GST is annual compliance under GST Law. Section 44(1) read with rule 80 of CGST rules covers the provisions of Annual return. There FAQ’s on GST annual return are d […]

Head wise Checklist for GST audit

This article will discuss about Head wise Checklist for GST audit. It is about verification of correctness of turnover, taxes paid, ITC and refund. It also includes the […]

GSTR 9C: Reconciliation and certification:

This article is drafted to address the important issues related to GSTR 9C.

What is GSTR 9C?

GSTR 9C is the form for audit report by a Chartered Accountant and Cost […]

Important ruling for place of supply in GST for Exports:

In the advance ruling of M/s Segoma India place of supply in GST for Exports is discussed.

Section 2(6) of IGST provide the definition of Export of […]

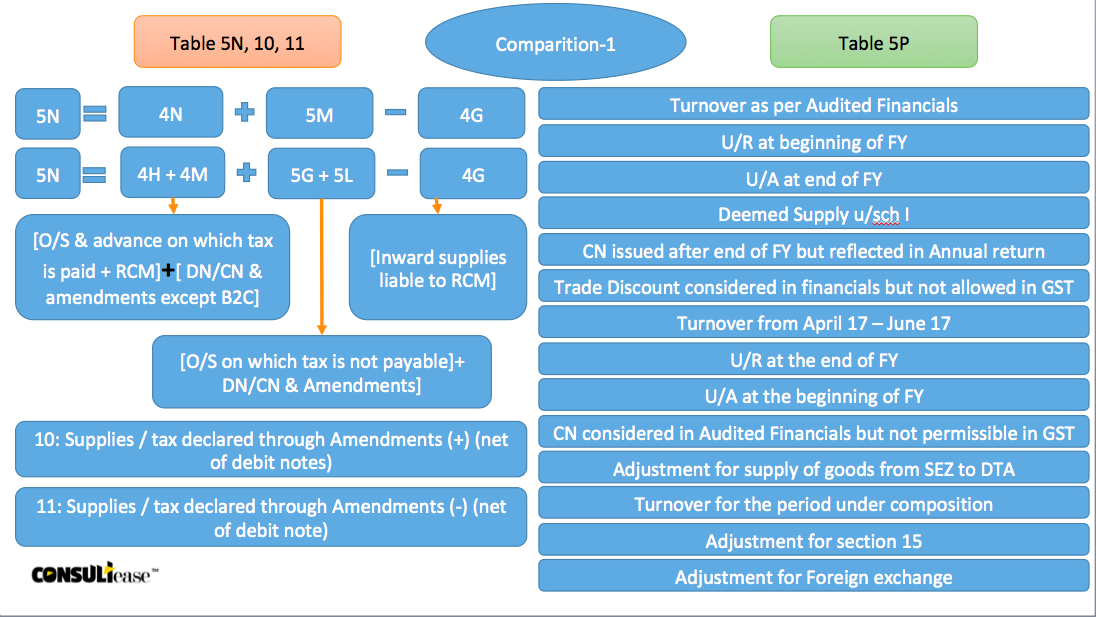

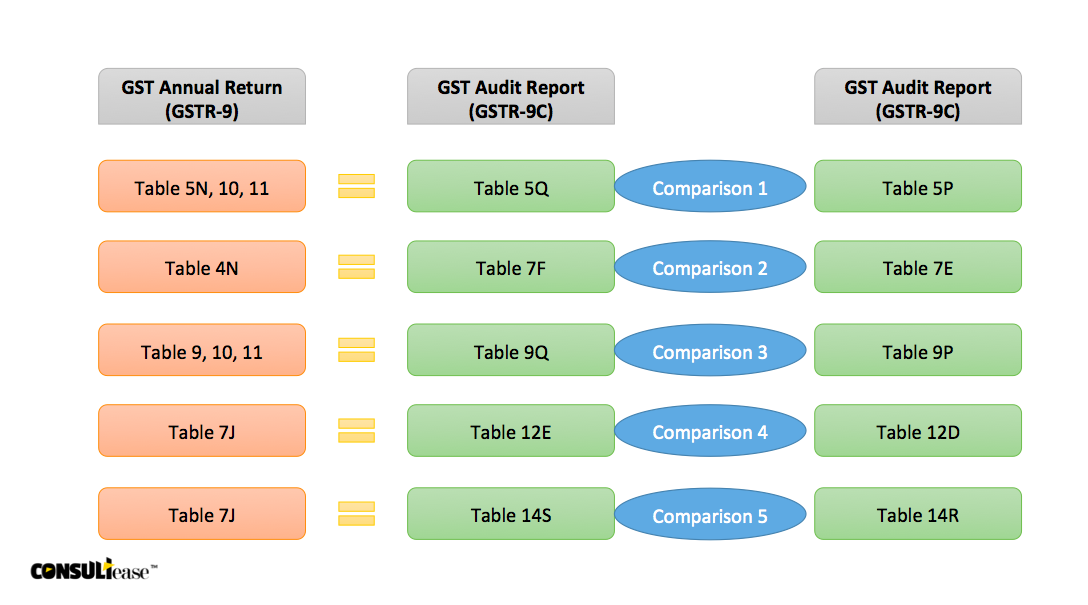

Reconciliation of GST audit report with annual return:

Reconciliation of GST audit report with annual return is important to understand. A set of data will move from GST annual return to GST audit report. There […]

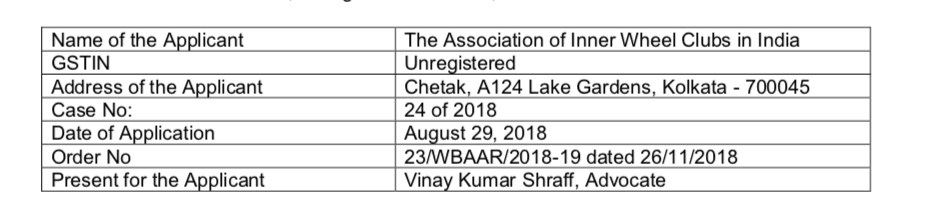

Membership fee can be consideration in GST

In the recent advance ruling by AAR of west Bengal clarified this issue. In the respected case the question raised before the authority was about activities done by i […]

Taxability of works contracts for PSU in GST

There is a huge number of works contracts for PSU in GST . Many contractors work for various government entities for construction projects. The Contracts done for […]

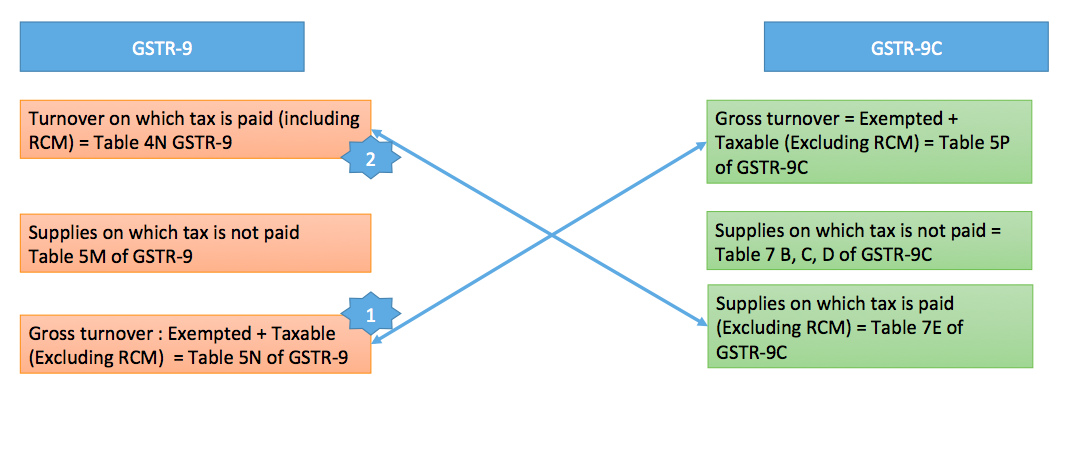

Mapping of turnover from GSTR 9 to GSTR 9C:

In this article we have discussed the Mapping of turnover from GSTR 9 to GSTR 9C. We will discuss all the mapping one by one. But in this particular write up we will c […]

Taxability of various supplies to patients in GST:

Healthcare services are exempt in GST. Hospitals do many activities to facilitate the patients. In this article we will discuss about the taxability of various […]

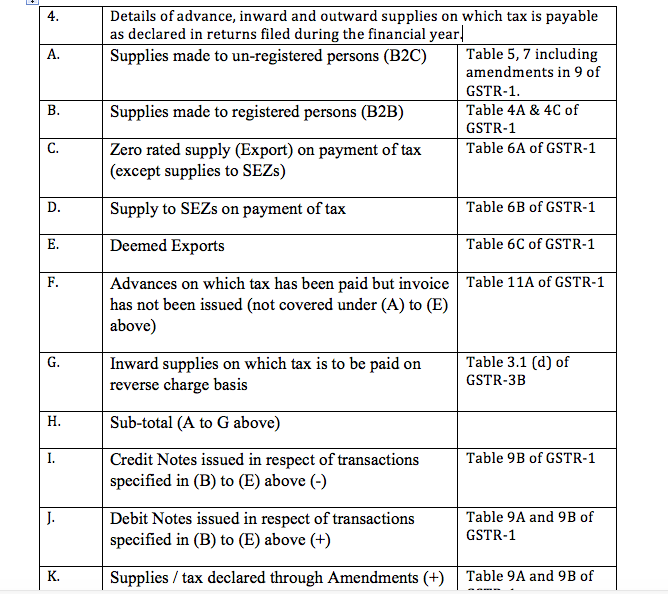

Mapping of Turnover in GST annual return:

Mapping of Turnover in GST annual return.Here we will see the link of data given in GSTR 1 or 3b into GST annual return.

Details of advance, inward and outward supplies […]

Treatment of transactions with employees in GST

Treatment of transactions with employees in GST is one of the most contentious issue in GST . Corporates find out new ways to retain their employees. In GST how […]

FAQ’s on GST audit

FAQ’s on GST audit and audit report.

Q.1: Who is liable for GST Audit?

Ans. Section 35(5) provide for GST audit in case the turnover is more than prescribed limit. Rule 80(3) provide for […]

Original order of GST AAR for NALCO:

Original order of GST AAR for NALCO. This ruling is important in the sense that it provide for the eligibility of ITC for expanses incurred on residential accomodation for […]

Original order of GST AAR of Nash Industries:

THE AUTHORITY ON ADVANCE RULINGS IN KARNATAKA GOODS AND SERVICES TAX

VANIJYA THERIGE KARYALAYA,

KALIDASA ROAD GANDHINAGAR, BENGALURU – 560 009

Advance Ruling N […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Stay on circular adding TCS for calculation of GST 7 years ago

Stay on circular adding TCS for calculation of GST:

Circular no. 76/50/2018 dated 31st December 2018 clarified the calculation of GST in case of TCS. In some cases TCS deduction is required under the provisions […]

CA Shafaly Girdharwal wrote a new post, GoM constituted to bring in real estate into GST 7 years ago

GoM constituted to bring in real estate into GST:

A GoM is constituted to bring in real estate into GST. A 7-Member Group of Ministers (GOM) has been constituted for boosting Real Estate Sector under GST regime […]

CA Shafaly Girdharwal wrote a new post, Ultra Vires RCM On Sea Freight 7 years ago

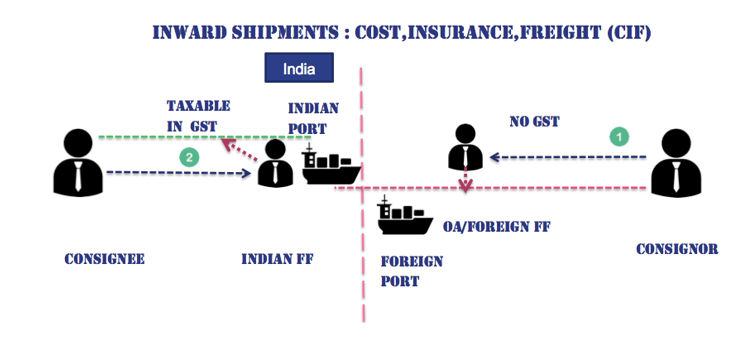

Ultra Vires RCM On Sea Freight

The coverage of Ocean freight under RCM:

There are many dark places in Law. These dark areas scare the taxpayer and the lawmakers too. It becomes a huge responsibility on […]

CA Shafaly Girdharwal wrote a new post, Important issues related to RCM on supply of security personnel 7 years ago

Important issues related to RCM on supply of security personnel

RCM on the supply of security personnel: Notification No. 29/2018- Central Tax (Rate) introduced the RCM on supply of security personnel. The […]

CA Shafaly Girdharwal wrote a new post, Car is used personal effect once delivery is taken: HC 7 years, 1 month ago

Car is used personal effect once delivery is taken: HC

In a landmark judgement Kerala high court held that car is not liable for detention once delivery is taken. In this case a car was purchased from other […]

CA Shafaly Girdharwal wrote a new post, HC in patran steel : Reason shall be recorded in writing for attachment 7 years, 1 month ago

Reason shall be recorded in writing for attachment:

Reason shall be recorded in writing for attachment for section 83 of CGST Act. In case of Steel Patran rolling mills Vs. Assistant commissioner HC held […]

CA Shafaly Girdharwal wrote a new post, FAQ’s on GST annual return 7 years, 1 month ago

FAQ’s on GST annual return

Annual return of GST is annual compliance under GST Law. Section 44(1) read with rule 80 of CGST rules covers the provisions of Annual return. There FAQ’s on GST annual return are d […]

CA Shafaly Girdharwal wrote a new post, Head wise Checklist for GST audit 7 years, 1 month ago

Head wise Checklist for GST audit

This article will discuss about Head wise Checklist for GST audit. It is about verification of correctness of turnover, taxes paid, ITC and refund. It also includes the […]

CA Shafaly Girdharwal wrote a new post, GSTR 9C: Reconciliation and certification 7 years, 1 month ago

GSTR 9C: Reconciliation and certification:

This article is drafted to address the important issues related to GSTR 9C.

What is GSTR 9C?

GSTR 9C is the form for audit report by a Chartered Accountant and Cost […]

CA Shafaly Girdharwal wrote a new post, Important ruling for place of supply in GST for Exports 7 years, 1 month ago

Important ruling for place of supply in GST for Exports:

In the advance ruling of M/s Segoma India place of supply in GST for Exports is discussed.

Section 2(6) of IGST provide the definition of Export of […]

CA Shafaly Girdharwal wrote a new post, Reconciliation of GST audit report with annual return 7 years, 2 months ago

Reconciliation of GST audit report with annual return:

Reconciliation of GST audit report with annual return is important to understand. A set of data will move from GST annual return to GST audit report. There […]

CA Shafaly Girdharwal wrote a new post, Membership fee can be consideration in GST 7 years, 2 months ago

Membership fee can be consideration in GST

In the recent advance ruling by AAR of west Bengal clarified this issue. In the respected case the question raised before the authority was about activities done by i […]

CA Shafaly Girdharwal wrote a new post, Taxability of works contracts for PSU in GST 7 years, 2 months ago

Taxability of works contracts for PSU in GST

There is a huge number of works contracts for PSU in GST . Many contractors work for various government entities for construction projects. The Contracts done for […]

CA Shafaly Girdharwal wrote a new post, Mapping of turnover from GSTR 9 to GSTR 9C 7 years, 2 months ago

Mapping of turnover from GSTR 9 to GSTR 9C:

In this article we have discussed the Mapping of turnover from GSTR 9 to GSTR 9C. We will discuss all the mapping one by one. But in this particular write up we will c […]

CA Shafaly Girdharwal wrote a new post, Taxability of various supplies to patients in GST 7 years, 2 months ago

Taxability of various supplies to patients in GST:

Healthcare services are exempt in GST. Hospitals do many activities to facilitate the patients. In this article we will discuss about the taxability of various […]

CA Shafaly Girdharwal wrote a new post, Mapping of Turnover in GST annual return 7 years, 2 months ago

Mapping of Turnover in GST annual return:

Mapping of Turnover in GST annual return.Here we will see the link of data given in GSTR 1 or 3b into GST annual return.

Details of advance, inward and outward supplies […]

CA Shafaly Girdharwal wrote a new post, Treatment of transactions with employees in GST 7 years, 2 months ago

Treatment of transactions with employees in GST

Treatment of transactions with employees in GST is one of the most contentious issue in GST . Corporates find out new ways to retain their employees. In GST how […]

CA Shafaly Girdharwal wrote a new post, FAQ’s on GST audit and GST audit report 7 years, 2 months ago

FAQ’s on GST audit

FAQ’s on GST audit and audit report.

Q.1: Who is liable for GST Audit?

Ans. Section 35(5) provide for GST audit in case the turnover is more than prescribed limit. Rule 80(3) provide for […]

CA Shafaly Girdharwal wrote a new post, Original order of GST AAR for NALCO 7 years, 2 months ago

Original order of GST AAR for NALCO:

Original order of GST AAR for NALCO. This ruling is important in the sense that it provide for the eligibility of ITC for expanses incurred on residential accomodation for […]

CA Shafaly Girdharwal wrote a new post, Original order of GST AAR of Nash Industries 7 years, 2 months ago

Original order of GST AAR of Nash Industries:

THE AUTHORITY ON ADVANCE RULINGS IN KARNATAKA GOODS AND SERVICES TAX

VANIJYA THERIGE KARYALAYA,

KALIDASA ROAD GANDHINAGAR, BENGALURU – 560 009

Advance Ruling N […]