Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Comment

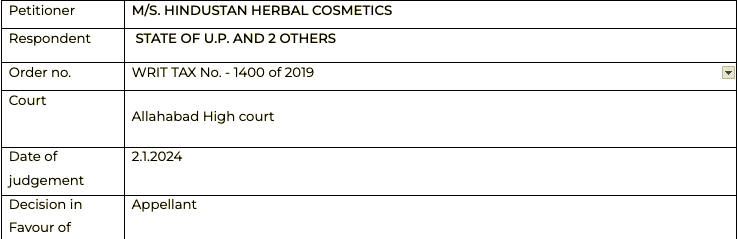

The court’s decision to set aside the penalty order and direct a fresh assessment aligns with principles of fairness and adherence to legal requirements. It underscores the importance of establishing […]

In an important updated the Delhi sales tax bar association demonstrated against the department.The reason behind that was the vague notices and orders by the GST department.

AI generated vague notices

The […]

Comment-

Every exporter using Paypal should be aware of this judgment. VEry important as in many cases the refund of tax on export was denied if the payment is received in rupees. In the case of an amount […]

Comment-

A search was conducted at the premises of the taxpayer. Lateron the same officer issues the notice. The SC decision in case of Ashok Kumar Yadav and others v. State of Haryana and others, (1985) 4 SCC […]

Comment-

This is one of the controversial judgments in GST. As we all know that many of us are deprived of our valid input tax credit because it was not claimed in GTSR 3b.

Commentary on the case-

In this judgment there was a typographical error in the vehicle number in E-way bill. The documents were cross checked at a check point and there was difference in vehicle number filled in […]

In a recent development the honourable SC has held that electoral bonds are unconstitutional. The court also made some observations regarding section 182 of Companies Act. This section was amended to go away with […]

Pleading

The present petition has been filed to assail the order dated 21.2.2023 passed by the Joint Director (CGST) (Appeals), Noida. “The operative portion of the order reads as be […]

Expat salary is under the lanses of Department. The supreme court already decided in a the case of Northern Operating Systems Private Limited (NOS). In this case the amount was deemed to be service and was made […]

Introduction

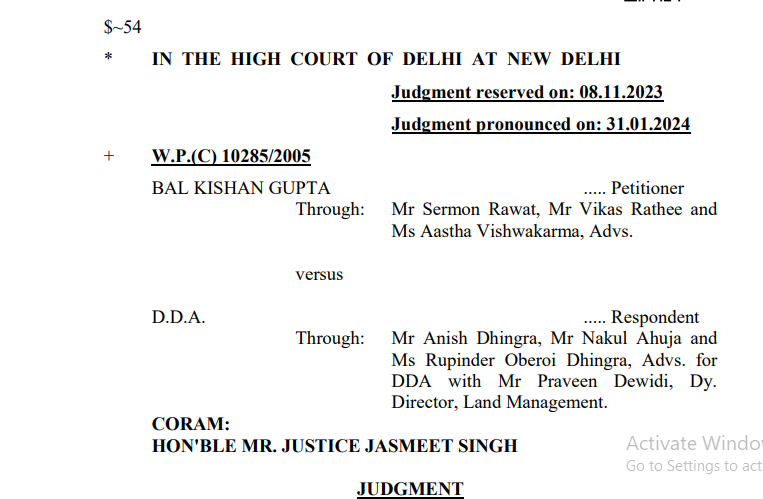

In a recent ruling, the Delhi High Court underscored the imperative for the Delhi Development Authority (DDA) to adhere to principles of natural […]

Comment

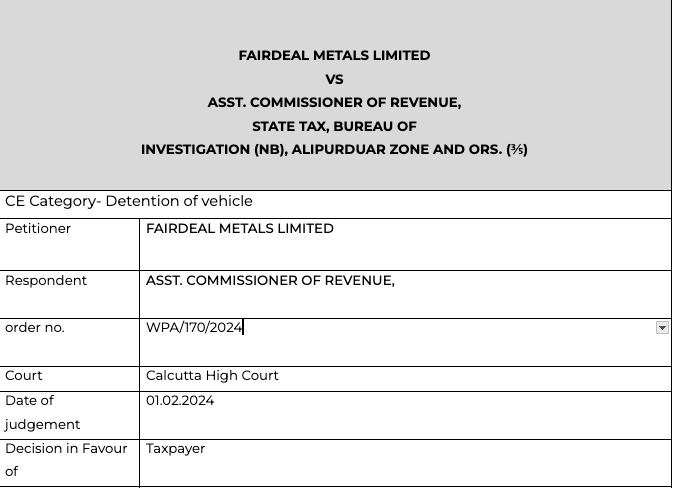

There were differences in various documents but that was corrected by the taxpayer. In case the correct documents are presented before the authorized before passing the order then it should be accepted by […]

Comment

The specific case of the petitioner is that there is no allegation against the petitioner but the entire allegation has been made against the supplier from whom the petitioner procured the goods.

Details […]

Comment

The petition filed challenging the constitutional validity of Anti profiteering provisions of GST is hereby quashed by the SC. The provisions of anti profiteering are upheld by the supreme court.

Details […]

Comment

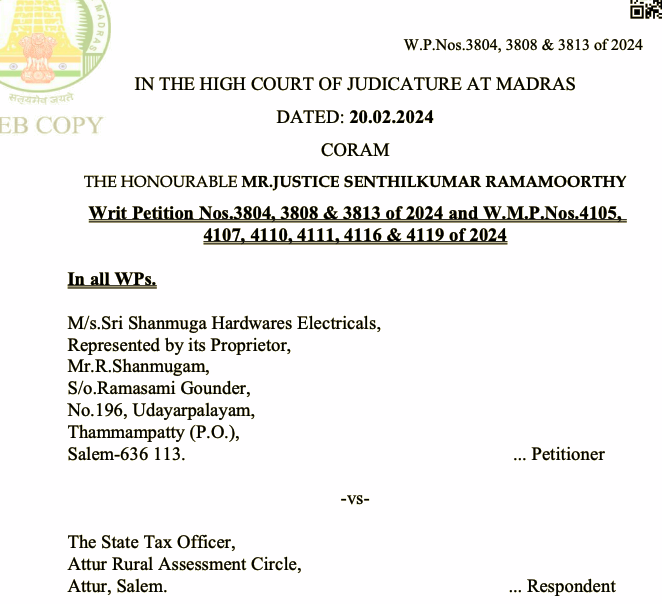

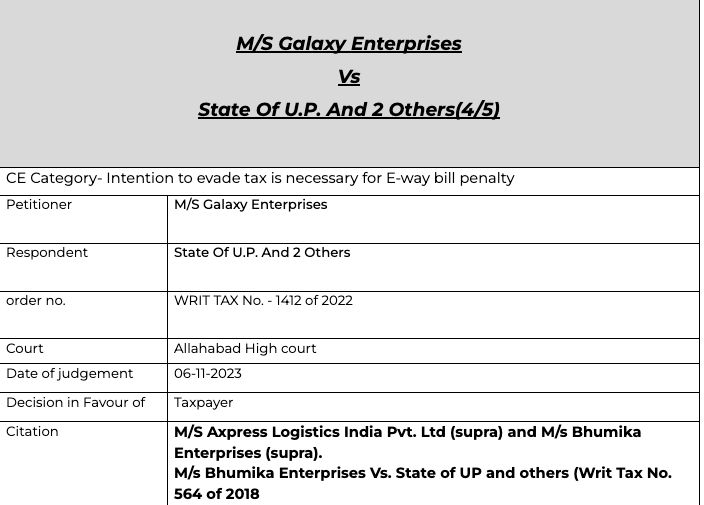

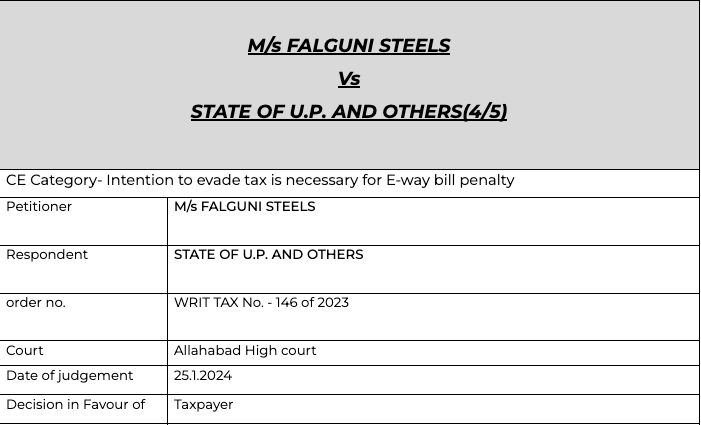

In many judgments it is clarified that there should not be a levy of penalty without an intention to evade tax. In this judgment court again clarified that the penalty should only be levied when there is […]

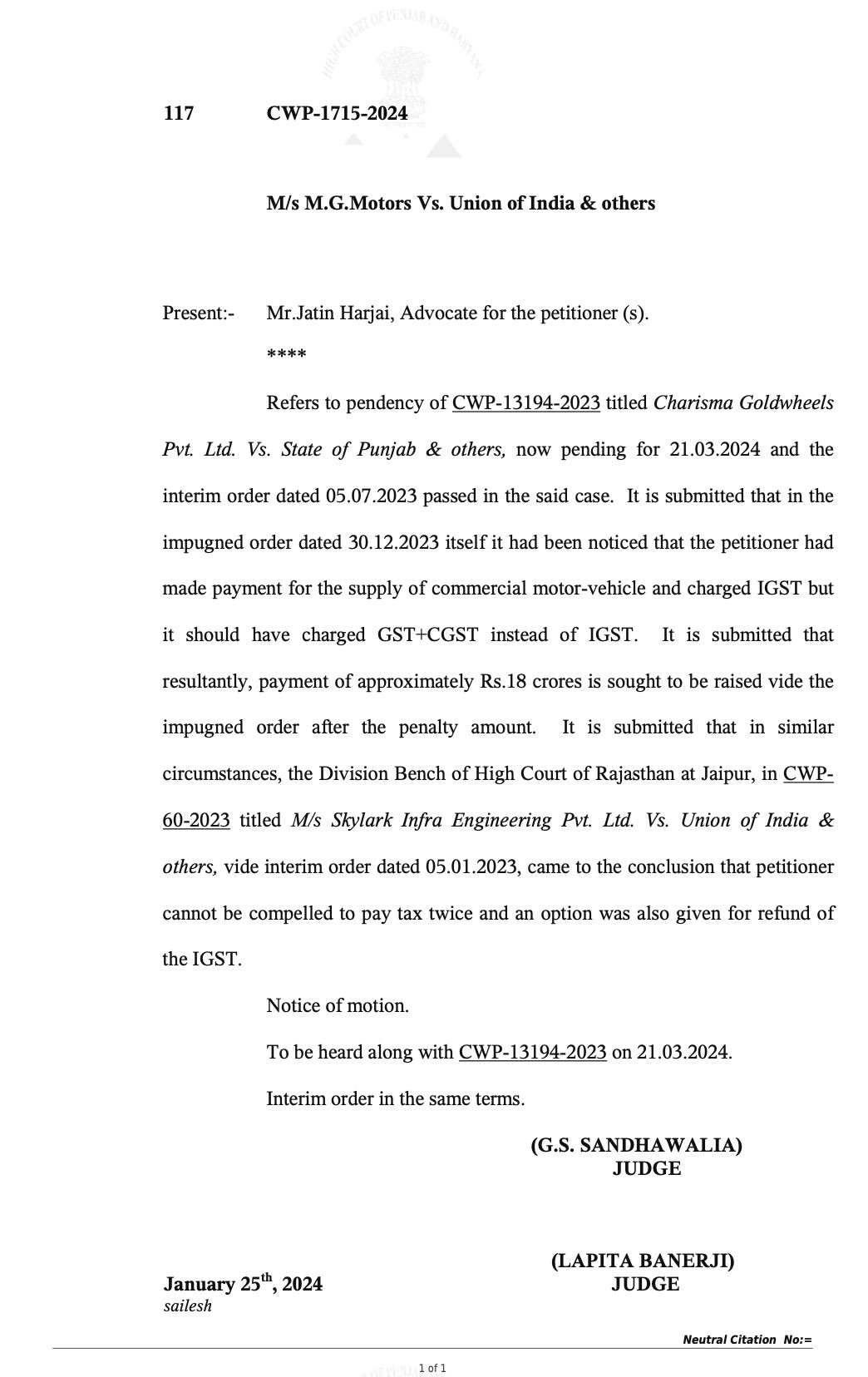

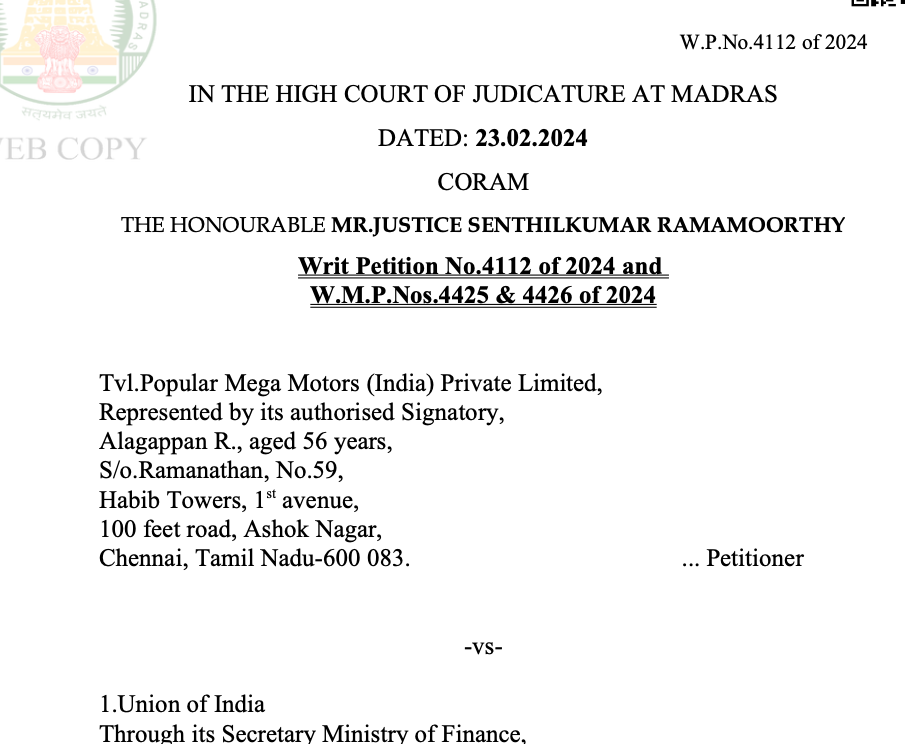

In a recent judgement the court has stayed the notice asking for the tax amount of Rs. 18 Cr for the sale of vehicles. The trucks sold to the inter state customers was charged for IGST. Lateron the department […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Tax Fairness: M/S Sanjay Sales Agency v. State of U.P. 1 year, 11 months ago

Comment

The court’s decision to set aside the penalty order and direct a fresh assessment aligns with principles of fairness and adherence to legal requirements. It underscores the importance of establishing […]

CA Shafaly Girdharwal wrote a new post, Whether the IBC will prevail GST- Judgment 2024 1 year, 11 months ago

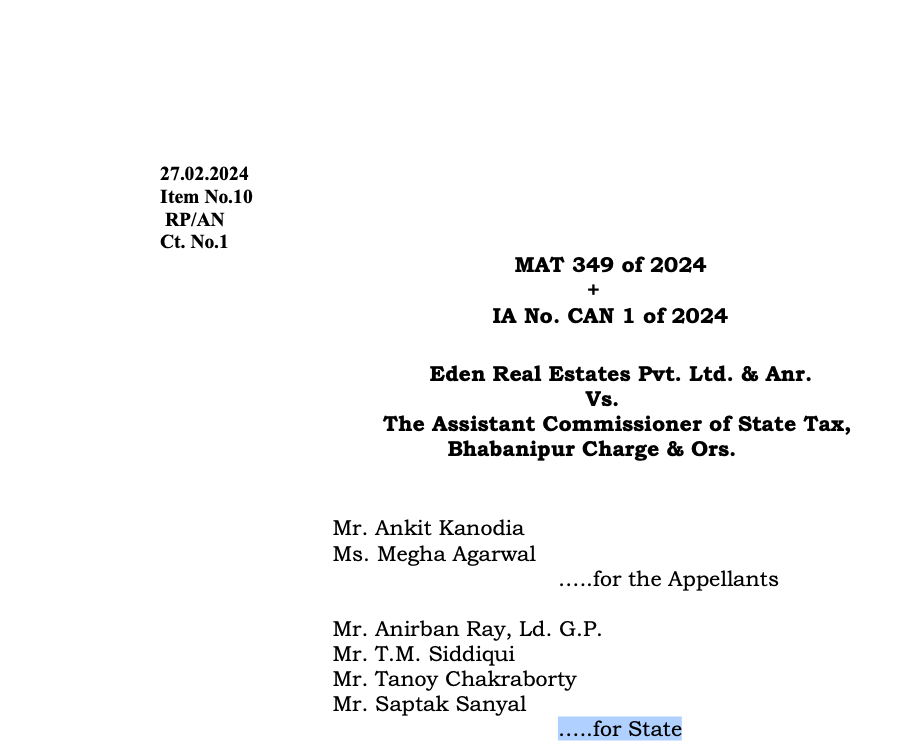

Petitioner

Eden Real Estates Pvt. Ltd. & Anr

Respondent

The Assistant Commissioner of State Tax, Bhabanipur Charge & Ors.

Comment

Whether the provisions of IBC will supersede the pr […]

CA Shafaly Girdharwal wrote a new post, Delhi Sales tax bar demonstration against vague notices and orders of Deptt 1 year, 11 months ago

In an important updated the Delhi sales tax bar association demonstrated against the department.The reason behind that was the vague notices and orders by the GST department.

AI generated vague notices

The […]

CA Shafaly Girdharwal wrote a new post, Exporters receiving payment via Paypal are eligible for GST refund- HC 1 year, 11 months ago

Comment-

Every exporter using Paypal should be aware of this judgment. VEry important as in many cases the refund of tax on export was denied if the payment is received in rupees. In the case of an amount […]

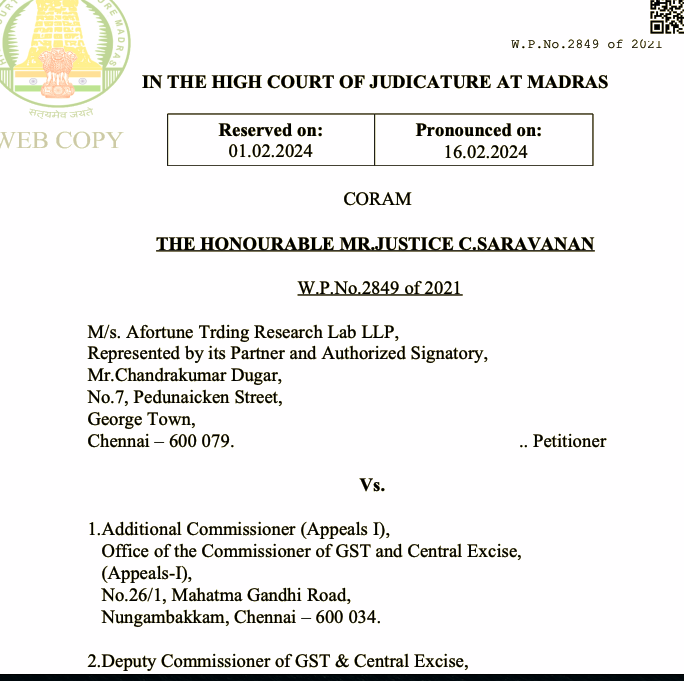

CA Shafaly Girdharwal wrote a new post, The officer searched u/s 67of GST can’t adjudicate- Madras HC 1 year, 11 months ago

Comment-

A search was conducted at the premises of the taxpayer. Lateron the same officer issues the notice. The SC decision in case of Ashok Kumar Yadav and others v. State of Haryana and others, (1985) 4 SCC […]

CA Shafaly Girdharwal wrote a new post, ITC cant be rejected only because it was not claimed in GSTR 3B-HC 1 year, 11 months ago

Comment-

This is one of the controversial judgments in GST. As we all know that many of us are deprived of our valid input tax credit because it was not claimed in GTSR 3b.

This is the normal understanding […]

CA Shafaly Girdharwal wrote a new post, Typographical error in vehicle number- High court decision on penalty 1 year, 11 months ago

Commentary on the case-

In this judgment there was a typographical error in the vehicle number in E-way bill. The documents were cross checked at a check point and there was difference in vehicle number filled in […]

CA Shafaly Girdharwal wrote a new post, CBIC issued procedure for amendment in Bill of entry [download pdf] 1 year, 11 months ago

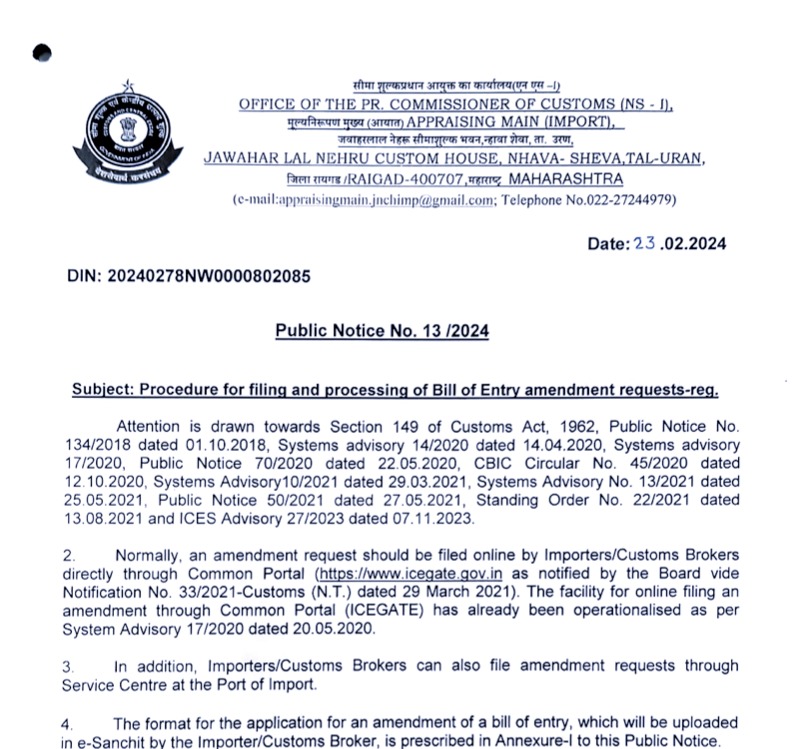

CBIC has issued a notification for the process of amendment in bill of entry. The procedure will be based on various amendments as per their nature.

Author can be reached at shaifaly.ca@gmail.com

Self […]

CA Shafaly Girdharwal wrote a new post, A cost of Rs. 50,000 levied on conducting the search during moratorium period by the GST department 1 year, 11 months ago

Brief summary of the case-

CE Category- NCLAT interplay with GST

Author can be reached at shaifaly.ca@gmail.com

A cost of Rs. 50,000 was levied on the department for conducting search during the moratorium […]

CA Shafaly Girdharwal wrote a new post, Benami Act will apply to past transactions where the property is “held” even after its applicability 1 year, 11 months ago

Commentary-

An important judgment where the Apex courts judgment was clarified so as to cover the past transactions in Benami

The applicability of Benami Act was settled by the Apex court in case of […]

CA Shafaly Girdharwal wrote a new post, Provisions of electoral bonds are unconstitutional- SC 1 year, 11 months ago

In a recent development the honourable SC has held that electoral bonds are unconstitutional. The court also made some observations regarding section 182 of Companies Act. This section was amended to go away with […]

CA Shafaly Girdharwal wrote a new post, ITC can be claimed on invoices. HC dropped the notice 1 year, 12 months ago

Details of the case

Citations

Suncraft Energy Private Limited and another vs. The Assistant Commissioner

Union of India vs. Bharti Airtel Limited and others

Pleading

To stay the SCN issued for recovery of […]

CA Shafaly Girdharwal wrote a new post, AA can’t remind back the case to adjudicating authority- HC 1 year, 12 months ago

Details of the case

Pleading

The present petition has been filed to assail the order dated 21.2.2023 passed by the Joint Director (CGST) (Appeals), Noida. “The operative portion of the order reads as be […]

CA Shafaly Girdharwal wrote a new post, Bombay High court stayed the order demanding tax on Expat Salary 1 year, 12 months ago

Expat salary is under the lanses of Department. The supreme court already decided in a the case of Northern Operating Systems Private Limited (NOS). In this case the amount was deemed to be service and was made […]

CA Shafaly Girdharwal wrote a new post, “Delhi High Court’s Procedural Fairness Ruling” 2 years ago

Introduction

In a recent ruling, the Delhi High Court underscored the imperative for the Delhi Development Authority (DDA) to adhere to principles of natural […]

CA Shafaly Girdharwal wrote a new post, No Penalty if the documents are produced before passing the order 2 years ago

Comment

There were differences in various documents but that was corrected by the taxpayer. In case the correct documents are presented before the authorized before passing the order then it should be accepted by […]

CA Shafaly Girdharwal wrote a new post, Yet another case to drop the E -way bill penalty 2 years ago

Comment

The specific case of the petitioner is that there is no allegation against the petitioner but the entire allegation has been made against the supplier from whom the petitioner procured the goods.

Details […]

CA Shafaly Girdharwal wrote a new post, Anti profiteering provisions are constitutionally valid- SC 2 years ago

Comment

The petition filed challenging the constitutional validity of Anti profiteering provisions of GST is hereby quashed by the SC. The provisions of anti profiteering are upheld by the supreme court.

Details […]

CA Shafaly Girdharwal wrote a new post, Penalty in absence of any evasion is bound to drop 2 years ago

Comment

In many judgments it is clarified that there should not be a levy of penalty without an intention to evade tax. In this judgment court again clarified that the penalty should only be levied when there is […]

CA Shafaly Girdharwal wrote a new post, High court stayed 18 crore demand on tax paid as IGST 2 years ago

In a recent judgement the court has stayed the notice asking for the tax amount of Rs. 18 Cr for the sale of vehicles. The trucks sold to the inter state customers was charged for IGST. Lateron the department […]