Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

We all know that GST is going to be a biggest reform but it’s not a win win situation for everyone. Especially the service sector is going to face some heat because of GST. Let us discuss some important points t […]

GST is going to be a reality very soon. Under new Law process of filing return and to claim input tax credit will be more transparent. Each and every Invoice will be matched with each other. Although final […]

GST Act was passed by Rajya Sabha yesterday and today it is again presented at Lok Sabha. There are some more steps to go and hopefully it will be a legislation very soon. Our finance minister is expecting to roll […]

It really takes a lot of efforts and money to generate leads but many times we feel it hard to convert them into sale. In this article we are going to cover some important situation you generally face in […]

We have deep knowledge about our niche but when it comes to create our website we always feel confused. Here we are going to educate you for the basic but most essential features you should discuss with your web […]

How to file TDS return

How to file TDS return without help of expert.

How to file TDS return without any software. Only the utility available on NSDL website will be […]

India has got the power to tax the capital gains on the sale of shares of domestic companies by entities based in Mauritius. This move will have a major impact on funds invested via Mauritius.Mauritius is used […]

As per the recent update in regulations, it is now mandatory for Mutual Fund investors to update the Extended KYC details at the time of creating a new portfolio. This has been effective since November 1, […]

CBDT has issued draft rules on foreign tax credit. These rules will provide clarity to Indian companies and individual assesses having foreign income. As per these rules assesse having foreign income will be able […]

So many articles written by many elite experts will tell you how to create wealth and reach the goal of financial planning. We read all those things more or less everyone will tell you same kind of things or some […]

In case you have booked any long term capital gain in last six months you can save tax by investing in 54EC bonds issued by NHAI recently. Find your eligibility here:

In its first bi-monthly policy RBI governor Raghuram Rajan reduced the repo by 25 bps although the market expectation was higher but still he cheered the market by his shift in liquidity management policy. RBI’s l […]

Rajkumar Panjwani

@rajkumarpanjwani

active 6 years, 5 months agoRajkumar Panjwani

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, How GST is going to make an adverse impact on service sector 9 years, 6 months ago

We all know that GST is going to be a biggest reform but it’s not a win win situation for everyone. Especially the service sector is going to face some heat because of GST. Let us discuss some important points t […]

CA Shafaly Girdharwal‘s profile was updated 9 years, 6 months ago

CA Shafaly Girdharwal wrote a new post, Model GST Law 2016: returns and Input tax credit maching mechanism 9 years, 6 months ago

GST is going to be a reality very soon. Under new Law process of filing return and to claim input tax credit will be more transparent. Each and every Invoice will be matched with each other. Although final […]

CA Shafaly Girdharwal wrote a new post, 26 FAQ’s on GST covering Transition, registration, filing of returns and input tax credit 9 years, 6 months ago

GST Act was passed by Rajya Sabha yesterday and today it is again presented at Lok Sabha. There are some more steps to go and hopefully it will be a legislation very soon. Our finance minister is expecting to roll […]

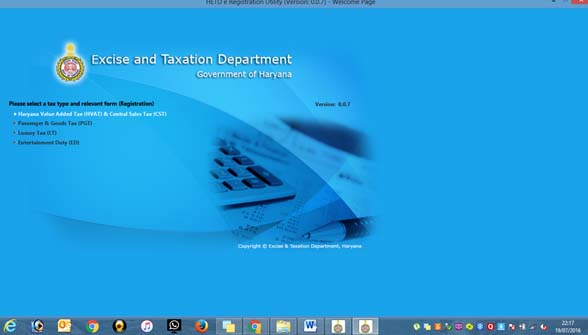

CA Shafaly Girdharwal wrote a new post, Step by step guide on Haryana VAT/CST registration online 9 years, 6 months ago

Here we will discuss the step by step guide to register under Haryana VAT

Before starting your registration under Haryana VAT compile the following details so that you won’t have to rush to files again and […]

CA Shafaly Girdharwal wrote a new post, 7 strategies plus patience to make you profit from share market 9 years, 7 months ago

There are two type of investors/traders:

a) Highly optimistic

b) Sunk cases.(vow to never come back)

No matter in which category you are you will have to take care of some points and these strategies ate […]

CA Shafaly Girdharwal wrote a new post, You are struggling to convert a lead into client because 9 years, 7 months ago

It really takes a lot of efforts and money to generate leads but many times we feel it hard to convert them into sale. In this article we are going to cover some important situation you generally face in […]

CA Shafaly Girdharwal wrote a new post, 8 must have features for your emerging consulting business website 9 years, 7 months ago

We have deep knowledge about our niche but when it comes to create our website we always feel confused. Here we are going to educate you for the basic but most essential features you should discuss with your web […]

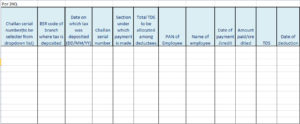

CA Shafaly Girdharwal wrote a new post, DIY: How to file TDS return without the help of any expert/software 9 years, 8 months ago

What you will learn here

How to file TDS return

How to file TDS return without help of expert.

How to file TDS return without any software. Only the utility available on NSDL website will be […]

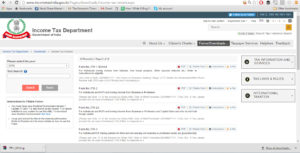

CA Shafaly Girdharwal wrote a new post, How to file ITR 1without help of any expert or software in 15 minutes 9 years, 9 months ago

What you will learn here

How to file ITR-1

File ITR using utility available free at Income tax department of India’s website

File ITR -1 without the help of any expert.

We all need to file ITR to f […]

CA Shafaly Girdharwal wrote a new post, Axe on Tax havens under new Mauritius treaty India will tax capital Gains 9 years, 9 months ago

India has got the power to tax the capital gains on the sale of shares of domestic companies by entities based in Mauritius. This move will have a major impact on funds invested via Mauritius.Mauritius is used […]

CA Shafaly Girdharwal wrote a new post, Why you need to update your kyc: RBI new Direction 9 years, 9 months ago

As per the recent update in regulations, it is now mandatory for Mutual Fund investors to update the Extended KYC details at the time of creating a new portfolio. This has been effective since November 1, […]

CA Shafaly Girdharwal wrote a new post, CBDT draft rules on foreign tax credit 9 years, 9 months ago

CBDT has issued draft rules on foreign tax credit. These rules will provide clarity to Indian companies and individual assesses having foreign income. As per these rules assesse having foreign income will be able […]

CA Shafaly Girdharwal wrote a new post, 10 tips to build and track your mutual funds portfolio 9 years, 9 months ago

In this article we are going to give answers to some basic questions every investor have in mind.

How to invest in mutual funds?

How to build a mutual fund’s portfolio?

How to track my mutual fund’s […]

CA Shafaly Girdharwal changed their profile picture 9 years, 10 months ago

CA Shafaly Girdharwal changed their profile picture 9 years, 10 months ago

CA Shafaly Girdharwal wrote a new post, Six things you should never do while investing 9 years, 10 months ago

So many articles written by many elite experts will tell you how to create wealth and reach the goal of financial planning. We read all those things more or less everyone will tell you same kind of things or some […]

CA Shafaly Girdharwal wrote a new post, Check if you can also save tax by investing in new tranche of 54EC bonds issued by NHAI 9 years, 10 months ago

In case you have booked any long term capital gain in last six months you can save tax by investing in 54EC bonds issued by NHAI recently. Find your eligibility here:

Eligibility for exemption by investing in […]

CA Shafaly Girdharwal wrote a new post, What RBI bi monthly policy April 2016 brings for investors and borrowers? 9 years, 10 months ago

In its first bi-monthly policy RBI governor Raghuram Rajan reduced the repo by 25 bps although the market expectation was higher but still he cheered the market by his shift in liquidity management policy. RBI’s l […]

CA Shafaly Girdharwal changed their profile picture 9 years, 10 months ago