Curbs on Non-Essential Goods: Ways to Regulate Imports

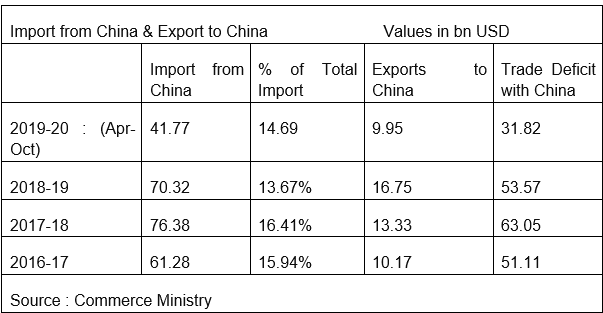

Imports are foreign goods and services that are produced in a foreign country and sold to domestic residents of a country. If a country imports more than i […]

Stringent Systems Put in Place to Detect Fraudulent Refund Claims by Exporters

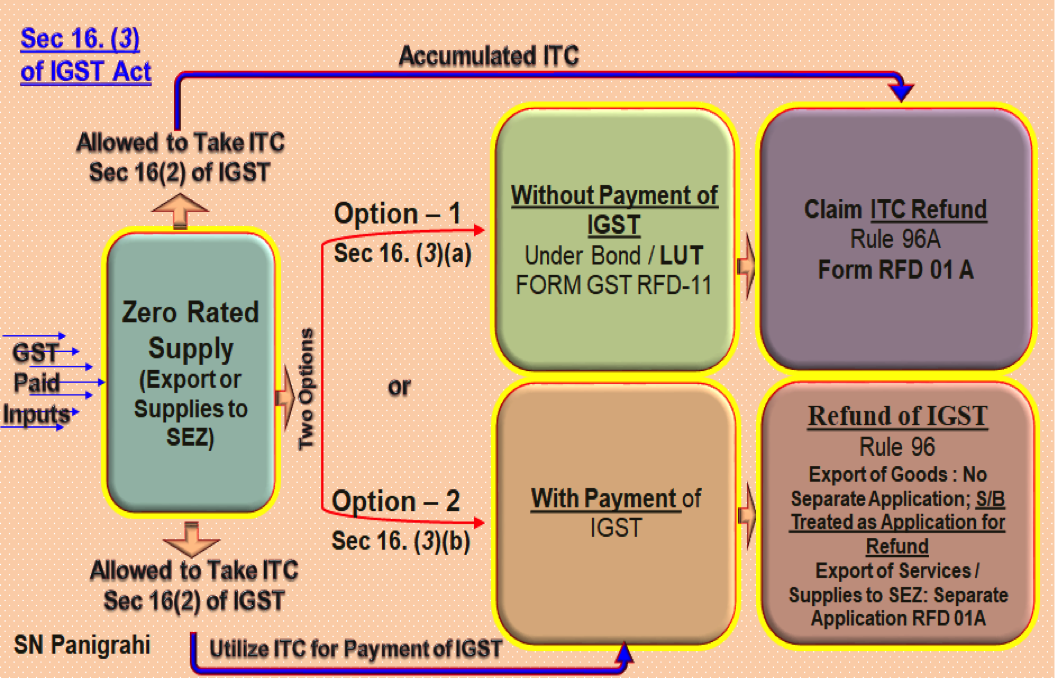

No Automatic Refund of IGST of Exports will be there anymore. As per Sec 16. (3) of IGST Act, Exporters of Goods or Services are […]

Introduction:

In this article we will discuss about our foreign trade policy. India Traditionally a Trade Deficit Country. India’s Exports in 2018-19 stood at $331 billion, while Imports soared high of $507.44 b […]

Introduction:

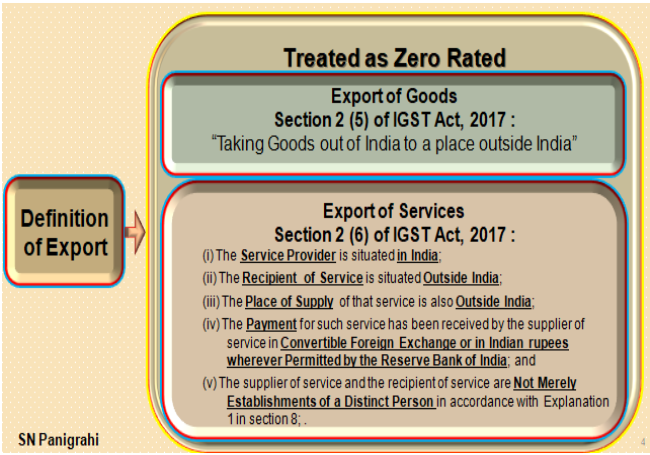

There are lot of Confusion regarding Export to Nepal / Bhutan. In this Article an attempt has been made to clarify those Critical Questions.

Let’s first understand basics and then move to c […]

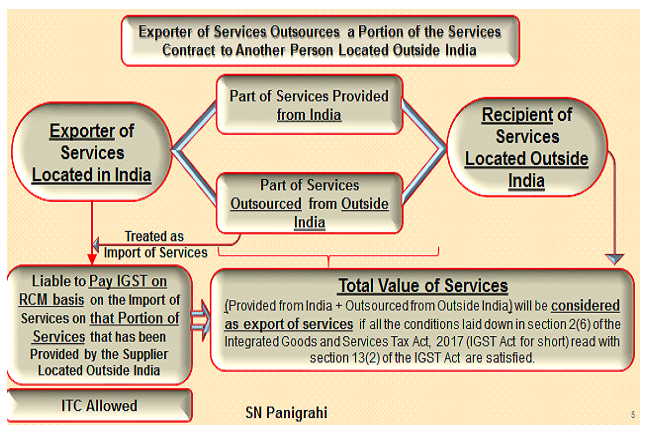

In case an exporter of services outsources a portion of the services contract to another person located outside India, what would be the tax treatment of the said portion of the contract at the hands of the […]

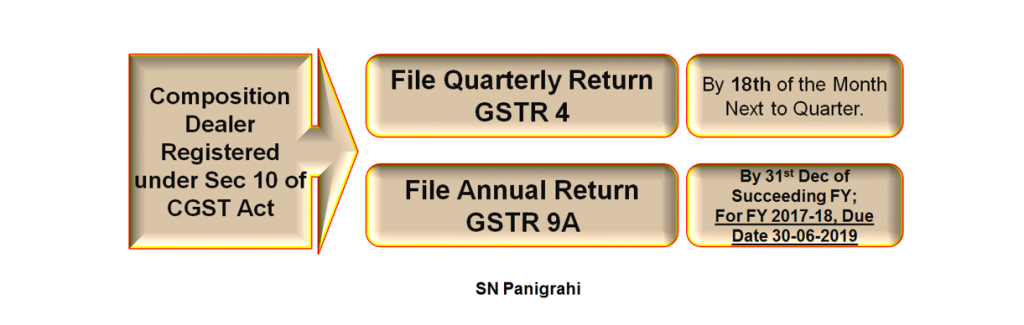

What is composition scheme?

A composition dealer is required to file GSTR-9A. They are covered by section 10 of CGST Act.Composition Scheme is a simple and easy scheme under GST for Small Taxpayers especially […]

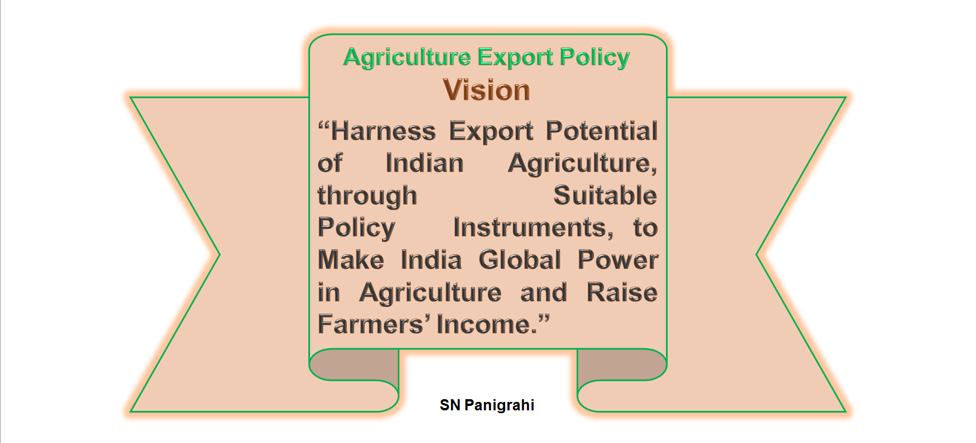

“Modi”-Nomics : Vision to Double Agricultural Exports, Agriculture Export Policy, 2018

The Union Cabinet chaired by Prime Minister Shri Narendra Modi has approved the Agriculture Export Policy, 2018.

The […]

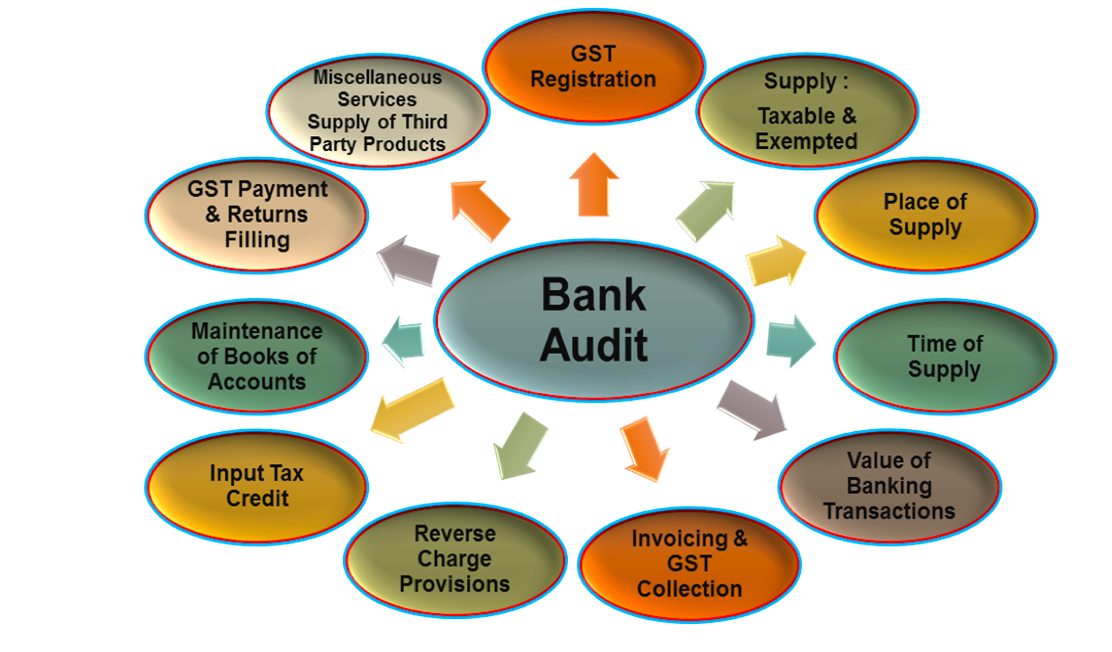

Bank Audit from GST Angle:

In this article we have discussed bank audit from GST angle.Bank auditing is the procedure of reviewing the services and procedures adopted by banks and other financial institutions. It […]

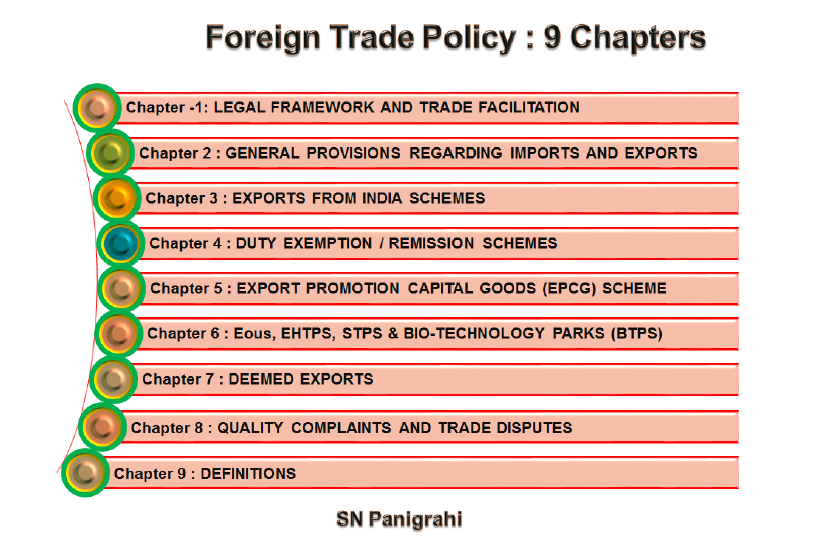

Advance Authorization Schemes under GST

The vision behind the Foreign Trade Policy continues to be focused on making India a significant participant in world trade and on enabling the country to assume a […]

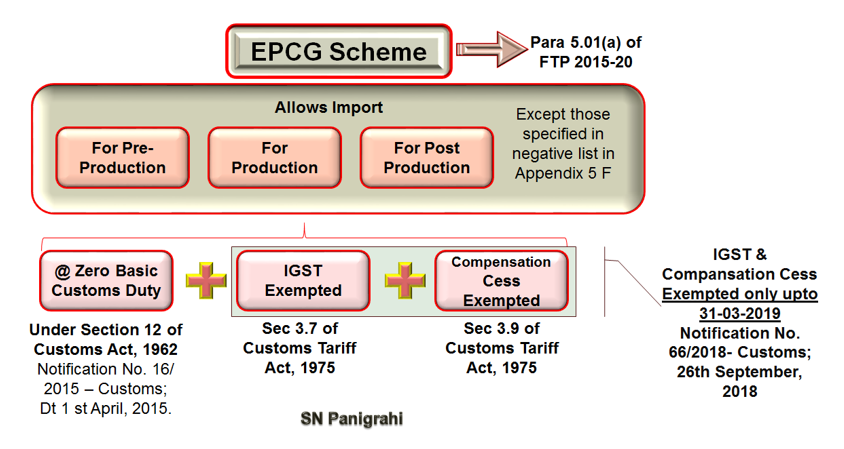

Complete Analysis of EPCG Scheme

This is a very Beneficial Export Promotion Scheme through which Capital Goods required for Export Production is allowed Duty-Free.

Objective

The objective of the EPCG Scheme is […]

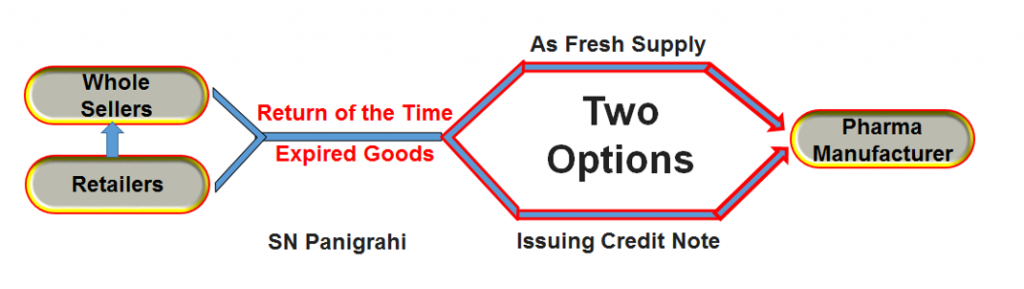

Procedure in Respect of Return of Expired Drugs or Medicine

The pharmaceutical sector was valued at US$ 33 billion in 2017. The country’s pharmaceutical industry is expected to expand at a CAGR of 22.4 per cent o […]

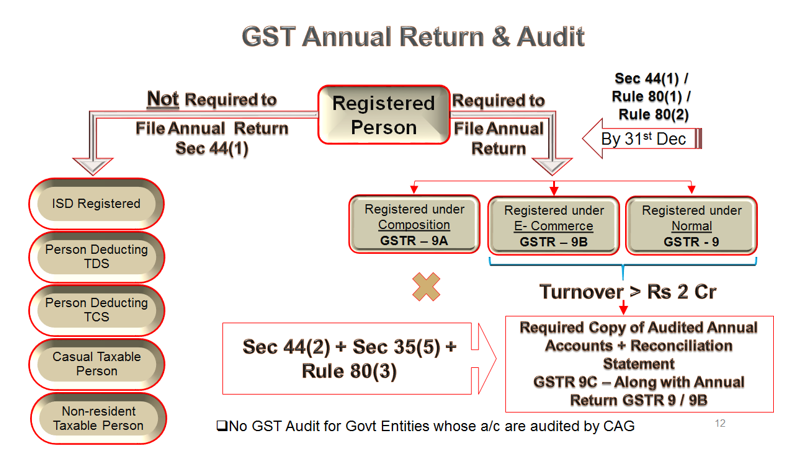

A Complete Guide on Annual Return

All companies (private limited company, one person company, limited company, section 8 company, etc) are required to file an annual return with the MCA every year. In addition to […]

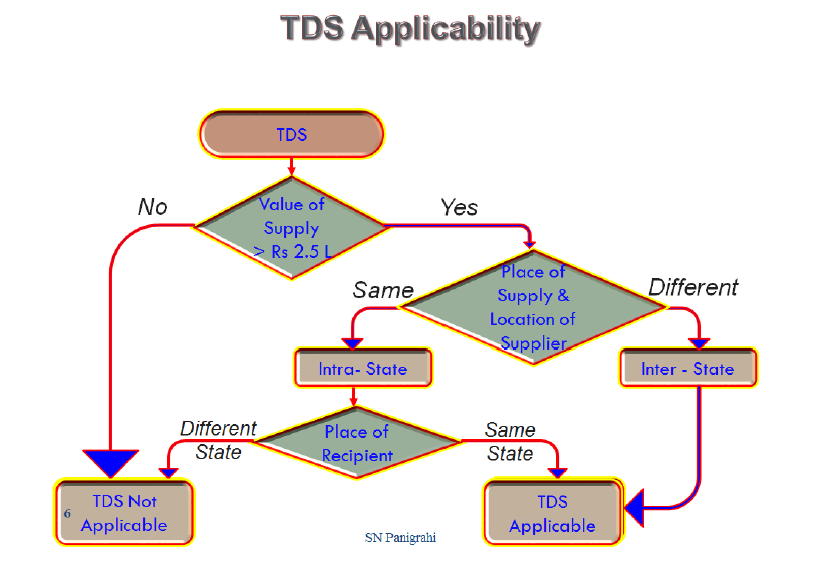

TDS provision under GST

The concept of TDS is a simple concept incorporated under GST with the intent to tap the possible chances of revenue leakage and Prevent Tax Evasion. Under the Scheme, the recipient […]

Joint Development Agreements: Real Estate in a Fix

Joint Development Agreements or JDAs are a common feature in the real estate sector wherein the landowner transfers the land to the real estate developer and […]

All You Want to Know About E-way bill – A Complete Practical Guide

This PPT Covers All Aspects Regarding E-Way Bill, includes

i. Understanding New E-Way Bill System

S N Panigrahi

@s-n-panigrahi

active 7 years, 8 months agoS N Panigrahi

OOPS!

No Packages Added by S N Panigrahi. Send a Hire request instead...

Send a messageOrder Now $14,550 (2)

4 Logo Drafts, Icon based, modern

312 Sold

30 Minutes Call with me

12 Sold

Monthly Fee

21 Sold

1 year shared hosting

ConsultEase.com Interviewed.

Read InterviewS N Panigrahi wrote a new post, India At Last Finding Some Ways to Regulate Imports 6 years, 1 month ago

Curbs on Non-Essential Goods: Ways to Regulate Imports

Imports are foreign goods and services that are produced in a foreign country and sold to domestic residents of a country. If a country imports more than i […]

S N Panigrahi wrote a new post, No Automatic Refund of IGST of Exports 6 years, 8 months ago

Stringent Systems Put in Place to Detect Fraudulent Refund Claims by Exporters

No Automatic Refund of IGST of Exports will be there anymore. As per Sec 16. (3) of IGST Act, Exporters of Goods or Services are […]

S N Panigrahi wrote a new post, Make (Videshi) Foreign Trade Policy SWADESHI 6 years, 8 months ago

Introduction:

In this article we will discuss about our foreign trade policy. India Traditionally a Trade Deficit Country. India’s Exports in 2018-19 stood at $331 billion, while Imports soared high of $507.44 b […]

S N Panigrahi wrote a new post, How to do Export to Nepal & Bhutan in GST 6 years, 9 months ago

Introduction:

There are lot of Confusion regarding Export to Nepal / Bhutan. In this Article an attempt has been made to clarify those Critical Questions.

Let’s first understand basics and then move to c […]

S N Panigrahi wrote a new post, GST on Outsourcing of Export Services 6 years, 9 months ago

In case an exporter of services outsources a portion of the services contract to another person located outside India, what would be the tax treatment of the said portion of the contract at the hands of the […]

S N Panigrahi wrote a new post, Annual Return for Composition Scheme- GSTR-9A 6 years, 9 months ago

What is composition scheme?

A composition dealer is required to file GSTR-9A. They are covered by section 10 of CGST Act.Composition Scheme is a simple and easy scheme under GST for Small Taxpayers especially […]

S N Panigrahi wrote a new post, Vision to Double Agricultural Exports 6 years, 10 months ago

“Modi”-Nomics : Vision to Double Agricultural Exports, Agriculture Export Policy, 2018

The Union Cabinet chaired by Prime Minister Shri Narendra Modi has approved the Agriculture Export Policy, 2018.

The […]

S N Panigrahi wrote a new post, Bank audit from GST angle 6 years, 10 months ago

Bank Audit from GST Angle:

In this article we have discussed bank audit from GST angle.Bank auditing is the procedure of reviewing the services and procedures adopted by banks and other financial institutions. It […]

S N Panigrahi wrote a new post, Advance Authorization Schemes under GST 6 years, 10 months ago

Advance Authorization Schemes under GST

The vision behind the Foreign Trade Policy continues to be focused on making India a significant participant in world trade and on enabling the country to assume a […]

S N Panigrahi wrote a new post, Complete Analysis of EPCG Scheme 7 years, 2 months ago

Complete Analysis of EPCG Scheme

This is a very Beneficial Export Promotion Scheme through which Capital Goods required for Export Production is allowed Duty-Free.

Objective

The objective of the EPCG Scheme is […]

S N Panigrahi wrote a new post, Procedure in Respect of Return of Expired Drugs or Medicine 7 years, 3 months ago

Procedure in Respect of Return of Expired Drugs or Medicine

The pharmaceutical sector was valued at US$ 33 billion in 2017. The country’s pharmaceutical industry is expected to expand at a CAGR of 22.4 per cent o […]

S N Panigrahi wrote a new post, A Complete Guide on Annual Return 7 years, 3 months ago

A Complete Guide on Annual Return

All companies (private limited company, one person company, limited company, section 8 company, etc) are required to file an annual return with the MCA every year. In addition to […]

S N Panigrahi wrote a new post, TDS provision under GST 7 years, 4 months ago

TDS provision under GST

The concept of TDS is a simple concept incorporated under GST with the intent to tap the possible chances of revenue leakage and Prevent Tax Evasion. Under the Scheme, the recipient […]

S N Panigrahi wrote a new post, Joint Development Agreements: Real Estate in a Fix 7 years, 5 months ago

Joint Development Agreements: Real Estate in a Fix

Joint Development Agreements or JDAs are a common feature in the real estate sector wherein the landowner transfers the land to the real estate developer and […]

S N Panigrahi changed their profile picture 7 years, 9 months ago

S N Panigrahi changed their profile picture 7 years, 9 months ago

S N Panigrahi wrote a new post, All You Want to Know About E-way bill 7 years, 9 months ago

All You Want to Know About E-way bill – A Complete Practical Guide

This PPT Covers All Aspects Regarding E-Way Bill, includes

i. Understanding New E-Way Bill System

Why, Who, When & How to Generate E-Way B […]