Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

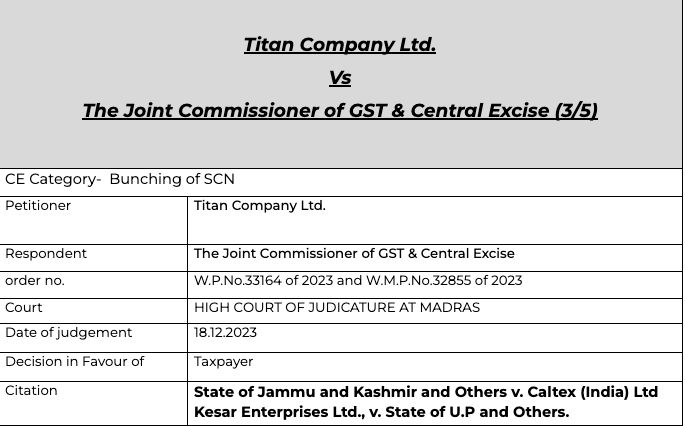

Bunching if notices cant extend the time limit us 73-

In a recent judgment the honourable Madras high court had rejected the notice, where the notices were bunched. There is a time limit for issuance of notices […]

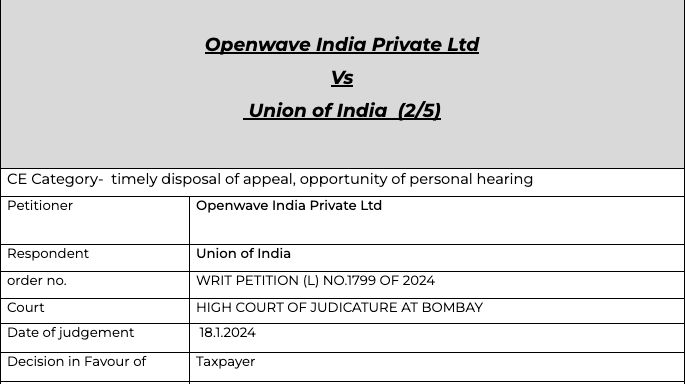

Appeal shall be disposed off in time bound manner and the opportunity of personal hearing shall be provided.

The opportunity of personal hearing shall be provided. The appeal shall be disposed off in time bound […]

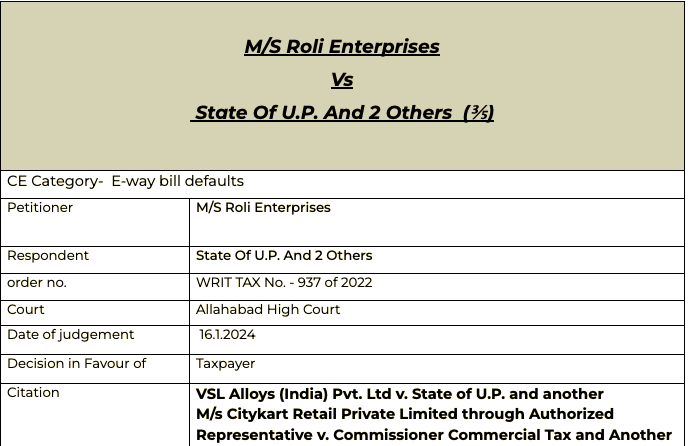

No E-way bill penalty-

The court quashed the E-way bill penalty levied in this case. It is a settled fact now that unless there is an evasion of tax the penalty u/s 129(3) is not leviable.

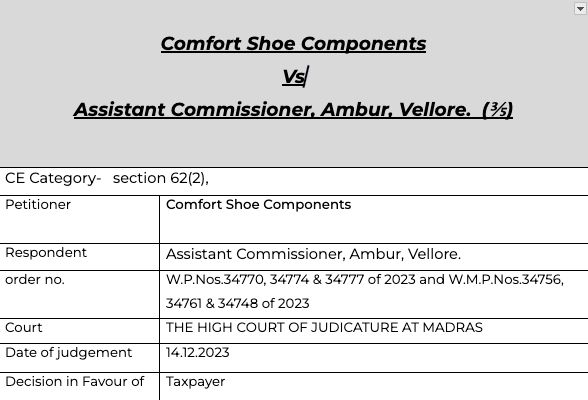

The time limit of section 62(2)-

In case of best judgment assessment, the proceedings are dropped if the TP files the return within 30 days. But if they file it after 30 days. Should it be allowed ? See what […]

Area covered by the judgment-

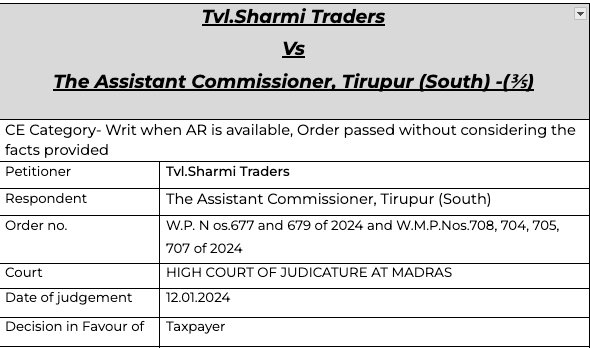

CE Category- Writ when AR is available, Order passed without considering the facts provided. The WRIT was accepted inspite of alternate remedy.

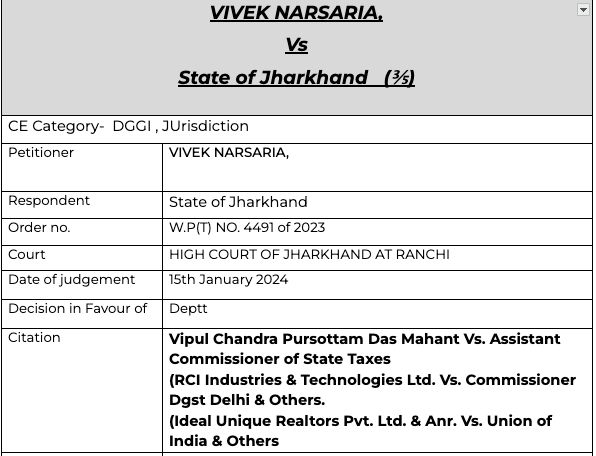

Does the DGGI officers enjoy the same power as the State authorities-

This is one of the important judgment for the cross empowerment and rights of DGGI officers. Here the multiple proceedings were tarted on the […]

DGGI,DGSI- Do they have the power of a Proper officer in GST?

Here the issue was related to the power of DGGI, DGSI to do the search at the premises of the taxpayer. The anti evasion wing already conducted the […]

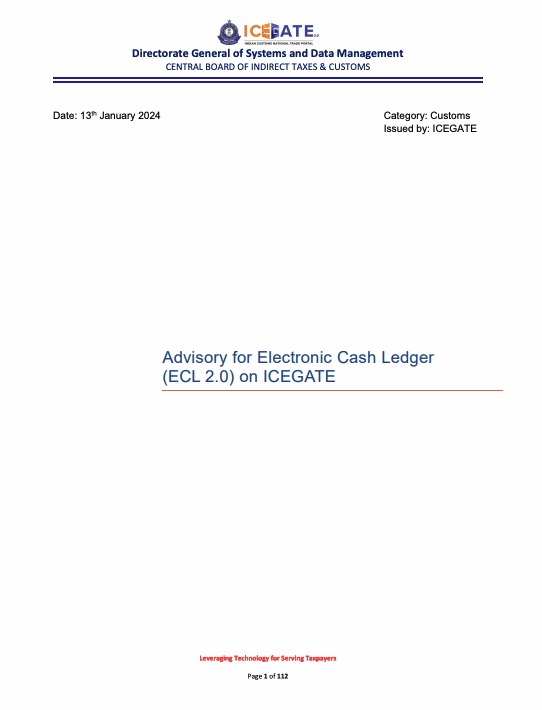

ICEGATE issued an advisory

New advisory on ECL is issued by the ICEGATE. The advisory is covering the screen shots of all the screens required. The headings covered in this advisory are.

Author can be reached at shaifaly.ca@gmail.com

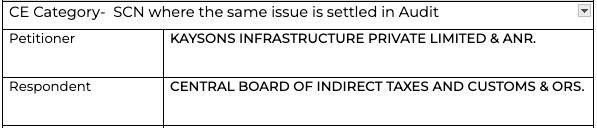

Facts-

A notice was issued to the taxpayer. But that issue was already settled in the audit for the same year. The contention of the petition […]

Appeal against the order of commissioner/AC

In a recent judgment the Uttaranchal High court has restricted the appeals against the orders of commissioner and AC.The issue under the consideration of the […]

Rectification allowed by Court-

The petitioner is supplier of electronic parts. It is supplying good on “bill to – ship to” model to BAL. Invoices were issued and GST was paid. However, while filing GSTR-1 ret […]

We all made a hue and cry for the extension of dates for returns. But at that time the department was telling us about the discipline and that we should not wait for the last date to file the returns.

Wrong ITC claimed

Very common scenario in the initial period of GST. The ITC of CGST SGST , wrongly claimed in IGST. Very useful judgment for all those taxpayer who committed the same mistake.

When people fall in love and get married, it’s often their hope that the union will last ’till death do them part.’ However, many things happen in between, and for one reason or the other, the union comes to a […]

The judgment of Delhi High Court in case of Amazon Wholesale-

The classification is always a litigated subject. In a recent judgement by the Delhi High Court classification of some items of Amazon Wholesale was […]

The honourable supreme court in its 476 pages judgments had upheld the abrogation of Article 370.

On 5 August 2019, the President issued CO 272, the Constitution (Application to Jammu and Kashmir) Order 2019. By […]

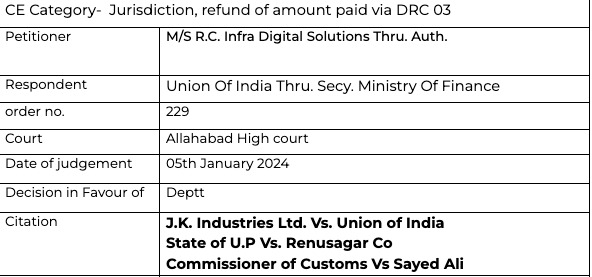

Whenever we have a demand from he department we rush to make payment. DRC 03 is the form we use to make the voluntary payment. This may be after a notice and without any notice also. When the time to declare a […]

GST penalty reduced from Rs. 56 lac to Rs. 10,000

This is going to be an interesting read. In a judgement the court reduced the penalty of Rs. 56 lac (Approx) to Rs. 10,000. In this case the penalty u/s 122 was […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Bunching of notices not allowed by the court- Read judgment 2 years ago

Bunching if notices cant extend the time limit us 73-

In a recent judgment the honourable Madras high court had rejected the notice, where the notices were bunched. There is a time limit for issuance of notices […]

CA Shafaly Girdharwal wrote a new post, Appeal should be disposed off in a time bound manner 2 years ago

Appeal shall be disposed off in time bound manner and the opportunity of personal hearing shall be provided.

The opportunity of personal hearing shall be provided. The appeal shall be disposed off in time bound […]

CA Shafaly Girdharwal wrote a new post, Even if part B of E-way is not filled, penalty is not leviable- Allahabad HC 2 years ago

No E-way bill penalty-

The court quashed the E-way bill penalty levied in this case. It is a settled fact now that unless there is an evasion of tax the penalty u/s 129(3) is not leviable.

M/s Roli enterprises […]

Prem wrote a new post, Time limit u/s 62(2) is not mandatory- TP have right to file return- HC 2 years ago

The time limit of section 62(2)-

In case of best judgment assessment, the proceedings are dropped if the TP files the return within 30 days. But if they file it after 30 days. Should it be allowed ? See what […]

CA Shafaly Girdharwal wrote a new post, Order passed without considering the reply is quashed by HC 2 years ago

Area covered by the judgment-

CE Category- Writ when AR is available, Order passed without considering the facts provided. The WRIT was accepted inspite of alternate remedy.

(The author can be reached at […]

CA Shafaly Girdharwal wrote a new post, DGGI doesn’t enjoy the special power as State GST officers- Jharkhand high court 2 years ago

Does the DGGI officers enjoy the same power as the State authorities-

This is one of the important judgment for the cross empowerment and rights of DGGI officers. Here the multiple proceedings were tarted on the […]

CA Shafaly Girdharwal wrote a new post, Interesting read- DGSI have the jurisdiction under GST? See what is take of Allahabad High court 2 years ago

DGGI,DGSI- Do they have the power of a Proper officer in GST?

Here the issue was related to the power of DGGI, DGSI to do the search at the premises of the taxpayer. The anti evasion wing already conducted the […]

CA Shafaly Girdharwal wrote a new post, Download ECL advisory issued on 13th Jan 2024 by ICEGATE 2 years, 1 month ago

ICEGATE issued an advisory

New advisory on ECL is issued by the ICEGATE. The advisory is covering the screen shots of all the screens required. The headings covered in this advisory are.

Table of Contents […]

CA Shafaly Girdharwal wrote a new post, SCN for the issues settled by the Audit, stayed by the HC 2 years, 1 month ago

Case details-

Author can be reached at shaifaly.ca@gmail.com

Facts-

A notice was issued to the taxpayer. But that issue was already settled in the audit for the same year. The contention of the petition […]

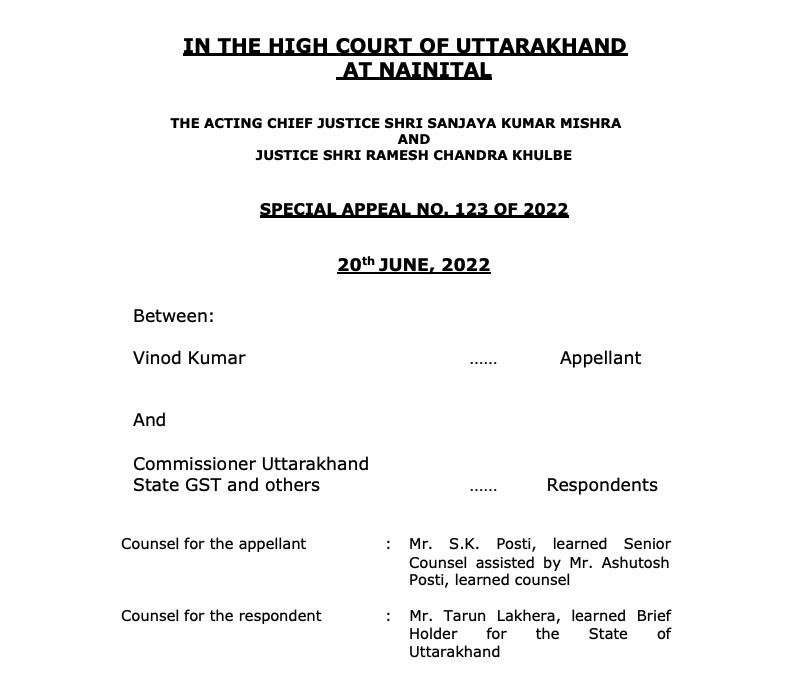

Prem wrote a new post, No appeal against the order of Commissioner /AC – Uttaranchal HC 2 years, 1 month ago

Appeal against the order of commissioner/AC

In a recent judgment the Uttaranchal High court has restricted the appeals against the orders of commissioner and AC.The issue under the consideration of the […]

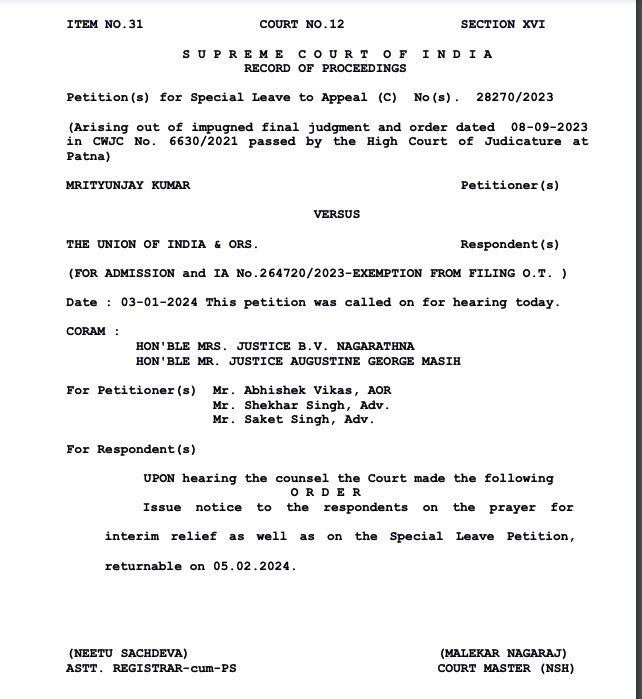

CA Shafaly Girdharwal wrote a new post, [Breaking] SC issued notice in SLP filed against judgment upheld section16(4) 2 years, 1 month ago

Section 16(4) is pain for all taxpayers since the GST was introduced. A long litigation is in place. But there is a good news.

The provision putting a time limit on taking credit after the November of the year […]

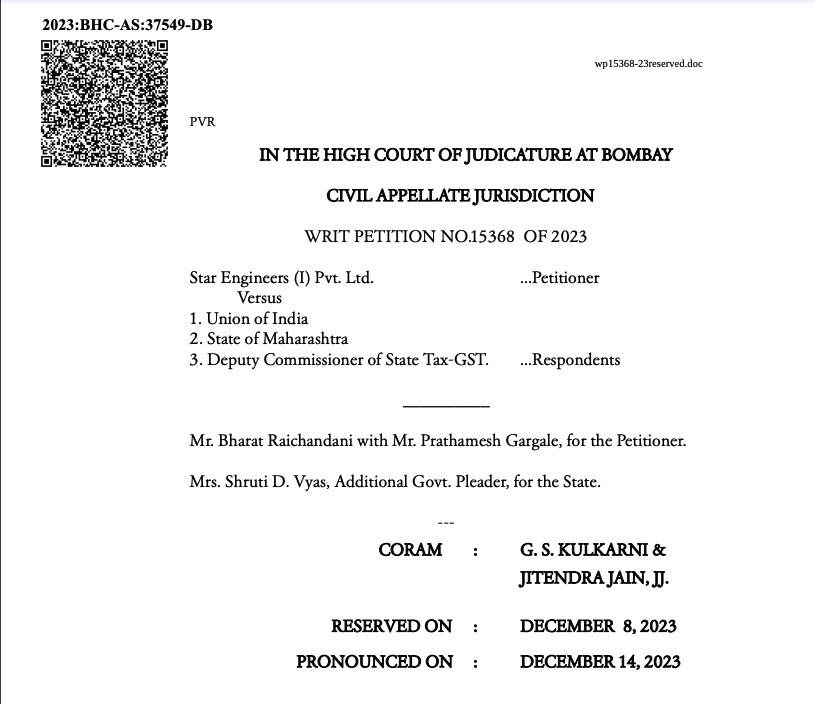

CA Shafaly Girdharwal wrote a new post, [download judgment] HC allowed the clarification of returns with 3 important clarifications 2 years, 1 month ago

Rectification allowed by Court-

The petitioner is supplier of electronic parts. It is supplying good on “bill to – ship to” model to BAL. Invoices were issued and GST was paid. However, while filing GSTR-1 ret […]

CA Shafaly Girdharwal wrote a new post, [Breaking] Notices issued in extended date stayed by court 2 years, 1 month ago

We all made a hue and cry for the extension of dates for returns. But at that time the department was telling us about the discipline and that we should not wait for the last date to file the returns.

The […]

CA Shafaly Girdharwal wrote a new post, [Breaking] Assessment order without a DIN is irregular and not illegal- SC 2 years, 1 month ago

In a recent development the honourable SC has reversed the judgement of Delhi high court. It was held in case of BRANDIX MAURITIUS HOLDINGS LTD

(The author can be reached at shaifaly.ca@gmail.com)

In this […]

CA Shafaly Girdharwal wrote a new post, [Breaking-read order] Court allowed to edit the return where ITC was claimed in wrong head 2 years, 2 months ago

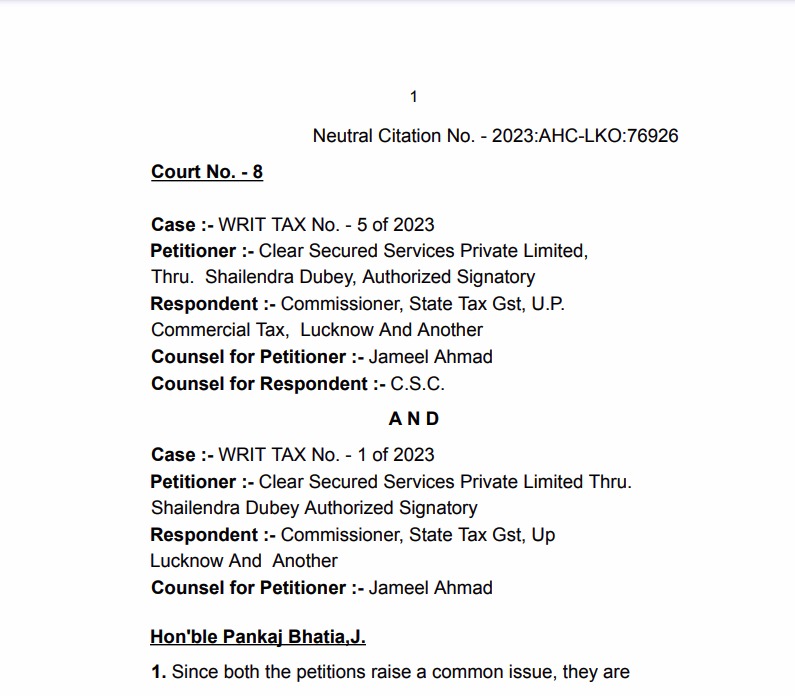

Wrong ITC claimed

Very common scenario in the initial period of GST. The ITC of CGST SGST , wrongly claimed in IGST. Very useful judgment for all those taxpayer who committed the same mistake.

Here the court […]

Prem wrote a new post, Understanding Alimony: What You Need To Know 2 years, 2 months ago

When people fall in love and get married, it’s often their hope that the union will last ’till death do them part.’ However, many things happen in between, and for one reason or the other, the union comes to a […]

CA Shafaly Girdharwal wrote a new post, Amazon wholesale India judgment on classification 2 years, 2 months ago

The judgment of Delhi High Court in case of Amazon Wholesale-

The classification is always a litigated subject. In a recent judgement by the Delhi High Court classification of some items of Amazon Wholesale was […]

CA Shafaly Girdharwal wrote a new post, [Breaking] SC Upholds abrogation of Article 370, historical day for Bharat-11-12-2023 2 years, 2 months ago

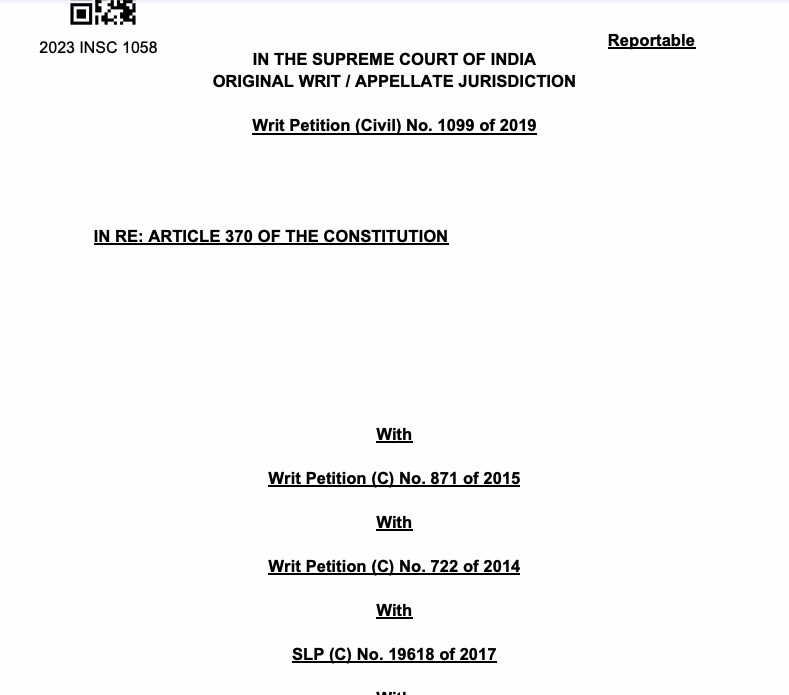

The honourable supreme court in its 476 pages judgments had upheld the abrogation of Article 370.

On 5 August 2019, the President issued CO 272, the Constitution (Application to Jammu and Kashmir) Order 2019. By […]

CA Shafaly Girdharwal wrote a new post, Mistakes while filing DRC 03 can land you in trouble 2 years, 2 months ago

Whenever we have a demand from he department we rush to make payment. DRC 03 is the form we use to make the voluntary payment. This may be after a notice and without any notice also. When the time to declare a […]

CA Shafaly Girdharwal wrote a new post, How a penalty in GST reduced from 56 lac to Rs. 10,000 2 years, 2 months ago

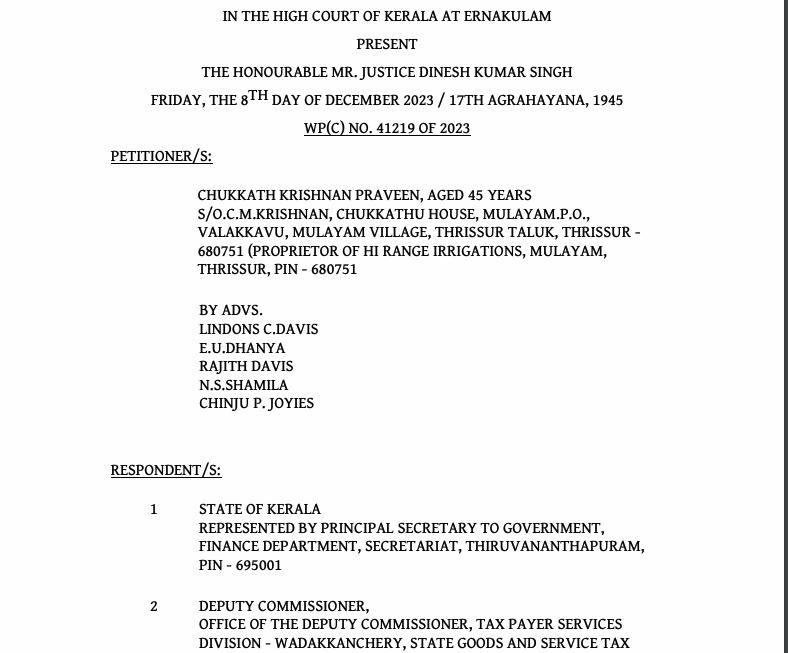

GST penalty reduced from Rs. 56 lac to Rs. 10,000

This is going to be an interesting read. In a judgement the court reduced the penalty of Rs. 56 lac (Approx) to Rs. 10,000. In this case the penalty u/s 122 was […]