Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Section 30 of Bhartiya Nyay Sanhita on TEXT :

Nothing is an offence by reason of any harm which it may cause to a person for whose benefit it is done in good faith, even without that person’s consent, if the c […]

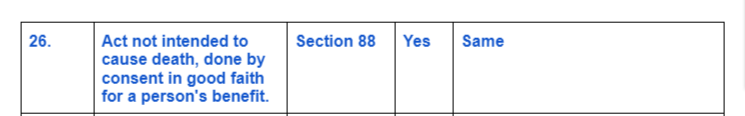

Section 26 of Bhartiya Nyay Sanhita on TEXT :

The exceptions in sections 21, 22 and 23 do not extend to acts which are offences independently of any harm which they may cause, or be intended to cause, or be known […]

Section 27 of Bhartiya Nyay Sanhita on TEXT :

Nothing which is done in good faith for the benefit of a person under twelve years of age, or of person with mental illness, by or by consent, either express or […]

Section 26 of Bhartiya Nyay Sanhita on TEXT :

Nothing, which is not intended to cause death, is an offence by reason of any harm which it may cause, or be intended by the doer to cause, or be known by the doer to […]

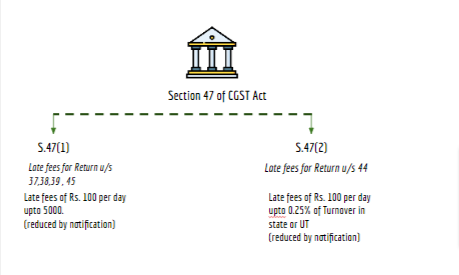

Section 47 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 47 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The ame […]

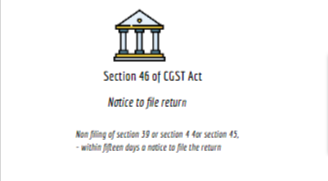

Section 46 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 46 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The ame […]

GST authorities have uncovered a syndicate engaged in the illicit transfer of input tax credit (ITC) worth Rs 275 crore through 102 fraudulent businesses.

The GST E-Way Bill System has issued an important update dated November 6, 2023. Starting from November 20, 2023, taxpayers with an Annual Aggregate Turnover (AATO) of Rs 20 Crore and […]

Section 25 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 On Text:

Nothing which is not intended to cause death, or grievous hurt, and which is not known by the doer to be likely to cause […]

Section 24 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In cases where an act done is not an offence unless done with a particular knowledge or intent, a person who does the […]

Section 23 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on text:

Nothing is an offence which is done by a person who, at the time of doing it, is, by reason of intoxication, incapable of […]

Section 22 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on text:

Nothing is an offence which is done by a person who, at the time of doing it, by reason of mental illness, is incapable […]

Section 21 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on TexT:

Nothing is an offence which is done by a child above seven years of age and under twelve, who has not attained […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

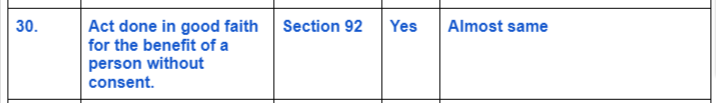

Read InterviewConsultEase Administrator wrote a new post, Section 30 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 30 of Bhartiya Nyay Sanhita on TEXT :

Nothing is an offence by reason of any harm which it may cause to a person for whose benefit it is done in good faith, even without that person’s consent, if the c […]

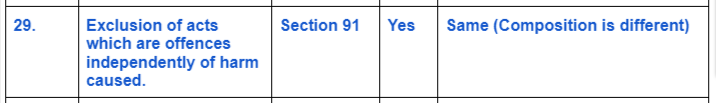

Prem wrote a new post, Section 29 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 26 of Bhartiya Nyay Sanhita on TEXT :

The exceptions in sections 21, 22 and 23 do not extend to acts which are offences independently of any harm which they may cause, or be intended to cause, or be known […]

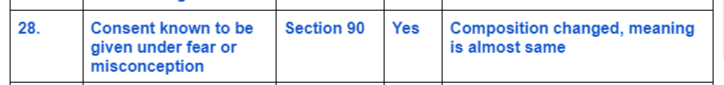

ConsultEase Administrator wrote a new post, Section 28 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 28 of Bhartiya Nyay Sanhita on TEXT :

A consent is not such a consent as is intended by any section of this Sanhita,––

(a) if the consent is given by a person under fear of injury, or under a mis […]

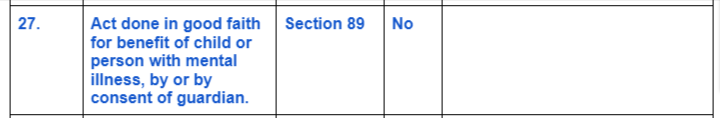

ConsultEase Administrator wrote a new post, Section 27 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 27 of Bhartiya Nyay Sanhita on TEXT :

Nothing which is done in good faith for the benefit of a person under twelve years of age, or of person with mental illness, by or by consent, either express or […]

CA Shafaly Girdharwal wrote a new post, Section 26 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 26 of Bhartiya Nyay Sanhita on TEXT :

Nothing, which is not intended to cause death, is an offence by reason of any harm which it may cause, or be intended by the doer to cause, or be known by the doer to […]

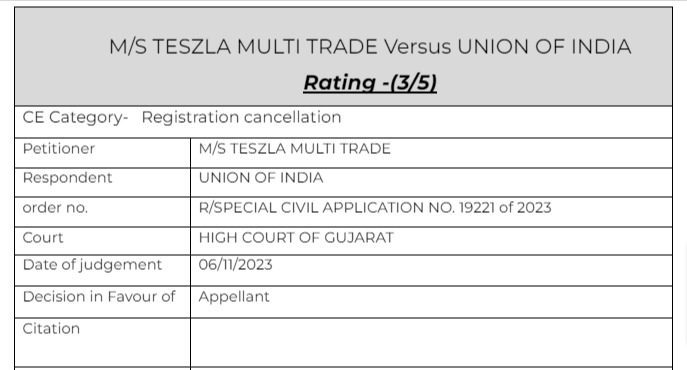

CA Shafaly Girdharwal wrote a new post, [update] Registration cant be kept suspended for long time 2 years, 3 months ago

The case is updated on 12-01-2024. The updated copy is attached here.

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

M/S TESZLA MULTI TRADE Versus UNION OF INDIA

Facts of the […]

CA Shafaly Girdharwal wrote a new post, Issue related to SCN jurisdiction, case listed for next date 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

MS SURYA BUSINEES PRIVATE LIMITED Vs THE STATE OF ASSAM

Citations:

Indo International Tobacco Ltd. v. Vivek Prasad and Ors

Facts of the […]

ConsultEase Administrator wrote a new post, Section 47 of CGST Act: Levy of late fees (updated till on October 2023) 2 years, 3 months ago

Section 47 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 47 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The ame […]

ConsultEase Administrator wrote a new post, Section 46 of CGST Act:Notice to return defaulters (updated till on October 2023) 2 years, 3 months ago

Section 46 of CGST Act of the CGST Act as amended by the Finance Act 2023

Note: Section 46 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The ame […]

ConsultEase Administrator wrote a new post, DGGI Exposes Fraudulent ITC Claims Syndicate Involving 102 Firms, Worth Rs 275 Crore 2 years, 3 months ago

GST authorities have uncovered a syndicate engaged in the illicit transfer of input tax credit (ITC) worth Rs 275 crore through 102 fraudulent businesses.

According to an official statement from the […]

ConsultEase Administrator wrote a new post, Two factor authentication in E way bill where AATO is 20 Cr or more 2 years, 3 months ago

The GST E-Way Bill System has issued an important update dated November 6, 2023. Starting from November 20, 2023, taxpayers with an Annual Aggregate Turnover (AATO) of Rs 20 Crore and […]

CA Shafaly Girdharwal wrote a new post, No jurisdictional issues when DGGI takes over the proceedings 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

AMIT GUPTA Vs UNION OF INDIA & ORS

Citations:

Indo International Tobacco Ltd. v. Vivek Prasad and Ors

Facts of the cases:

The petitioner […]

CA Shafaly Girdharwal wrote a new post, Fuel provided free of cost by recipient will be included in the value 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

M/s Shree Jeet Transport Vs UNION OF INDIA

Citations:

State of Karnataka v. M.K. Agro Tech Private Limited,.

Partington v. Attorney […]

ConsultEase Administrator wrote a new post, Court rejected the AIMS plea that a handicap person cant do MBBS 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

BAMBHANIYA SAGAR VASHARAMBHAI Vs UNION OF INDIA & OR

Facts of the cases:

In pursuance to the order passed by this Court, a report was filed […]

ConsultEase Administrator wrote a new post, Section 25 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 25 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 On Text:

Nothing which is not intended to cause death, or grievous hurt, and which is not known by the doer to be likely to cause […]

ConsultEase Administrator wrote a new post, Section 24 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 24 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

In cases where an act done is not an offence unless done with a particular knowledge or intent, a person who does the […]

ConsultEase Administrator wrote a new post, Section 23 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 23 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on text:

Nothing is an offence which is done by a person who, at the time of doing it, is, by reason of intoxication, incapable of […]

ConsultEase Administrator wrote a new post, Section 22 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

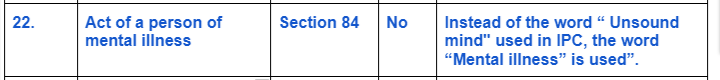

Section 22 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on text:

Nothing is an offence which is done by a person who, at the time of doing it, by reason of mental illness, is incapable […]

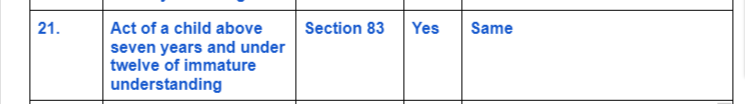

ConsultEase Administrator wrote a new post, Section 21 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 21 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on TexT:

Nothing is an offence which is done by a child above seven years of age and under twelve, who has not attained […]

CA Shafaly Girdharwal wrote a new post, The ITC was allowed even if the by-product is not taxable. It was a judgment of VAT but is applicable on GST also. 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

M/S MODI NATURALS LTD Vs THE COMMISSIONER OF COMMERCIAL

Citation

State of Karnataka v. M.K. Agro Tech Private Limited,.

Partington v. […]