Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Section 4 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

The punishments to which offenders are liable under the provisions of this Sanhita

are—

(a) Death;

(b) Imprisonment fo […]

Section 1 of Bhartiya Nyay Sanhita as compared to the same provision in IPC Act 1860 on Text:

(1) Throughout this Sanhita every definition of an offence, every penal provision, and every Illustration of every […]

Section 1 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

1. (1) This Act may be called the Bharatiya Nyaya Sanhita, 2023.

(2) It shall come into force on such date as the […]

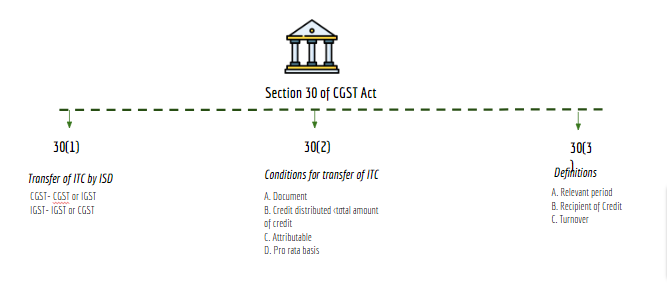

Section 30 of CGST Act as amended by the Finance Act 2023

Note: Section 30 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is […]

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

MANISH KOTHARI Vs DIRECTOR OF ENFORCEMENT MINISTRY OF FINANCE DEPT. OF REVENUE HEADQUARTER INVESTIGATION UNIT

In India, there are multiple stock investment options available for traders and investors alike. However, choosing the one that suits your financial goals and return needs is a tedious task. Today, we will explore […]

Introduction

The Goods and Services Tax (GST) has transformed India’s indirect tax landscape by replacing a multitude of taxes with a unified system. To ensure a smooth and effective implementation of GST, it is […]

Post credit to Advocate Bharat Raichandani

Introduction

Goods and Services Tax (GST) is a comprehensive indirect tax that has been a game-changer in the Indian tax landscape. It has simplified the taxation […]

The Supreme Court, in a recent ruling, rejected a public interest litigation (PIL) challenging the validity of Charles Darwin’s Theory of Evolution and Albert Einstein’s renowned mass–energy equivalence eq […]

At present, the Income-Tax Department is grappling with approximately 3.5 million pending refund cases due to issues related to mismatched and unverified bank account details of taxpayers. CBDT Chairperson Nitin […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, Section -4 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 4 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

The punishments to which offenders are liable under the provisions of this Sanhita

are—

(a) Death;

(b) Imprisonment fo […]

ConsultEase Administrator wrote a new post, Section -3 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 1 of Bhartiya Nyay Sanhita as compared to the same provision in IPC Act 1860 on Text:

(1) Throughout this Sanhita every definition of an offence, every penal provision, and every Illustration of every […]

ConsultEase Administrator wrote a new post, Section -1 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 2 years, 3 months ago

Section 1 of Bhartiya Nyay Sanhita as compared to same provision in IPC Act 1860 on Text:

1. (1) This Act may be called the Bharatiya Nyaya Sanhita, 2023.

(2) It shall come into force on such date as the […]

ConsultEase Administrator wrote a new post, Section 30 of CGST Act: revocation of registartion (updated till on October 2023) 2 years, 3 months ago

Section 30 of CGST Act as amended by the Finance Act 2023

Note: Section 30 of the CGST Act is amended retrospectively by Finance Act 2023 with retrospective effect from 1st July 2017. The amended portion is […]

CA Shafaly Girdharwal wrote a new post, Benefit of amnesty should be provided even if after or before the period given in scheme 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

M/s.GMR Enterprises Vs The Commercial Tax Officer,

Citations:

Tvl.Suguna Cut piece Vs Appellate Deputy Commissioner

Facts of the cases:

A […]

CA Shafaly Girdharwal wrote a new post, Why SC rejected the bail of Ex. Delhi CM , Manish Sisodia even when he is not proven guilty yet 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

MANISH SISODIA Vs CENTRAL BUREAU OF INVESTIGATION

Citations:

Vijay Madanlal Choudhary and Others v. Union of India and Others

Ravinder […]

CA Shafaly Girdharwal wrote a new post, The notice is returned as unclaimed, it shall be deemed to be served 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

PRIYANKA KUMARI V/s SHAILENDRA KUMAR

Citations:

K.Bhaskaran Vs. Sankaran Vaidhyan Balan and Another,

Ajeet Seeds Limited Vs. K. Gopala […]

CA Shafaly Girdharwal wrote a new post, Court denied the bail for apprehension of illegal detail/arrest of appellant 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

ASHISH MITTAL Vs DIRECTORATE OF ENFORCEMENT & ANR

Citations:

Union of India vs. Kunisetty Satyanarayana

Special Director vs. Mohd. Ghulam […]

CA Shafaly Girdharwal wrote a new post, Bail granted to Chartered Accountant in PMLA Case 2 years, 3 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

MANISH KOTHARI Vs DIRECTOR OF ENFORCEMENT MINISTRY OF FINANCE DEPT. OF REVENUE HEADQUARTER INVESTIGATION UNIT

Citations:

Sanjay Pandey v. […]

ConsultEase Administrator wrote a new post, 10 Different Types of Investment in the Stock Market 2 years, 3 months ago

In India, there are multiple stock investment options available for traders and investors alike. However, choosing the one that suits your financial goals and return needs is a tedious task. Today, we will explore […]

ConsultEase Administrator wrote a new post, (Pdf)E-Book of GST Act, Rules, Forms Assessment, Demand & Recovery 2023 Edition (CA Naveen Garg) 2 years, 4 months ago

Introduction

The Goods and Services Tax (GST) has transformed India’s indirect tax landscape by replacing a multitude of taxes with a unified system. To ensure a smooth and effective implementation of GST, it is […]

ConsultEase Administrator wrote a new post, (Pdf)E-book of GST ASSESSMENT, DEMAND & RECOVERY Edition 2023 (CA Naveen Garg) 2 years, 4 months ago

Post credit to Advocate Bharat Raichandani

Introduction

Goods and Services Tax (GST) is a comprehensive indirect tax that has been a game-changer in the Indian tax landscape. It has simplified the taxation […]

CA Shafaly Girdharwal wrote a new post, 101 historical judgments of SC- Does the freedom of speech includes the right to criticise the government 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

Kedarnath Singh Vs State of Bihar

The important case related to the sedition law in India. We have freedom of speech as a fundamental right […]

CA Shafaly Girdharwal wrote a new post, Route disclosure is not required under GST provisions, Penalty order quashed by court 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

M/S Om Prakash Kuldeep Kumar VS State Of U.P. And 2 Others

Citations:

M/s Karnataka Traders Vs. State of Gujrat

Vijay Metal Vs. […]

CA Shafaly Girdharwal wrote a new post, SC judgement on grounds of appeal in Pankaj Bansal is not applicable on UAPA 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

AMIT CHAKRABORTY VS STATE (NCT OF DELHI)

Citations:

1. Pankaj Bansal Vs. Union of India & Ors

2. K.M. Abdulla Kunhi and B.L. Abdul Khader […]

Prem wrote a new post, Order rejecting the GST refund for amount not paid by client on account of insolvency set aside. 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

GLOBUS REAL INFRA PVT LTD VS ADDITIONAL COMMISSIONER, CGST APPEALS II

Facts of the cases:

On 18.11.2020, the petitioner filed a Refund […]

CA Shafaly Girdharwal wrote a new post, One cant be a party in Cheque bounce case just because they were handling the affairs of business 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

Siby Thomas Vs M/s. Somany Ceramics Ltd

Citations:

Anita Malhotra v. Apparel Export Promotion Council & Anr

Ashok Shewakramani & […]

CA Shafaly Girdharwal wrote a new post, Upload of order on GSTN portal is not equal to communication (Writ accepted) stay given with 50% tax deposit 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

Cases Covered:

M/S Baghel Trading Co VS State Of U.P. And 2 Others

Citations:

Whirlpool Corporation vs. Registrar of Trademarks

Mr.Chandar Jain […]

ConsultEase Administrator wrote a new post, Stop wasting the time of SC by these kind of PIL’s 2 years, 4 months ago

The Supreme Court, in a recent ruling, rejected a public interest litigation (PIL) challenging the validity of Charles Darwin’s Theory of Evolution and Albert Einstein’s renowned mass–energy equivalence eq […]

Prem wrote a new post, 35 lakh income tax refund cases pending due to bank account mismatch and validation 2 years, 4 months ago

At present, the Income-Tax Department is grappling with approximately 3.5 million pending refund cases due to issues related to mismatched and unverified bank account details of taxpayers. CBDT Chairperson Nitin […]