Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

Cases Covered:

Pankaj Bansal Vs Union of India & Ors

.

Facts of the cases:

The summons were issued to Pankaj Bansal and Basant Bansal for a case by ED. While they were in the Office of ED, another summon […]

The department may have sent you a notice you failed to check. The notices in GST regime can be sent on the dashboard. This is a proper service of notice. But many taxpayers are not habitual of looking at their […]

Websites serve various goals from just entertaining and informing the audience, to promoting something, selling products and services, and many more, but all websites have a singular goal of grabbing the most […]

New return form prescribed for OIDAR and Online gaming service from outside India to a person in India-

The curb on online gaming companies is getting tight. On 29th September the government has made some […]

In the recent developments, the government put a new valuation for online gaming. Recently they sent hefty notices to these companies. Now a whole scheme to […]

The Women’s Reservation Bill will not necessitate state approval if it secures passage in parliament with a special majority. According to Article 368 of the Indian Constitution, achieving a special majority […]

On Friday, the government implemented changes in its fiscal policies. Notably, the special additional excise duty (SAED) for crude petroleum was raised to Rs 12,100 per tonne, effective from September 30. This […]

The battle of copyright between the Theo’s and Theobroma is decided.

It is submitted by Mr. Wadhwa, ld. Counsel that Defendant has registered the mark “THEO” and, therefore, it should be using the mark ‘TH […]

In a recent judgment by Delhi High court has observed that NCLT dont have the power of assuming the IBC as ultra vires.

Introduction

In the case of “Insolvency and Bankruptcy Board of India vs. State Bank of […]

In a recent regulatory disclosure, Infosys announced the receipt of a GST demand order, accompanied by interest and penalties. The cumulative demand, inclusive of penalties, stands at INR 37.75 lakh. Within this […]

The online gamers have decided to approach the court. Recently major online gaming companies received hafety notices from the department. The total amount of this litigation is expected to the tune of 1,50,000 […]

As a result of this development, individuals can now participate in court proceedings at the Gujarat High Court either in person or virtually, using video conference technology.

The account of Doctor Liver is banned by the court for posting defamatory content against Himalaya Wellness. The appellant told the court that the purpose of all those posts was to push the products of […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Grounds of arrest should be informed to complete proceedings under section 19 of PMLA 2002 (Pdf Attach) 2 years, 4 months ago

Cases Covered:

Pankaj Bansal Vs Union of India & Ors

.

Facts of the cases:

The summons were issued to Pankaj Bansal and Basant Bansal for a case by ED. While they were in the Office of ED, another summon […]

Prem wrote a new post, The order to freeze account was set aside by Court (Pdf Attach) 2 years, 4 months ago

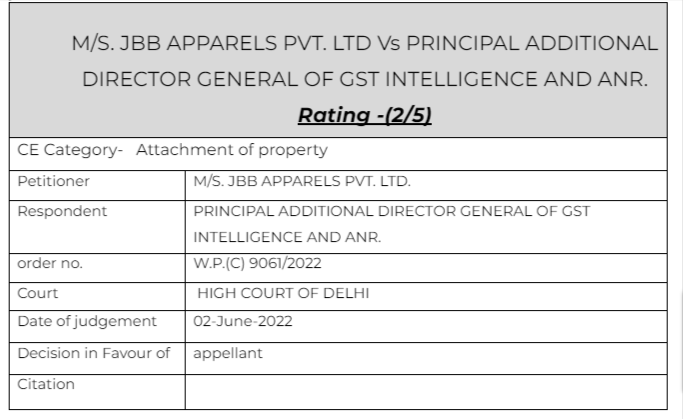

Cases Covered:

M/S. JBB APPARELS PVT. LTD Vs PRINCIPAL ADDITIONAL DIRECTOR GENERAL OF GST INTELLIGENCE AND ANR.

Facts of the cases:

The appellant’s bank accounts were freezed. They went to get it […]

CA Shafaly Girdharwal wrote a new post, Any rectification, which adversely affects any person is possible only after following the principles of natural justice 2 years, 4 months ago

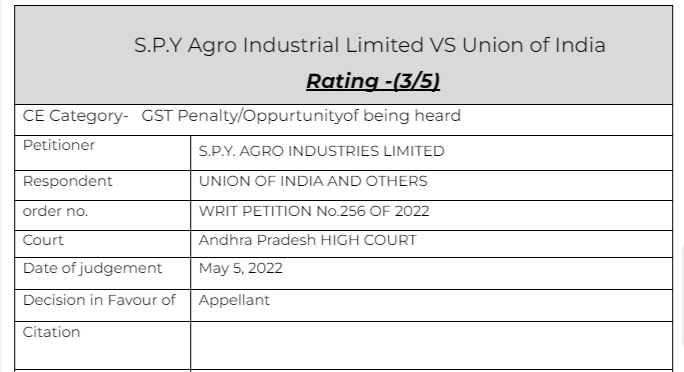

Cases Covered:

S.P.Y Agro Industrial Limited VS Union of India

Facts of the cases:

The petitioner failed to submit its returns in GSTR-3B for the months of January 2020 to June 2020 and as such, the […]

ConsultEase Administrator wrote a new post, You may have got a notice from GST, Check it 2 years, 4 months ago

The department may have sent you a notice you failed to check. The notices in GST regime can be sent on the dashboard. This is a proper service of notice. But many taxpayers are not habitual of looking at their […]

ConsultEase Administrator wrote a new post, Boost the ranking prospects of your WordPress website by using these tips 2 years, 4 months ago

Websites serve various goals from just entertaining and informing the audience, to promoting something, selling products and services, and many more, but all websites have a singular goal of grabbing the most […]

ConsultEase Administrator wrote a new post, New return form for OIDAR and Online gaming services from outside India to a person in India 2 years, 4 months ago

New return form prescribed for OIDAR and Online gaming service from outside India to a person in India-

The curb on online gaming companies is getting tight. On 29th September the government has made some […]

CA Shafaly Girdharwal wrote a new post, Change in valuation one online gaming to hit major online gaming companies 2 years, 4 months ago

The author can be reached at shaifaly.ca@gmail.com

In the recent developments, the government put a new valuation for online gaming. Recently they sent hefty notices to these companies. Now a whole scheme to […]

Prem wrote a new post, Analysis: The Absence of State Assembly Ratification for the Women’s Reservation Bill 2 years, 4 months ago

The Women’s Reservation Bill will not necessitate state approval if it secures passage in parliament with a special majority. According to Article 368 of the Indian Constitution, achieving a special majority […]

ConsultEase Administrator wrote a new post, Taxon domestic crude increased 2 years, 4 months ago

On Friday, the government implemented changes in its fiscal policies. Notably, the special additional excise duty (SAED) for crude petroleum was raised to Rs 12,100 per tonne, effective from September 30. This […]

CA Shafaly Girdharwal wrote a new post, Section 62 doesn’t give power to impose penalty(Pdf Attach) 2 years, 4 months ago

Cases Covered:

S.P.Y Agro Industrial Limited VS Union of India

Facts of the cases:

The petitioner failed to submit its returns in GSTR-3B for the months of January 2020 to June 2020 and as such, the […]

CA Shafaly Girdharwal wrote a new post, Registration cant be cancelled without giving reasons(Pdf Attach) 2 years, 4 months ago

Cases Covered:

MUHAMMAD SALMANUL FARIS K, VsTHE SUPERINTENDENT

Facts of the cases:

The registration of the Appellant was cancelled on the ground that the petitioner has issued Invoices/Bills to other […]

CA Shafaly Girdharwal wrote a new post, ITC denied for non payment of tax by supplier(Pdf Attach) 2 years, 4 months ago

Cases Covered:

M/s.Jai Balaji Paper Cones VS The Assistant Commissioner, Sales Tax,

Facts of the cases:

The petitioner made the payment of tax and invoice value to the seller. But the amount was not paid […]

CA Shafaly Girdharwal wrote a new post, E-way bill lapsed but necessary documents were available (Pdf Attach) 2 years, 4 months ago

Cases Covered:

Western Carrier India Ltd, Vs State Of U.P.

Facts of the cases:

In a recent judgment the Allahabad high court has waived off the penalty levied u/s 129 of CGST Act. The vehicle was […]

ConsultEase Administrator wrote a new post, Battle of Theo’s and Theobroma decided in favor of Theobroma (Pdf Attach) 2 years, 4 months ago

The battle of copyright between the Theo’s and Theobroma is decided.

It is submitted by Mr. Wadhwa, ld. Counsel that Defendant has registered the mark “THEO” and, therefore, it should be using the mark ‘TH […]

Prem wrote a new post, Case-4 101 historical cases which changed India. Doctrine of basic structure of Constitution of India. 2 years, 4 months ago

Cases Covered:

Kesavananda Bharati Sripadagalvaru & Ors. v. State of Kerala & Anr

We all understand that the government of India has the right to amend the Constitution of India. But can they amend everything. […]

ConsultEase Administrator wrote a new post, NCLT don’t have rights to declare any provision ultra vires (Pdf Attach) 2 years, 4 months ago

In a recent judgment by Delhi High court has observed that NCLT dont have the power of assuming the IBC as ultra vires.

Introduction

In the case of “Insolvency and Bankruptcy Board of India vs. State Bank of […]

ConsultEase Administrator wrote a new post, 26.5 lac IGST Demand notice on Infosys 2 years, 4 months ago

In a recent regulatory disclosure, Infosys announced the receipt of a GST demand order, accompanied by interest and penalties. The cumulative demand, inclusive of penalties, stands at INR 37.75 lakh. Within this […]

ConsultEase Administrator wrote a new post, Online gamers decided to go to the court against notices by GST 2 years, 4 months ago

The online gamers have decided to approach the court. Recently major online gaming companies received hafety notices from the department. The total amount of this litigation is expected to the tune of 1,50,000 […]

Prem wrote a new post, Hybrid mode of hearing for all benches, said Gujarat high court(Pdf Attach) 2 years, 4 months ago

As a result of this development, individuals can now participate in court proceedings at the Gujarat High Court either in person or virtually, using video conference technology.

The hybrid system, which was […]

ConsultEase Administrator wrote a new post, Account of doctor banned for posting against Himalaya 2 years, 4 months ago

The account of Doctor Liver is banned by the court for posting defamatory content against Himalaya Wellness. The appellant told the court that the purpose of all those posts was to push the products of […]