Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

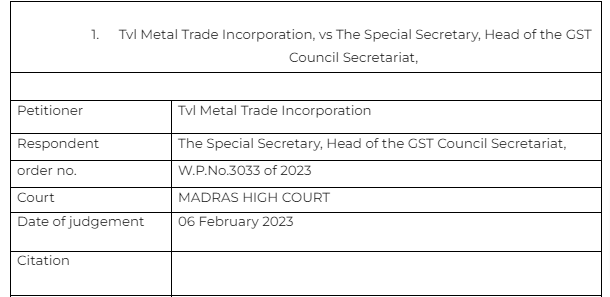

Very controversial issue of GST. Many cases are pending on this issue. Jurisdiction of other authority when the TP is assigned to the other one. In a recent judgment the Madras high court has said that the […]

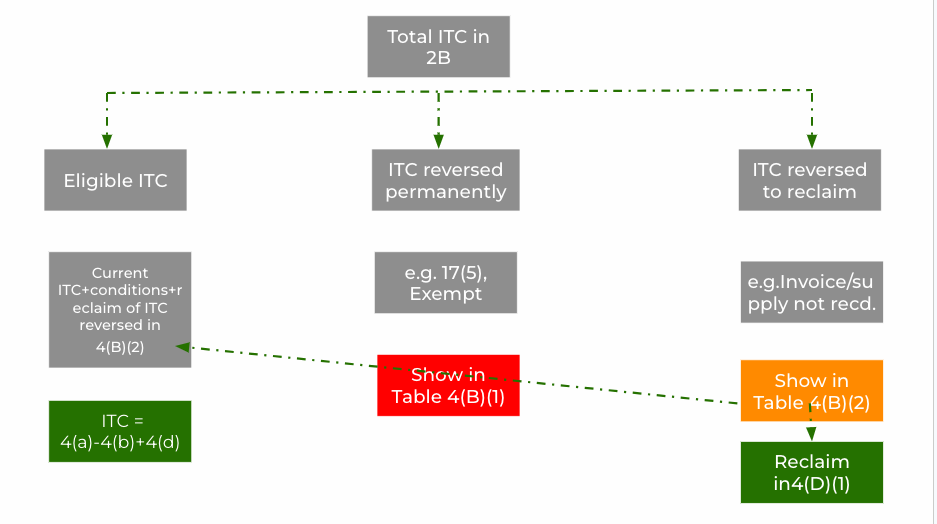

New mechanism to report ITC in GSTR 3B

A new mechanism was introduced by notification no. 14/2022 read with circular no. 170/2/2022. This mechanism will ensure the proper reporting of ITC in GSTR 3B.

How it […]

Case Covered:

Agrawal And Brothers Vs Union Of India

Facts of the case

The invoices of the petitioner were not entered in the GSTR 1 of the supplier. The tax was deposited but it was mistakenly deposited […]

The procedure must start with selecting an audio format for the recording. But with numerous audio formats accessible, it can be difficult to determine which one offers the best quality.

Opening a business bank account in the US as a non-US resident presents an exciting opportunity for business growth and market expansion. International entrepreneurs can unlock access to new markets and broaden […]

Respondent – The Assistant Commissioner – State Tax, Anantapur Circle – 1, Anantapuramu Division

Facts-

The petitioner prays for a writ of mandamus declaring

In this judgement a SCN was sent to the taxpayer. Instead of going to the appeal the appellant went to the court. A writ under article 226 of Constitution of India was filed. The contention of taxpayer was that […]

In the fast-paced world of financial advising, where time is of the essence and client satisfaction is paramount, virtual assistants play a crucial role.

These skilled professionals bring a unique set of […]

In today’s competitive business landscape, outsourcing accounting and financial services has emerged as a strategic solution for companies seeking cost savings and specialized expertise.

Stocks as a whole can be confusing to navigate as a beginner. Especially when every expert out there is trying to use some “stock lingo”. Sometimes it helps, but sometimes all it does is intimidate you […]

Petitioner-Agrawal and Brothers Respondent – Union of India, Western Railway Division DRM Office, Ratlam and Office of the Superintendent, CGST, and 2. Central Excise, Range-I Division Ratlam, Court- Madhya […]

In today’s time, the young audience expresses itself through different social media platforms. Millennials and Gen Z are not afraid to share their experiences after using a product/service. They usually express […]

It is to be noted that the RCM Notification no.13/2017-Central Tax (Rate) dated 28.06.2017 does not use the phrase ‘services provided by any person to a Company, who is a Director in the said Company’. Instead, it […]

Speaking order or reasoned order is considered the third pillar of natural justice. A reasoned decision is called a reasoned decision because it contains reasons of its own in its support. When the adjudicating […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewCA Shafaly Girdharwal wrote a new post, Taxpayer should appear for hearing in case of dual proceedings- TVL Metal 2 years, 5 months ago

Very controversial issue of GST. Many cases are pending on this issue. Jurisdiction of other authority when the TP is assigned to the other one. In a recent judgment the Madras high court has said that the […]

CA Shafaly Girdharwal wrote a new post, New scheme of claiming ITC in GST w.e.f. 01-09-2023 2 years, 5 months ago

New mechanism to report ITC in GSTR 3B

A new mechanism was introduced by notification no. 14/2022 read with circular no. 170/2/2022. This mechanism will ensure the proper reporting of ITC in GSTR 3B.

How it […]

CA Shafaly Girdharwal wrote a new post, FAQ’s on Arrest in GST 2 years, 5 months ago

Can we seek anticipatory bail in case of arrest in GST u/s 438 of CRPC?

No, CRPC is made applicable via section 69(3) of GST whereas the arrest is made via section 69(1). Thus Section 438 of anticipatory […]

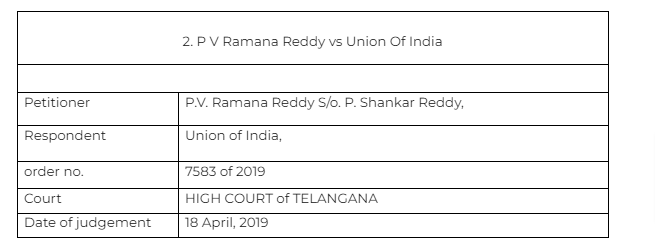

CA Shafaly Girdharwal wrote a new post, 7 Important outcome about arrest in GST in case of PV Ramanna Reddy 2 years, 5 months ago

Case Covered:

P V Ramana Reddy vs Union Of India

Citations :

Badaku Joti Savant v. State of Mysore

Ramesh Chandra Metha v. State of West Bengal

Illias v. Collector of Customs

Percy R […]

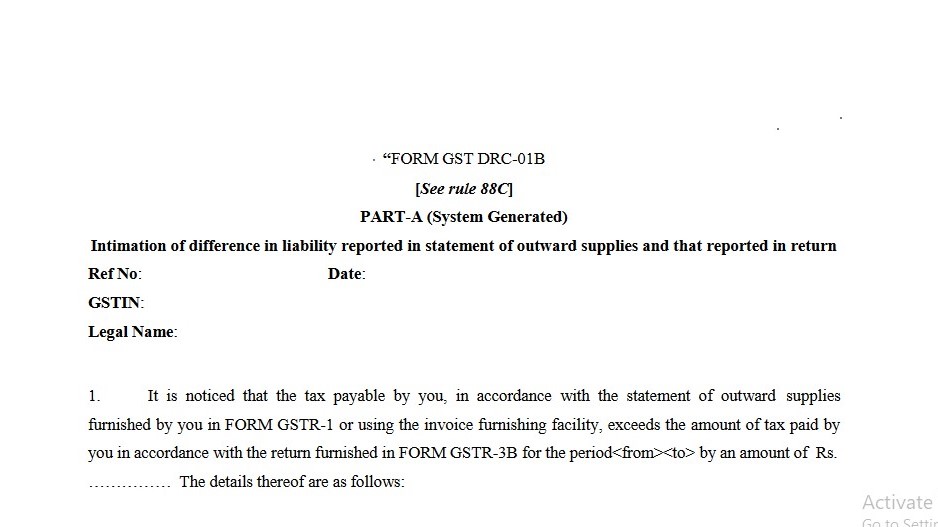

CA Shafaly Girdharwal wrote a new post, How an error in return will fetch you an instant notice in GST? 2 years, 5 months ago

Two new instant notices in GST

Well this for the good of taxpayers. Although it is taxing at the immediate level it will be helpful in future.

Two new rules are inserted in GST provisions. The dynamics […]

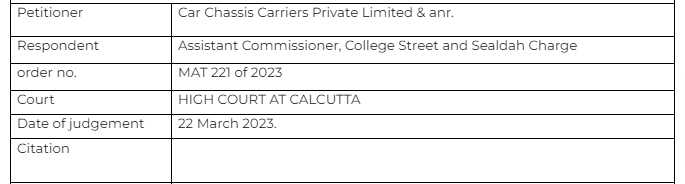

CA Shafaly Girdharwal wrote a new post, ITC in the case of Car Chassis Carriers Private Limited & anr. vs. Assistant Commissioner, College Street and Sealdah Charge 2 years, 5 months ago

Case Covered:

Car Chassis Carriers Private Limited & anr. vs. Assistant Commissioner, College Street and Sealdah Charge

Facts of the case

The department sent a communication to the appellant to reverse t […]

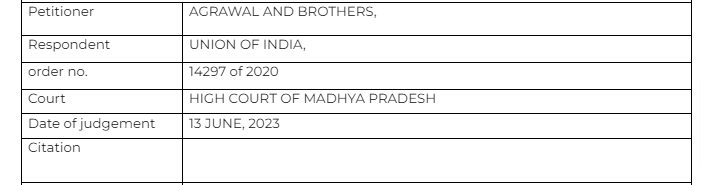

CA Shafaly Girdharwal wrote a new post, ITC in the case of Agrawal And Brothers Vs Union Of India 2 years, 5 months ago

Case Covered:

Agrawal And Brothers Vs Union Of India

Facts of the case

The invoices of the petitioner were not entered in the GSTR 1 of the supplier. The tax was deposited but it was mistakenly deposited […]

ConsultEase Administrator wrote a new post, What Is The Best Audio Format For Music Sound Quality? 2 years, 5 months ago

The procedure must start with selecting an audio format for the recording. But with numerous audio formats accessible, it can be difficult to determine which one offers the best quality.

However, only choosing […]

Prem wrote a new post, Important GST judgement on ITC reversal for default of supplier 2 years, 6 months ago

Brief details of the judgement-

Case- SUNCRAFT ENERGY PRIVATE LIMITED AND ANOTHER VERSUS THE ASSISTANT COMMISSIONER

Court- Calcutta High court

Issue- Liability of reversal of ITC by recipient for default of […]

ConsultEase Administrator wrote a new post, Opening A Business Bank Account For Non-US Residents: How-To, Opportunities, And Hurdles 2 years, 6 months ago

Opening a business bank account in the US as a non-US resident presents an exciting opportunity for business growth and market expansion. International entrepreneurs can unlock access to new markets and broaden […]

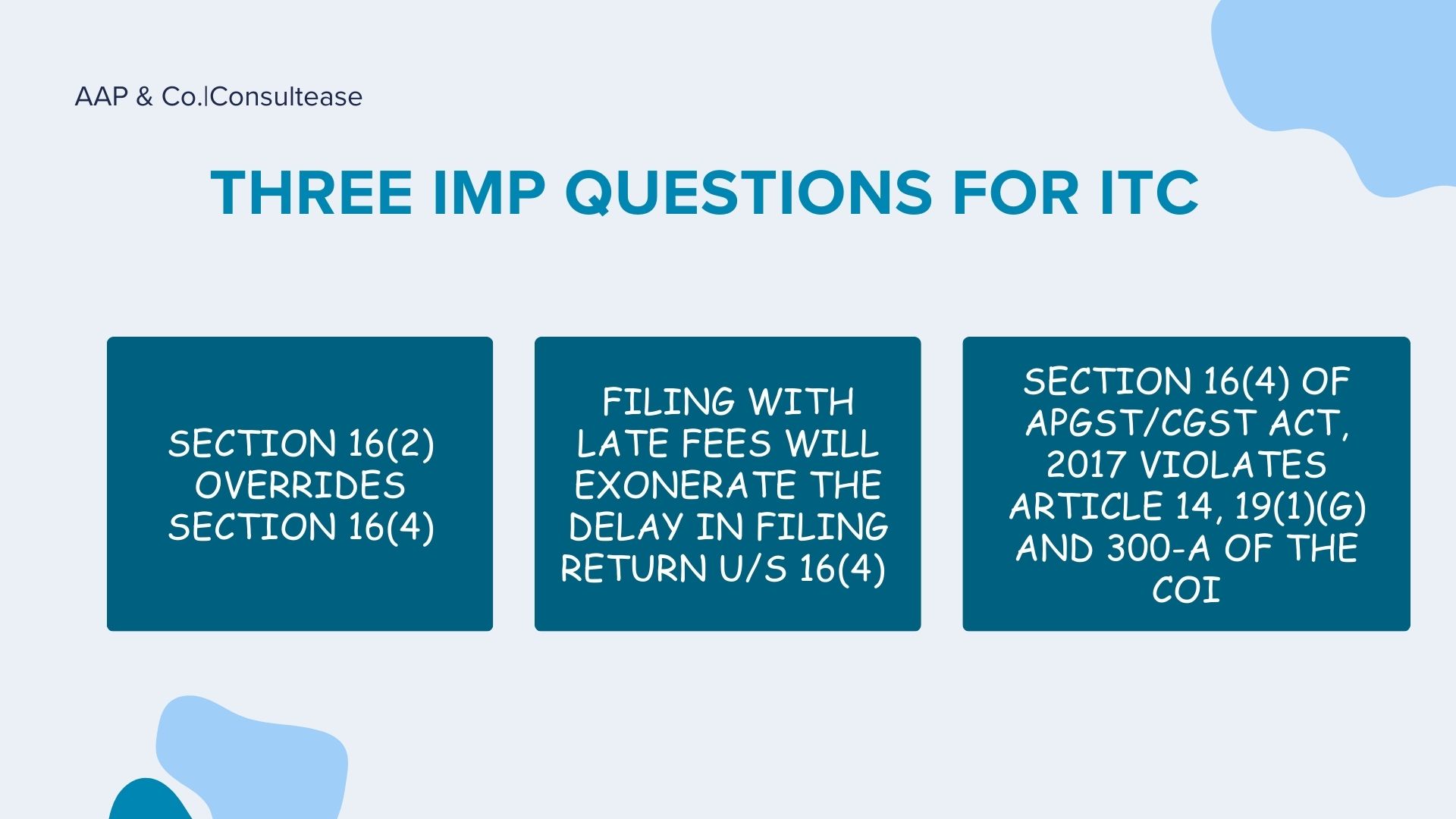

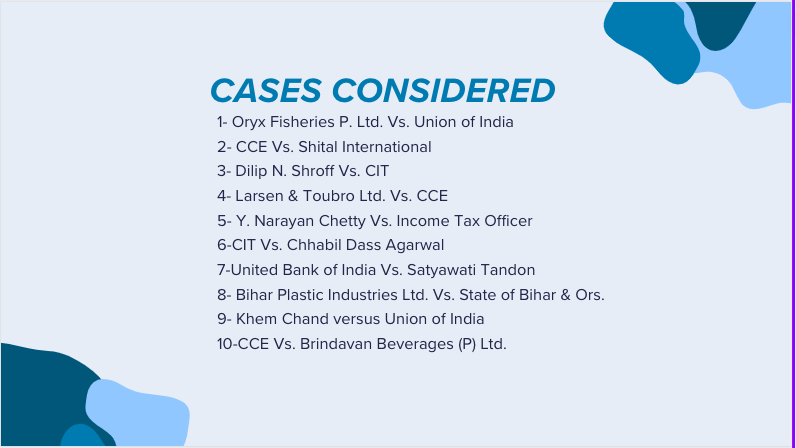

CA Shafaly Girdharwal wrote a new post, Three Most Important Issues in Time Barred ITC Resolved by Court in Thirumalakonda Plywoods Case 2 years, 6 months ago

Appellant – Thirumalakonda Plywoods,

Respondent – The Assistant Commissioner – State Tax, Anantapur Circle – 1, Anantapuramu Division

Facts-

The petitioner prays for a writ of mandamus declaring

(a) Sec […]

Prem wrote a new post, SCN Quashed in Case of Nikas Services Pvt Ltd as Vague 2 years, 6 months ago

In this judgement a SCN was sent to the taxpayer. Instead of going to the appeal the appellant went to the court. A writ under article 226 of Constitution of India was filed. The contention of taxpayer was that […]

ConsultEase Administrator wrote a new post, Role of Virtual Assistant for Financial Advisors 2 years, 7 months ago

In the fast-paced world of financial advising, where time is of the essence and client satisfaction is paramount, virtual assistants play a crucial role.

These skilled professionals bring a unique set of […]

ConsultEase Administrator wrote a new post, The Advantages of Outsourcing Accounting and Financial Services: Cost Savings and Expertise 2 years, 7 months ago

In today’s competitive business landscape, outsourcing accounting and financial services has emerged as a strategic solution for companies seeking cost savings and specialized expertise.

By delegating these […]

Prem wrote a new post, Things To Consider Before Opting For A Stock Market Investment 2 years, 7 months ago

Stocks as a whole can be confusing to navigate as a beginner. Especially when every expert out there is trying to use some “stock lingo”. Sometimes it helps, but sometimes all it does is intimidate you […]

CA Shafaly Girdharwal wrote a new post, Diwakar enterprises Vs CCGST- No tax without authority of law 2 years, 7 months ago

Petitioner- Diwakar Enterprises Pvt. Ltd.

Respondent-Commissioner of CGST and anr. 2020

Court- Punjab & Haryana (Chandigarh)

In this case, the input credit ledger of the taxpayer was blocked. A search was […]

CA Shafaly Girdharwal wrote a new post, In the High Court of Madhya Pradesh at INDORE BEFORE Hon’ble Shri Justice Vivek Rusia & Hon’ble Shri Justice Hirdesh on the 13th of June, 2023 – Writ Petition No. 14297 of 2020 2 years, 7 months ago

Petitioner-Agrawal and Brothers Respondent – Union of India, Western Railway Division DRM Office, Ratlam and Office of the Superintendent, CGST, and 2. Central Excise, Range-I Division Ratlam, Court- Madhya […]

ConsultEase Administrator wrote a new post, Maximize Your Social Media Strategy With Social Listening Tools 2 years, 7 months ago

In today’s time, the young audience expresses itself through different social media platforms. Millennials and Gen Z are not afraid to share their experiences after using a product/service. They usually express […]

ConsultEase Administrator wrote a new post, NO GST UNDER RCM ON DIRECTOR’S SERVICES PROVIDED IN INDIVIDUAL CAPACITY 2 years, 7 months ago

It is to be noted that the RCM Notification no.13/2017-Central Tax (Rate) dated 28.06.2017 does not use the phrase ‘services provided by any person to a Company, who is a Director in the said Company’. Instead, it […]

ConsultEase Administrator wrote a new post, SPEAKING ORDER UNDER GST REGIME 2 years, 7 months ago

Speaking order or reasoned order is considered the third pillar of natural justice. A reasoned decision is called a reasoned decision because it contains reasons of its own in its support. When the adjudicating […]