Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

1. Introduction

Financial reporting in India has undergone a significant transformation owing to the adoption of Indian Accounting Standards (Ind AS) and fair value is the guiding principle in financial […]

Union Of India

Facts of the Case:

The petitioner No.1 – Nagri Eye Research Foundation through the petitioner No.2 – its Secretary has challenged the imp […]

As per the Income-tax Act, 1961, there is a requirement to furnish Form 15CA/15CB electronically. Presently, taxpayers upload the Form 15CA, along with the Chartered Accountant Certificate in Form 15CB, […]

The Government has decided to provide income tax exemption to the amount received by a taxpayer for medical treatment from an employer or from any person for treatment of COVID-19 during the financial year […]

Assistant Commissioner of Income Tax

Facts of the case:

The present writ petition has been filed challenging the assessment order dated 01st June 2021. […]

India has always been a self-reliant country. Though the MSME Development Act was enacted in 2006, most of the attention was given only to Khadi and Coir. Now with the changing geopolitical conditions, the focus […]

Union Of India

Order of the Hon’ble Court:

Heard Mrs. Pragya Pandey, learned counsel for the petitioners, and Sri Ashok Singh learned counsel for the […]

The MSME sector is the soul and blood of the Indian economy. It provides the raw material for the bigger industries, maximum employment, and also spearheads innovation, design, and technology in the fast-changing […]

Due to the disastrous second wave of the Covid-19 pandemic, in order to reduce the compliance burden, the Income Tax Department, in accordance with the Taxation and Other Laws (Relaxation and Amendment of Certain […]

There are many sections in the Income-tax act that give exemptions and deductions to encourage people to invest in different assets and various financial schemes. This gives financial and social security to […]

Introduction

Housing societies are bodies to maintain the societies. They are formed to provide common services. They collect an amount for these services. Generally called RWA or housing societies. There is […]

The Union of India

Facts of the Case:

The petitioner in W.P.No.27100 of 2019 challenges an order of the Authority for Advance Ruling (AAR) levying tax on […]

The State of Tripura

Facts of the Case:

The petitioner has challenged an order dated 02.01.2021 passed by the learned Judicial Magistrate, 1st Class, Bishalgarh under […]

Sachindra

@sachindrabansal

active 7 years, 9 months agoSachindra

Adv. Ashok Kumar Das

Gauhati, India

CA Mahesh Bansal

New Delhi, India

Vivek Agarwal

Vijay Kumar Bhardwaj

Ludhiana, India

CA Paras Dawar

Mr. Paras Dawar is a Fellow member of the Institute of Chartered Accountants of India. He is a graduate in law from the prestigious Faculty of Law, University of Delhi. He is also an Honours Graduate in Commerce and holds a Diploma in International Taxation. He specializes in Direct tax, International tax, and Insolvency law advisory, litigation and dispute resolution. He has successfully represented various domestic and international clients before tribunals and other revenue authorities.

New Delhi, India

Featured Consultants

ConsultEase.com Interviewed.

Read InterviewConsultEase Administrator wrote a new post, Concept Paper On All about Fair Value: ICAI 4 years, 6 months ago

1. Introduction

Financial reporting in India has undergone a significant transformation owing to the adoption of Indian Accounting Standards (Ind AS) and fair value is the guiding principle in financial […]

ConsultEase Administrator wrote a new post, Patna HC in the case of Pankaj Sharma V/s UOI 4 years, 6 months ago

Case Covered:

Pankaj Sharma

Versus

Union of India

Order of the Hon’ble Court:

Learned counsel for the parties desire the matter be taken up today Petitioner has prayed for the following […]

CA Shafaly Girdharwal wrote a new post, How to login at the GST portal and use it 4 years, 6 months ago

What is GST Portal?

GST portal is the portal adopted for GST compliances. If you are a taxpayer in GST you need to use this portal. It has the following functionalities.

Registration of a new […]

ConsultEase Administrator wrote a new post, Circular No. 157/13/2021-GST 4 years, 7 months ago

To,

The Principal Chief Commissioners/ Chief Commissioners/ Principal Commissioners/ Commissioners of Central Tax (All)

The Principal Director Generals/ Director Generals (All)

Madam/Sir,

Subject: […]

ConsultEase Administrator wrote a new post, Gujarat HC Order in the case of Nagri Eye Research Foundation Versus Union Of India 4 years, 7 months ago

Case Covered:

Nagri Eye Research Foundation

Versus

Union Of India

Facts of the Case:

The petitioner No.1 – Nagri Eye Research Foundation through the petitioner No.2 – its Secretary has challenged the imp […]

ConsultEase Administrator wrote a new post, Circular No. 16/2021-Customs 4 years, 7 months ago

To,

All Principal Chief Commissioners/ Chief Commissioners of Customs/ Customs (Preventive),

All Principal Chief Commissioners/ Chief Commissioners of Customs & Central tax,

All Principal Commissioners/ […]

ConsultEase Administrator wrote a new post, CBDT grants further relaxation in electronic filing of Income Tax Forms 15CA/15CB 4 years, 7 months ago

As per the Income-tax Act, 1961, there is a requirement to furnish Form 15CA/15CB electronically. Presently, taxpayers upload the Form 15CA, along with the Chartered Accountant Certificate in Form 15CB, […]

ConsultEase Administrator wrote a new post, Tax exemption to ameliorate stress due to COVID-19: PIB 4 years, 7 months ago

The Government has decided to provide income tax exemption to the amount received by a taxpayer for medical treatment from an employer or from any person for treatment of COVID-19 during the financial year […]

ConsultEase Administrator wrote a new post, Delhi HC in the case of Three C Homes Pvt. Ltd. 4 years, 7 months ago

Case covered:

Three C Homes Pvt. Ltd

Versus

Assistant Commissioner of Income Tax

Facts of the case:

The present writ petition has been filed challenging the assessment order dated 01st June 2021. […]

ConsultEase Administrator wrote a new post, What are the benefits for MSME in India? 4 years, 7 months ago

India has always been a self-reliant country. Though the MSME Development Act was enacted in 2006, most of the attention was given only to Khadi and Coir. Now with the changing geopolitical conditions, the focus […]

ConsultEase Administrator wrote a new post, Karnataka HC Order in the case of M/s Global International 4 years, 7 months ago

Case Covered:

M/s Global International

Versus

Union Of India

Order of the Hon’ble Court:

Heard Mrs. Pragya Pandey, learned counsel for the petitioners, and Sri Ashok Singh learned counsel for the […]

ConsultEase Administrator wrote a new post, Udyam Registration – Eligibility, Process, Documents Required, and Certificate 4 years, 7 months ago

The MSME sector is the soul and blood of the Indian economy. It provides the raw material for the bigger industries, maximum employment, and also spearheads innovation, design, and technology in the fast-changing […]

ConsultEase Administrator wrote a new post, A Handy Checklist of Various Compliances to Be Completed Till 31 July 2021 4 years, 7 months ago

Due to the disastrous second wave of the Covid-19 pandemic, in order to reduce the compliance burden, the Income Tax Department, in accordance with the Taxation and Other Laws (Relaxation and Amendment of Certain […]

ConsultEase Administrator wrote a new post, Kerala AAR in the case of Shri N.M. Thualseedharan, M/s. N.V. Chips 4 years, 7 months ago

Case Covered:

Shri N.M. Thualseedharan, M/s. N.V. Chips

Facts of the Case:

The applicant requested for advance ruling on the following;

1. Whether jack fruit chips sold without BRAND NAME are classifiable as […]

ConsultEase Administrator wrote a new post, CESTAT Order in the case of M/s. ICICI Econet Internet And Technology Fund 4 years, 7 months ago

Case Covered:

M/s. ICICI Econet Internet And Technology Fund

Versus

Commissioner Of Central Tax

Facts of the Case:

Brief facts of the case are that the Appellants are venture capital funds established as […]

ConsultEase Administrator wrote a new post, 9 Investment Options to Save Income Tax 4 years, 7 months ago

There are many sections in the Income-tax act that give exemptions and deductions to encourage people to invest in different assets and various financial schemes. This gives financial and social security to […]

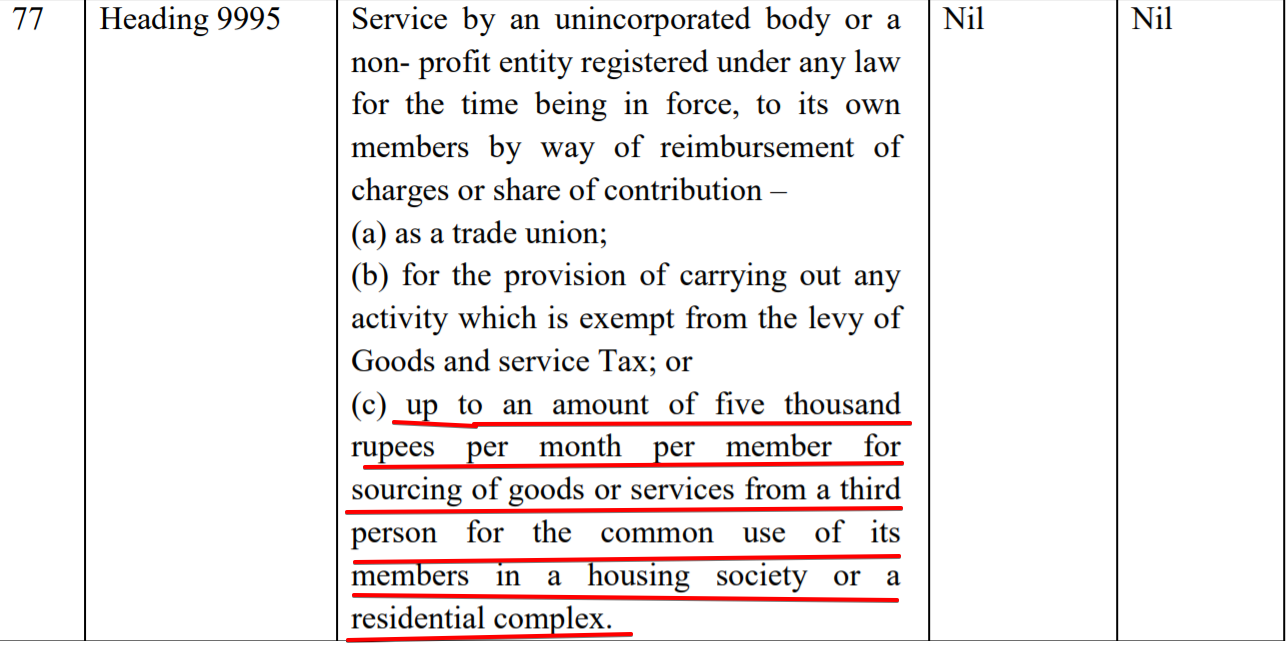

CA Shafaly Girdharwal wrote a new post, GST on services of RWA, Madras high court ends the confusion 4 years, 7 months ago

Introduction

Housing societies are bodies to maintain the societies. They are formed to provide common services. They collect an amount for these services. Generally called RWA or housing societies. There is […]

ConsultEase Administrator wrote a new post, Madras HC Order in the case of Greenwood Owners Association Versus The Union of India 4 years, 7 months ago

Case Covered:

Greenwood Owners Association

Versus

The Union of India

Facts of the Case:

The petitioner in W.P.No.27100 of 2019 challenges an order of the Authority for Advance Ruling (AAR) levying tax on […]

ConsultEase Administrator wrote a new post, Gujarat HC in the case of Messrs Vishnu Aroma Pouching Pvt Ltd Versus Union Of India 4 years, 7 months ago

Case Covered:

Messrs Vishnu Aroma Pouching Pvt Ltd

Versus

Union Of India

Facts of the Case:

By this petition under Article 226 of the Constitution of India, the petitioners seek the following substantive […]

ConsultEase Administrator wrote a new post, Tripura HC Order in the case of Shri Sentu Dey Versus The State of Tripura 4 years, 7 months ago

Case Covered:

Shri Sentu Dey

Versus

The State of Tripura

Facts of the Case:

The petitioner has challenged an order dated 02.01.2021 passed by the learned Judicial Magistrate, 1st Class, Bishalgarh under […]